The main job for traders this week will be to continue to digest the implications of last week’s historic moves by key central banks.

While the Fed, the SNB and the BoJ captured most of the headlines it was last week’s ECB emergency meeting that covered the “fragmentation issue” that provides the backdrop for this trade idea.

The "fragmentation issue" refers to prospects of a first ECB rate hiking cycle in over a decade that has seen the bond yields on weaker nations surge in recent months, reigniting fears of a rerun of the 2010 European debt crisis.

To prevent a recurrence, the ECB at its emergency meeting last week preannounced that it would introduce a new sovereign credit backstop (anti-fragmentation tool).

While details are light at this stage, a credit backstop is significant for yields and ensures that ECB rate hikes are transmitted equally across the eurozone members rather than only onto weaker heavily indebted nations.

In theory, this will allow the ECB to hike faster, away from negative rates towards the neutral rate, a positive for the EURUSD.

Elsewhere the surprise rate hike by the SNB put the spotlight on the traditional funding currencies, including the CHF, EUR and JPY.

While the BoJ confirmed it has no intention of doing away with its dovish yield curve control just yet, the ECB is itching to raise rates and will get started next month possibly by as much as 50bp.

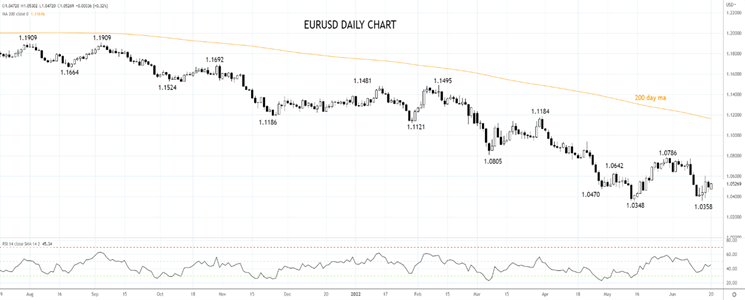

Due to the challenging inflation and growth backdrop, we have been medium-term EURUSD bears. However, based on last week’s shifts outlined above and after the EURUSD tested and recently held the 1.0350 support zone, we think the EURUSD is right for a rebound towards 1.0780/00.

To take advantage of this, we favour buying the EURUSD on dips to 1.0500/1.0480. The stop loss would be placed at 1.0340 and the profit target is resistance at 1.0780/1.0800.

Source Tradingview. The figures stated are as of June 20th 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade