- Dollar analysis: Greenback losses a bit of momentum

- EUR/USD bears eye 200-day average

- Looking ahead to next week: Global PMIs and Jackson Hole Symposium

Welcome to another edition of Forex Friday, a weekly report in which we highlight selected currency themes. In this week’s report, we will focus on the US dollar analysis, and provide updates on the EUR/USD outlook, before looking ahead to the next week.

The US dollar remained largely on the front-foot by late afternoon in London. Barring a late-day sell-off, the Dollar Index thus looked set to close higher for the fifth consecutive week. In the week ahead, China’s ongoing situation should keep FX traders on their toes. In terms of data, global PMIs should offer lots of volatility in mid-week, before the focus turns to the Jackson Hole symposium.

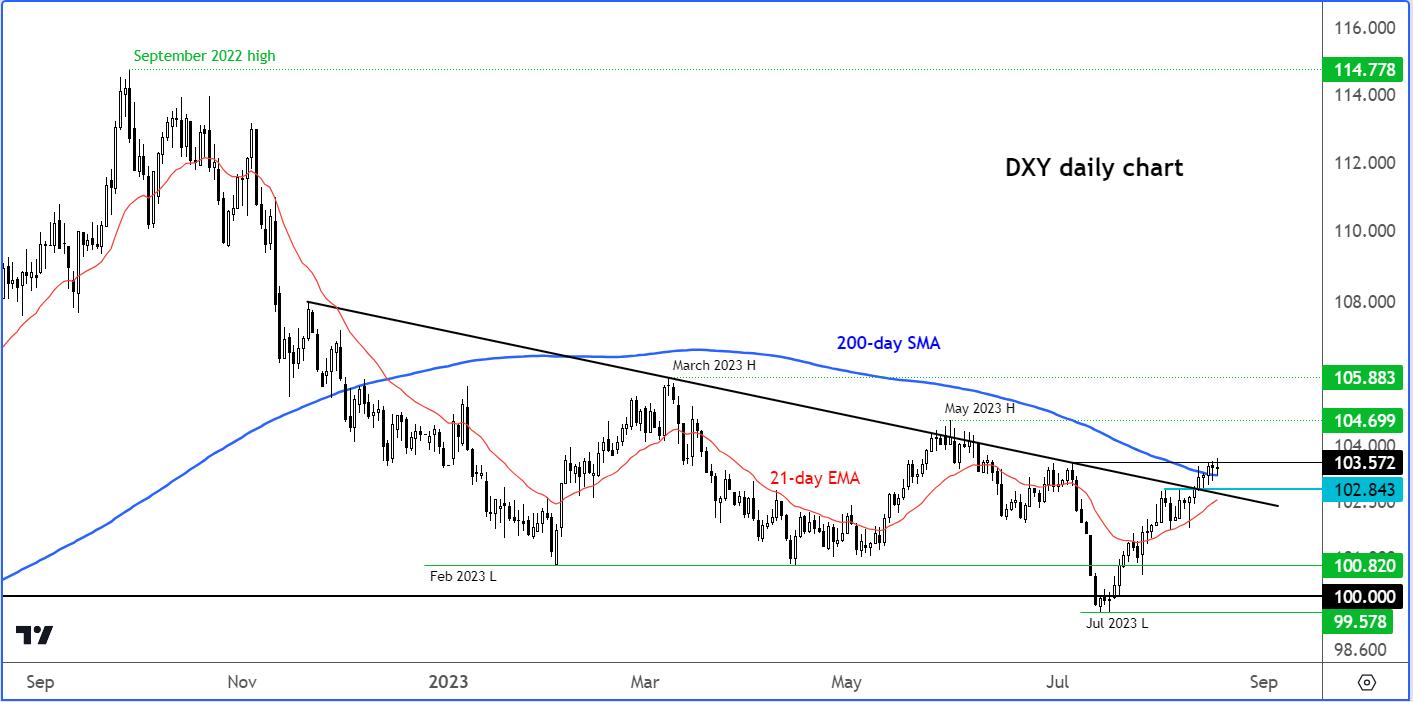

Dollar analysis: Greenback losses a bit of momentum

The dollar has been pushing higher this week because of two major reasons: rising bond yields and risk off hitting stocks.

Risk assets took a beating this week, as investors worried about high interest rates and overstretched valuations, while evidence pointed towards China's economy rapidly losing momentum. Unsurprisingly, stocks most exposed to China took a brunt of the sell-off, including big luxury brands.

So far, China’s efforts to stabilise its markets have been futile. The People’s Bank of China was at it again overnight, taking its defence of the yuan to a whole new level as it fixed the USD/CNY more than 1,000 pips stronger than expected. But this failed to prevent the yuan from falling sharply, and the USD/CNH held recent gains. Chinese equities dropped sharply, along with global markets. This kept the dollar supported against most currencies, albeit the lack of fresh data meant the greenback would lose some momentum.

Still, the Dollar Index has broken its bearish trend line and now is trying to hold above the 200-day average. While above the 200 day, we will maintain a bullish view on the DXY towards the March peak at 104.70. However, in the event the index falls back below the trend line and support around 102.85ish, then this could be the reversal signal many dollar bears would be looking for.

Source: TradingView.com

As we transition to the next week, it is important to keep an eye on the developments in China, especially as the economic calendar is set to be quieter next week.

Traders have used the yuan as a proxy for risk appetite, since the currency closely tracks the country’s economic performance. So, whether you trade the Aussie or New Zealand dollars or the euro, the situation in China is going to have a big impact.

The fact that China is now intervening more aggressively goes to show how concerned the government has become about the state of the world’s second largest economy. Watch out for more PBOC interventions in the early parts of next week.

It is also worth watching US bond yields. The sell-off in stocks meant US bonds would attract some demand on haven flows in these twilight parts of the week. The US 10-year yields have dropped back somewhat, after nearly testing the October 2022 high at 4.335% on Thursday. The slightly weaker yields and risk off tone helped to offer the yen some support, which is among the reasons why the dollar index was flattish on Friday.

Recently, bond yields have been pushing higher, discouraging investors from investing into low- or zero-yielding assets like the Japanese yen or gold. A surprisingly resilient US economy has helped to keep bond yields supported, making the yen, gold and stocks which have low dividend yields less attractive compared to the higher “risk free” returns from investing in government bonds.

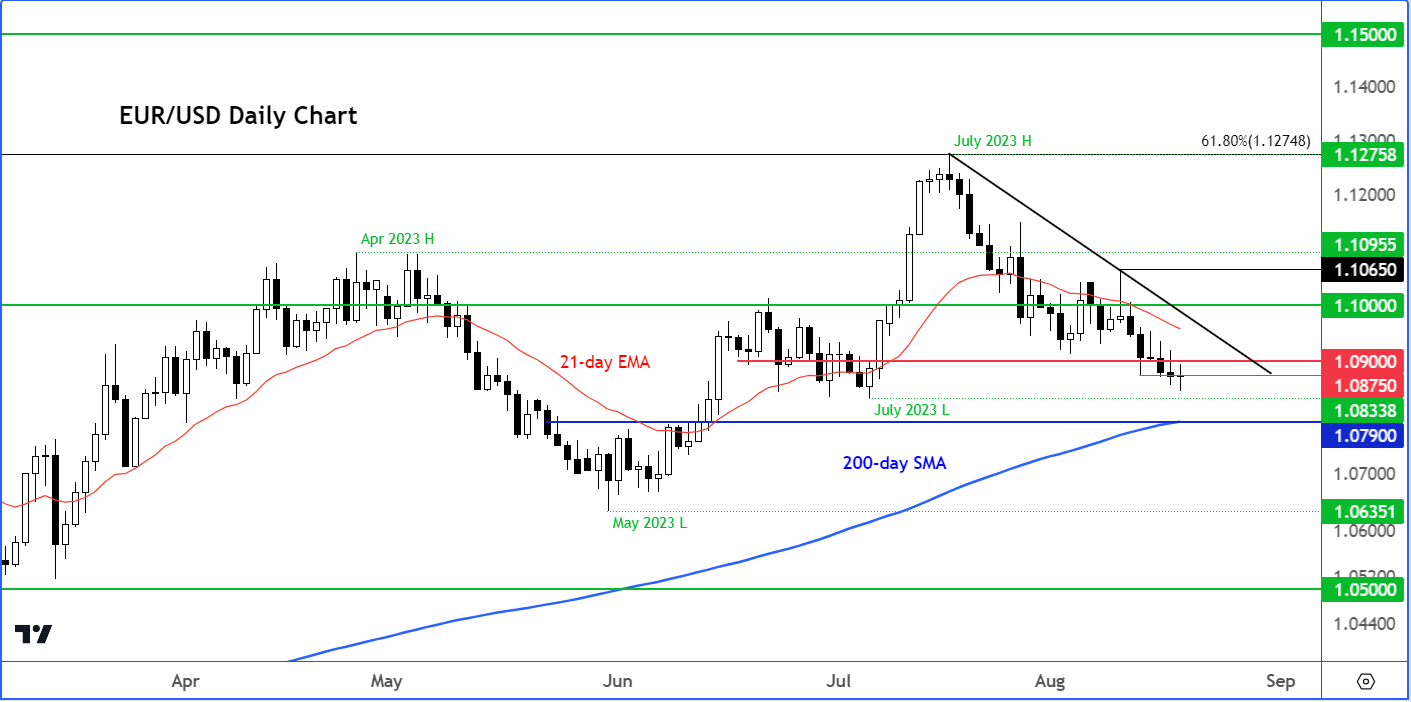

EUR/USD bears eye 200-day average

With regards to the EUR/USD, the Eurozone PMIs on Tuesday should provide some volatility ahead of the Jackson Hole symposium in the week ahead (see the macro highlights below).

Unless we see a fundamental change, the EUR/USD could be heading to 1.0790 next. This is where prior support meets the 200-day average. Key resistance is now at 1.0900 – a closing break above this level would pave the way for a potential recovery to 1.1000 handle where the bearish trend line comes into play.

Source: TradingView.com

Looking ahead to next week: Global PMIs and Jackson Hole Symposium

Global PMIs

Wednesday, August 23

All Day

Concerns over the health of the global economy intensified last week with the release of soft Chinese industrial data. This week, the focus will be on manufacturing PMI data from around the world, including the Eurozone, UK and US. Activity in the sector has been deteriorating, across all regions. Another disappointing set of PMI numbers could raise recession alarm bells.

Jackson Hole Symposium

Thursday, August 24

All Day

In recent years, central bank officials have used the Jackson Hole summit to signal major policy shifts. This year’s event will be held on 24 to 26 August. Many central banks are looking to pivot away from policy tightening. The Fed, ECB and BoE are all nearing the end of their rate hiking cycles if they haven’t already. But given upside risks to inflation, the likes of Powell, Lagarde and Bailey will probably signal intention to remain flexible and data dependent.

German ifo Business Climate

Friday, August 25

09:00 BST

Although last week’s data releases were mostly positive from the Eurozone, with Eurozone industrial production beating and GDP matching expectations, the more forward-looking indicators point to a slowdown, especially in Germany. This makes the closely-watched German ifo Business Climate index, which is based on surveyed manufacturers, builders, wholesalers, services, and retailers, all the more important.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade