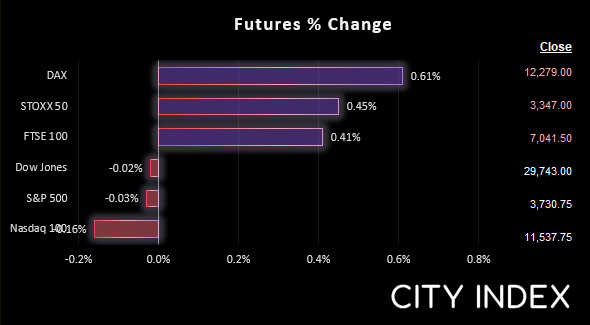

Asian Indices:

- Australia's ASX 200 index rose by 118.5 points (1.83%) and currently trades at 6,580.50

- Japan's Nikkei 225 index has risen by 158.17 points (0.6%) and currently trades at 26,332.27

- Hong Kong's Hang Seng index has risen by 216.01 points (1.25%) and currently trades at 17,466.89

- China's A50 Index has risen by 34.65 points (0.27%) and currently trades at 12,999.13

UK and Europe:

- UK's FTSE 100 futures are currently up 28.5 points (0.41%), the cash market is currently estimated to open at 7,033.89

- Euro STOXX 50 futures are currently up 15 points (0.45%), the cash market is currently estimated to open at 3,350.30

- Germany's DAX futures are currently up 74 points (0.61%), the cash market is currently estimated to open at 12,257.28

US Futures:

- DJI futures are currently down -7 points (-0.02%)

- S&P 500 futures are currently down -18 points (-0.16%)

- Nasdaq 100 futures are currently down -1.25 points (-0.03%)

The risk-on vibe which swept global markets yesterday made it was across to Asia today. And perhaps that is not so surprising, since they have been given another whiff of QE (thanks BOE!). The ASX 200 was the leader overnight, with all major stock market indices posting gains.

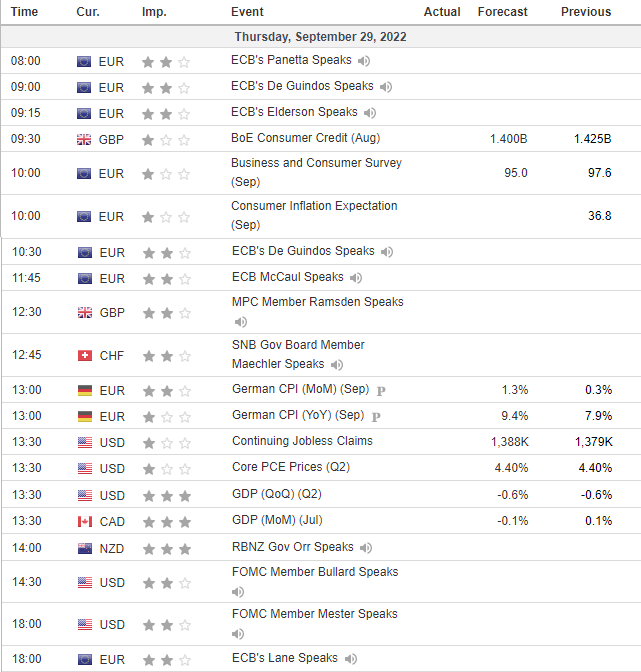

German inflation is expected to rise to a 70-year high of 9.4% y/y at 13:00 BST today. Although with a set of regional inflation reports to be released ahead of the main one, we should have a fairly good idea of how realistic this expectation is beforehand.

The US release the final revision of Q2 GDP. Even though it is a lagging indicator, any signs of PCE or core PCE softening in Q2 would likely be warmly welcomed by investors and the Fed alike.

On the topic of central banks, we have planet of CB speakers today. Three ECB members speak between 8-9am, a couple more at 10:30 and 11:45. BOE’ Ramsden speaks at 12:30, then an ANB board member is at 12:45. RBNZ governor Orr is scheduled to speak at 14:00, then Fed members Bullard and Mester are up at 14:30 and 18:00 respectively. Oh, and ECB’s Lane also speaks at 18:00.

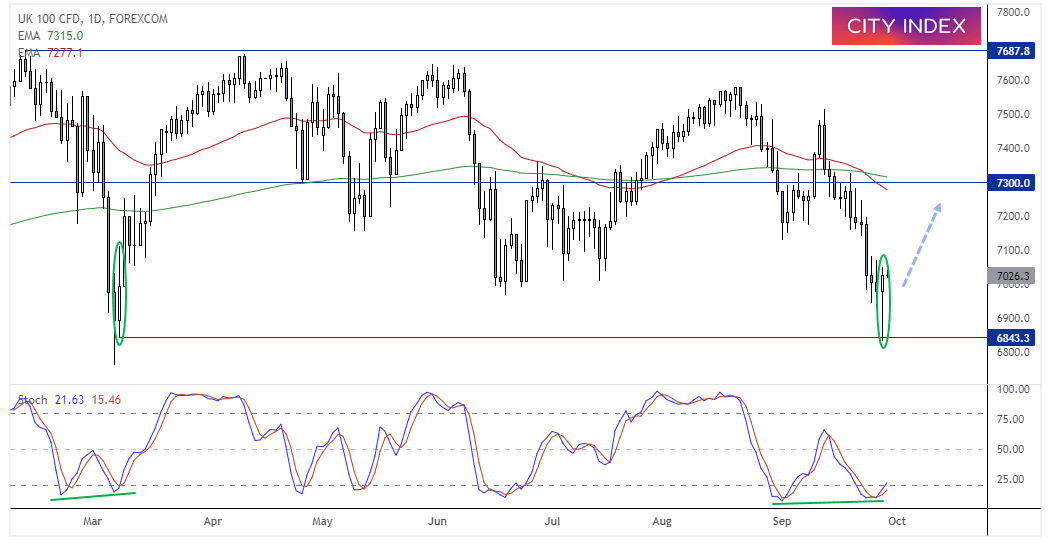

FTSE 100 daily chart:

The FTSE has found support at the lows of its 6840 – 7690 range. A large bullish hammer formed on the daily chart, which has also occurred with a bullish divergence with the stochastic oscillator. The 50 and 200-day EMA’s sit around the midway point of 7300, which makes a potential countertrend target for bulls over the near-term.

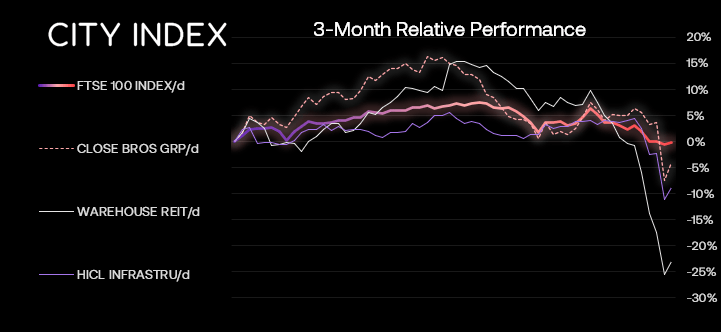

FTSE 350 – Market Internals:

FTSE 350: 3854.58 (0.30%) 28 September 2022

- 169 (48.15%) stocks advanced and 175 (49.86%) declined

- 0 stocks rose to a new 52-week high, 162 fell to new lows

- 15.1% of stocks closed above their 200-day average

- 98.29% of stocks closed above their 50-day average

- 1.14% of stocks closed above their 20-day average

Outperformers:

- + 12.21% - PureTech Health PLC (PRTC.L)

- + 12.05% - Hikma Pharmaceuticals PLC (HIK.L)

- + 6.94% - Land Securities Group PLC (LAND.L)

Underperformers:

- -6.88% - Airtel Africa PLC (AAF.L)

- -6.73% - Molten Ventures PLC (GROW.L)

- -6.25% - Global Smaller Companies Trust PLC (GSCT.L)

Economic events up next (Times in BST)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade