- The RBNZ April interest rate decision arrives 2pm Wellington time on Wednesday

- Markets and economists are split on whether the RBNZ will cut rates in Q3 or later

- RBNZ days often bring higher volatility and larger ranges. With US CPI out later in the session, it could be a wild session

- RBNZ is a central bank that has a track record for going its own way, meaning it may not be easily swayed by expectations for other central banks

The overview

While it may be the smallest G10 FX central bank, what the Reserve Bank of New Zealand (RBNZ) lacks in size it more than makes up for in terms of market impact, often sparking major moves in the New Zealand dollar under the leadership of Governor Adrian ‘Shock and’ Orr.

It’s notorious for delivering surprises, setting the scene for a volatile day in the Kiwi and New Zealand rates markets on Wednesday as its April monetary policy decision parlays into the release of US consumer price inflation data later in the session.

This note looks at interest rate pricing, the data flow available to the RBNZ prior to the decision, along with key levels on NZD/USD and NZD/JPY to build trade setups around.

The background

Expect NZD volatility

RBNZ rates days bring volatility. A lot of volatility. Looking back over the past 20 meeting dates, the NZD/USD daily range as a percentage of the prior close stands at 1.41%, a full 30 basis points more than the average over the same period.

Directional moves can also be substantial with eight meetings delivering gains or losses exceeding 0.9%, underlining the point that it can and does surprise relative to market expectations regularly.

Markets eyeing rate cuts from Q3 2024

24 hours out from the April decision, no move in the cash rate is expected at the meeting. Looking further out, overnight index swaps pricing implies just over a one-in-three chance of the RBNZ delivering a 25 basis point rate cut by August. October is priced at 90% with November deemed a literal coin toss as to whether the bank will deliver back-to-back cuts, taking the cash rate to 5%.

Economist forecasts are similar with a poll conducted by Reuters revealing 15 of 29 expect the first cut to arrive by the end of the third quarter. The remaining 14 expect the cash rate to remain steady until the fourth quarter or later.

Six weeks ago, the RBNZ noted risks around New Zealand’s inflation outlook were more balanced, although it retained a slight risk that rates may need to rise further with the first reduction not expected until the middle of the 2025 calendar year.

For those new to trading RBNZ decisions, the divergence on the timing of rate cuts between markets, economists and the bank is not a new development, so it can be expected any guidance it provides will be less dovish than markets currently anticipate.

This meeting will not feature updated economic forecasts, including the influential rate path track, so any new information will be conveyed in the policy statement or by Governor Orr when he gives his press conference one hour following the decision.

Gauging the surprise risk

At its February meeting, the RBNZ delivered a dovish surprise relative to expectations that had been skewing towards the risk of another hike following a change in forecast from a prominent New Zealand bank. Heading into this meeting, a similar evolution has been taking place with the rapid unwind in Fed rate cut pricing flowing through to similar moves in Kiwi swaps markets.

The RBNZ has a reputation for setting its own course rather than being heavily influenced by the actions of other central banks, as demonstrated after the initial pandemic phase when it became the first developed market central bank to lift interest rates to curb inflationary pressures. It did so when other central banks, including the Fed, were talking about inflation being transitory.

It’s only a hunch, but with New Zealand in a double-dip recession, the risks for this meeting skew towards the RBNZ moving closer to current market pricing rather than further away. That points to the potential for weakness in the New Zealand dollar and rally in Kiwi short-end rates.

The trade setup

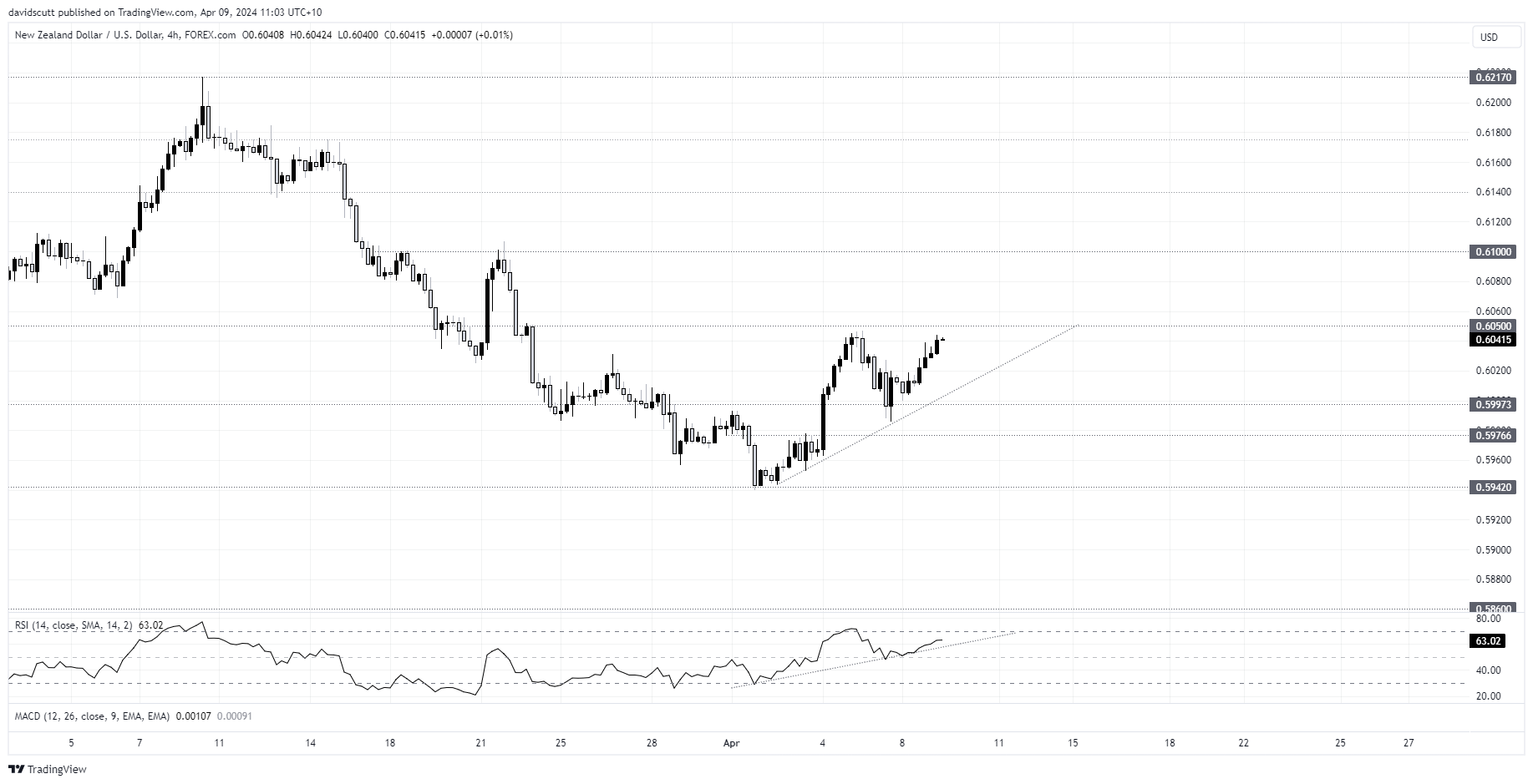

NZD/USD

Upside momentum is building for NZD/USD within an ascending triangle pattern, suggesting the near-term bias is higher, especially if we see a clean break above .6050. Above, the resistance levels to watch include .6100, .6140, .6175 and .6217, the double-top hit in March.

On the downside, a break of the minor uptrend opens the door to a push below .6000 with .5975, .5942 and .5860 the initial levels to watch.

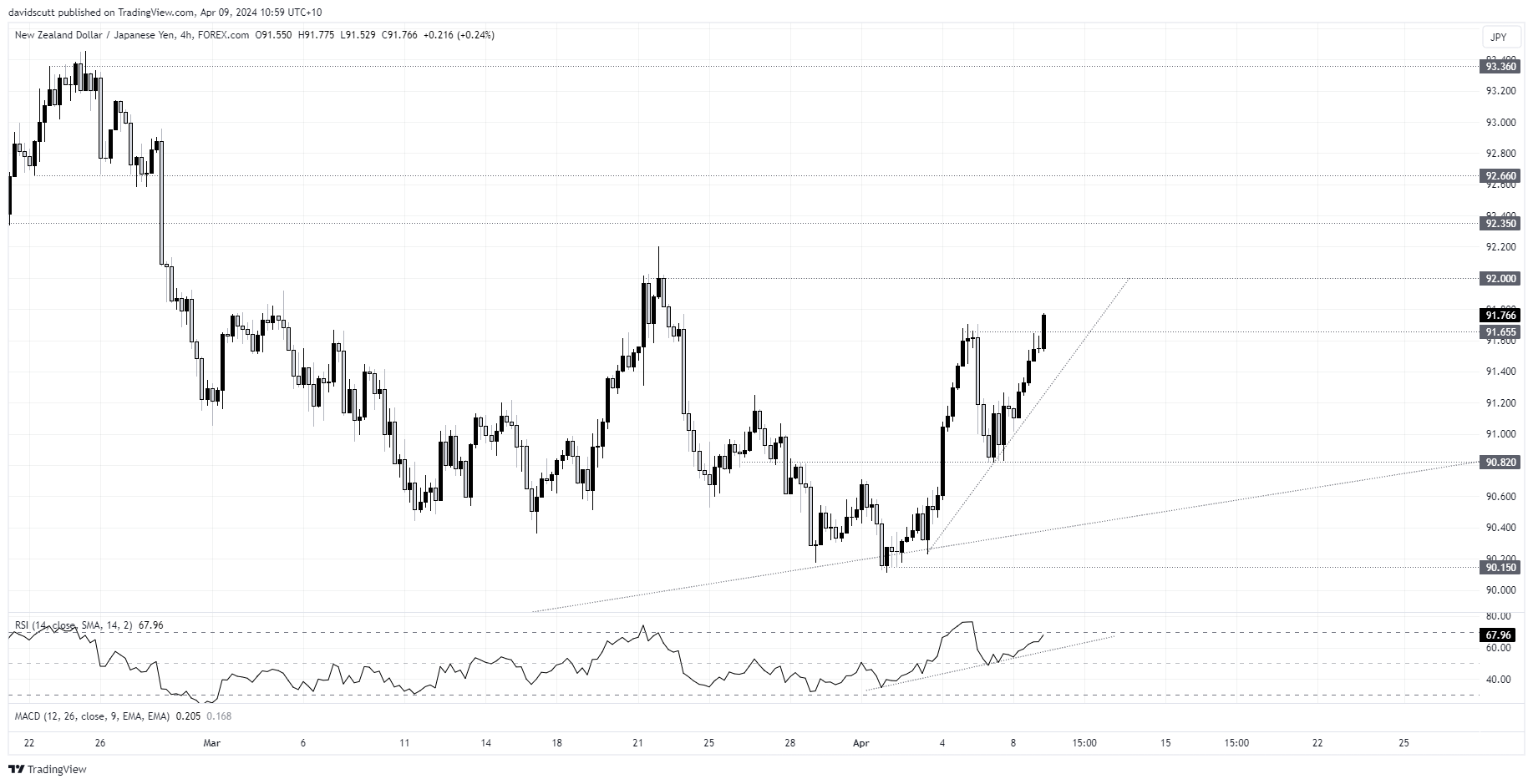

NZD/JPY

NZD/JPY is also carrying building upside momentum, bouncing hard from the intersection of minor horizontal and uptrend support around 90.82 late last week. Having broken through minor resistance above 91.65 earlier today, the near-term bias is higher. However, with USD/JPY stuck below 152 thanks to the threat of BOJ intervention, any further thrusts higher may have to be driven by the Kiwi in the absence of a bullish USD/JPY break.

Topside levels to watch include 92.00, 92.35, 92.66 and 93.36. On the downside, a break of the uptrend brings a retracement to 90.82 into play. Below, long-running uptrend support is located around 90.50, making that a key level to monitor in terms of longer-term directional risks.

The wildcards

Other than the RBNXZ delivering another major surprise, a likely drop in market liquidity in the lead up to the US CPI report may result in whippy price action, including the potential for initial moves to be reversed.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade