- Gold analysis: What are precious metals traders watching for the rest of this week?

- Us dollar and yields rise following on hawkish comments from the Fed’s Christopher Waller

- Gold technical analysis point to new records

Gold analysis video and insights on Silver, WTI and USD/JPY

Gold recovered from earlier weakness to turn positive on the day, rising above the key $2200 level. Silver also turned positive, although it lagged behind gold. The gains for precious metals came despite a stronger US dollar, which rose to a 5-week high against the euro, with the single currency hurt by further weakness in German data – this time retail sales disappointing again with an unexpected 1.9% month over month drop. The greenback was also firmer against antipodean dollars, pound, and franc. Bond yields had also edged higher, all thanks to some hawkish comments from the Fed’s Christopher Waller overnight. Yet, gold was shining brightly, pointing to a strong healthy trend.

Gold analysis: What are precious metals traders watching for the rest of this week?

Hawkish comments from Waller overnight helped to support the US dollar more than it weighed on gold. In fact, gold has risen to a new high on the week, while the EUR/USD, for example, dropped to a 5-week low in early European trade, with the single currency also being hit by further weakness in German data.

Given that gold is not responding much to the strength in US dollar, we could well see a fresh record high for gold even if today’s upcoming US data point to further strength in the world’s largest economy. Later, we will get the final estimate of Q4 GDP, as well as the revised figures from University of Michigan’s sentiment surveys and the usual weekly jobless claims data. GDP is seen remaining unchanged at 3.2%, while jobless claims are expected to tick up slightly to 212K from 212K previously.

The primary macro event of the week is potentially on Friday, with the release of the core PCE index, which is the Fed's preferred measure of inflation. Any significant deviations in the PCE data from the expected +0.3% m/m or 2.8% y/y readings could impact gold prices. Additionally, Fed Chair Jerome Powell is scheduled to speak on Friday. These events collectively could offer the market further insights into the Federal Reserve's stance on interest rates. If we see weaker PCE data and the Fed chairman simply re-iterates what he has said in the past, then this should be good news for gold.

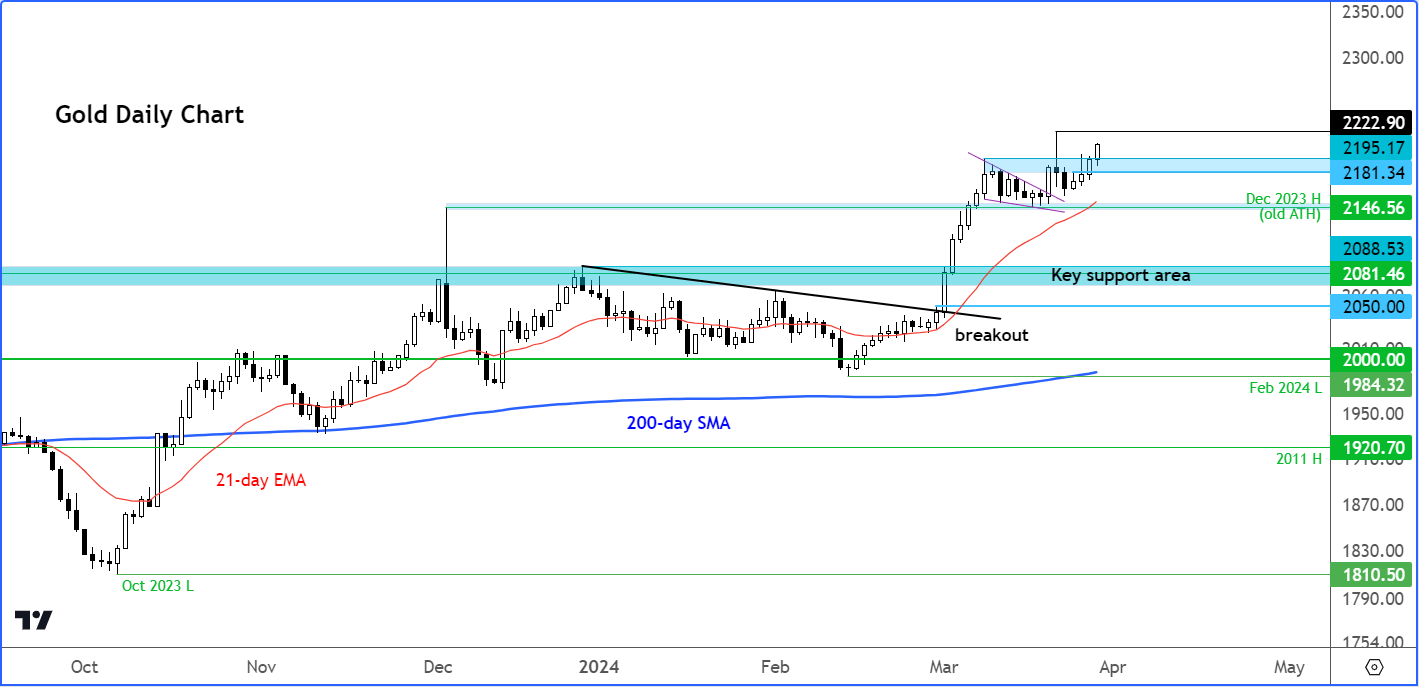

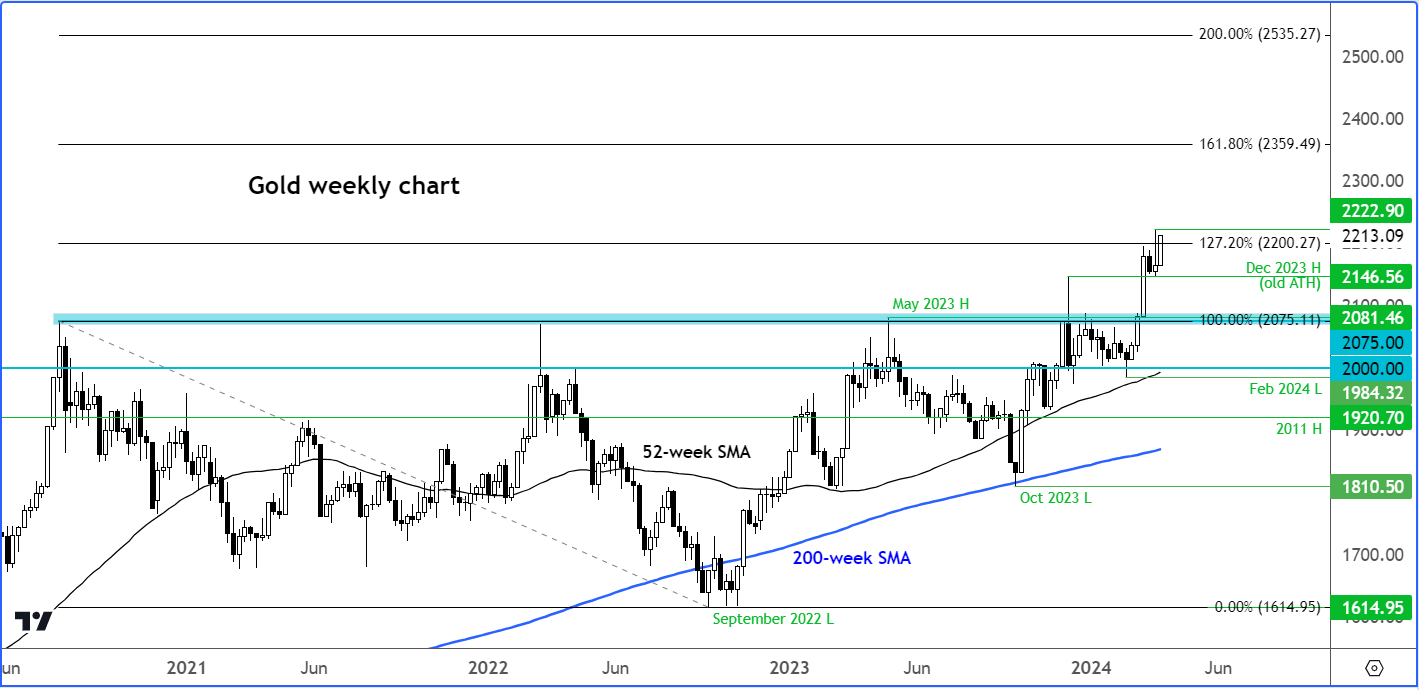

Gold technical analysis

Gold is continuing to show strength from a technical perspective, maintaining nearly all of its recent gains. Bullish momentum remains intact, with no significant bearish reversal patterns observed on the daily timeframe yet. Despite a prior bearish signal with an inverted hammer candle last week, gold held above the December's old record high at $2146, making it a crucial support level. So price action has remained positive.

In fact, at the time of writing, gold was starting to climb above resistance level around $2195 to $2200 area, which has acted as a bit of a hurdle in the last few days. But now that we are above it, this is clearly a bullish outcome and could potentially lead to new record high.

From here, the immediate target is at $2222, last week’s high.

Looking at the weekly gold chart, the 161.8% Fibonacci extension level at $2359, derived from the significant downswing between August 2020 and September 2022, could be the next upside target. The precious metal has reacted to the 127.2% extension level of this same swing already, at $2200. On the downside, key support below $2146 lies around $2075 to $2081, previously a strong resistance zone.

Source for all charts used in this article: TradingView.com

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade