H2 Crypto Assets Outlook

After about a decade as THE breakthrough technology to watch, crypto assets have been clearly upstaged by the promise of artificial intelligence so far this year. Some pundits are even calling AI products like ChatGPT “everything crypto hoped to be” given its immediate, mass-market use case.

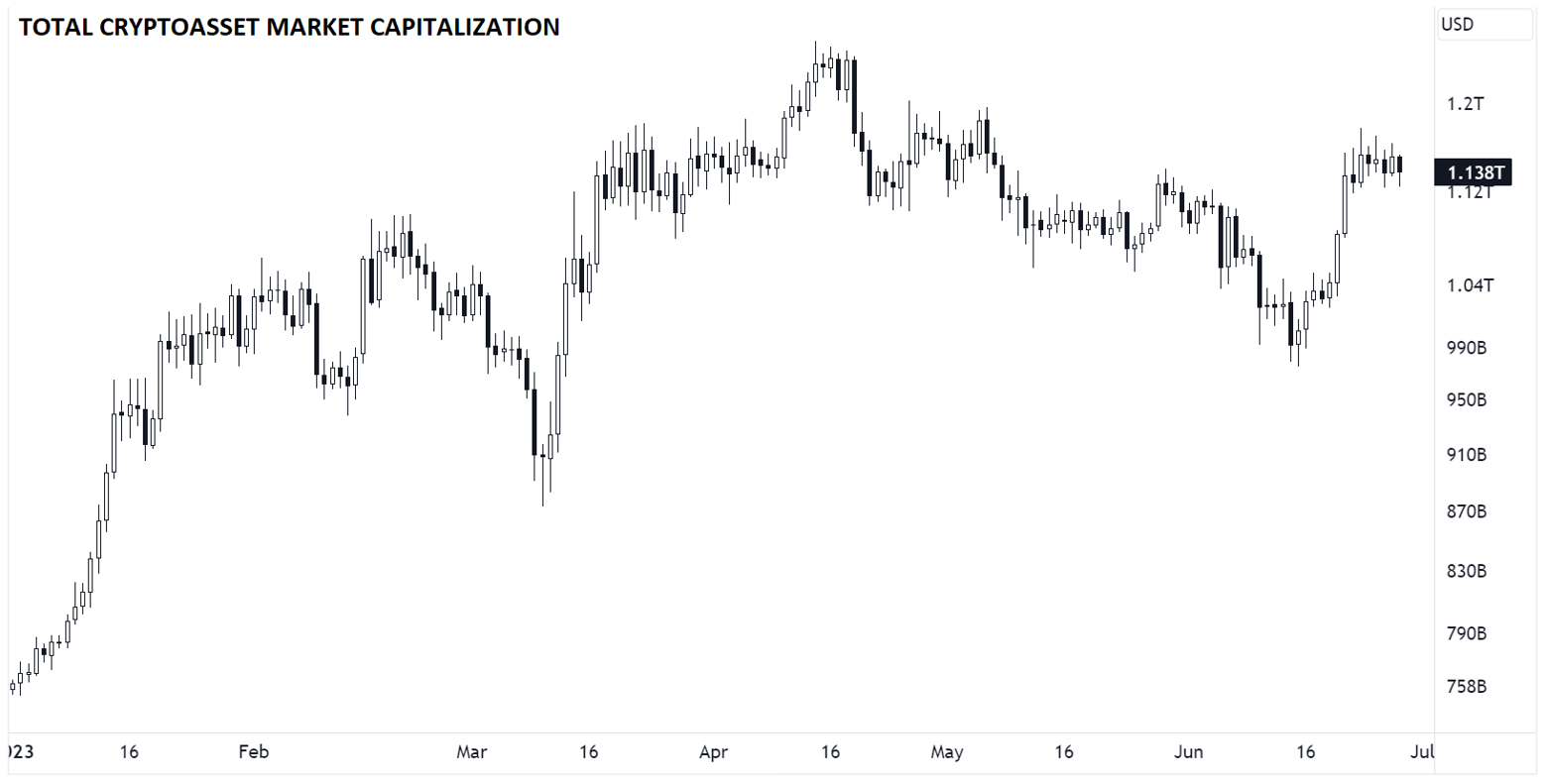

Despite all the headlines and hype shifting away from the crypto asset space, the largest tokens – Bitcoin (+80% as of writing) and Ethereum (+50%) – have quietly seen a stellar start to the year. On the whole, the market capitalisation of all crypto assets has increased from below $800B at the start of the year to more than $1.1T at the halfway point:

Source: TradingView, CryptoCap

What’s driving the big moves? …And more importantly, are they likely to carry over into the second half of the year? Read on for our thoughts.

H1 Recap: Whenever one door closes…

Heading into the year, we – and just about everyone else – cited increased regulation in the wake of prominent 2022 collapses of FTX, Three Arrows Capital, and Terra Luna among others as the most salient risk for crypto assets in 2023.

As of writing in mid-June, those risks are being realised, with US regulators cracking down aggressively on prominent brokerages like Coinbase and Binance, while Europe introduces Markets in Crypto-Assets (MiCA) regulations. Put simply, governments on both sides of the Atlantic are broadly seeking to fit crypto assets into existing securities regulations, creating an additional burden for current operators and throttling access for retail traders.

While that sounds ominous (and certainly is for some operators), the bearish implications have been largely offset by aggressive moves to enter the market by “TradFi” (traditional finance) behemoths. TradFi powerhouses like Fidelity, Charles Schwab and Citadel teamed up to launch a noncustodial crypto exchange called EDX; this is seen as a precursor for the approval of a Bitcoin exchange-traded fund (ETF) in the US that would open the floodgates for institutional and individual capital to flow into the asset class. Indeed, both Blackrock and Fidelity have filed for ETF approvals and given their close connections with regulators, many analysts believe they’ve received tacit approval already.

Outside of the dark-but-improving regulatory environment, the macroeconomic backdrop is also a mixed bag for crypto assets. Interest rates have risen precipitously over the last few quarters and measures of money supply are falling sharply. But overall, the global economy has held up better than expected so far, keeping consumers’ purchasing power intact. With central banks seemingly determined to keep tightening monetary policy and leading economic indicators rolling over, crypto enthusiasts will be hoping that the economy can continue to defy expectations and grow steadily in the second half of the year.

Bitcoin: Fundamentals and technicals remain healthy

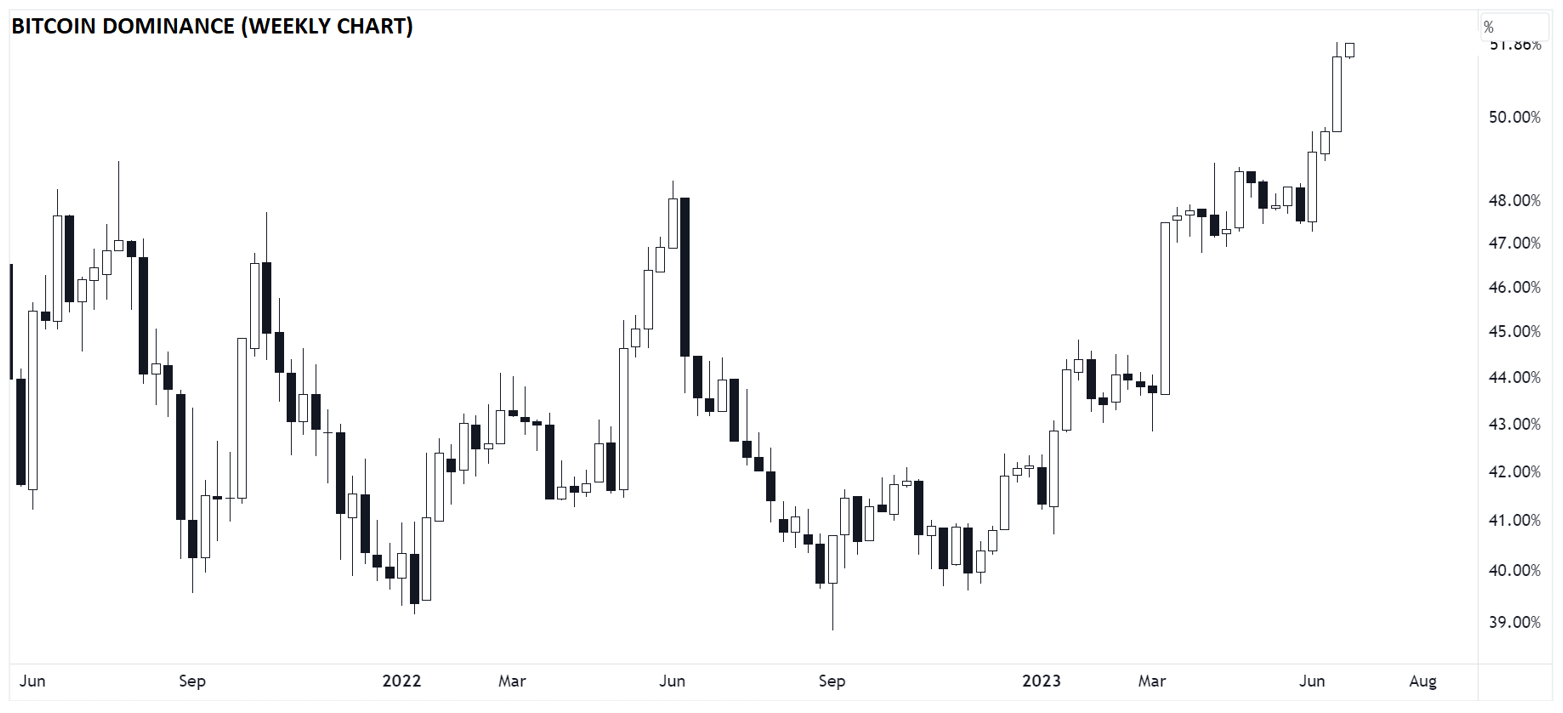

Focusing on the world’s largest and oldest crypto asset, Bitcoin reasserted its dominance over the space in the first half of the year. As the chart below shows, Bitcoin’s “dominance” – the proportion of the total crypto market cap made up by Satoshi’s invention – has surged from near-record lows of just 40% at the start of the year to more than 50%, its highest reading in more than two years:

Source: TradingView, StoneX

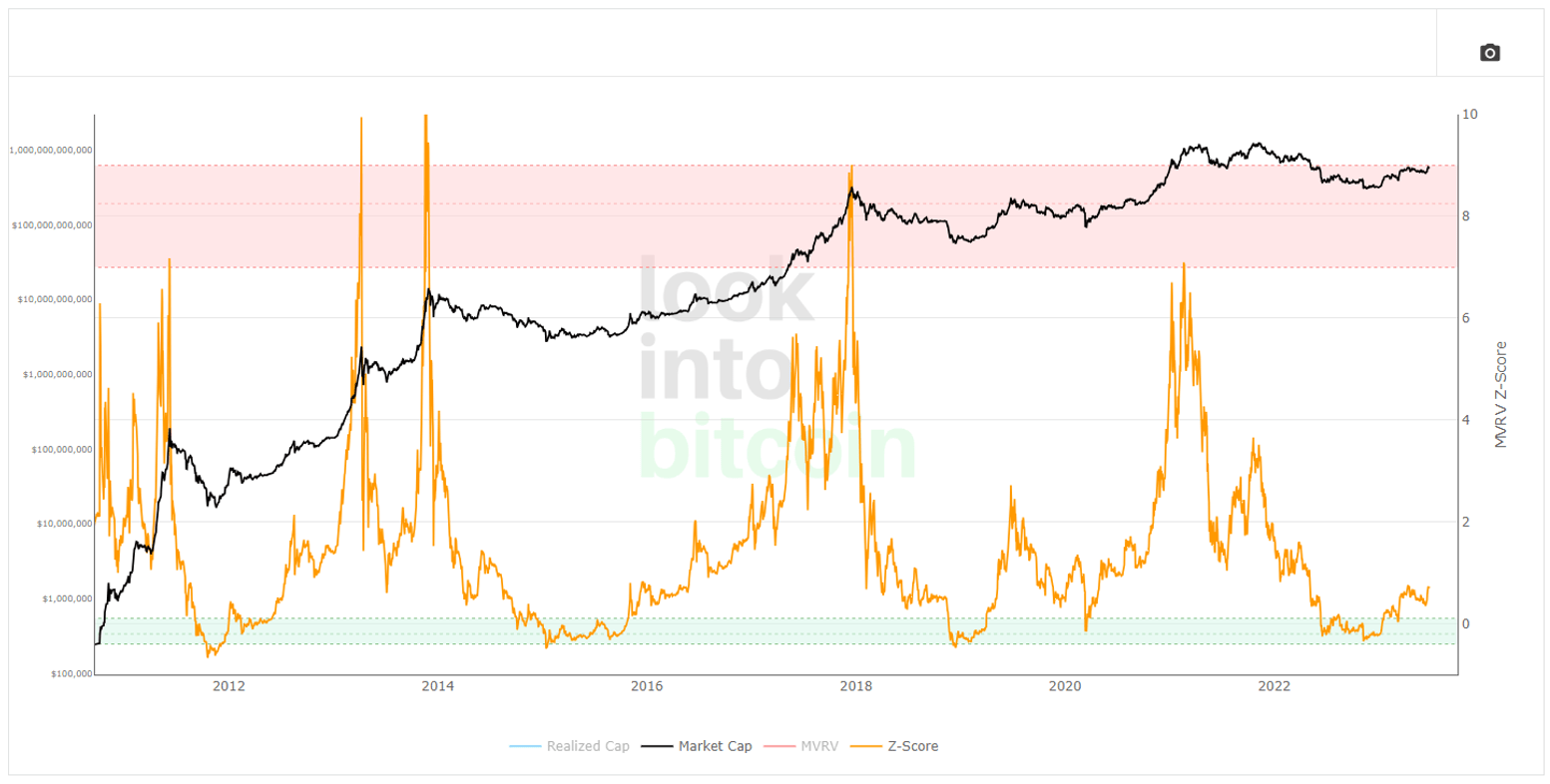

Despite the big move higher through the first six months of the year, Bitcoin is still far from levels that have historically marked “overbought” cycle peaks. One of the best historical valuation ratios for Bitcoin has been the MVRV Z-Score, which measures the current market value of Bitcoin relative to the last price at which each Bitcoin was last moved and normalises that ratio based on its standard deviation. In the past, readings at or below 0 have signalled bear market bottoms, with bull market peaks emerging above 7; currently, that measure is still below 1:

Source: GlassNode

One final consideration when it comes to Bitcoin is the four-year “halving cycle”. For the uninitiated, the amount of new Bitcoin that is paid out to miners is cut in half roughly every four years, and Bitcoin’s price has historically traced out a similar pattern across the four-year cycle with prices rallying sharply in the year after the halving, falling in year two, finding a bottom in year three, and ramping up in year four in anticipation of another surge. With the next halving on track for April 2024, we’re historically entering one of the most bullish periods for cryptocurrency.

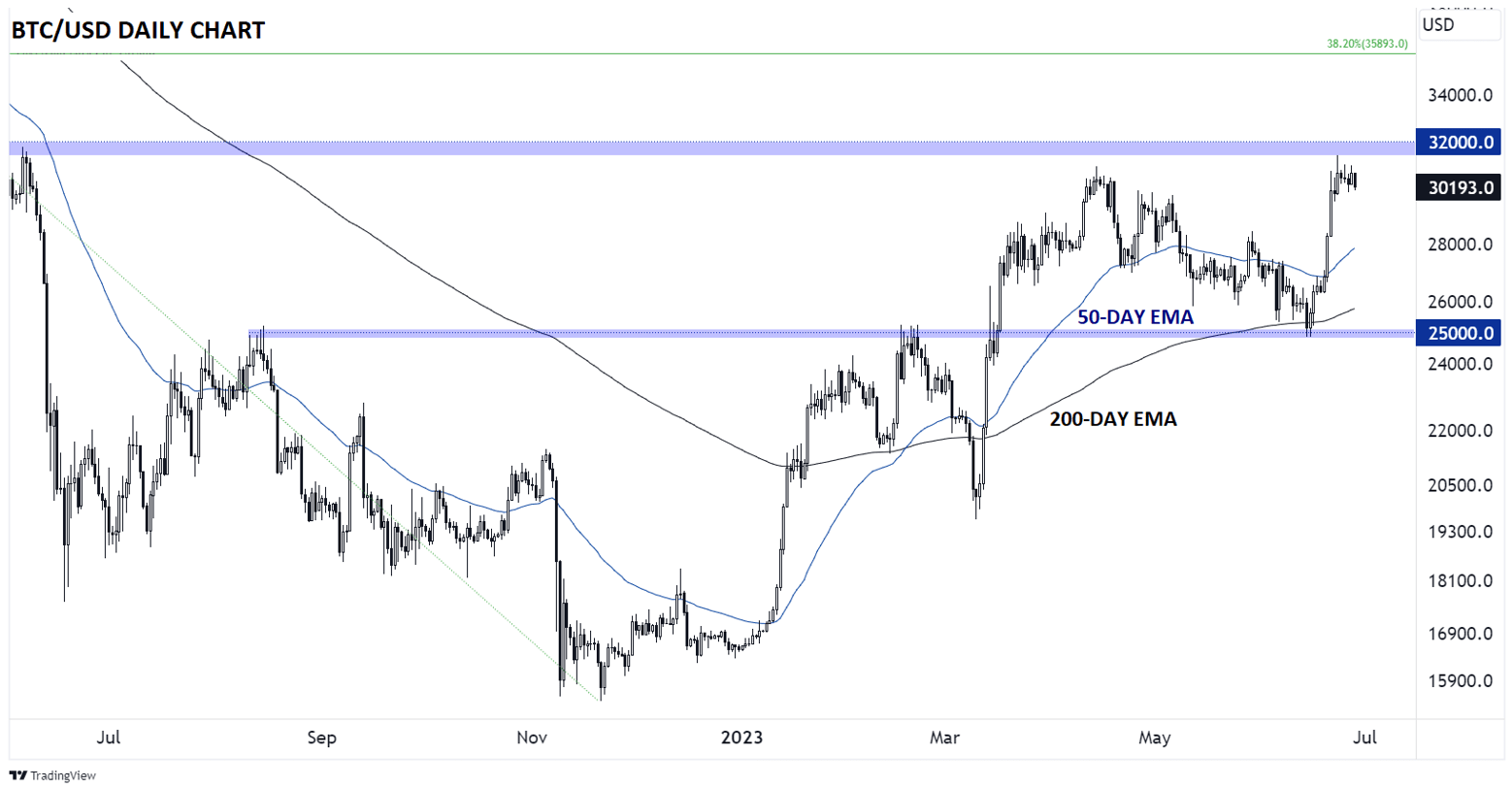

Turning our attention to the BTC/USD chart, prices are consolidating in a sideways range between previous-resistance-turned-support around $25,000 and previous resistance from the middle of last year in the $32,000 area. With the 50-day exponential moving average (EMA) trending higher above the upward-trending 200-day EMA, the longer-term technical trend favours the bulls as long as support near $25K holds. A break above resistance at $32K could expose the 38.2% Fibonacci retracement of the last bear cycle near $36K next.

Source: TradingView, StoneX

Ethereum: How the supply/demand picture could change dramatically

The world’s undisputed #2 crypto asset has also had a strong start to the year, though it hasn’t managed to keep pace with its “big brother.” As we noted in our annual outlook, the recent bull market provided a “proof of concept” for several smart contract use cases, from decentralised finance (DeFi) to non-fungible tokens (NFTs) to decentralised autonomous organisations (DAOs). And while the hype and price action have outstripped their utility so far, many analysts are confident that these use cases will only continue to grow in the coming years.

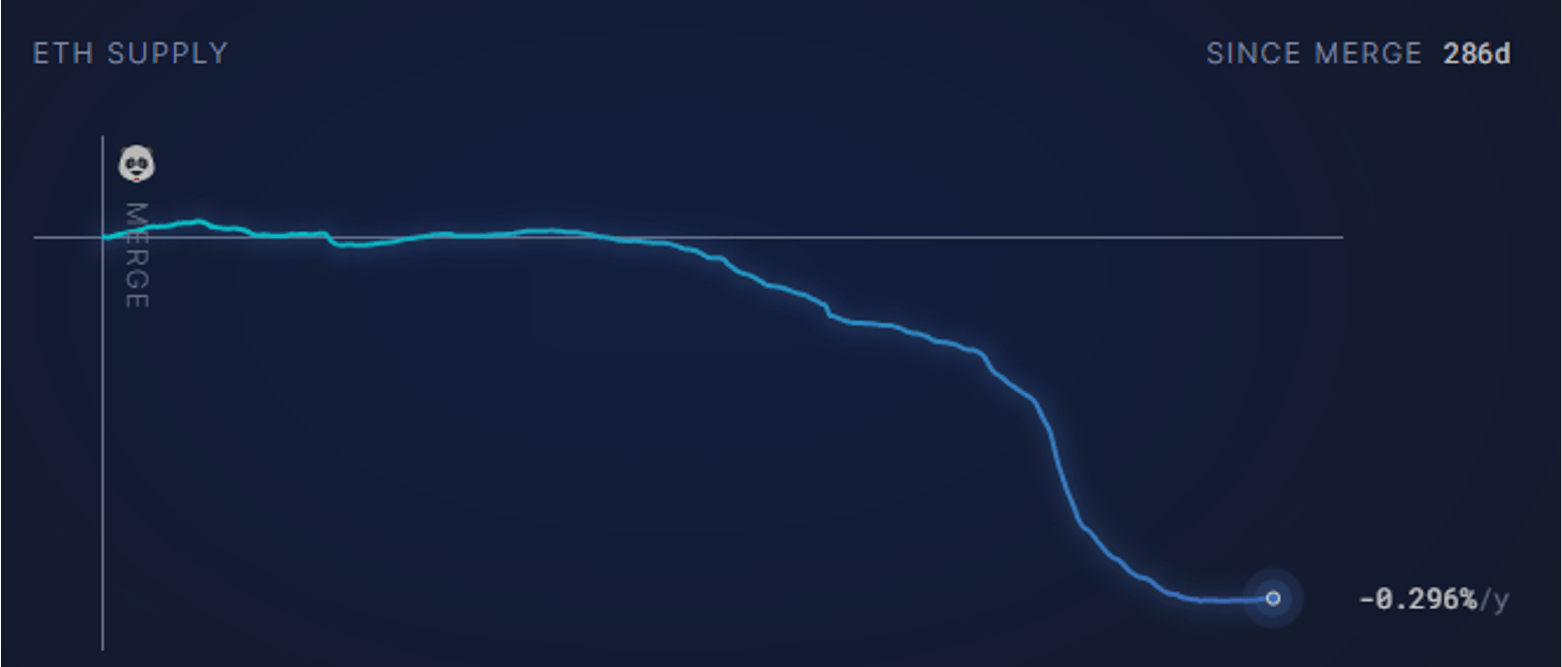

If the first half of the year showed anything for Ethereum, it’s that the ecosystem is highly leveraged to demand its blockspace (read: usage). Following “The Merge” that converted the blockchain to proof-of-stake security and the introduction of EIP-1559, which allows a portion of each transaction fee to “burn” excess tokens, the supply of Ethereum has turned deflationary, with the total supply of ETH tokens on track to decline by -0.3% annually:

Source: Ultrasound.Money

While that may not sound particularly impressive, it’s worth noting that this burn is proportional to network usage and has taken place amidst a “crypto winter”, so if/when demand rises again, the supply burn could rise to closer to -1% or -2% per year at the same time that demand spikes, providing a potentially favourable supply/demand backdrop.

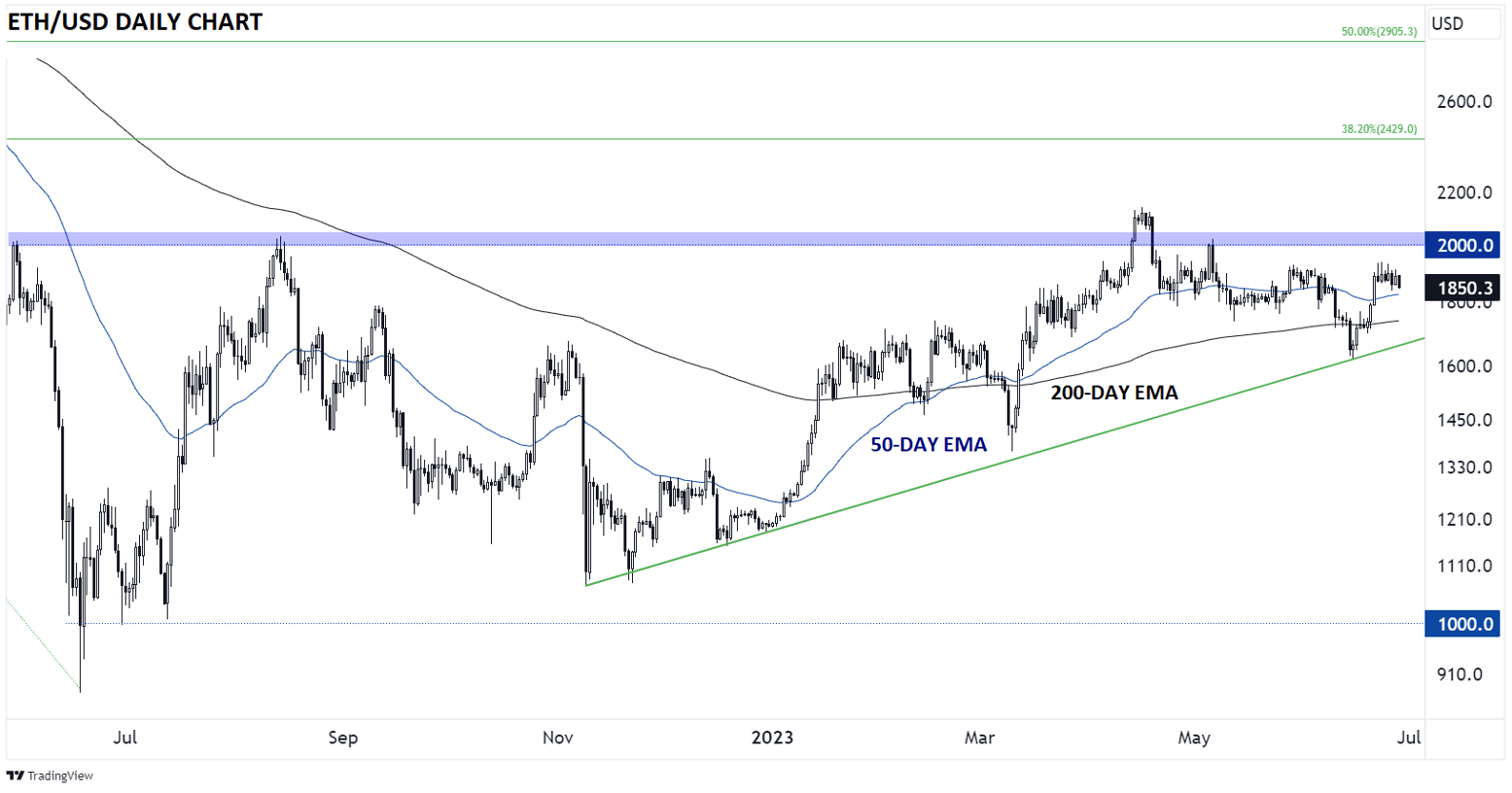

Technically speaking, ETH/USD has been more choppy than Bitcoin of late, with prices unable to break convincingly above the psychologically-significant $2000 level so far. That said, the pair has consistently found support at a bullish trendline off November’s lows, and both the 50- and 200-day EMAs are still rising, signalling that the uptrend off the bottom remains intact for now. A confirmed break above $2000 and the year-to-date high closer to $2100 would open the door for a continuation toward the 38.2% Fibonacci retracement of the bear cycle near $2400 next, whereas a break below support in the $1700 area would call the rally off and bring last year’s lows into serious question.

Source: TradingView, StoneX

To summarise the overall situation for the major crypto assets heading into the second half of 2023, it appears that last year’s lows marked the cycle bottom, and with another Bitcoin halving just around the corner, we may be entering a historically bullish window. While more aggressive regulation could disrupt the space, it brings with it the silver lining of more accessible, secure investment vehicles that could drive large capital inflows to the space.

Bitcoin and Ethereum continue to operate out of the limelight for now, and that’s exactly where crypto enthusiasts should prefer. Paradoxically, risk tends to be the lowest when everyone has given the space up for dead, whereas the risk of large losses is highest when the evening news is running nightly stories about the exciting future of crypto assets and everyone is blindly buying newly spun-up tokens with grand promises.

Time will tell if we see another such period of euphoria in the space, but the evidence above suggests that we’re far closer to a long-term trough than a peak.

Written by Matt Weller, Global Head of Research

Follow Matt on Twitter @MWellerFX