US futures

Dow futures -0.16% at 38725

S&P futures -0.40% at 5128

Nasdaq futures -0.58% at 17875

In Europe

FTSE -0.24% at 7707

Dax 0.04% at 17948

- Nerves show as the Fed’s 2-day meeting kicks off

- FOMC rate decision on Wednesday

- Nvidia’s announcement fails to attract more buyers

- Oil holds onto yesterday’s gains

The Fed’s 2-day meeting kicks off today

U.S. stocks are heading for a weaker open as nerves show through at the start of the Federal Reserve’s two-day monetary policy meeting later today. The rate announcement is due tomorrow.

The market is fully pricing in the Fed leaving interest rates unchanged at 5.25% to 5.5% this month, but the Fed could adopt a slightly more hawkish tone after hotter-than-expected inflation data for two straight months.

With no rate changes expected, the focus will also be on the Federal Reserve's new projections, particularly the dot plot, which in December signaled three rate cuts this year. However, given the sticky inflation, the Fed could lower this to two rate cuts this year. Such a move would lift the US dollar and lower equities on concerns of high rates for longer.

According to the CME fed watch tool, the market is pricing in little more than a 50/50 chance of the Fed cutting rates at the June meeting, down from around 85% just a month earlier. Meanwhile, the market is pricing in a 75% probability of a rate cut in the July meeting.

Corporate news

Nvidia is set to open lower as its annual developers conference continues. Yesterday, Chief Jensen Huang unveiled a new AI chip, the B200 Blackwell, which is 30% faster than its predecessor in some operations. However, the announcement failed to attract new buyers into a stock that had already traded up 240% Over the past year.

Bitcoin and cryptocurrency-related stocks will also be in focus after Bitcoin experienced its largest one-day decline in two weeks yesterday and continues to fall today. While the exact cause of the decline is unclear, concerns over a more hawkish Federal Reserve, notable withdrawals from Grayscale ETF, and some large liquidation could be significant contributing factors.

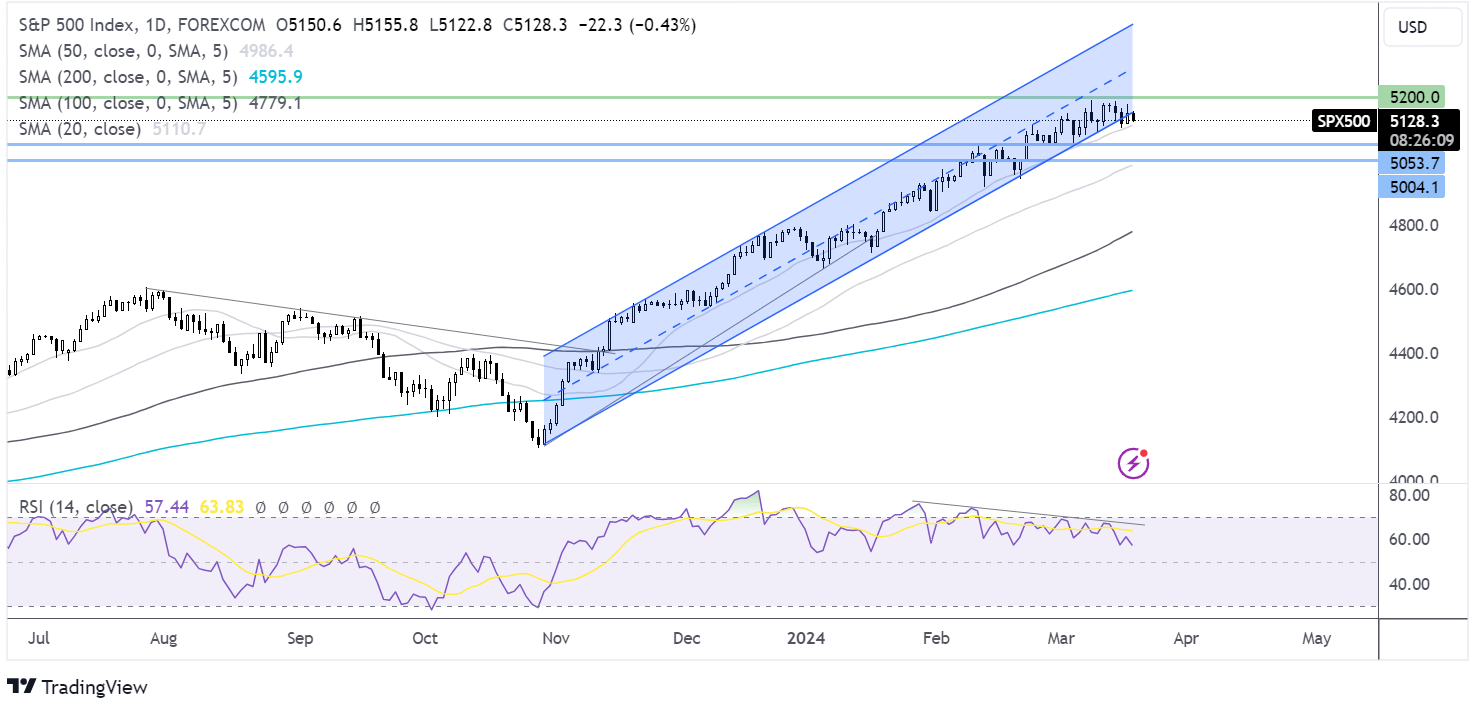

S&P 500 forecast – technical analysis.

The S&P 500 is easing lower after reaching an all-time high of 5188 earlier in the month. The price is falling out of the multi-month rising channel as it heads towards 5100, the 20 SMA. A break below here opens the door to 5050, the March low. On the upside, should the 20 SMA hold, a rise back up towards 5188 and fresh all-time highs could be on the cards.

FX markets – USD rises, USD/JPY rises

The US dollar is rising as the Federal Reserve interest rate decision comes into focus. Expectations that the Fed could adopt a more hawkish stance after persistently sticky inflation has lifted the USD against its major peers.

EUR/USD is falling against a stronger U.S. dollar and after data from the eurozone showed that wage growth slowed in the final quarter of 2023. Wage growth eased to 3.1%, down from 5.2%, and comes after the ECB president Christine Lagarde had warned that solid wage growth had been a reason to be cautious about cutting rates. Meanwhile, German ZEW economic sentiment improved for an eighth straight month, jumping to 30.5, up from 19.9 in February, suggesting there could be light at the end of the tunnel for the German economy.

USD/JPY has risen towards 150.5 after the Bank of Japan raised interest rates for the first time in 17 years. BoJ hiked by 0.1% to 0% amid signs that a wage inflation cycle could be emerging. However, the yen fell following the decision as the rate increase was only a marginal move away from the ultra-loose policy, and the central bank cited uncertainties surrounding the Japanese economy to suggest that further increases are unlikely for now.

Oil holds yesterday’s gains

Oil prices rose around 2% yesterday, and they are holding those gains, hovering around a four-month high.

Oil rose to its highest level since November yesterday, boosted by lower crude exports from Saudi Arabia and signs of strong demand from China.

However, concerns about exports rising from Russia as Ukraine continues attacks on oil refineries are limiting the upside today.

The stronger U.S. dollar is also capping gains as attention turns to the FOMC meeting. The USD is rising on the prospect of high interest rates for longer in the US, the world's largest consumer of oil. This hurts the oil demand outlook and makes oil more expensive for buyers with other currencies.

Looking ahead, attention will be on the API oil inventory data. Oil rallied last week after US crude stockpiles showed a -5.521-million-barrel draw, which was larger than expected.