Asian Indices:

- Australia's ASX 200 index fell by -5.4 points (-0.08%) and currently trades at 6,810.30

- Japan's Nikkei 225 index has risen by 246.86 points (0.91%) and currently trades at 27,363.56

- Hong Kong's Hang Seng index has fallen by -77.79 points (-0.43%) and currently trades at 18,010.18

- China's A50 Index has fallen by -48.18 points (-0.37%) and currently trades at 12,908.11

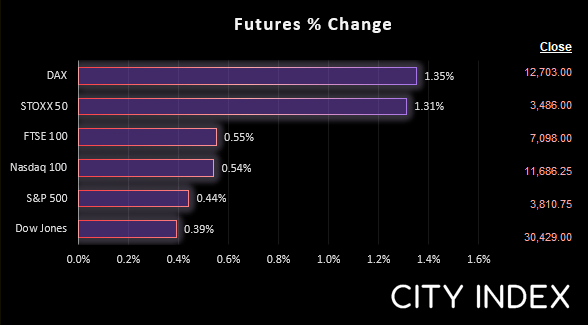

UK and Europe:

- UK's FTSE 100 futures are currently up 40 points (0.57%), the cash market is currently estimated to open at 7,092.62

- Euro STOXX 50 futures are currently up 45 points (1.31%), the cash market is currently estimated to open at 3,492.72

- Germany's DAX futures are currently up 170 points (1.36%), the cash market is currently estimated to open at 12,687.18

US Futures:

- DJI futures are currently up 126 points (0.42%)

- S&P 500 futures are currently up 64.5 points (0.55%)

- Nasdaq 100 futures are currently up 17.25 points (0.45%)

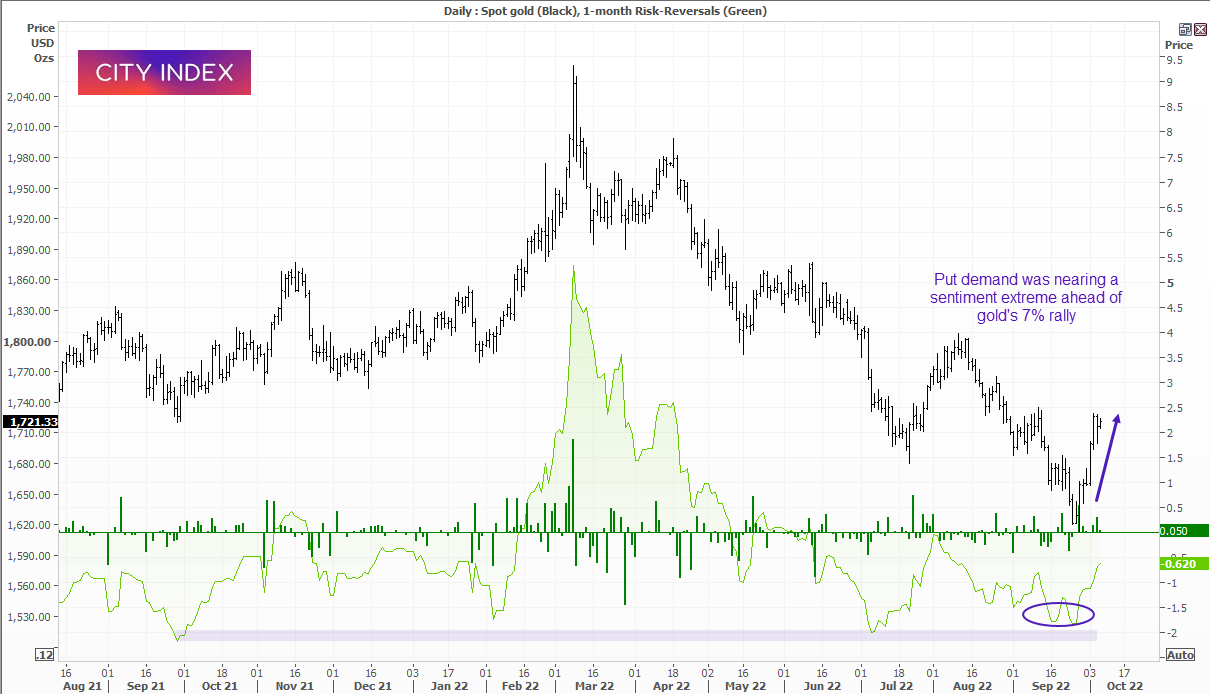

On the 20th of September, I noted that put demand for gold futures was approaching a sentiment extreme. Whilst I was not outright bullish, I was wary of becoming too bearish at such low levels and erred on the side of caution as such sentiment reads rarely make precise timing tools – but can provide an indication that an inflection point may be approaching. Six trading days later, gold went on to print its swing low and prices have since rallied over 7%.

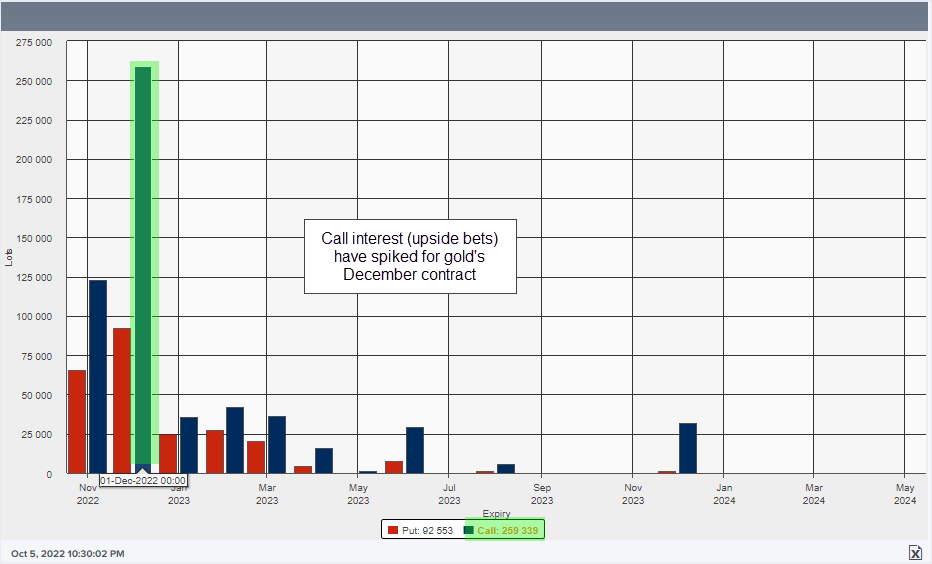

A weaker dollar and lower yields have certainly helped with this case. And due to manage funds being net-short, we can assume some short covering has also been at work. But today I have noted that call demand (upside bets) have spiked for the December contract, and are also around twice as high for November than puts (downside bets).

Of course, we still have plenty of time for things to go wrong before now an December’s expiration – but the point is that speculators have shown their intentions with future money on the line.

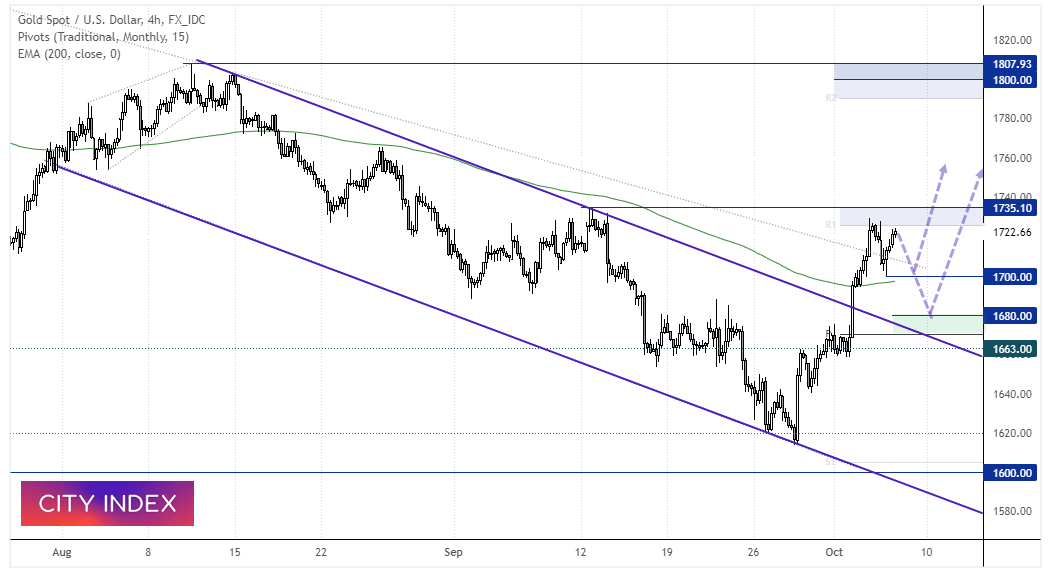

Gold 4-hour chart:

Spot gold is currently enjoying its best week since February and sitting near its 3-week high. Given its strong rally from just above 1600 and 6-consecutive bearish months, a bit of mean reversion could be expected. And it may have more upside to give.

A bullish trend is developing on the 4-hour chart and prices have broken above two bearish trendlines and the 200-bar EMA. Its met resistance around the monthly R1 pivot and 1735 high, so its initial pullback comes as no major surprise. Perhaps we’ll see another leg lower as part of a 3-wave correction, in which case bulls could seek evidence of a swing low above 1680 to anticipate its next leg higher. Alternatively, bulls could wait for a break above 1735.10 to assume bullish continuation towards the monthly R2 pivot and highs around 1800.

FTSE 350 – Market Internals:

FTSE 350: 3884.53 (-0.48%) 05 October 2022

- 68 (19.43%) stocks advanced and 276 (78.86%) declined

- 1 stocks rose to a new 52-week high, 9 fell to new lows

- 17.43% of stocks closed above their 200-day average

- 28% of stocks closed above their 50-day average

- 1.71% of stocks closed above their 20-day average

Outperformers:

- + 6.23% - Hilton Food Group PLC (HFG.L)

- + 4.43% - Hill & Smith Holdings PLC (HILS.L)

- + 3.75% - Vietnam Enterprise Investments Limited (VEILV.L)

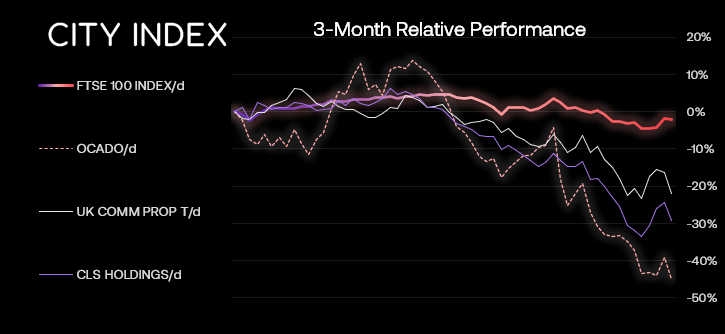

Underperformers:

- -10.04% - Ocado Group PLC (OCDO.L)

- -6.72% - UK Commercial Property REIT Ltd (UKCM.L)

- -6.45% - CLS Holdings PLC (CLSH.L)

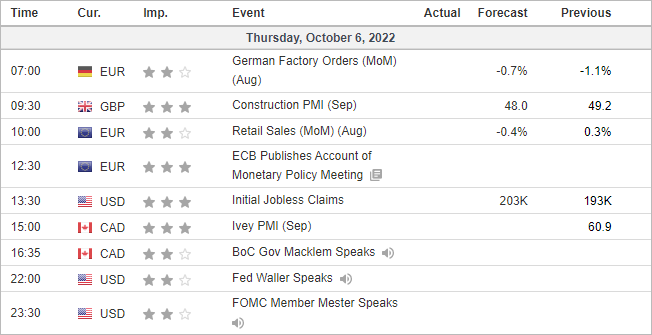

Economic events up next (Times in BST)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade