US futures

Dow futures +0.03% at 37706

S&P futures +0.16% at 4791

Nasdaq futures +0.4% at 16858

In Europe

FTSE -0.05% at 7661

Dax -0.08% at 16684

- US CPI rises 3.4% YoY vs 3.1% prev.

- An early rate cut looks less likely, but stocks march higher

- Bitcoin mining and crypto stocks rise after SEC ETF approval

- Oil rises as Mid East tensions offset demand worries

CPI rises by more than expected, core CPI cools

US stocks have recovered after an initial selloff following hotter-than-expected US inflation data. Hotter inflation means that the Fed is less likely to cut rates early, but the markets are still attempting to march higher.

US inflation rose 0.3% MoM, ahead of the 0.2% expected, pushing the annual rate up to 3.4% in December from 3.1% in November.

Core CPI, which removes more volatile items such as food and energy, rose 3.9% annually versus forecasts of a 3.8% increase.

As well as hot inflation, the jobs market proved to be stronger than expected, with jobless claims coming in at 202K, down from 210K.

Whilst inflation figures were hotter than expected, the fact that core prices are still cooling supports the view that the Federal Reserve will still be inclined to cut interest rates this year. However, it's also clear that the slow rate at which core inflation is cooling, combined with the uptick in headline inflation raises, means an early start to rate cutting this year looks less likely.

Attention will now turn towards earnings, with the key for earning season kicking off on Friday with results from banking giants JP Morgan, Bank of America, and Citigroup two ahead of the open tomorrow.

Corporate news

Citigroup is falling ahead of earnings tomorrow after the bank warned investors of a possible quarterly loss I ring to the decline of the Argentine peso and restructuring charges.

Left is down over 1% after Goldman Sachs downgraded the ride-hailing up to neutral from buy.

Crypto stocks and Bitcoin miners rallying after the SEC gave the green light for a spot Bitcoin ETF to begin trading in the US marathon digital riot platforms and micro strategy are all expected to climb.

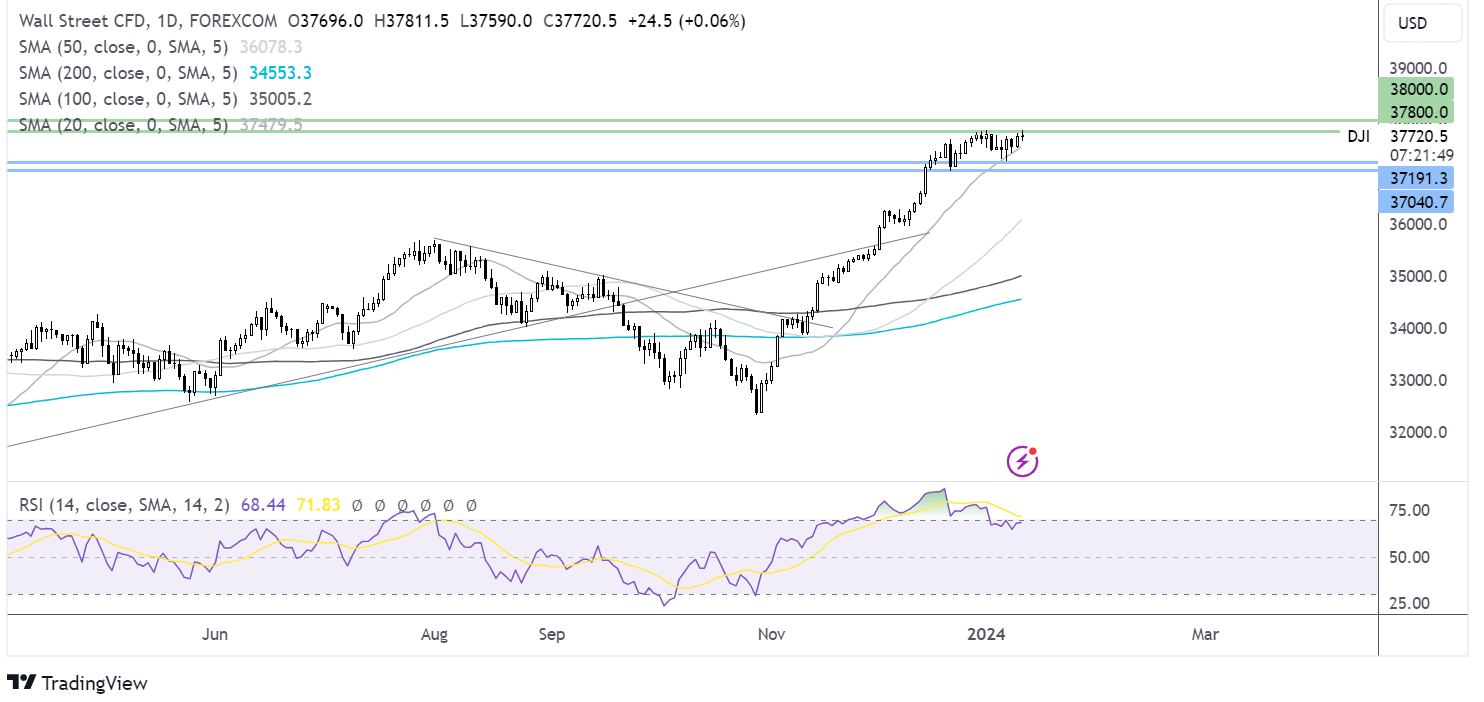

Dow Jones forecast – technical analysis

The Dow Jones is being guided higher by the 20 SMA. The RSI is coming out of overbought territory. Should the 20 SMA hold, buyers will look to retest resistance at 37800 and a new all-time high. Meanwhile, a break below the near term support brings 37000 round number and mid December low into focus.

FX markets – USD rises GBP/USD falls

The USD is rising after US inflation data, which came in hotter than expected, causing the market to dial back rate cut expectations.

EUR/USD is falling amid a quiet eurozone economic calendar and on USD strength. Investors will look ahead to tomorrow's speech by ECB chief economist Philip Lane for clues over the timing of the central bank's next move. The market reined in ECB rate cut bets after inflation ticks higher in December.

GBP/USD is falling amid U.S. dollar strength after US inflation data and amid a quiet economic calendar in the UK. Looking ahead, GDP data is due tomorrow, which is expected to show that the UK economy contracted in November after shrinking in Q3. Weak data could see the market bring forward BoE rate cut bets.

Oil rises as Mid East tensions offset growth concerns

Oil prices all rose as tensions in the Middle East escalated after Iran seized a tanker in the Gulf of Oman. An unexpected build in US crude oil inventories could cap gains.

Houthi militants have been attacking commercial vessels in the Red Sea, showing support for Hamas in their battle against Israel in Gaza. These attacks have been concentrated around the Bob al Mandab Strait. Today's incident is located closer to the key Strait of Hormuz, unnerve the market.

Separately, data on Wednesday showed that US crude stockpiles unexpectedly increased by 1.3 million barrels, well ahead of the 700,000 barrel draw that was forecast, raising concerns over the demand outlook.

While oil prices have been trending steadily downward since October, WTI appears to have found a floor and trades between $70 to $75 a barrel.