US futures

Dow futures -0.24% at 38860

S&P futures -0.28% at 5064

Nasdaq futures -0.4% at 17896

In Europe

FTSE -0.83% at 7621

Dax -0.28% at 17580

- US GDP Q4 annualized was 3.2% vs 3.3% preliminary reading

- US Core PCE data tomorrow is in focus

- Salesforce reports earnings after the close

US GDP downwardly revised, US core PCE in focus

U.S. stocks point to a modestly lower open as investors show caution ahead of tomorrow's inflation reading, which could influence when the Federal Reserve will start to cut interest rates.

The core PCE index, the Fed's preferred inflation gauge, is due on Thursday, and jitters surrounding the release have prevented stocks from building on last week's AI-inspired record highs.

Data from the US has been mixed. Today, the second estimate of US Q4 GDP came slightly below the preliminary reading at 3.2% vs 3.3% annualized, which is down slightly from 4.9% in the previous quarter. Yesterday, consumer confidence and durable goods orders also missed forecasts. Meanwhile, the labor market continues to show resilience.

Meanwhile, Fed officials have continued to push back against early interest rate cuts. Investors will watch out for comments from Atlanta Fed President Raphael Bostic and New York Fed President John Williams later today.

The market will also be watching U.S. Congress's attempts to avert a partial government shutdown at the end of the week.

Corporate news

Apple will be in focus after the tech giant canceled work on its EV a decade after kicking off the project. Several employees will be shifted to the company's AI division, which should give investors more optimism about the company's ability to compete against peers in the AI space.

Bumble is set to open 9% lower after Q4 earnings missed expectations. The dating app posted a loss per share of $0.19, larger than the $0.12 forecast, and revenue came in at $273.6 million below the 275.26 million forecast.

Salesforce will also be in focus as it is set to unveil its latest earnings after the closing bell. Revenue is expected to have jumped 10% to $9.22 billion in Q4, helping the company back into profit after it posted a loss a year ago quarter owing to a restructuring charge.

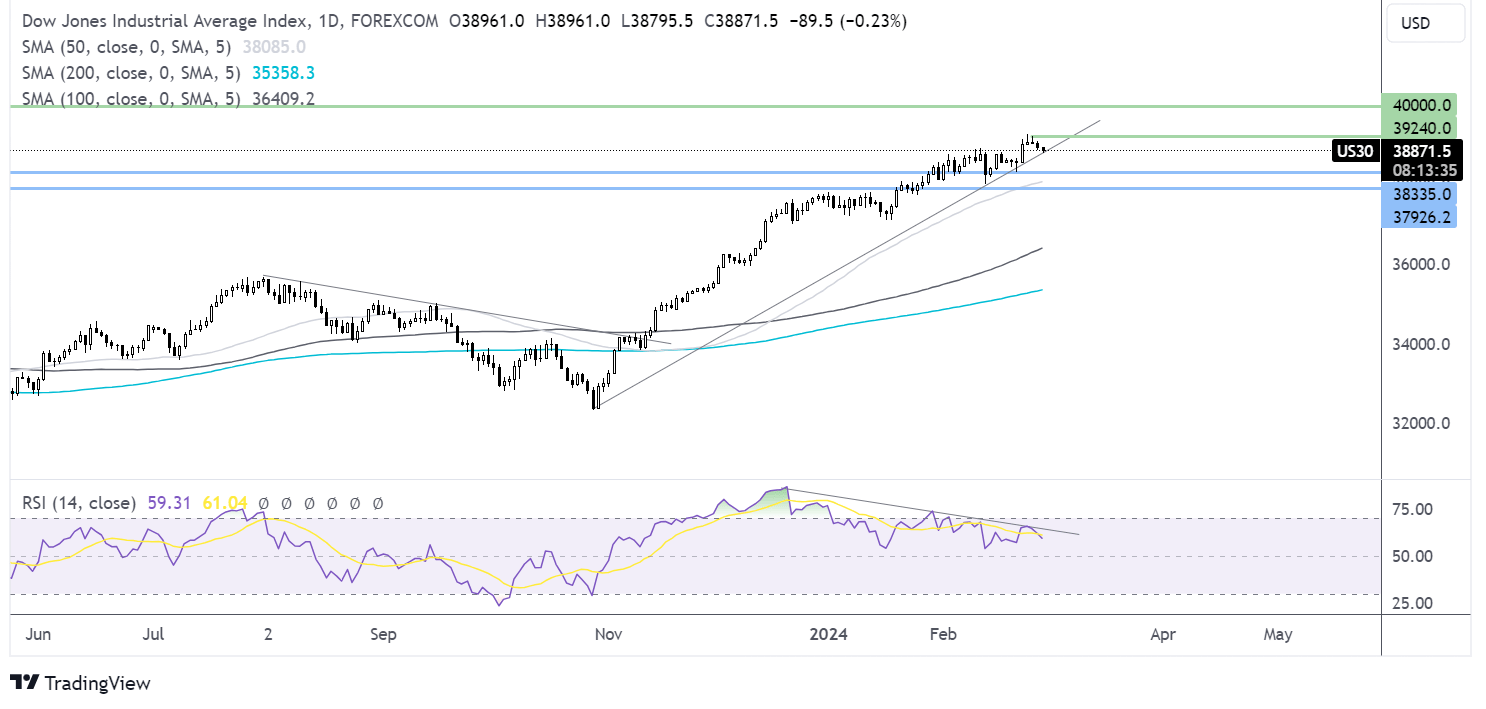

Dow Jones forecast – technical analysis

After running into resistance at 39240, a record high on Monday, the price has eased lower and is testing the multi-month rising trendline support. A break below here could open the door to 38335, last week’s low, and 38000, the February low. Meanwhile, should the trendline support hold, buyers could look for a rise 39240 for fresh all time highs.

FX markets – USD rises, EUR/USD falls

The USD is rising as investors look ahead to key inflation data tomorrow and after Federal Reserve officials continue to push back on the prospect of an early interest rate cut. Sticky inflation could further support the view that the Fed is in no rush to loosen monetary policy.

EUR/USD is falling amid a stronger U.S. dollar and after failing to rise above its 200 SMA. Eurozone consumer confidence shows that the mood darkened in the region as the eurozone sentiment indicator slid to 95.4, defying expectations of a slight improvement. Industry confidence was more negative and dampened hope of a strong recovery in the eurozone.

NZD/USD plunged 1% after RBNZ left rates on hold at 5.5%, in line with expectations, but sounded more dovish than the market expected. Investors no longer expect the RBNZ to hike interest rates and instead have priced in two rate cuts for this year.

Oil falls ahead of EIA data.

Oil prices are falling over 1%, giving back yesterday's gains amid concerns over the prospect of high interest rates for longer, which overshadow expectations of an extended supply cut by OPEC+.

Fed governor Michelle Bowman signaled on Tuesday that she was in no rush to start cutting interest rates, echoing comments from other Federal Reserve officials. High interest rates for longer could dampen growth and hurt the oil demand outlook, pulling oil prices lower.

Meanwhile, gains are being limited by reports that OPEC+ is considering extending voluntary oil output cuts into the second quarter of this year. This move would likely tighten the oil market.

Attention will now turn to EIA oil inventory data, which comes after API stockpile figures yesterday showed an 8.43 million barrel build in the week ending February 23rd, well ahead of expectations of a 1.8 million barrel build.