Following the FOMC rate decision, gold gave up much of its earlier gains, falling alongside equities as the dollar recovered from earlier weakness that was driven by disappointing US data and company earnings. Gold was up earlier in the day on Wednesday to extends its rise for the fourth session, after the market pricing of rate cuts for 2024 jumped to 145 basis points compared to 130 bps earlier in the week. Investors were attaching a 65% probability of a rate cut in March, from around 45%, after the publication of the ADP private payrolls and Chicago PMI raised concerns about the economy. However, the Fed then stepped up to drive all risk assets and dollar-denominated commodities lower.

FOMC triggers hawkish repricing of interest rates

As I mentioned yesterday, it would have been a real surprise to me if the Fed adopted a dovish stance, given the consistently robust US economic data, apart from those released earlier in the day on Wednesday. The Fed was expected by many analysts, including us, to emphasize that while inflation and the job market are progressing positively toward a soft landing, they are not in a hurry to implement rate cuts. When rate cuts are eventually here, they are likely to be more measured than in previous instances. That is precisely what the main message was from Powell’s press conference. If anything, the Fed Chair was a little more hawkish than expected.

Still, traders are not letting go of the possibility of an earlier-than-expected rate cut. They are now pricing in around 38% probability that the Fed may cut rates in March. Those expectations could rise further if incoming US data from now on takes a bearish turn.

Attention will turn to US job data. Today we will have the challenger job cuts and jobless claims figures to look forward to, ahead of the official non-farm payrolls report on Friday. The ADP payrolls data showed jobs grew less than expected yesterday printing at 107K, down from 158K.

Eurozone inflation beats

Meanwhile, inflation data from the Eurozone surprised to the upside, coming in at 2.8% instead of 2.7% expected, down from 2.9% previously, with core CPI easing to 3.3% from 3.4%, but again beating expectations. This is likely to keep the ECB on a hawkish path until they are confident that interest rates are heading sustainably lower. This is another factor that could weigh on gold prices

BoE seen holding policy unchanged

With the Fed out of the way, the Bank of England's interest rate decision is looming. Given that three BoE policymakers had previously voted for a rate hike and inflation has increased since then, the likelihood of a rate cut in the next couple of meetings are very slim. Clearly, the focus is shifting to when the Bank of England might consider cutting rates in the future. The decision will be accompanied by fresh projections, which could indicate the beginning of a gradual shift towards a cycle of rate cuts. The data since the last projections in November, including lower-than-expected economic activity, may contribute to this potential shift in policy.

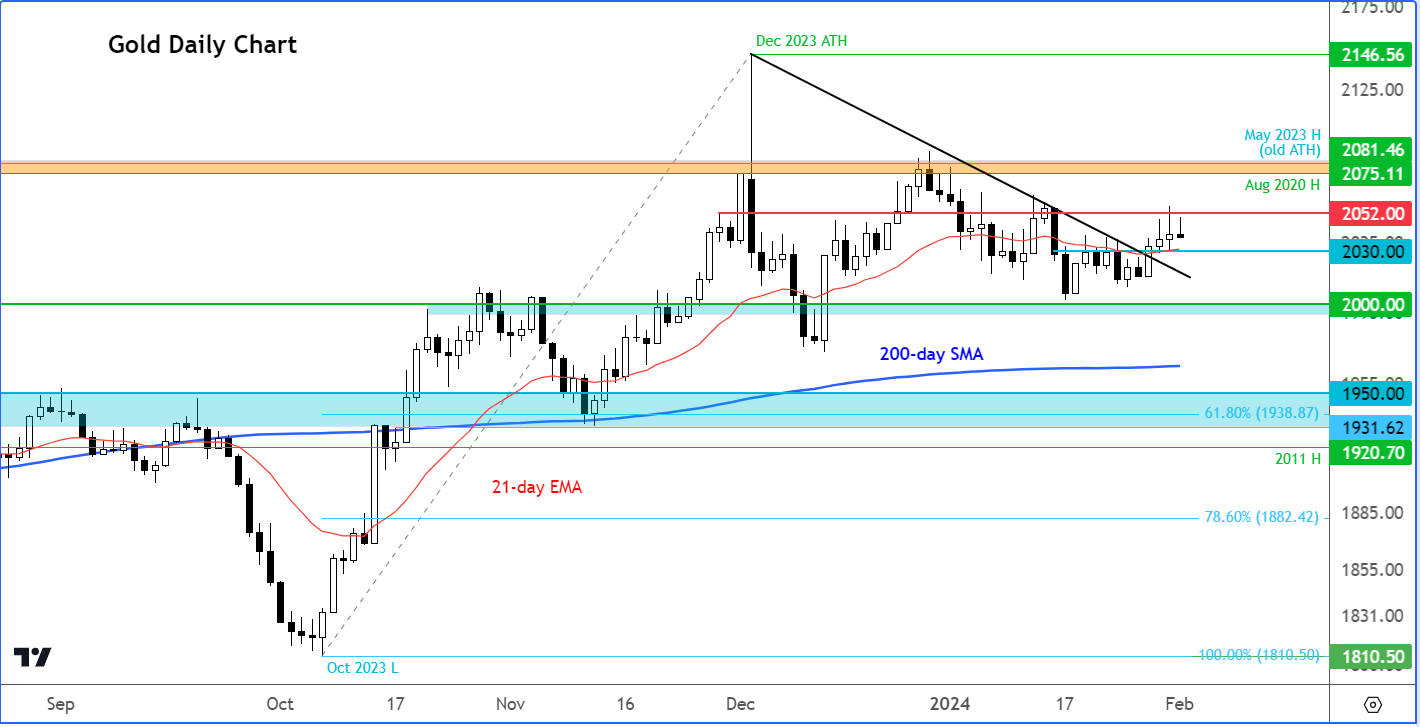

Gold outlook: Technical analysis

Source: TradingView.com

At the time of writing, XAUUSD was a touch lower on the day after it held below resistance in the $2050/55 area post Fed. This is where the metal had sold off from last time, so a close above this area is now needed to tip the balance back in the bulls’ favour. Short-term support is seen around $2030, where the 21-day exponential moving average also converges. There’s nothing significant below this level until $2000.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade