- Pound analysis: BoE’s rate hike was never in doubt to impact GBP/USD outlook

- GBP/USD’s recent falls has not much to do with UK, but a lot to do with US bond markets

- GBP/USD technical analysis – bulls awaiting reversal

The Bank of England has announced its policy decision, but unlike the June meeting, there were no major surprises this time. GBP/USD dipped then bounced but ultimately did not move significantly in terms of initial reaction. Governor Bailey gave very little away in his initial comments, although he didn’t push back against market pricing of another rate increase in September. Traders’ focus will now turn to the US again, where long-dated bonds have been selling off since that Fitch downgrade. The ISM Services PMI, due later today, could move the dollar – and therefore the GBP/USD – if we see a significant deviation in the actual reading from expectations.

Pound analysis: BoE’s rate hike was never in doubt

June was the first time in 5 months that UK CPI came in below expectations, providing a welcome relief for everyone. But at a still very high annual pace of 7.9% on the headline and 6.9% in terms of core CPI, the BoE was never going to let its guard down.

Indeed, the BoE has warned that further rate increases could be on the way, should inflationary pressures remain persistent.

Prior to today’s rate decision, most analysts were expecting a 25bp hike from the BoE, although there were also some calls for a bigger hike of 50 bps.

But as it turned out, the BoE decided to go with the standard 25 bps hike, although it wasn’t a unanimous decision. MPC officials Mann and Haskell voted for 50 bps hike, while Dhingra voted to keep policy unchanged. As you would expect with inflation still very high here in the UK, the BoE also kept its guidance that rates may – not will – rise if inflation persists.

This was the 14th straight rate rise to take the Bank Rate to 5.25%, its highest level since 2008. There is a risk that we may even see a 15th consecutive rate increase, because the BoE says it "will ensure that bank rate is sufficiently restrictive for sufficiently long" to return inflation returns to target. But a split committee means the BoE policy is not on a pre-set course. So, take what the BoE says with a pinch of salt.

Indeed, the BOE has acknowledged that monetary policy is now restrictive, effectively hedging their bets over their warning for further rate increases. Previously, the BoE had said that the MPC “will adjust Bank Rate as necessary” to return inflation to target, but now, it has said that “will ensure that Bank Rate is sufficiently restrictive for sufficiently long to return inflation…”

The market implied probability of a 25 basis point rate hikes in September is now around 68% with traders expecting UK rates to peak at 5.68% in March 2024, instead of 5.74% priced in earlier.

The GBP initially reacted negatively because of the fact the market pricing for a rate hike was slightly more than 25 bps, but the GBP/USD managed to bounce off its lows quicky to return to pre-BoE levels. Similar reaction was observed in the EUR/GBP, suggesting that traders are not too sure about the BoE’s next move.

Some of the other notable headlines from the BoE:

- ¨BOE: Some of Upside Inflation Risks "May Have Begun To Crystallise"

- ¨BOE Raises Inflation Forecast For 2024 To 2.5% From 2.25%

- ¨BOE Raises Inflation Forecast For 2025 To 1.5% From 1%

Why has the GBP/USD been falling recently?

The recent drop in the cable has had little to do with the UK. The GBP/USD has been falling along with other major currency pairs because of a strengthening US dollar. The greenback has found good support from the sell-off at the long end of the US Treasury market owing to the unexpected decision from Fitch to downgrade the US credit rating. The focus will remain on the US bond market, although we will also have some key US data to distract investors later on.

Will the dollar continue pressing higher?

The further strengthening of the US dollar so far this week has nothing to do with the Fed’s expected policy decision. It has a lot to do with the sell-off in US bond market, especially at the long end of the curve. This has been triggered by that rating downgrade by Fitch, causing investors to demand more for the increased risks associated with holding Treasurys. While a US debt default is unthinkable, it could happen at some future point in time. So, we wouldn’t rule out the possibility of further increases in US bond yields in the near-term. It will be interesting to watch next week’s $103 billion bond auction. This will tell us a lot about investors’ willingness to hold That said, the correction potential for the dollar is now high, and investors may soon start selling USD once the dust settles down.

Jobless claims and ISM services PMI up next

Investors’ attention today may get focused on data again. We will have the initial jobless claims and the services ISM PMI due later. The dollar could fall back, especially if we see a big rise in jobless claims or a big dip in the services ISM, as that would reinforce recession concerns again. Otherwise, it is difficult to call a dollar peak just yet. The official nonfarm payrolls report will be out on Friday. In terms of company earnings, results from tech giants Apple and Amazon will be the big ones to watch today.

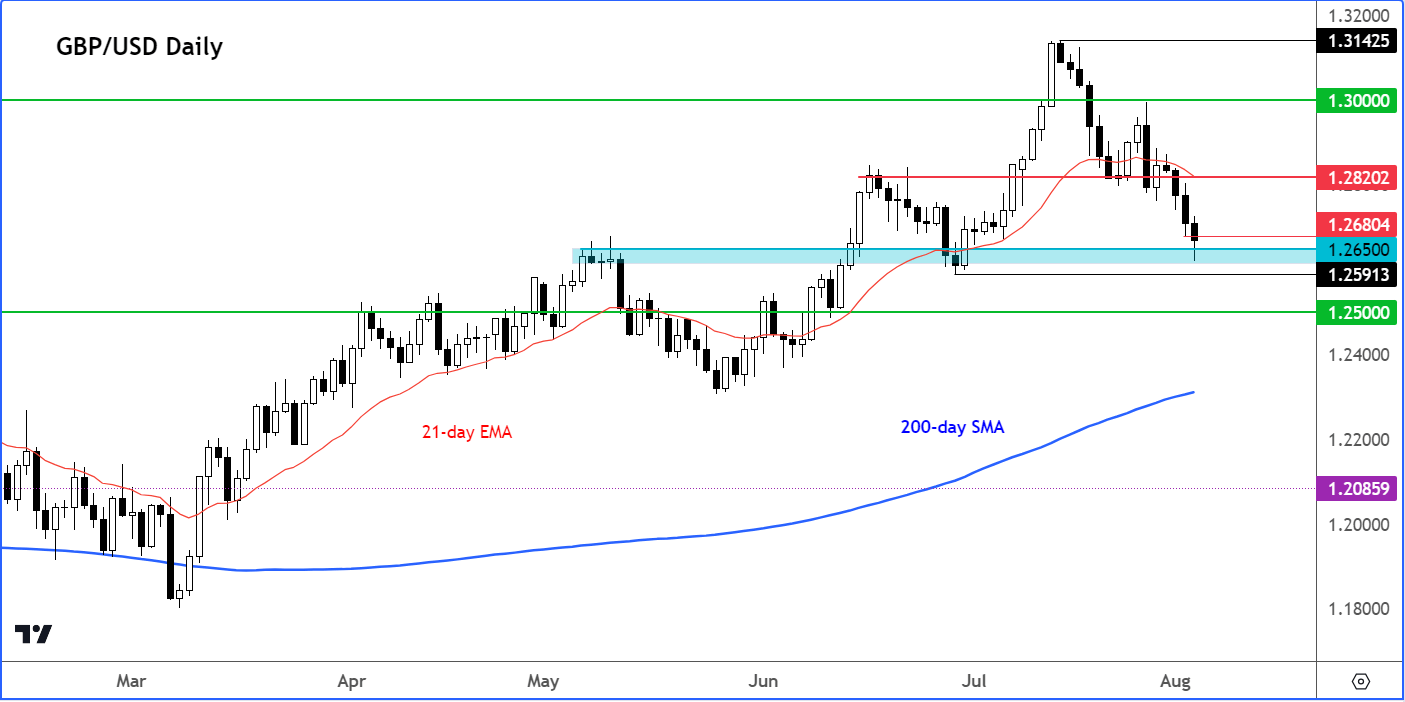

GBP/USD technical analysis – bulls awaiting reversal

The GBP/USD was testing a key support area around 1.2600 to 1.2650 range at the time of writing. This area had been resistance and support in the past and is the base of the rally that begun at the end of June. So, there is a possibility we will get a bounce here, although the first area of trouble – Wednesday’s low – is now not too far off at 1.2680, which may offer some resistance. But should we go above this level decisively then then there is a chance for a bigger recovery toward 1.2820ish key level.

On the downside, the next target for the bears is the liquidity resting below the previous interim low that was made at the back of June at 1.2591. Below that, there’s nothing significant until the round handle of 1.2500.

Source: TradingView.com

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade