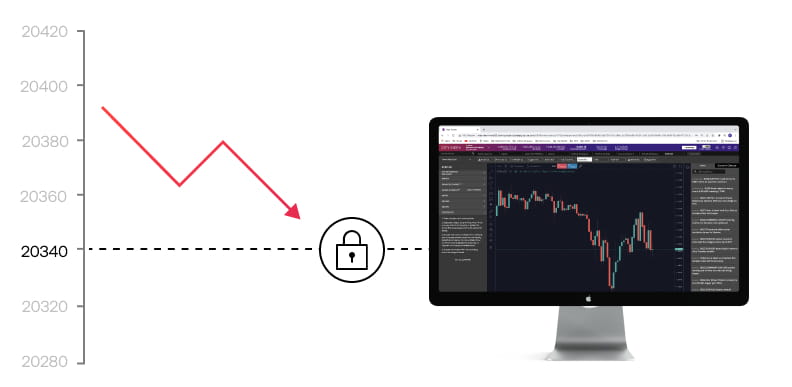

Trading with guaranteed stop loss orders (GSLOs)

Take control of your trading account with our guaranteed stop loss orders (GSLO) feature. Ensure your stop loss is executed at the level you choose, protecting your funds and reducing your risk.

What are the benefits of GSLOs?

What is a GSLO?

GSLOs are similar to standard stop loss orders, but with a key difference: they guarantee to close your trade at the exact price specified by you, regardless of underlying market volatility and gapping. GSLOs are ideal for traders who are trading in volatile markets or who don't want to risk more than their initial deposit.

By setting the exact closeout level upfront you determine your maximum risk, potentially resulting in lower margin required to place the trade. This also makes GSLOs a limited-risk product - you cannot lose more than your initial margin if the market moves against you.

GSLOs act like insurance that you only pay for when you need. They are free to place, and you only pay a small premium if the GSLO is triggered, providing a cost-effective method of managing your risk.

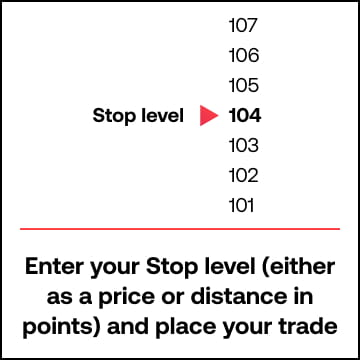

How to place a GSLO

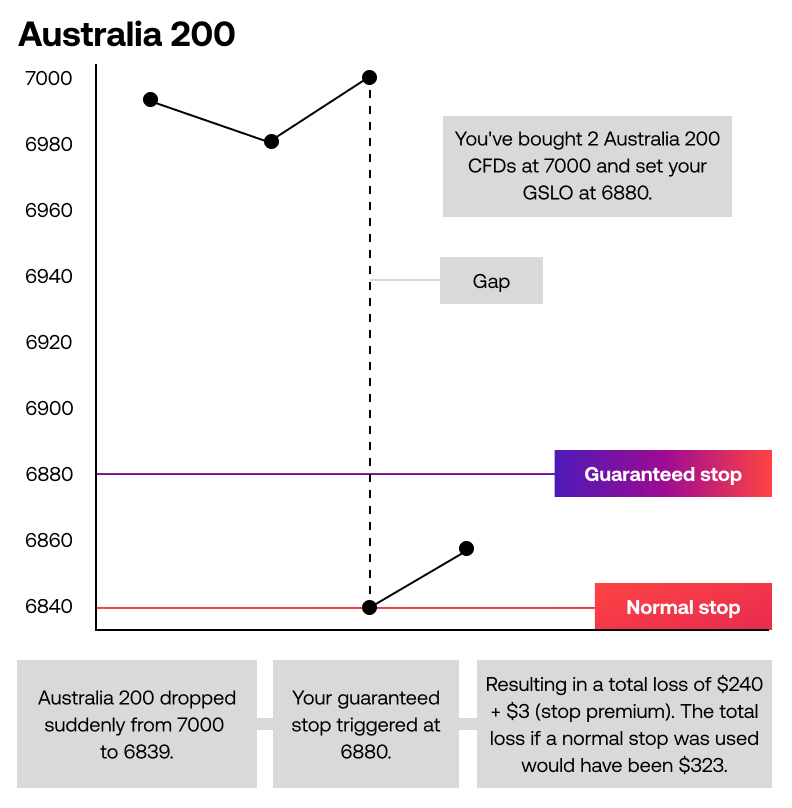

Example of a GSLO trade

You believe the Australia 200 market price is going to rise, so you buy 2 Australia 200 CFDs with an opening price of 7000.

You place a GSLO at 6880, which means the maximum loss on the trade would be (7000 – 6880 = 120) x 2 = $240.

The stop premium for the Australia 200 is 1.5x the quantity of CFDs and would therefore be 2 x 1.5 = $3 if your GSLO was triggered.

As a result of high volatility, the price of the Australia 200 moves against you and unexpectedly drops from 7000 to 6839.

Despite market gapping, your trade closes automatically at your specified GSLO price of 6880.

Your total loss on the trade is therefore $240 (maximum risk) + $3 (stop premium) = $243

If you had used a standard stop, then your position would have closed at 6839 and resulted in a loss of $322.