When will Microsoft release Q1 earnings?

Microsoft will release first quarter earnings after markets close on Tuesday October 25. A conference call will be held at 1430 PT.

Microsoft Q1 earnings consensus

Wall Street forecasts Microsoft will report a 9.6% rise in revenue in the first quarter of its new financial year to $49.66 billion, toward the bottom of its $49.25 billion to $50.25 billion guidance range, and a 1.8% increase in diluted EPS to $2.31.

Microsoft Q1 earnings preview

Microsoft is expected to report the strongest earnings growth out of all Big Tech this season although, at just 1.8%, there isn’t much to cheer about.

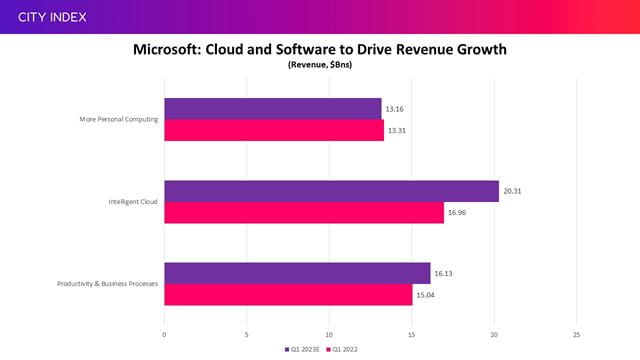

Microsoft provides an array of vital services and products to businesses, such as cloud computing and software, and this is expected to benefit the company this season as demand here is likely to hold-up better than on the consumer side. This is demonstrated by the fact revenue from Microsoft’s More Personal Computing arm that is more geared toward consumers is forecast to decline from last year and countered by strong growth from its other units catering to businesses:

(Source: Q1 2023 estimates from Bloomberg)

The company, which makes over half its sales outside the US, will feel the impact from the strong dollar considering the topline is forecast to grow almost 15% at constant currency.

More Personal Computing, which makes its money from Xbox gaming consoles, Surface laptops, its Windows operating system and its search and advertising operation, is forecast to report a 1.4% drop in revenue and a 5.7% fall in operating profit to $4.8 billion. We have already heard warnings from other tech companies, including semiconductor stocks, that demand for both gaming and consumer electronics has stalled. The boom in demand for hardware from businesses during the height of remote work during the pandemic is also unwinding. This not only hits demand for its hardware, but also impacts the number of people using its Windows system.

Productivity & Business Processes homes its suite of Office and Dynamic software as well as its recruitment-focused social media site LinkedIn. The software, which is mostly offered through lucrative licensing, remains key for both individuals and businesses and demand should hold up better than other forms of software going forward. Forecasts suggest Office demand from consumers will continue to grow but that it will be far more sluggish on the commercial side. LinkedIn will also contribute to topline growth as labour conditions remain tight. The overall division is forecast to report a 7.3% increase in revenue and a 5.2% rise in operating income to $7.8 billion this quarter.

Intelligent Cloud remains the biggest contributor to both topline growth and operating income. The unit is forecast to deliver a 20% rise in revenue and a slightly faster 21% increase in operating profit this quarter to $8.7 billion. Azure, which underpins its cloud operations and is often closely watched by the markets, is expected to report an impressive 43% rise in revenue at constant currency and remains the brightest part of the business.

Microsoft said it was aiming to deliver double digit revenue growth and higher operating income at constant currency this financial year when it outlined targets earlier in 2022, but this could be vulnerable given slower growth and multiple headwinds limiting progress at the bottom-line. Wall Street currently believes it can just about deliver, with 10.8% revenue growth pencilled-in over the full year and a 9.9% increase in operating profit.

Where next for MSFT stock?

Microsoft shares have rebounded since hitting 34-month lows just over a week ago, although the recovery has already shown signs of running out of steam.

Trading volumes have been on the decline during the past week and the five-day average volume at time is 25% below the 10-day, 20-day and 30-day averages, although we are likely to see a spike on the day of the results and in the wake of the update as we have seen in the past. We could see the stock drift back toward the $225 mark, in-line with the March 2021 low, if it remains under pressure and the 34-month low of $219 remains in play.

The stock briefly managed to break back above the $239 level of resistance-turned-support that we saw back in March 2021 before coming back under pressure. This is the first upside target for the stock before $241.50, the June-low, comes back into view. From there, it can eye a sharper jump to recapture the October-high of $250 and then the 50-day and 100-day moving averages are back in play. Notably, the 200-day moving average is currently aligned with the June ceiling at $275.

The 52 brokers that cover the stock believe there is even greater upside potential with an average target price of $323, although this has been curtailed from over $346 over the past three months.

Turning to the weekly chart, we can see that Microsoft shares have formed a series of lower-highs and lower-lows since peaking at all-time highs just under a year ago and this downtrend is still intact.

Take advantage of extended hours trading

Microsoft will release earnings after US markets close and this means most must wait until they reopen the following day before being able to trade. But by then, the news has already been digested and the instant reaction in share price has happened in after-hours trading. To react immediately, traders should take their positions in pre-and-post-market sessions.

With this in mind, you can take advantage of our service that allows you to trade Big Tech stocks using our extended hours offering.

While trading before and after hours creates opportunities for traders, it also creates risk, particularly due to the lower liquidity levels. Find out more about Extended Hours Trading.

How to trade Microsoft stock

You can trade Microsoft shares with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for ‘Microsoft’ in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade

Or you can try out your trading strategy risk-free by signing up for our Demo Trading Account.