US futures

Dow futures +0.34% at 38684

S&P futures +0.48% at 5102

Nasdaq futures +0.8% at 18043

In Europe

FTSE +0.23% at 7667

Dax +0.04% at 17698

- Stocks rebound after yesterday’s selloff

- ADP private payrolls rose 140k vs 107k previously

- GBP/USD holds steady as Chancellor delivers Spring Budget

- Oil rises as OPEC+ output cuts overshadow oil demand outlook worries

Jerome Powell could give further clues on rate cuts

U.S. stocks are set to open higher, recovering from a steep sell-off in the previous session and ahead of Federal Reserve Chair Powell’s testimony before Congress.

The three leading indices fell steeply on Tuesday, fueled by profit-taking following recent gains to record highs and uncertainty over the timing of the Fed’s interest rate cuts.

Investors are now looking ahead to the start of Federal Reserve chair Jerome Powell's testimony before Congress. Powell's testimony could offer further clues about the central bank's path for interest rates. The market is looking for two questions to be answered -when the first rate cut could come and how many rate cuts there will be this year.

Powell is widely expected to maintain a hawkish tilt, reiterating that the Fed needs to see more evidence that inflation is cooling towards the 2% level before cutting rates.

His testimony comes after recent data showing the US economy remains resilient, which gives the US central bank more wiggle room to keep rates higher for longer. Powell’s comments could either dampen hopes of an early rate cut or boost investor expectations that a rate trim is coming soon.

The Fed has already made it clear that a March rate cut is off the table. The market is currently pricing in a 70% probability of a rate cut in June. A hawkish-sounding pound may see investors rein in those expectations further.

On the data front, the ADP private payrolls report rose by less than expected. Private payrolls rose 140k in February, less than the expected at 150K, up from 107k in January. The data comes ahead of the non-farm payrolls report on Friday.

Corporate news

Crowdstrike is surging 23% premarket after beating cushy earnings and guidance expectations. The cybersecurity firm posted EPS of $0.95c vs. $0.82c forecast on revenue of $845 million vs. $839 million forecast.

Nordstrom is expected to fall 10% on the open despite beating sales expectations for the holiday quarter. The department store warned that revenue may decline in the coming year.

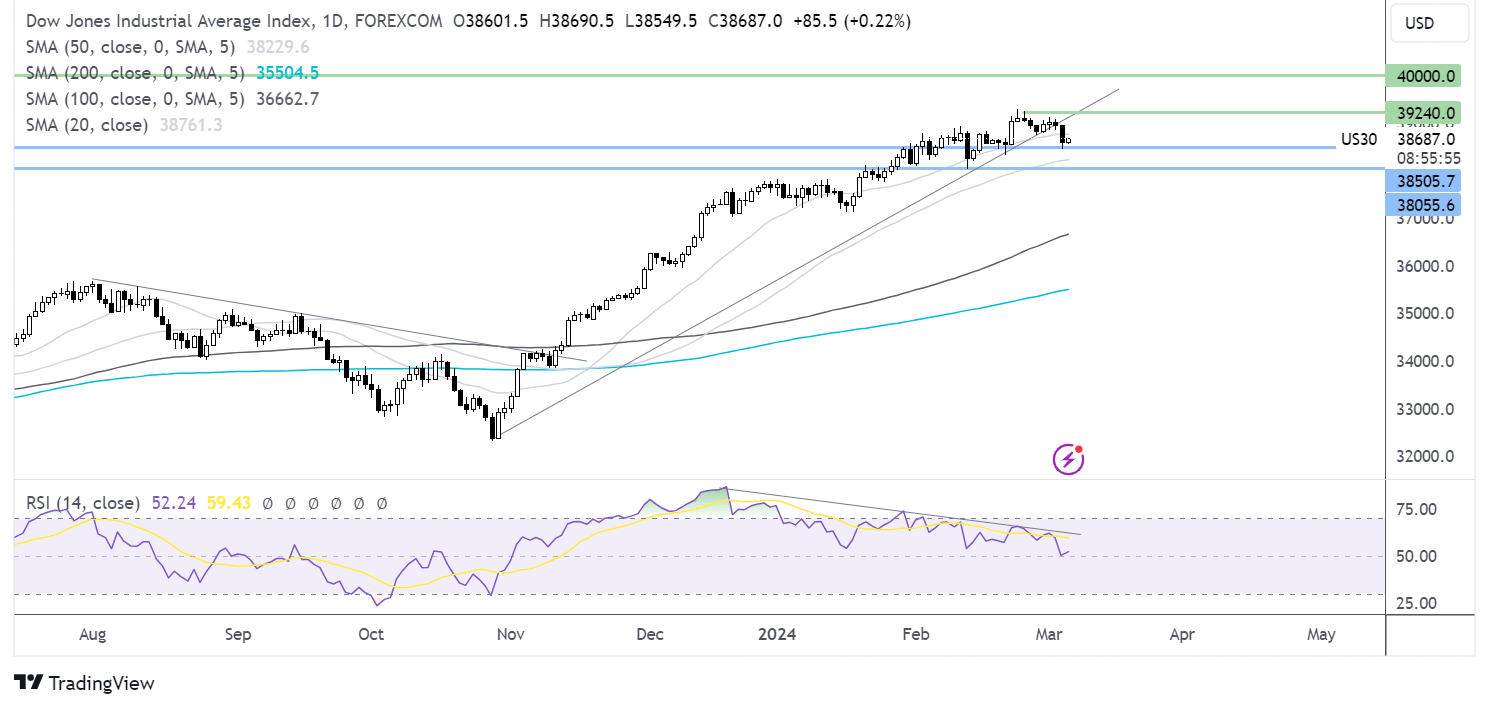

Dow Jones forecast – technical analysis.

After running into resistance at 39285, the Dow Jones eased lower, falling below the multi-month rising trendline. The price has found support above 38500. Buyers will look to rise above 39000 to extend gains to 39284 and fresh all-time highs. Meanwhile, sellers will look for a break below 38450, yesterday’s low, before bringing 38000 into focus, the February low.

FX markets – USD rises, GBP/USD steady

The U.S. dollar is falling for the third straight day in cautious trade ahead of the Federal Reserve chair Powell's testimony. Powell's testimony could either dampen hopes of an early rate cut or boost the prospect of an early rate trim.

EUR/USD is rising after retail sales rebounded in January, rising 0.1% after falling -1.1% in December amid a pick-up at the start of the year. The data offers some hope that the consumer rebound could drive a broader economic recovery. The data comes ahead of the ECB meeting tomorrow, where the central bank is expected to leave interest rates unchanged at 4%.

GBP/USD is holding steady as the Chancellor unveils his Spring Budget. At the time of writing, the pound has ticked just a few pips lower in a tame move. The OBR’s inflation forecast sees CPI falling below 2% in two months time. Should this be the case, the BoE may move to cut interest rates sooner rather than later. The market sees the BoE cutting rates in August.

Oil rises as OPEC+ production cuts overshadow demand outlook worries

Oil prices are rising, snapping a four-day losing streak, as OPEC+ output cuts overshadow oil demand outlook concerns.

China set its growth target for 2024 at around 5%. However, there was a lack of big stimulus plans to help boost the struggling economy, raising concerns over whether the target would be achievable.

Attention is now on US Federal Reserve Jerome Powell's bi-annual meeting at Congress, where investors will be watching for more clarity over the direction of US interest rates. Signs of a Fed cut would be seen as positive for the economy and help boost oil demand. However, a hawkish tilt could have the reverse impact.

Oil is finding support from the OPEC+ announcement on Sunday that it will extend its output cuts of 2.2 million barrels per day until the end of the second quarter.