GBP/USD takeaways

- Despite a quiet economic calendar to start the week, GBP/USD has seen some volatile price action on the back of the US Services PMI report.

- GBP/USD continues to find support at the bottom of its 2-month range in the low- to mid-1.2300s.

- The near-term bias remains for a continued grind higher given the longer-term uptrend and well-defined support zone.

GBP/USD fundamental analysis

It’s been a quiet start to the week’s trade in the UK, with essentially no economic data on the calendar today. The only report of note was the revision to the flash Services PMI report, a negligible tick up to 55.2 from the initial estimate of 55.1.

Meanwhile, across the proverbial pond, the US saw an eye-raising data point. The ISM Services PMI survey for May came in at 5003, well below the 52.6 reading expected after last month’s 51.9 print. Notably the “Prices Paid” component of the survey was just 56.2 vs. 59.6 last month; this marks the lowest price pressures in this survey since May of 2020!

Between a chorus of Fed speakers coming out in favor of a pause and the middling economic US economic data of late, it’s increasingly difficult to see the Fed hiking interest rates this month unless next week’s CPI report is truly elevated. Instead, Jerome Powell and company may prefer to gather another six weeks of data on how the past 15 months’ worth of rate hikes are impacting the economy before making that decision at the end of July.

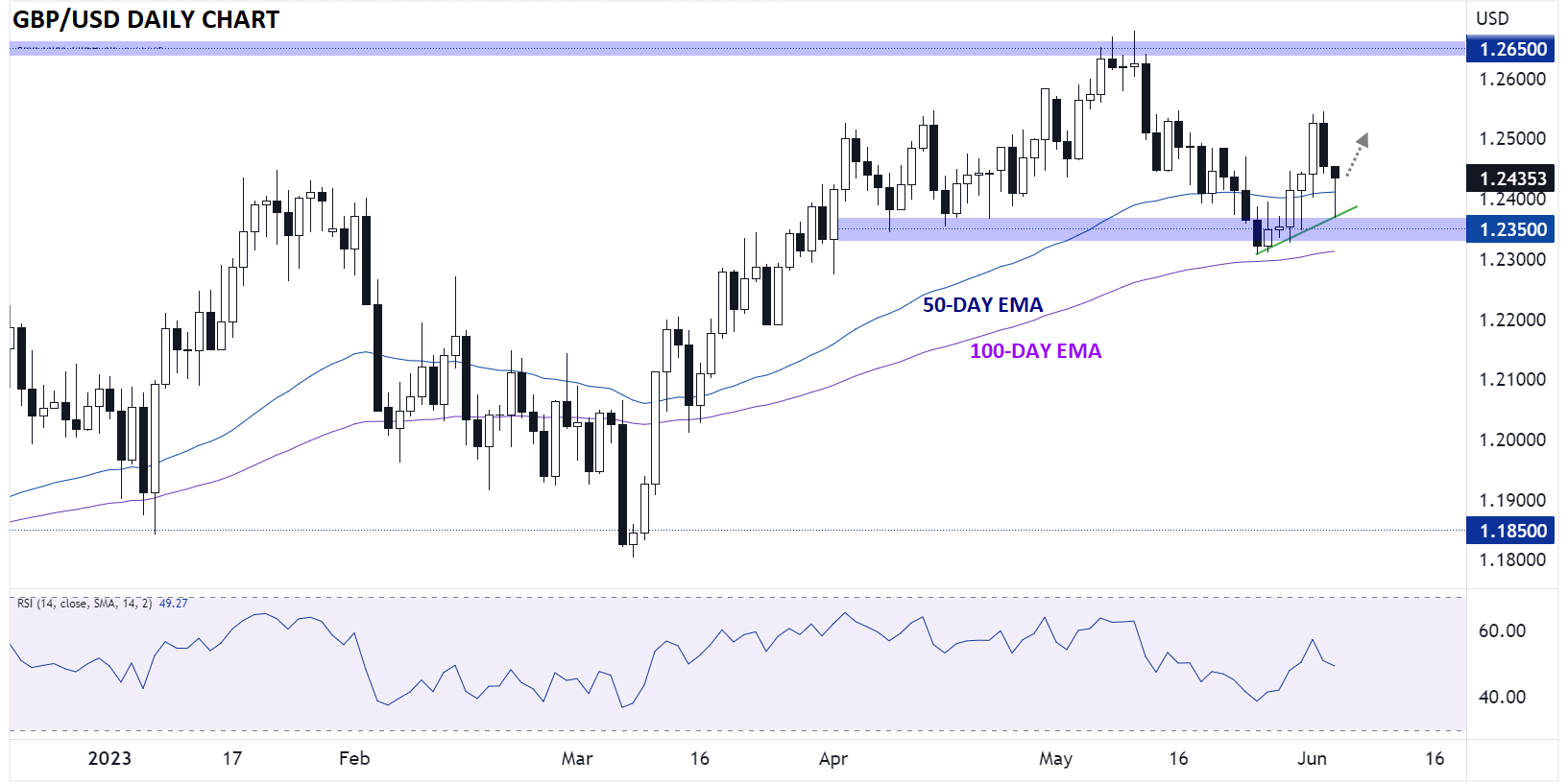

British pound technical analysis – GBP/USD daily chart

Source: TradingView, StoneX

As the GBP/USD chart above shows, cable has been edging higher in fits and starts since bottoming near previous support in the lower-1.2300s about 10 days ago. The pair dropped sharply to retest the mid-1.2300s earlier today before buyers again stepped in to defend that area.

From a technical perspective, GBP/USD remains above its rising 50- and 100-day EMAs, with rates in the lower half of the two-month range between about 1.2325 and 1.2650, potentially setting the stage for a continued bounce toward the top of that range as we move through the month.

Looking ahead, tonight’s UK BRC Retail Sales Monitor and tomorrow’s Construction PMI figures out of the UK are likely to lead to some volatility, but the ongoing bounce off the bottom of the medium-term sideways range remains the dominant storyline for now.

-- Written by Matt Weller, Global Head of Research

Follow Matt on Twitter: @MWellerFX