- Gold analysis: Revisions to past NFP data takes shine off headline beat

- Gold technical analysis: $2030ish support holds, eyes turn to $2075/80 resistance area

Gold video analysis

Gold managed to come sharply off its lows to turn flat at the time of writing. The dollar initially rallied but then sold off as traders reacted to a mixed US jobs report. Is this the start of a new uptrend for gold? We will certainly need to see more price action, but the early signs suggest that the dollar selling may have resumed now that the week’s main data highlight is out of the way. Let’s see whether the ISM services PMI will deliver a surprise later and accelerate the dollar selling.

So why did the dollar react negatively to the jobs report?

Prior to the release of the December non-farm jobs report, the dollar had been pushing higher as traders trimmed their bets of a March Fed rate cut. Employment indicators released earlier this week were mostly positive, suggesting that today’s jobs report could surprise to the upside.

Well, as it turned out, the NFP report did surprise to the upside, causing the dollar to extend its gains in the immediate aftermath of the report.

BUT investors soon realised that there were a net 71,000 downward revision in the prior two months of data. If you consider these revisions, then today’s job report is not quite as big a beat as it looks on the headline front. Still, wages remain strong, and this is something that may discourage the Fed from cutting rates sooner rather than later.

All told, it was a mixed report, and given this week’s bidding of the dollar, I wouldn’t be surprised now to see the greenback fall back lower as the report was overall not too strong as it appeared at first glance.

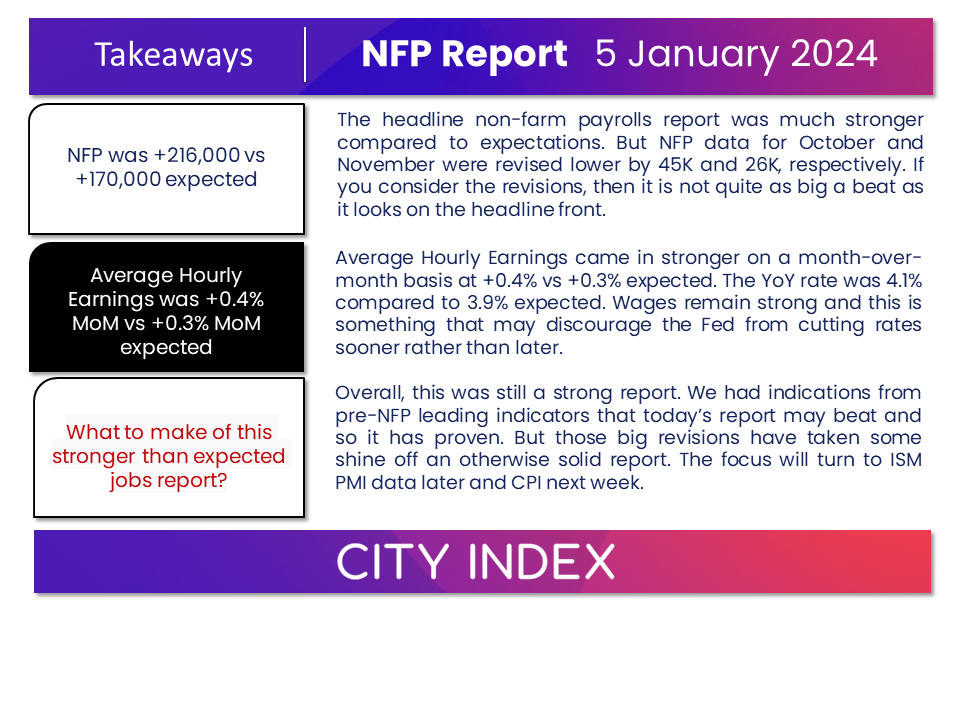

NFP prints 216K vs. 170K expected

The headline non-farm payrolls report was much stronger compared to expectations. But NFP data for October and November were revised lower by 45K and 26K, respectively. Average Hourly Earnings came in stronger on a month-over-month basis at +0.4% vs +0.3% expected. The YoY rate was 4.1% compared to 3.9% expected.

Overall, this was still a strong report. We had indications from pre-NFP leading indicators that today’s report may beat and so it has proven. But those big revisions have taken some shine off an otherwise solid report. The focus will turn to ISM services PMI data later and CPI next week. The ISM services PMI expected to come in roughly unchanged from the previous months 52.7 print.

Gold analysis: technical levels to watch

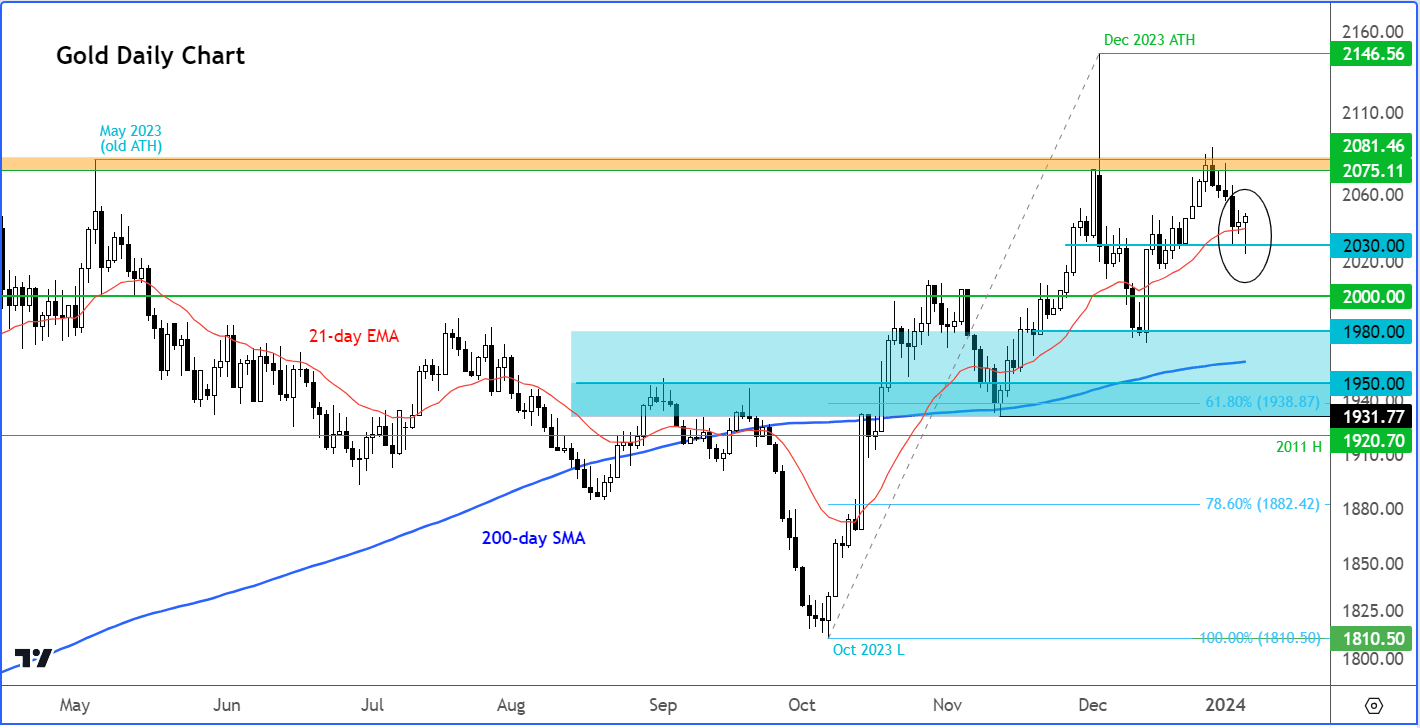

Source: TradingView.com

Gold is finding support right where you would have expected circa 2030ish, a level which had acted as both support and resistance in the past. If it manages to close today’s session higher, then this could pave the way for further technical buying in the days ahead. Key resistance is seen around $2075 to $2080ish, where the metal had formed major highs in recent years. Above that zone there is nothing significant seen until the December’s peak of $2146. On the downside, the next big level below support near $2030ish is at $2000.

-- Content created by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade