USD/JPY Takeaways

- The BOJ has occasionally intervened into the forex market over the last few decades, most often to bolster the value of its currency and support the country’s export-driven economy.

- Last year’s interventions occurred at 145.00 and 150.00 in USD/JPY, when the pair was roughly 600 pips above its 50-day EMA and 1,000 pips above its 100-day EMA.

- If we don’t see intervention at the start of the week, the key zone to watch will be 146.00-147.00, but longer-term yen bulls need to see a shift in BOJ policy.

What is Forex Market Intervention?

For the uninitiated, forex market intervention generally involves the direct purchase or sale of currencies by central banks. A central bank may choose to sell its national currency, thereby increasing its supply and reducing its value relative to other currencies, or it may buy its national currency, thereby decreasing its supply and enhancing its value.

BOJ Intervention: Historical Examples and impact on USD/JPY

While the Bank of Japan (BOJ) has a long history of intervening in the foreign exchange markets, most of its notable interventions have aimed to curb the appreciation of the yen to maintain the competitiveness of Japan's export-driven economy. These interventions usually involved selling yen and buying foreign currencies, primarily the U.S. dollar:

- June 28, 1995: In the face of a rapidly appreciating yen, the BOJ decided to intervene by selling yen in the forex market. The yen's value had been rising quickly, making Japanese exports less competitive and threatening the nation's economic recovery following the burst of the asset price bubble in the early 1990s.

- August 11, 1998: The BOJ's intervention took place against the backdrop of the Asian financial crisis. The crisis had caused severe economic turmoil in the region, with currency values fluctuating wildly. The BOJ chose to intervene again to maintain economic stability, selling yen to mitigate its excessive volatility and sustain a favorable environment for economic recovery.

- 2003-2004: These years marked a period of extraordinary interventions by the BOJ. The yen was threatening to appreciate significantly, which would have adversely affected Japan's export-oriented economic model. To counter this threat, the BOJ sold over $300 billion in yen throughout the year, making this one of the most massive and sustained interventions by a central bank in forex market history.

The peak of this intervention campaign occurred in the first quarter of 2004, with the BOJ selling nearly $150 billion of yen during this period alone. These interventions played a crucial role in keeping the yen weak and supporting Japan's economic recovery from its "Lost Decade.”

- September 15, 2010: This date marks the BOJ's first unilateral intervention since the massive campaign in 2003-2004. The yen had been appreciating rapidly due to various global economic trends and the effects of the global financial crisis. In response, the BOJ sold over 2 trillion yen in a bid to dampen the yen's strength and support Japanese exporters.

- October 31, 2011: On this day, the BOJ conducted what was its largest one-day intervention to date, selling an estimated 8 trillion yen. The yen had continued to strengthen, posing significant challenges to Japan's efforts to recover from the devastating earthquake and tsunami that struck the country in March of that year. By selling a massive amount of yen, the BOJ sought to reverse the yen's trend of appreciation and facilitate economic recovery.

BOJ Intervention to Weaken the Japanese Yen

However, the BOJ can and has intervened in the past to support a weakening yen, but such actions are less common and usually less dramatic than those intended to stem a strong yen.

For instance, during the Asian Financial Crisis in the late 1990s, Japan had to deal with a weakened yen due to financial instability in the region. Around this time, the BOJ cooperated with other central banks globally to intervene and stabilize currency markets, which could also involve supporting a weakening yen.

Another example could be found during the Global Financial Crisis in 2008. Although there was no direct intervention in the forex market by selling foreign currencies to buy yen, the BOJ used various monetary policy tools, such as lowering interest rates and providing additional liquidity to the banking system, to boost the overall economy and indirectly support the yen.

More recently, the central bank sold trillions of yen in an effort to reduce the value of its currency in September and October of 2022 as USD/JPY crossed 145, and then again at 150, its highest level (the yen’s lowest level) since 1990.

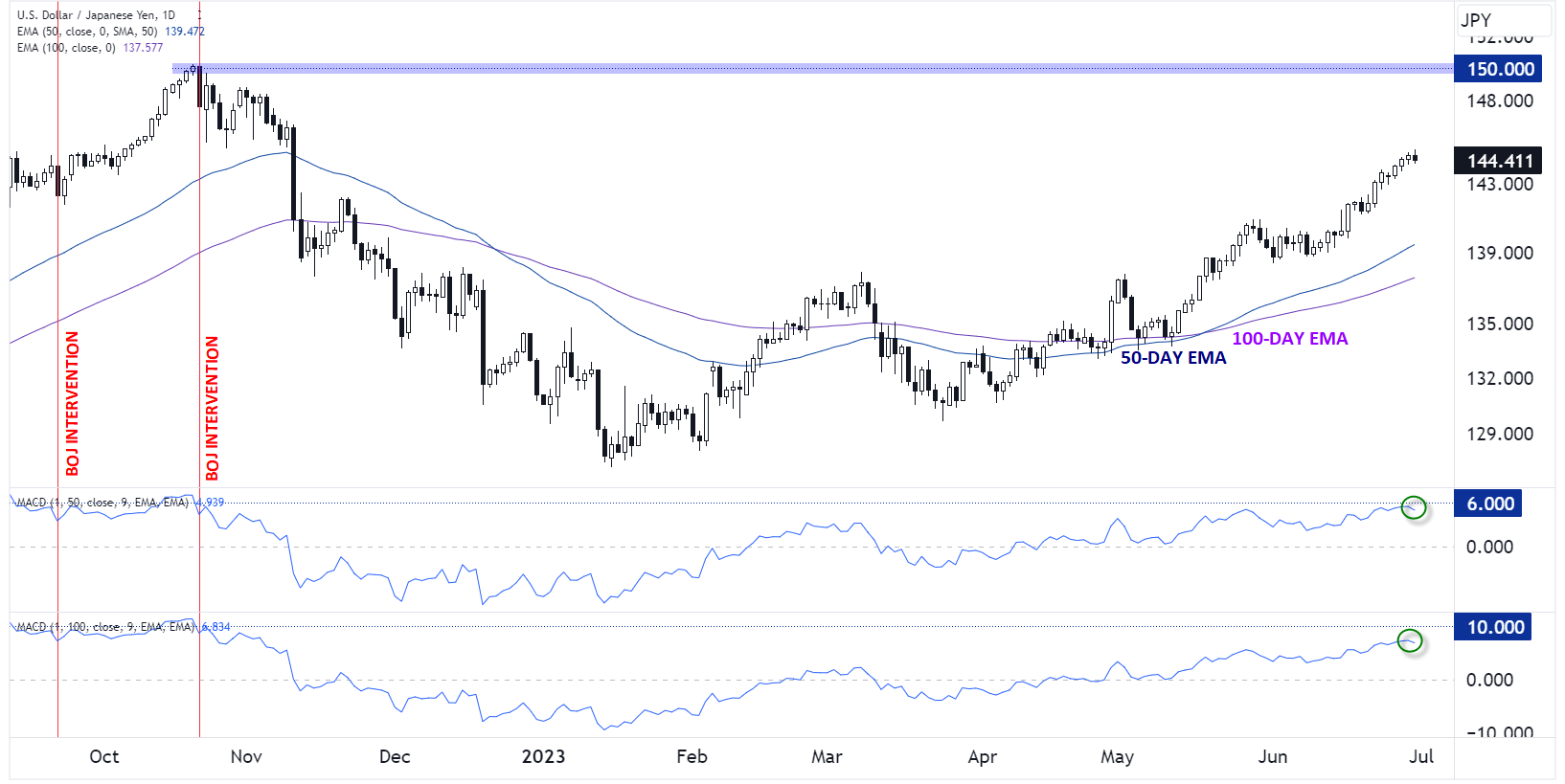

Japanese Yen Technical Analysis – USD/JPY Daily chart

Source: TradingView, StoneX

Turning our attention to the current chart, USD/JPY tested the 145.00 level on Friday, the same level where the BOJ first intervened last September, though its worth noting that BOJ authorities say they look at the speed of yen falls, rather than levels, in deciding whether to step in. From that perspective, the yen is not quite seeing as fast of a depreciation as it did last year.

As the chart below shows, USD/JPY is roughly 600 pips above its 50-day EMA, near the same deviation as last year. However, the deviation above the 100-day EMA is “only” about 700 pips, less than the ~1,000 pips above that longer-term trend measure that prompted intervention last year.

Assuming we don’t see any surprises from the BOJ early in the coming week, when many US traders will be out on a long holiday weekend celebrating independence day, the BOJ may be willing to tolerate a move toward 146.00 or 147.00 before starting to step in.

Regardless of what happens moving forward, it’s important for traders to understand that even entities as rich as central banks can only stem the tide of the $5T/day forex market. In order for the yen to stop weakening on a sustained basis, the BOJ will have to show signs of joining the rest of the world in tightening monetary policy, starting by relaxing its yield curve control (YCC) program, which is unlikely until the next scheduled BOJ meeting on July 28th at the earliest.

-- Written by Matt Weller, Global Head of Research

Follow Matt on Twitter: @MWellerFX