- Dollar analysis: What to expect from the FOMC rate decision today?

- Don’t forget about other central bank meetings this week: BoE, ECB and SNB

- Hawkish Fed puts GBP/USD into focus, while dovish Fed could benefit JPY/USD, gold and silver

No one is expecting any further tightening from the Fed ahead of the FOMC’s last policy decision of the year. Market pricing of 125 basis point rate cuts in 2024 will be put to the test today and judging by the Fed’s cautious approach to things, there is a good chance Powell and co will push back against those expectations at today’s meeting. Whether the market will believe the Fed is another question, however. If the Fed is quite hawkish, then the GBP/USD may be the one to watch for downside, given this morning’s weaker data from the UK. However, if the Fed is not so hawkish, then the USD/JPY could slump, and gold and silver could rebound.

What to expect from the FOMC rate decision today?

Much of the focus will be on the FOMC staff projections, the dot plots, as well as Powell’s press conference. The Fed feels that monetary policy is now restrictive enough to bring inflation sustainably down its 2% target in the coming months. So, I doubt we will hear any strong messages about further tightening. Inflation data released on Tuesday was a touch on the stronger side, but trending in the right direction. Jobs market is also cooling, although considering how tight monetary policy is, employment is holing up quite well.

Against this backdrop, I suspect FOMC officials will signal a few rate cuts in 2024 in the dot plots, effectively pushing back against market expectations of about 125 basis points rate reduction. Policymakers at the Fed have historically always been behind the curve and more cautious than market pricing.

The FOMC’s Q3 projections estimated that interest rates could to 5.1% in 2024, which would require two 25bp cuts next year. If they stick to their 2024 projection made in September, this will come as a hawkish surprise, potentially leading to a sharp dollar rally. However, if it is closer to market pricing, then the dollar will likely show a more muted upside reaction, if any, and may even end up lower on the session. It will also be interesting to see if there will be a sharp change in the Fed’s inflation projections for 2024, after signalling core PCE price index will fall to 2.6% at their September FOMC meeting.

Don’t forget about other central bank meetings this week

Once the Fed is out of the way, the focus will turn to the Bank of England, European Central Bank and Swiss National Bank. These three major central banks in Europe are also expected to keep their policies unchanged on Thursday. The BOE has indicated a prolonged hold on the current rate, but we may see their tone change given how soft the economy has been. The bigger-than-expected 0.3% drop in monthly GDP and 0.5% fall in construction output we saw earlier today suggests the BoE’s tight policy is choking the economy. Meanwhile, the ECB is also seen holding rates unchanged. Consistently weak economic data has seen traders anticipate an ECB rate cut next year, lifting the DAX to reach fresh record highs. Similar to the Fed, a slightly dovish tone from the ECB is likely needed to justify the repricing for cuts. However, if the ECB doesn’t signal such a move on Thursday, then this may support the euro and exert some downward pressure on the DAX.

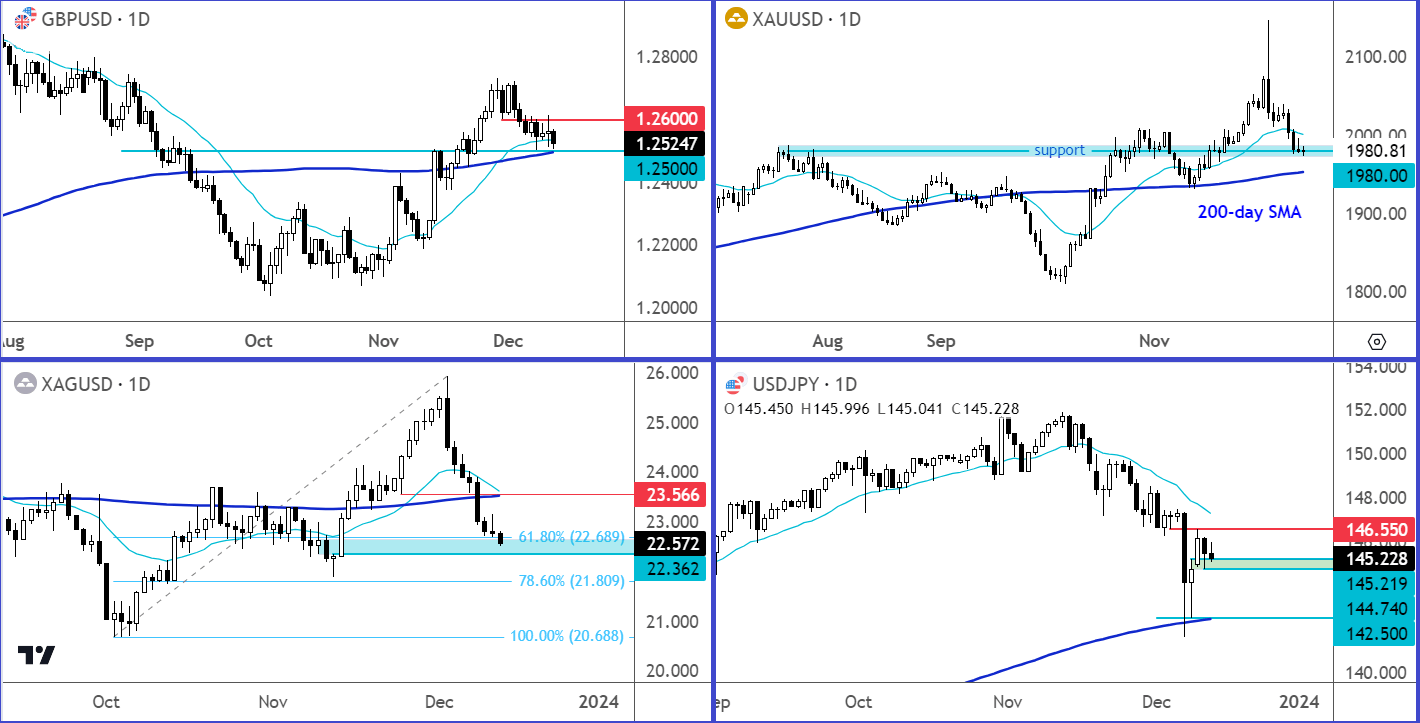

Dollar analysis: USD/JPY, GBP/USD, gold and silver among markets to watch

Source: TradingView.com

If the Fed turns out to be more hawkish than anticipated, then it makes sense to pair the dollar against currencies where economic data has been soft or where the central bank is expected to turn dovish quicker. The BoE and GBP come to mind in this regard. The GBP/USD has already shown signs of a possible bearish reversal around the 1.2600 resistance area, but so far key support around 1.2500 has held firm, where we also have the 200-day average. However, a stronger pushback on rate cuts could see the cable break below 1.25 handle.

On the other hand, if the Fed is more aligned with market expectations, then we could see a negative-dollar and positive-bond reaction, causing yields to sink. In this event, looking for long setups on gold, silver and JPY (i.e. short USDJPY or GBP/JPY) trades would make more sense.

It is worth pointing out that since Friday’s jobs report, the market has trimmed its lofty expectation of dovish tilt from the Fed. Thus, the market is probably not as heavily positioned dollar-short as before. Therefore, even if the Fed turns out to be more hawkish than expected the upside potential for the dollar could be limited.

Video analysis: USD/JPY, Gold and Silver analysis

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade