- GBP/USD outlook: UK CPI could sway BoE decision

- FOMC likely to go for a hawkish hold on Wednesday

- BOE could mimic ECB's dovish hike on Thursday

- GBP/USD Outlook: Technical analysis suggests downside

The GBP/USD will come into sharp focus over the next couple days, with two pivotal events on the horizon: the FOMC and BoE rate decisions. Additionally, traders are anticipating the release of UK CPI and retail sales data, as well as global PMI figures this week. These developments collectively have the potential to shape the near-term GBP/USD outlook.

Before delving into the FOMC and BoE meetings, it is worth pointing out that the UK CPI will be released on Wednesday, which could influence the BoE’s decision and thus the GBP/USD outlook. So, let's first glance at this influential data before tackling the bigger risk events.

UK CPI - Wednesday, September 20, 07:00 BST

Recent economic indicators in the UK have displayed signs of strain due to high inflation and rising borrowing costs. However, robust wage growth persists as workers demand higher compensation. To curb the price-wage spiral before it becomes uncontrollable, inflation needs to decelerate rapidly. In the previous month, CPI dropped notably from the June figure of 7.9% y/y but remained at a high 6.8% in July. For August, CPI is projected to rebound to 7.1% y/y from July's 6.8%. Core CPI is expected at 6.8%, slightly down from the prior month's 6.9%, while RPI is seen increasing to 9.3% from the previous 9.0%.

FOMC Policy Decision - Wednesday, September 20, 19:00 BST

Strong inflation figures in the US, along with surprising economic resilience in several key sectors, have sparked speculation that the Fed may not have completed its tightening cycle. Although no policy changes are anticipated at this FOMC meeting, traders will closely examine hints regarding the next meeting. If there is a clear indication of a final rate hike before year-end, this could bolster the dollar again.

Pay close attention to the policy statement, the latest dot plots, and Fed Chair Jerome Powell's remarks during the FOMC press conference. The Fed might signal the likelihood of an additional hike this year, thanks to a slower disinflation process bolstered by a robust US consumer and increased inflation expectations. The FOMC may also revise the 2024 median plot to indicate fewer rate cuts than previously projected. Such a move could discourage bearish bets on the dollar, exerting downward pressure on GBP/USD.

Until the policy meeting this week, there are no significant US data releases expected to influence the Fed's stance. Recent Michigan confidence data showed minimal change in consumer sentiment for September, but economic and inflation expectations for the economy improved. Thursday's release of August retail sales exceeded expectations, primarily due to increased fuel sales. Additionally, producer price inflation (PPI) surpassed estimates, and jobless claims fell slightly following a significant drop in the previous week. These developments foster optimism that a severe economic downturn may be avoided.

BOE Policy Decision - Thursday, September 21, 12:00 BST

The recent depreciation of the pound reflects a reduction in investors' hawkish expectations for the Bank of England (BoE) due to weaker-than-expected UK economic data. GDP figures from the previous week disappointed, raising concerns of an impending recession. However, strong wage growth suggests a potential uptick in consumption. The Monetary Policy Committee (MPC) will consider the latest CPI data released the day before their rate decision. Economists expect a CPI increase compared to the previous month, which is unlikely to deter the MPC from voting for another 25-basis point rate hike, potentially raising the Bank Rate to 5.50%.

The question remains: Is this the peak in interest rates? Goldman Sachs analysts, for one, anticipate the BoE to pause in November, abandoning their prior view of further hikes. This shift is attributed to the belief that wage and price pressures may ease, aligning with the MPC's preference for a flatter rate trajectory.

Investors have also adjusted their expectations, with weaker UK data prompting a significant reduction in anticipated BoE rate hikes. Approximately 75 basis points of hikes were priced in just a month ago, whereas markets now anticipate around 35 basis points until the peak. Consequently, there is a considerable likelihood that the BoE will deliver a final 25-basis point hike on Thursday, similar to the ECB's recent signal.

Keep an eye out for any key phrase changes in the BoE's rate statement, akin to the ECB's suggestion that rates are "sufficiently restrictive." Such a move could weaken the pound, potentially driving the GBP/USD towards the low 1.20s.

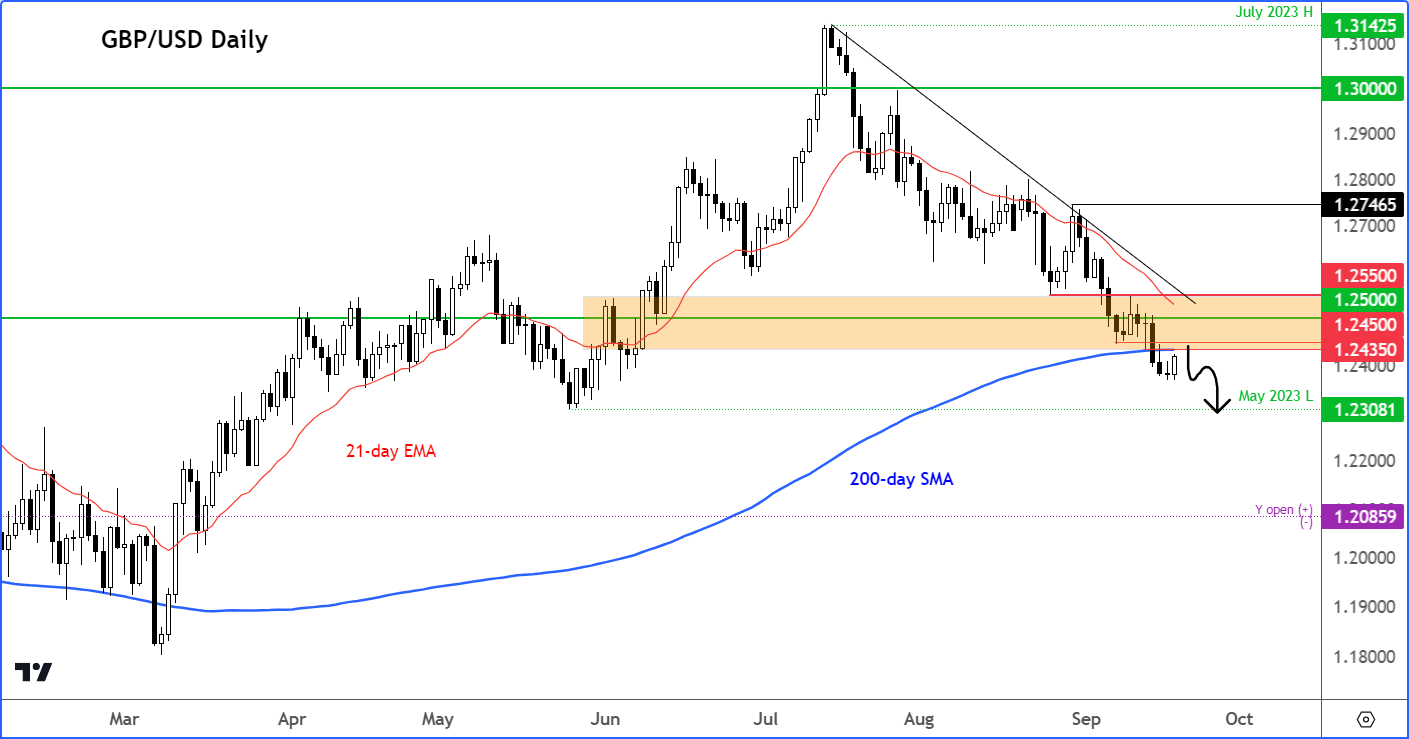

GBP/USD Outlook: Technical analysis

Reflecting the price action in the EUR/USD, the GBP/USD also exhibited a downward trend on Thursday, extending into Friday, before bouncing back due to profit-taking ahead of the above macro events. The technical damage has already been inflicted, however, with rates closing below the 200-day moving average on both Thursday and Friday.

Caution is therefore advised as we could easily see renewed weakness in the cable. At the time of writing, it was testing critical resistance levels just below the 1.2450 area. This area had previously acted as support. Similar to the EUR/USD, the GBP/USD may surpass its previous low recorded in May at 1.2308. Below this point, there are few clear reference points to consider aside from round figures such as 1.22, 1.21, and potentially even 1.20. Given the growing bearish momentum, bullish traders should await the emergence of a significant reversal pattern before considering bullish trade opportunities on this pair.

Source: TradingView.com

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade