- GBP/USD analysis: BoE holds policy at 5.2% in split decision

- What’s next for GBP/USD and will US dollar rise much further?

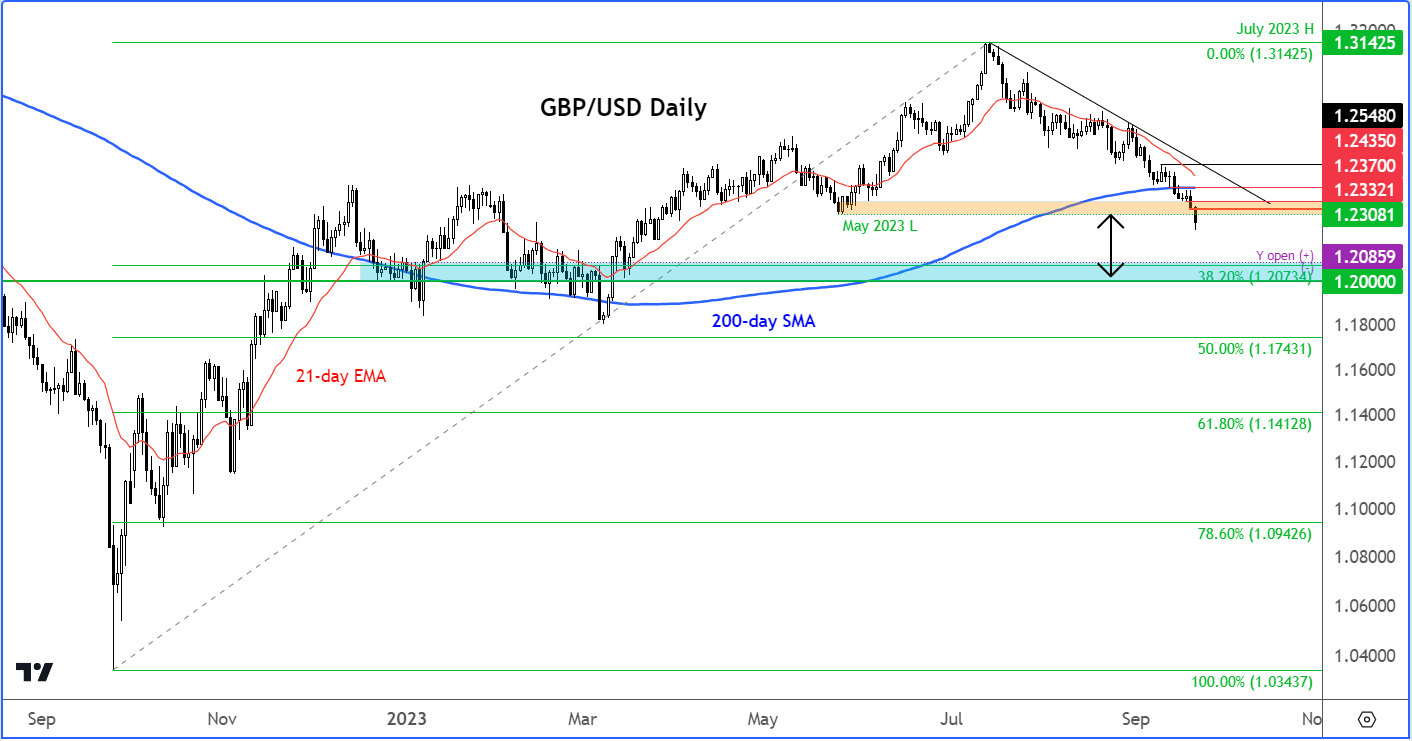

- GBP/USD technical analysis continues to point lower

Earlier, the Bank of England announced interest rates would be kept unchanged in a surprise move (not to us) and the pound took another plunge, dropping below 1.2250 in initial reaction. The BoE’s policy statement was somewhat hawkish and the MPC split. This means that the next few policy decisions could be close calls, especially if inflation doesn’t come down fast enough. So, it is not too unreasonable to assume the downside for the pound could be limited moving forward. However, this probably won’t be the case against the US dollar, with the latter likely to remain supported on the dips thanks to a very hawkish Fed. The GBP/USD could therefore weaken further, even if other pound crosses show strength. Traders will be on data watch again now that we have heard from both the Fed and BoE, as well as several other major central banks this week.

So, why didn’t the BoE hike interest rates then?

The BoE decided to err on the side of caution and kept policy unchanged. Clearly, the BoE is worried about the economic performance of the nation, which has been quite shocking. Policymakers feels that monetary policy is now restrictive enough to rein in on inflation, which is still three times the BoE’s 2% target rate. But the BoE feels that CPI could fall significantly in the near-term, reflecting lower annual energy inflation and further declines in food and core goods price inflation. And with monetary policy going to be “sufficiently restrictive for sufficiently long” period of time, the economic cost of an additional hike would have outweighed the benefits in terms of bringing inflation lower.

However, with global oil prices rising and record wage growth in the UK, there are plenty of reasons why price pressures could remain elevated. For that reason, the BoE has kept the door open towards further rate increases if needed. In any case, it will keep monetary policy restrictive for a long period of time until it is convinced inflation is brought back to the 2% target “sustainably” in the medium term.

BoE holds policy in split decision

In case you missed it, the BoE decided to keep rates unchanged at 5.25% in a 4-5 vote vs. 8-1 expected. Governor Bailey and MPC members Broadbent, Dhingra, Pill and Ramsden all voted to hold policy unchanged. Cunliffe, Greene, Haskel and Mann wanted another 25bps hike. The only thing the committee was unanimous on was to vote in favour of reducing the stock of UK government bond purchases by £100 billion over the next twelve months, to a total of £658 billion.

This was one of the toughest decisions for the BoE policymakers. Just a week or so ago the market was almost fully convinced that the central bank would hike rates by 25 basis points, attaching a 90% probability to this outcome.

But those odds were slashed after the release of cooler-than-expected inflation data on Wednesday. The probability of a rate hike fell to 50/50, dragging the pound lower with it. In addition to weakening inflationary pressures, we had seen further evidence of a slowing economy with monthly GDP data falling 0.5% and PMI data being in the contraction territory of below 50.0.

The repricing of the BoE rate decision meant that whatever the central bank would now decide, one group of market participants would be proven wrong and therefore the pound would react more meaningfully than would have been the case had the rate decision been a more predictable one.

Lo and behold the pound did move sharply, slumping around 65 pips in the immediate reaction to the rate decision, before bouncing off its lows ever so slightly.

What’s next for GBP/USD and will US dollar rise much further?

The focus will turn to incoming data now that we have had both the Fed and BoE rate decisions out of the way.

- US jobless claims, Philly Fed and existing home sales will be released today

- BOJ policy decision and Global PMIs will be released on Friday

If incoming data continues to support the view that the US economy is holding its own better than the UK, then should keep the pressure on the GBP/USD for a while yet.

This is because the Fed has scaled back expectations of its 2024 easing cycle quite significantly, now implying that 50 basis points of rate cuts are likely instead of 100 it had projected back in June. What’s more, the Fed has significantly there may be one more rate increase to come before 2023 ends. So, in effect, the Fed is signalling that interest rates will be cut by a net 25 basis points by the end of 2024, which is quite hawkish.

Now, whether that will be the case remains to be seen, with the Fed and other central banks having a habit of significantly under- or over-estimating things. The market will make its own mind up, which will depend on incoming data of course.

For the dollar to end its bullish bias, we will now need to see significantly softer US activity data moving forward. Until that happens, the dollar should remain in a bullish trend.

GBP/USD technical analysis

The GBP/USD has now dropped below our main target of 1.2308, the May low, where stop orders of many trapped long speculators undoubtedly were residing. With this pool of liquidity now tapped, the next question is this: will there be acceptance below this 1.23ish level? So far, the answer seemed to be a resounding yes. Let’s see if that changes later, with the participation of US investors.

If there is acceptance below 1.23ish then we should see renewed technical selling pressure in the days ahead as more bullish speculators abandon their bets. In this case, I reckon the GBP/USD could be heading back down towards 1.20-1.21 range next, where we have a number of technical factors converging – the 38.2% Fibonacci retracement level with the opening price of 2023, and the psychological importance of the 1.20 round figure.

However, if there is no acceptance below 1.23, and we see a quick rally back above this level, then this would raise the possibility that we have seen at least a short-term bottom. In this scenario, a move back towards the 200-day average at 1.2330ish could be the outcome.

So, from a tactical point of view and given that the cable has already dropped to my main downside target, today I will just watch price action to see where it ends up. This should give us a good idea in terms of what to expect next. A bearish close is what I would continue to favour and expect.

Source: TradingView.com

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade