H2 Macroeconomic Outlook

The global economy managed to tiptoe around numerous landmines in the first half of 2023. From the (still ongoing) fears of overtightening monetary policy to the risks of a fraught emergence from China’s “Zero COVID” policy to concerns about a banking panic and tightening lending standards, there were plenty of hurdles that could have tipped slowing growth into an outright contraction.

So far, so good, as they say.

Of course, pessimists would say those risks are not behind us, merely taking longer to manifest than some believed. In that way, the second half of the year will be when the proverbial “rubber meets the road”: Will the developed world’s most aggressive interest rate hiking cycle in at least half a century finally tip the global economy into recession? Is China’s post-COVID boost already sputtering? Are the liquidity issues in the banking system behind us or merely slumbering?

The last six months of the year will provide insight into all these critical questions – read on to see our views.

H2 Global Growth Outlook

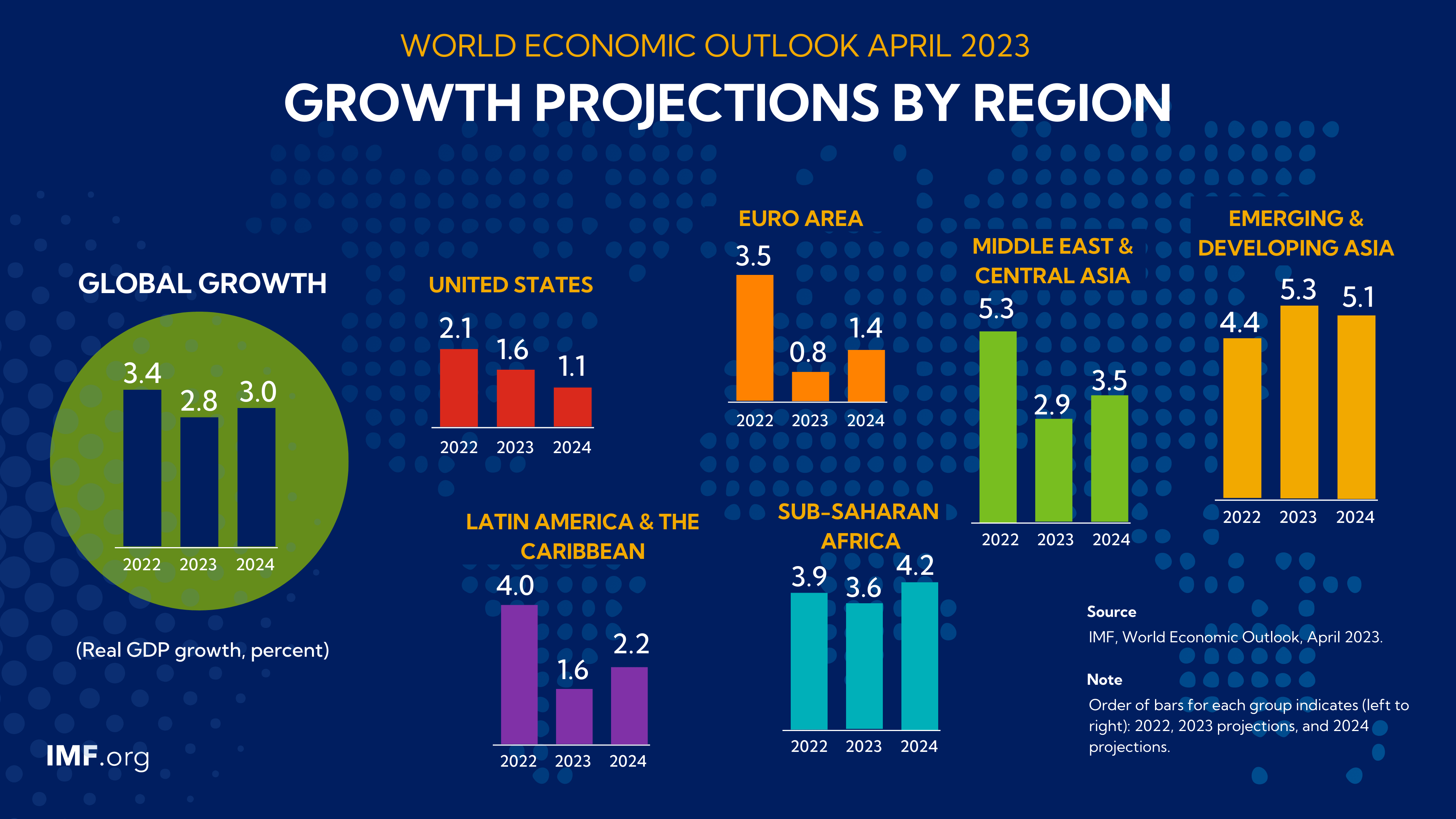

Per the International Monetary Fund’s most recent World Economic Outlook report, global growth is projected to come in just below 3% across the whole of 2023. In its April update, the IMF predicts 2.8% growth for the global economy this year, below the 2022 estimate of 3.4% and 21st-century average of 3.8% as higher interest rates continue to take a toll on growth.

In particular, this slowdown will be driven by a downshift in advanced economies, which are projected to grow just 1.3%, less than half of the 2022 estimate of 2.7%. As the graphic below shows, growth is expected to be relatively tepid in the US (1.6%) and Euro area (0.8%), with stronger growth projected in Asia and Africa:

Source: IMF

Inflation outlook

Fitness gurus will tell you that the first step is the hardest.

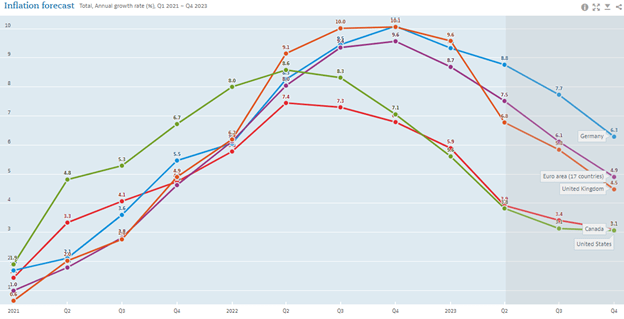

When it comes to taming inflation, the opposite is true. Merely by turning off the fiscal spigots and raising interest rates off the zero lower bound last year (along with the inevitable end of post-COVID supply chain disruptions), global policymakers knew that they could take inflation down from the near double-digit rate that it had been running at last year, especially we started to lap the “base effects” from summer’s surge in food and energy prices after the outbreak of the Russia-Ukraine war.

Now though, comes the hard part. While inflation should continue to fall generally over the second half of the year, price pressures may soon begin to fall at a slower rate if labour markets remain healthy, making the 2% target that most central banks aim for difficult to achieve:

Source:OECD

Perhaps the biggest surprise for economists and traders this year has been the resilience of the world’s labour markets. Despite surging interest rates and fading fiscal stimulus, most major economies are sporting unemployment rates near their lowest levels of the century, and as long as global consumers retain their jobs, they’re likely to keep spending their paychecks, preventing price pressures from receding entirely.

As we discussed in our full 2023 outlook at the start of the year, the risks of sticky/secular inflation remain, with potential benefits for gold and other commodities if central banks are forced to tolerate an extended period of above-2% inflation.

Central banks

Speaking of central banks, one important factor to watch as we move through the second half of the year will be the impact (if any) from the aggressive interest rate hiking cycle that central banks started a little over a year ago. While the exact delay is hotly debated and ever-changing, economists broadly agree that monetary policy impacts underlying economic activity with a lag.

As of writing in late June, it appears that, if anything, global central banks are reaccelerating their interest rate increases. After pausing interest rate hikes earlier in the year, the Reserve Bank of Australia and Bank of Canada both surprised markets by raising interest rates again, and while the Fed “skipped” a rate hike at its June meeting, Jerome Powell and company currently expect two additional 25bps increases this year. Meanwhile, markets are pricing in another 100bps of tightening from both the European Central Bank and Bank of England by the end of the year.

The old saying is that rate hike cycles end when central banks break something, and despite some warning signs from the banking system and moribund housing markets, it’s hard to argue that anything has truly “broken” with the global economy yet. These key areas, as well as the general health of global labour markets, will be the key flashpoints to watch in the second half of the year.

Conclusion

Taking a step back, the first half of 2023 clearly went about as well as it could have, given all the risks investors were watching at the start of the year. The odds of a so-called “soft landing” in the economy have clearly increased, but we’re not in clear skies yet. Time will tell if the global economy’s luck will hold out for another six months or more, but hopefully this article helped identify some of the key factors to watch in the second half of the year.

Please read the other reports in our H2 2023 Market Outlook for insights on how these dynamics will impact specific markets that you may be trading and the key trends to watch moving forward.

Here’s to a happy, healthy, and successful second half of the year!

Written by Matt Weller, Global Head of Research

Follow Matt on Twitter @MWellerFX