- Crude oil outlook: WTI tests support as MidEast situation remains tense

- Yields on the rise again on stronger US data

- EUR/USD outlook: Technical levels to watch

- USD/CNH outlook: Yuan starting to break down again

Welcome to another edition of Technical Tuesday, a weekly report where we highlight some of the most interesting markets that will hopefully appease technical analysts and traders alike. In this week’s report, we will get technical on crude oil, USD/CNH, EUR/USD and bond yields.

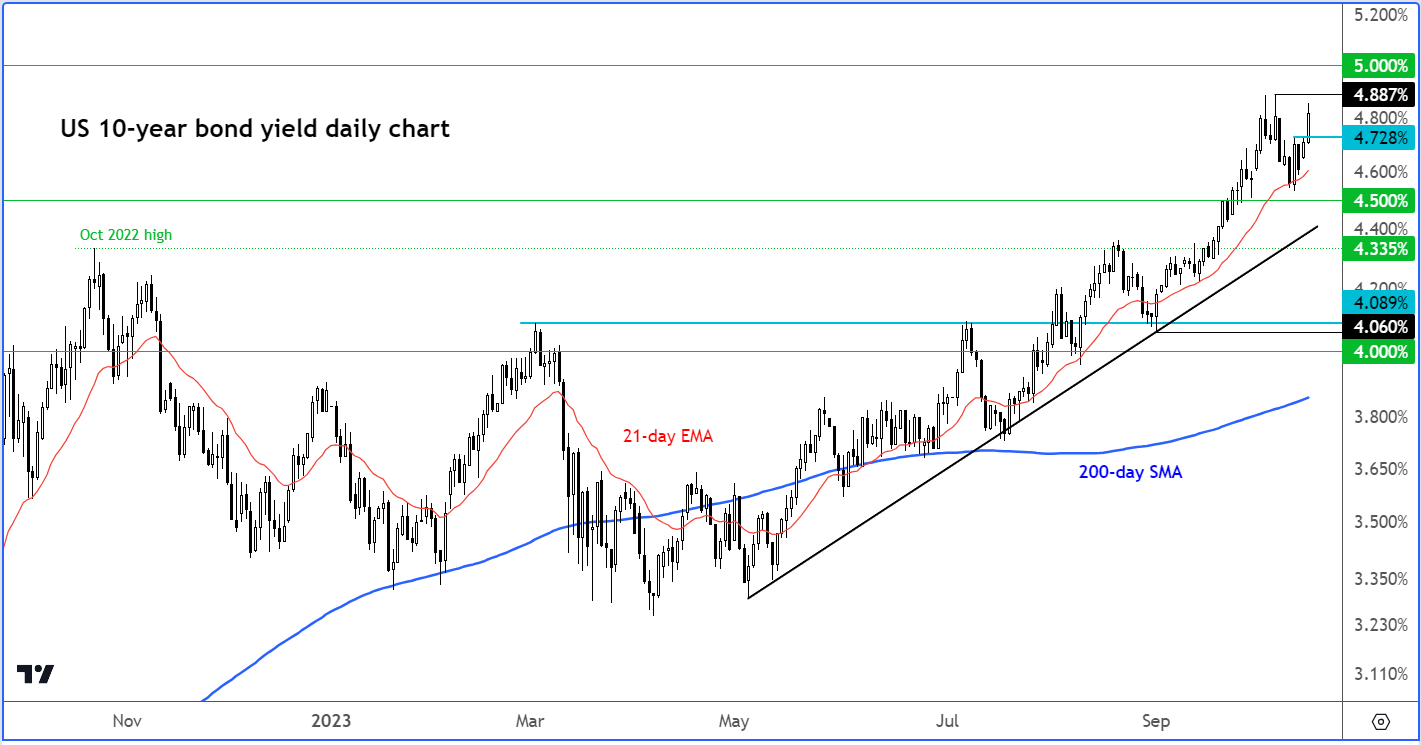

Yields on the rise again

Right now, the chart to watch is that of the US 10-year bond yield. We have seen renewed weakness creep into government bonds, lifting their yields, after better-than-expected economic reports, namely retail sales and industrial production, reinforced the case for the Fed to keep interest rates higher for longer.

The yields on the benchmark Treasury 10-year debt climbed towards its recent high (4.887%) reached a couple of weeks ago, which was the highest since 2007. If yields reach those levels, then this could hurt gold again and possibly the Nasdaq too.

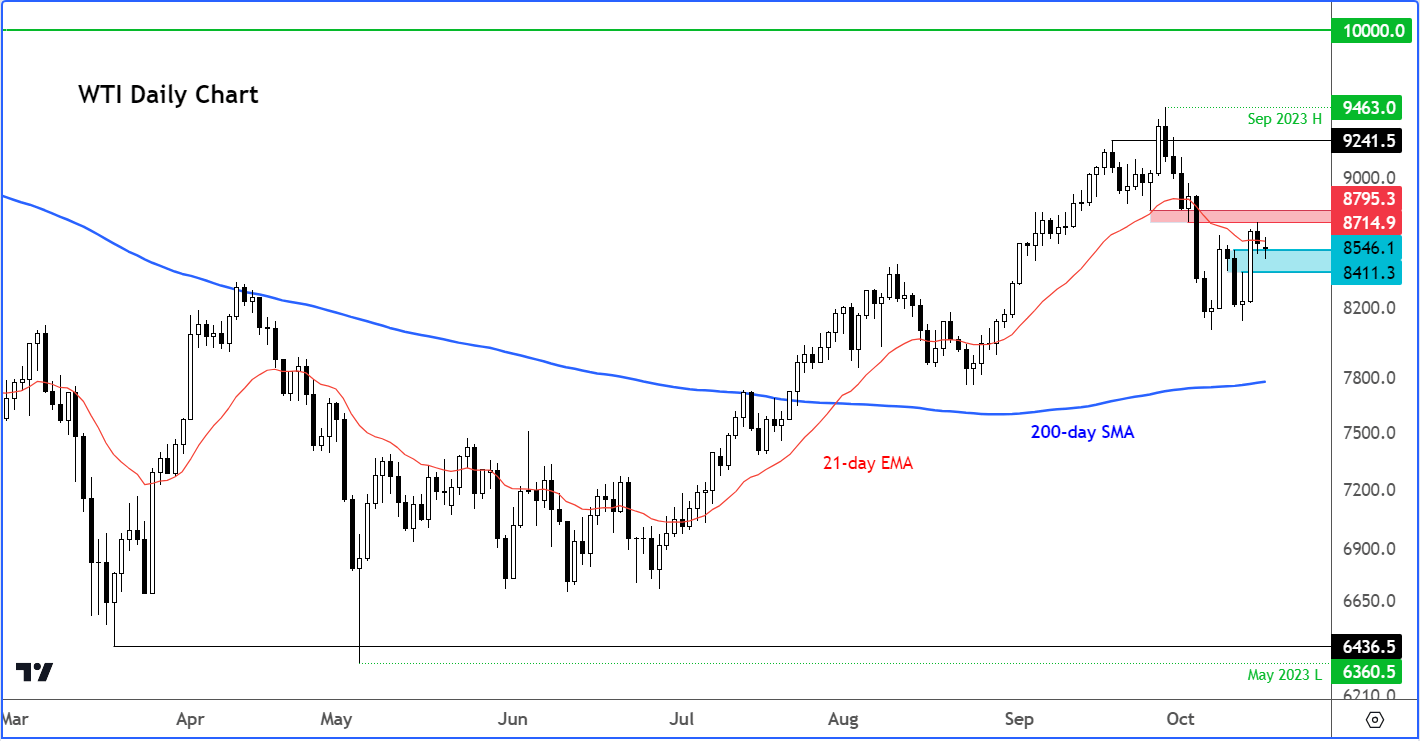

Crude oil outlook: WTI tests support as MidEast situation remains tense

Following the 5% rise on Friday, crude oil prices gave back some of those gains at the start of this week. However, this could be a temporary respite before oil prices rise again. Clearly, the path of least resistance is to the upside following that big upsurge, so don’t be surprised if the bullish trend were to resume from around current levels. There is always the risk that the developments in the Middle East could draw in large oil-exporting nations, which may hurt oil production and thereby cause prices to rise. The big worry is if Iran gets involved. Iran has said that if Gaza operations continue there would be regional escalation in the conflict.

Until such a time that the situation de-escalates, oil prices should continue to find support on any short-term dips. Even then, the OPEC’s ongoing supply cuts means prices are unlikely to fall significantly anyway.

The key support area to watch is around $84.10 to $85.45, which is where WTI had found strong resistance previously, until it was reclaimed following Friday’s breakout. Once resistance, this area could very well turn into support, leading to another move higher. But if oil fails to hold support here, however, then we could be talking about low $80s again. On the upside, resistance is seen in the region between $87.15 and $87.95, the previous support range. A break above this area could pave the way for a move towards September’s high at $94.63 and $95.00 next.

So, WTI is kind of stuck between two key technical ranges here and depending on the direction of the break, we could well see a sharp continuation in the direction of the break.

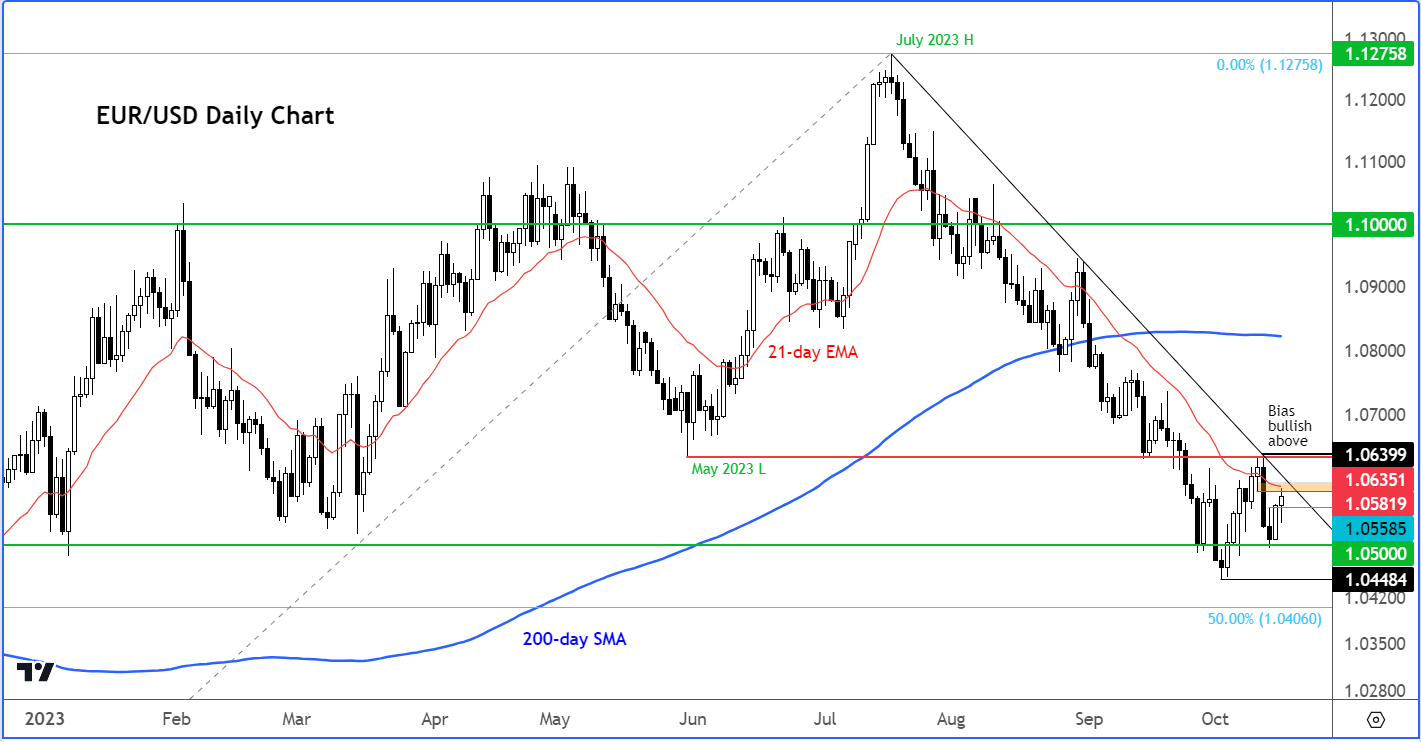

EUR/USD outlook: Technical levels to watch

At the time of writing, the EUR/USD was near its session and weekly highs of around 1.0590. This level was previously support, until it gave way on Thursday, when the EUR/USD failed to break above its bearish trend line and key resistance at 1.0635, which was the last major low made in May.

Therefore, despite the positive start to the week, the directional bias on the EUR/USD remains bearish until we break above that 1.0635 level or form a key reversal pattern at lower levels first. On the downside, key support sits at 1.0500. This level has again held firm so far in Monday’s session, after the bulls defended this zone for the past three weeks or so on the weekly time frame.

So, the EUR/USD is stuck between a rock and a hard place. A decisive break below 1.0500 would likely trigger fresh follow-up selling below this level for some time, while a move above 1.0635 resistance could lead to a sharp short-squeeze rally. Conservative traders may therefore wish to wait for the EUR/USD to make up its mind before jumping into any trades.

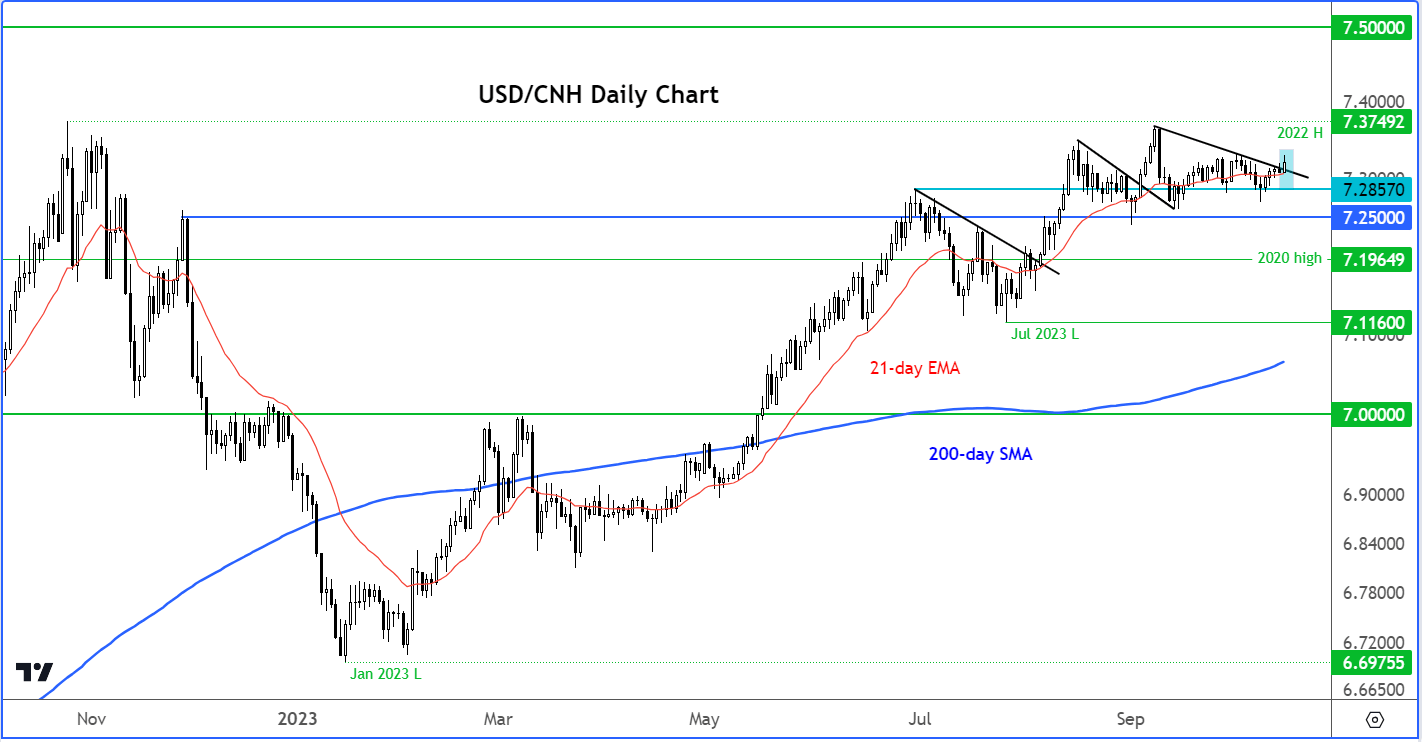

USD/CNH outlook: Yuan starting to break down again

At the time of writing, the USD/CNH was trying to break above its short-term resistance trend, thereby threatening to resume its bullish trend. The weakness in the yuan was also mirrored in the technology sector where stocks underperformed, with Nvidia shares slumping. However, other major indices were doing better. The US is restricting the sale of chips the company designed specifically for the Chinese market. The yuan is also under pressure because of a strong US dollar, supported by strong data today (retail sales and industrial production).

As we look forward to the rest of the week, the USD/CNH could move decisively higher should the upcoming data releases from China disappoint expectations again. As well as GDP, we will have industrial production and retail sales data to look forward to from the world’s second largest economy on Wednesday. Concerns over China’s struggling economy has been a key theme for much of the year, which has held back the local stock markets and the yuan, as well as some commodity prices like copper. But will we start to see some signs of stabilization in data to arrest the underperformance of Chinese assets?

From a technical perspective, the USD/CNH has been consolidating near the previous year’s high of 7.3450, and with today’s (so far unconfirmed) break of the short-term bearish trend, more losses could be on the way. On the downside, the key support level to watch is at 7.2700. A break below this level is needed to ignite some real selling pressure.

Source for all charts used in this article: TradingView.com

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade