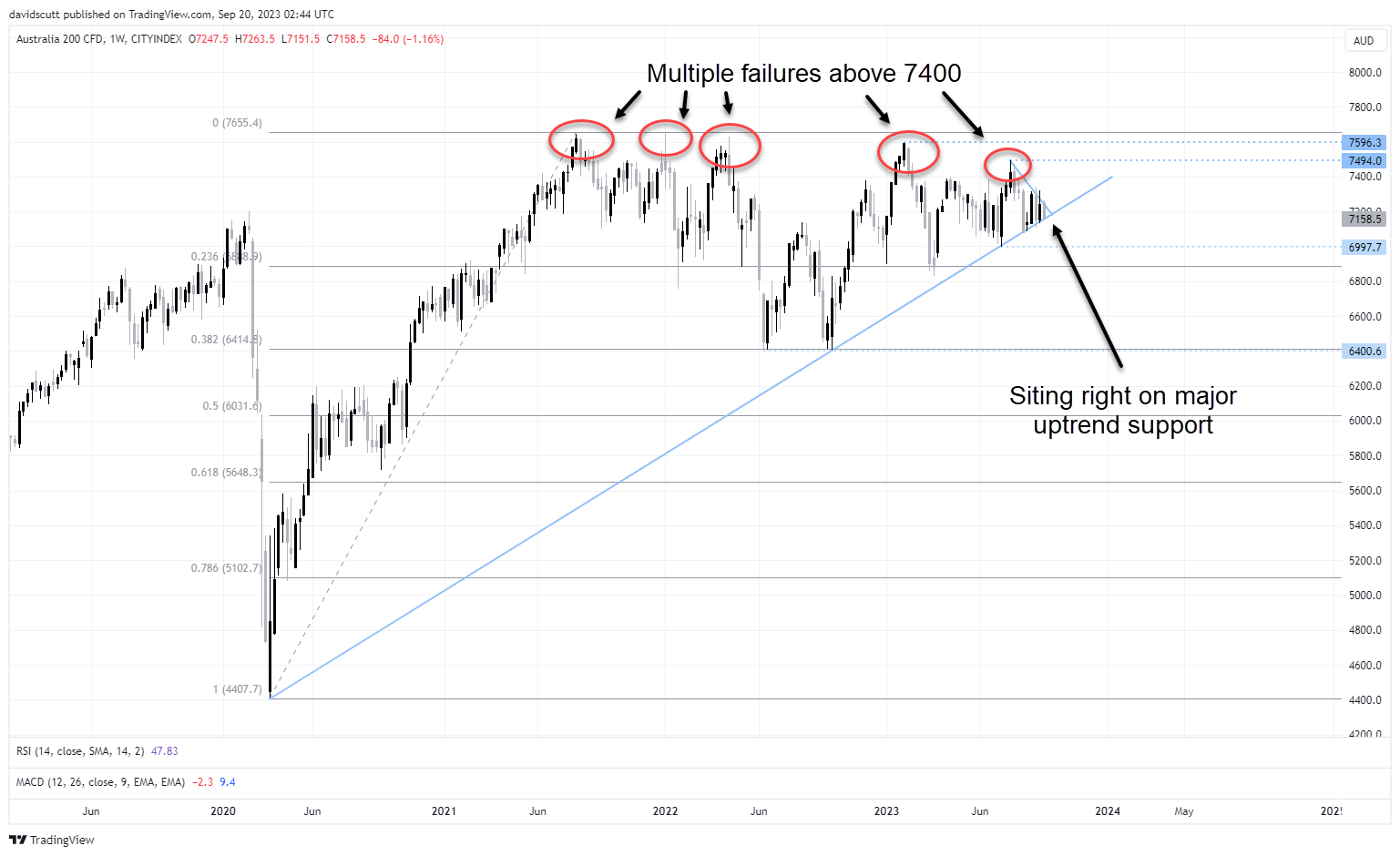

An uneventful year for the ASX 200 could be about to get a lot more exciting with Australia’s benchmark index perilously close to breaking long-run uptrend support dating back to the start of the coronavirus pandemic. With major risk events arriving in the coming days, headlined by the Federal Reserve’s September interest rate decision, and global bond yields pushing towards cyclical highs on the back of higher energy inflation, the next few days loom as a pivotal moment for the longer-term trajectory.

ASX 200 screams stalemate

Looking at the weekly chart, it screams stalemate. Bulls are staunchly defending the uptrend but are unwilling to push the index meaningfully higher given its checkered history above 7400 over the past few years. Using an analogy from climbers on Mount Everest, it’s the ‘death zone’ for bulls.

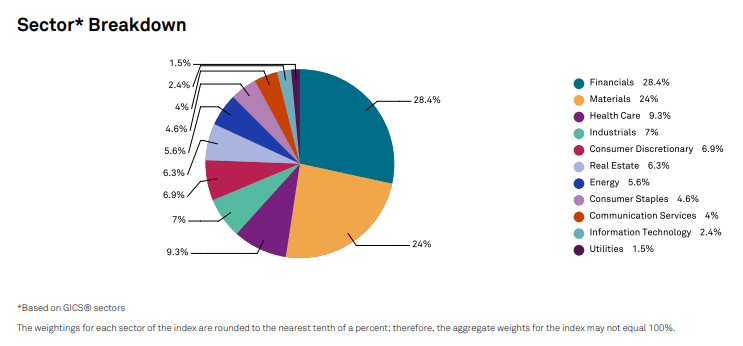

With the index yet to breakdown, there’s are grounds for it to continue griding higher in the short-to-medium term. But when looking at the ASX 200 from a fundamental perspective, you must remember over half the index weighting reflects movements in miners and banks. So, you’re essentially taking a view on what happens in those areas.

Source: S&P Global

ASX 200 outlook dependent on banks and miners

On the materials sector, even though it’s down 10% from the highs struck earlier this year, it remains well above levels seen before the China economic reopening excitement arrived late last year. Even though the economic boom that many expected never arrived, and with few signs yet the government will rollout stimulus measures anywhere near the scale seen following the GFC, there’s been no meaningful recalibration of investor expectations yet.

As for the banks, it’s essentially a play on expectations for bad debt provisioning, loan growth and margins. While risks around the former have diminished given the reacceleration in house price growth around the country, it’s hard to get excited about the prospects elsewhere. The cost of capital continues to increase while disposable incomes are getting squeezed, limiting access and demand for credit. Are we likely to see margins and asset growth boom in such an environment? Probably not.

With the outlook for the two largest components in the ASX 200 hardly compelling, it comes down to what will be the catalyst to drive the market higher? None of the remaining sectors outside healthcare are likely to move the dial. It suggests external factors, such as a rapid reacceleration in the Chinese economy or soft economic landing for developed nations allowing interest rates to be cut, will be likely be required. Without them, it points to a modestly bearish backdrop and potential for the index to breakdown technically.

Big fortnight ahead for ASX 200

Given where the ASX 200 sits on the weekly chart, the next fortnight looks pivotal for its trajectory towards the end of the year and into 2024. It’s currently sitting right on the long-term support line, wedged in by downtrend resistance it’s failed to break on several occasions since July.

If the support were to give way, a push back towards 7000 appears likely. Beyond that, while the index did a plenty of work below 6900 last year, 6400 would be the next major target, coinciding with the 38.2% Fib of the pandemic low-high. As mentioned earlier, the index has a terrible track record above 7400, suggesting a stop above may be suitable should any near-term downside prove to be a false break.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade