Market Summary:

- Crude oil prices snapped a three-day bearish streak after Russia announced a cut in oil production, and geopolitical tensions continued to rise with attacks on energy infrastructure in Russia and Ukraine

- The US dollar index retraced slightly from resistance levels around 104.20 including trend resistance from the 2022 high

- And that sums up FX moves nicely on a quiet Monday; prices essentially retraced slightly against Friday’s moves to see EUR/USD retest its 200-day MA from below, GBP/USD bounce slightly from its 200-day MA, USD/CAD retreat back below 1.36 and USD/JPY remain in a tight range between 151 – 151.50.

- The retracement shows a slight hesitancy to break immediately higher, but is not deep enough to threaten the bias for an eventual upside break

- Gold prices are standing up to the stronger US dollar overall, although volatility has picked up notably after its failed break above $2200 but at the same time looks comfortable above the 2150 area – hence the bias for some choppy trade above that key level

- Fed member Bostic repeated his stance that he only expects one Fed cut this year, a view in line with my own despite the dot plot continuing to favour three cuts

- This saw Wall Street indices retreat for a third day, but again the trading ranges were very small and not enough to spark fears of a sustainable move lower

Events in focus (AEDT):

- 10:30 – Australian consumer sentiment (Westpac)

- 10:50 – Japan’s corporate services price index

- 23:15 – BOC deputy governor Roger speaks

- 23:30 – US durable orders

- 23:30 – Canadian wholesale sales

- 00:00 – US house price index

- 01:00 – US consumer confidence (Consumer Board)

- 03:30 – Atlanta Fed GDPNow (Q1)

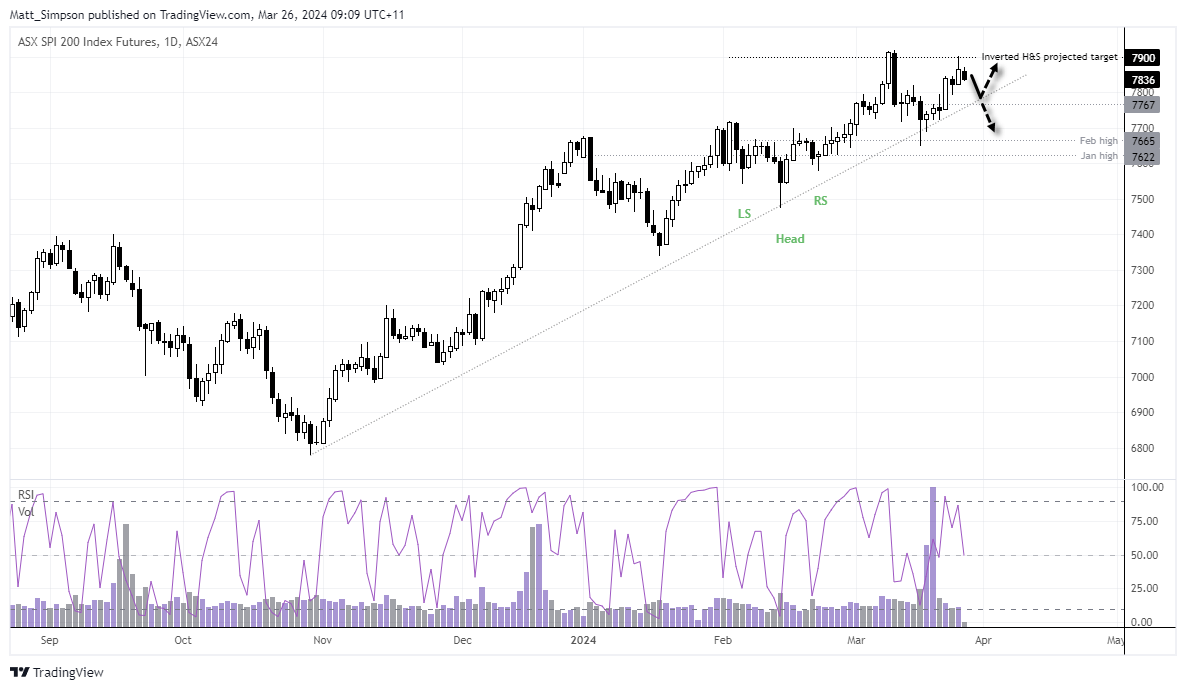

ASX 200 technical analysis:

The move lower on Wall Street saw the ASX 200 futures contract retrace slightly, but given it has once again met resistance at 7900 then I suspect another dip lower could be in order. We have not seen any real trading volumes since last Tuesday, and since then prices have risen whilst volumes declined to show a lack of bullish enthusiasm. Therefore, today’s bias is to fade into minor rallies and seek a move to at least 7800, 7767 or the bullish trendline.

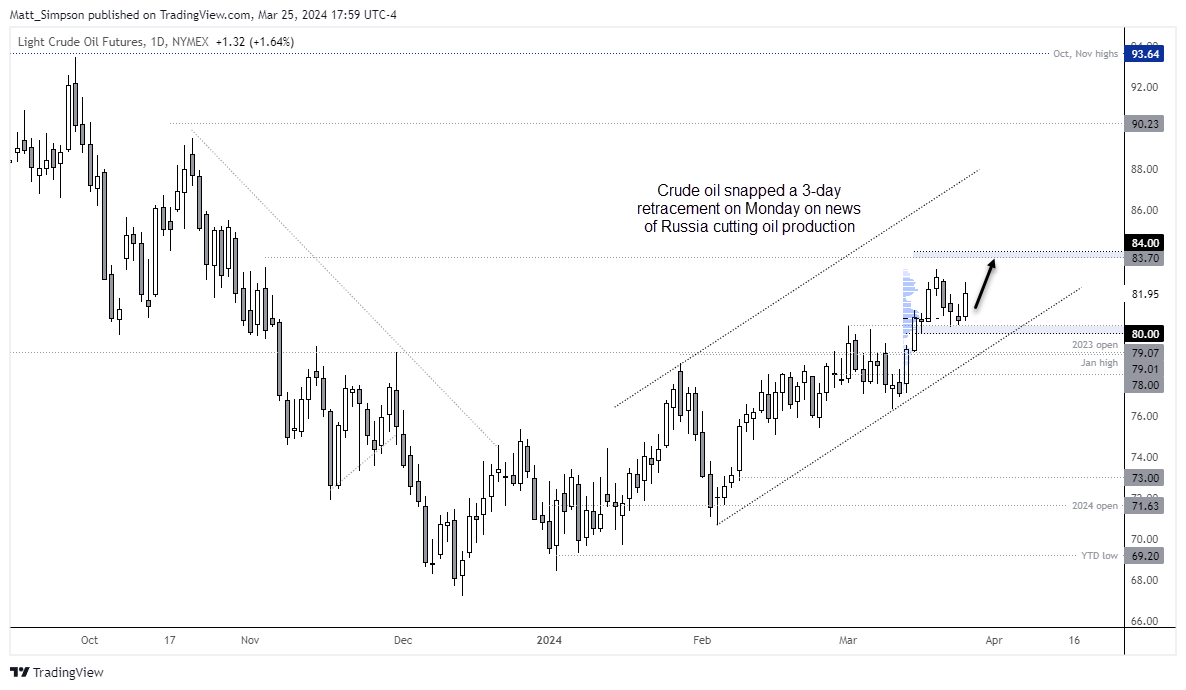

WTI crude oil technical analysis (daily chart):

As a reminder, I set an upside target around $84 ahead of crud oil’s latest leg higher. Whilst it failed to hit that level initially, the bias remains for it to do so. The daily chart shows an inverted hammer on the third day of its retracement, which found support at the March 1 high. Bullish range expansion formed on Monday, and the plan is to seek retracements of bullish continuation patterns on lower timeframes with $84 still in mind.

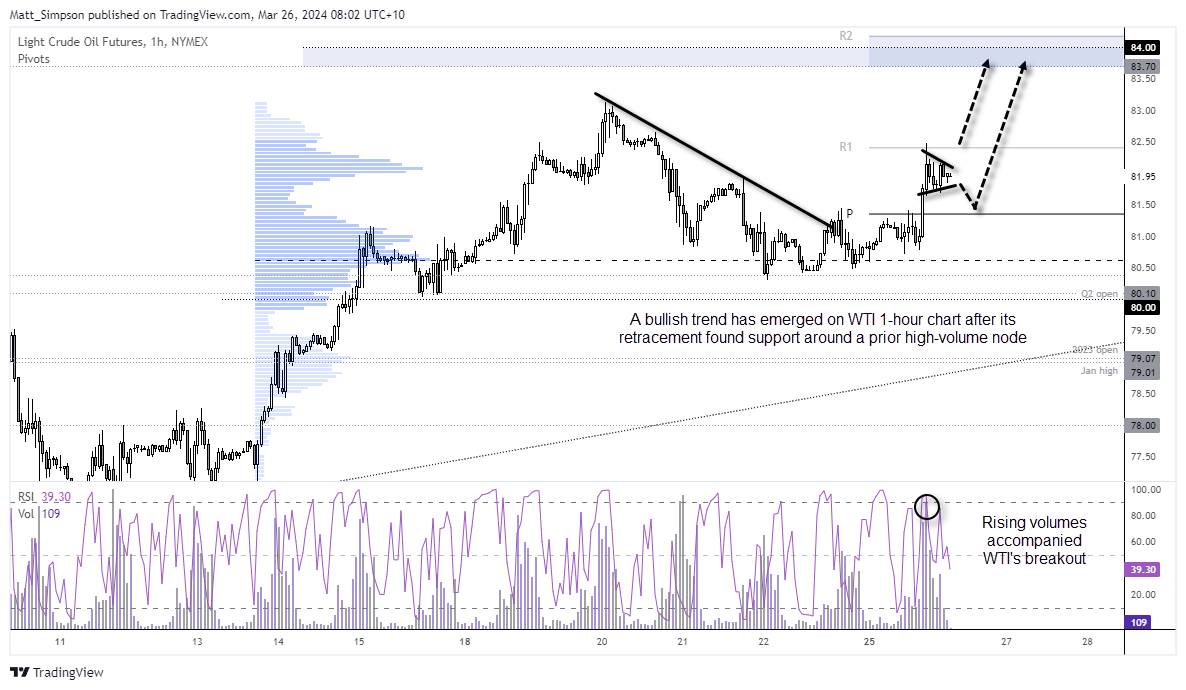

WTI crude oil technical analysis (1-hour chart):

The 1-hour chart shows that prices accelerated higher above the weekly pivot and were accompanied by higher volumes. A small pennant is also forming, which could indicate a breakout from the bullish continuation pattern, with a break above the weekly R1 bringing the $83.70 - $84 zone into focus. Should prices initially break lower from the pennant, I would then be looking for evidence of a swing low around the weekly pivot point for a potential bullish setup.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade