As viewed first hand here in Australia, Omicron has wreaked havoc with supply chains as workers who contract the virus isolate at home.

In New Zealand, home isolation will further exacerbate existing staff shortages and undermine business confidence. Mindful that New Zealand's borders remain shut to international workers.

Q4 NZ inflation data is scheduled to be released after Thursday's FOMC meeting at 8.45 am Sydney time and is likely to provide a further hit to business and consumer confidence with a considerable increase expected.

Consumer prices are expected to have risen by 1.5% in the December quarter and will take annual inflation to 6.0% y/y, up from 4.9% last quarter. It would be the highest annual inflation rate in New Zealand in over 30 years.

Against a backdrop of strong domestic demand, inflation is widespread. Covid disruptions and wider global inflation is expected to see a big lift in tradable inflation. While domestic inflation is expected to rise due to large increases in construction prices, labour shortages and transport costs.

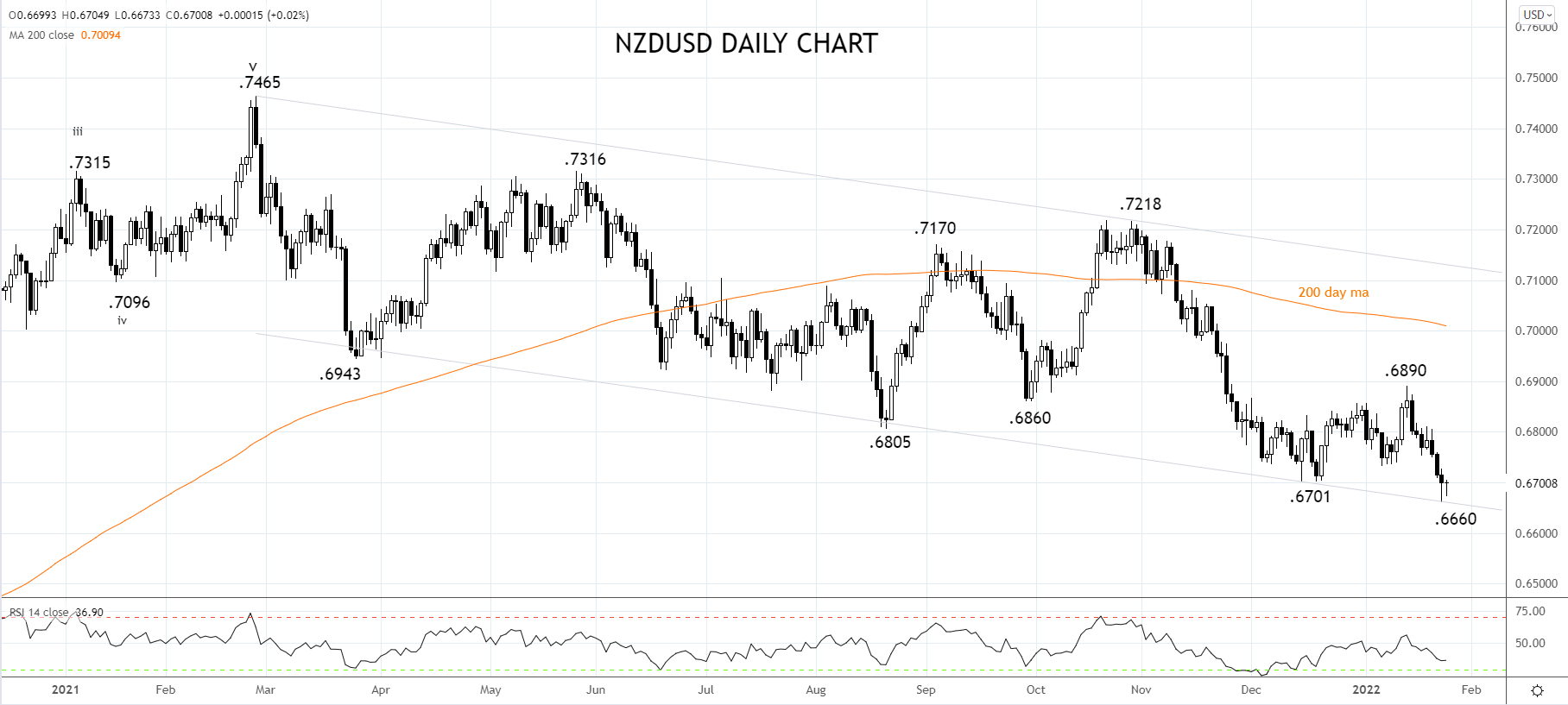

Turning now to the currency. The NZDUSD made new cycle lows overnight at .6660 after breaking below horizontal support at .6700c.

As can be viewed on the chart below, the NZDUSD is again testing multi month trend channel support from where bounces have previously occurred. Also notable, bullish divergence evident on the RSI.

Providing the NZDUSD holds above .6660/50 on a closing basis allow for a short-term bounce back towards .6900c. However, if the NZDUSD breaks support at .6660/50, there is scope for the decline to extend towards .6550 and then .6500c in the medium term.

Source Tradingview. The figures stated areas of January 25th, 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade