Today’s US macro data has proven to be mostly positive, causing the dollar to extend its gains from earlier in the session. Bond yields have remained elevated, which in turn have helped to keep the downward pressure on gold. We had a very strong retail sales print at +3.0%, with core sales also easily exceeding expectations at +2.3% m/m. This was followed by better-than-expected Empire State Manufacturing Index (-5.8 vs. -18.2 expected), although industrial production took some shine off from an otherwise strong set of US data.

With the dollar rising further, gold has fallen out of favour. The precious metal has now given up most of its gains made earlier in the year.

Gold investors are unnerved by the falling government bond prices, causing their yields to rise. This is undermining assets that pay no interest - like gold and silver, although Bitcoin has managed to extend its recent recovery.

The US dollar has now started to make a bit of a comeback. Gold, already on its knees following that strong US jobs report on Friday and hawkish Fed comments, has fallen further out of favour.

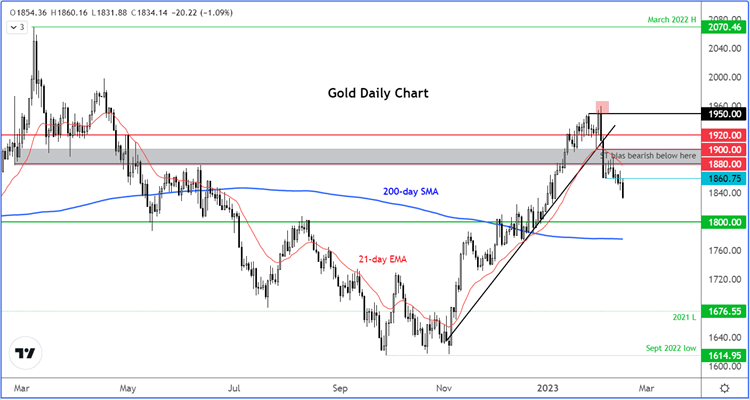

While it remains below the grey shaded region on the chart around $1880 to $1900, the path of least resistance continues to be south.

Before we turn bullish on gold, it needs to show a decisive bullish candle or needs to reclaim the above region first. For now, the path of least resistance is still to the downside, and there nearest obvious reference point is now at $1800, which is where gold might be heading to next.

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade