- What are the risks of CFD trading?

- CFD risk management

- Using orders with CFDs

- Stop orders with CFDs

- Limit orders with CFDs

- Hedging with CFDs

- Practise CFD trading in a risk-free demo

- CFD risk management FAQs

What are the risks of CFD trading?

The main two risks of CFD trading are leverage and volatility. Both increase the chance of larger losses on your trades, just in different ways.

Leverage

When you trade CFDs, you won’t have to pay the full value of the position upfront because they use leverage. Instead, you’ll pay a small initial deposit – known as margin.

But your profit and loss are calculated using the position’s full value. This can result in magnified gains, but also creates magnified risk – making it important to understand how CFDs work before you trade.

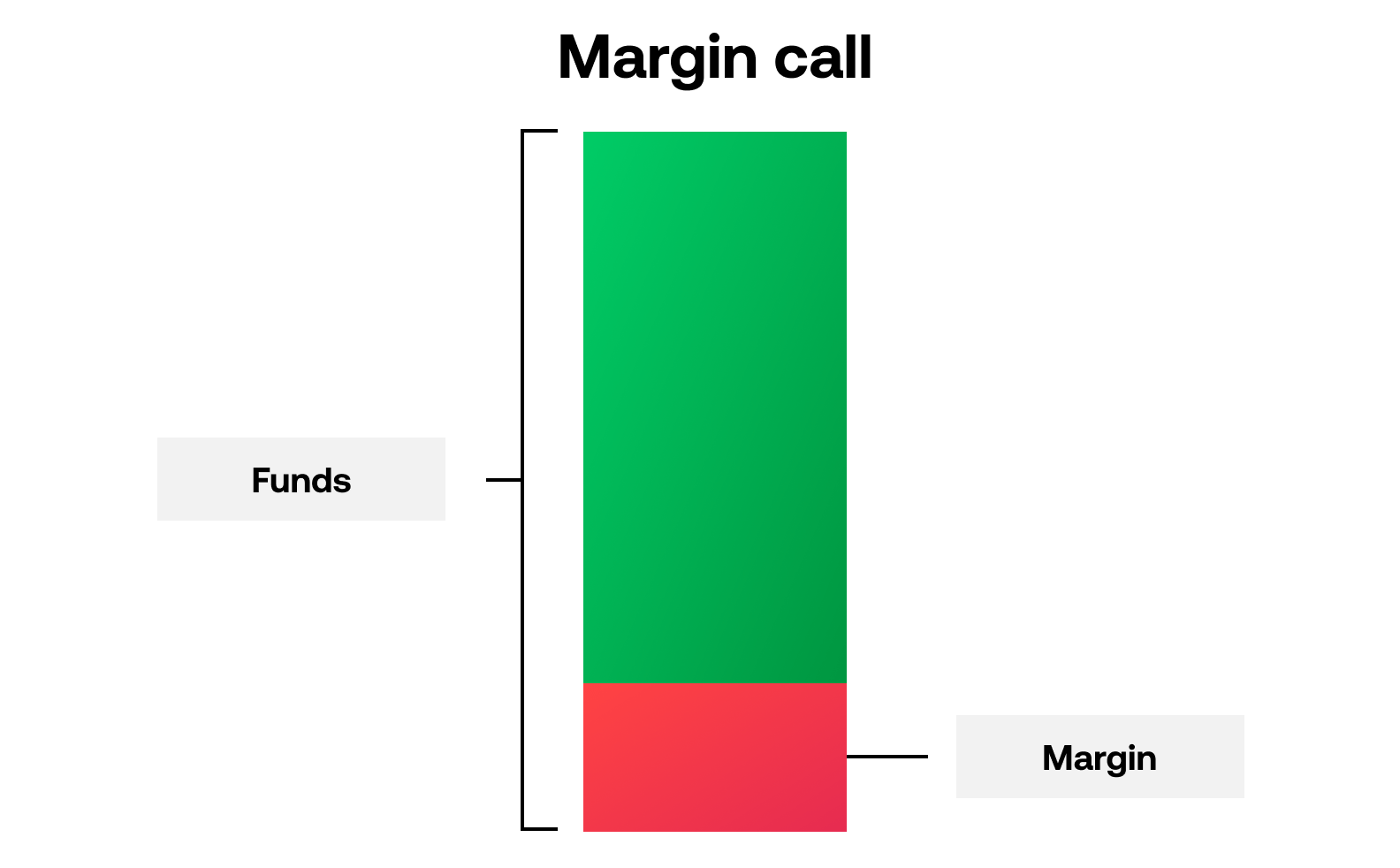

Trading on margin means you always have to have the required amount of capital in your account to cover your position. If you don’t have sufficient funds, there’s a risk that you’ll be placed on margin call and your positions will be closed automatically.

Take a look at our CFD examples to see how leverage works

Volatility

Volatility is the rapid changes in the price of an asset. Some markets are inherently volatile – such as forex – while others are only volatile around certain events and breaking news. For example, shares normally see more movement in earnings season.

Volatility does create opportunities for short-term traders, but it also increases the risk that a winning position can turn into a losing one in the blink of an eye.

This is especially true if gapping occurs, which is when the price of an instrument moves suddenly from one level to another, without any trading in between.

The risk here is that there won’t be time to place an order, or that existing orders can execute, between the two price levels. This could result in unfavourable prices than you anticipated.

Can you lose more than you invest with CFDs?

In theory, it is possible to lose more than you invest with a CFD. However, in practice that shouldn't happen due to negative balance protection, which is a regulatory requirement set out by the Australian Securities and Investment Commission (ASIC) to help protect CFD traders.

If your funds drop below 50% of the amount you're required to keep in your account as CFD margin, then your broker will start automatically closing your positions to prevent your losses from exceeding your deposits.

CFD risk management

Now that we’ve assessed the main risks of CFD trading, let’s explore some of the ways you can manage these risks, including:

- Stop orders

- Limit orders

- Hedging

- Demo accounts

Using orders with CFDs

Using orders with CFDs is one of the most common ways of managing risk. There are several different orders you can attach to your trades. These are divided into stops and limits.

- Stops – are orders that are triggered at a specified price that’s less favourable than the current market price

- Limits – are orders that are triggered at a specified price that’s more favourable than the current market price

Stop orders with CFDs

There are two types of stop orders: entry and exit.

Stop-entry orders

Stop-entry orders are an instruction to a broker to open your CFD position at a worse price than the current market price. The purpose of this is to confirm a trend and avoid the risk of entering the market just for it to reverse straight away.

For example, if oil was trading at $76 and you thought the price would rise, you might set a stop-entry order at $76.50. Then once the uptrend is underway, your position will be opened automatically.

Stop-exit orders

When attached to a CFD trade, stop-exit orders (better known as stop losses) will automatically close your position when it reaches a predefined amount of loss.

So, if you attach a stop loss to your long oil CFD at $70 and the market falls from $76.50 to $70, your trade would close and your loss would be capped.

The drawback of a basic stop is that it won’t always be executed at the level you’ve set in periods of extreme volatility. This is called slippage, when the market moves – or gaps – too quickly for your broker to execute your order. It can result in a less favourable price and more loss.

To avoid the risk of slippage, you can use a variation of a stop-loss order called a guaranteed stop-loss order or GSLO.

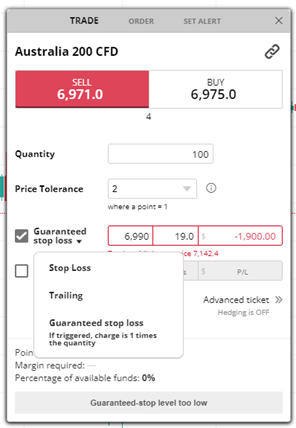

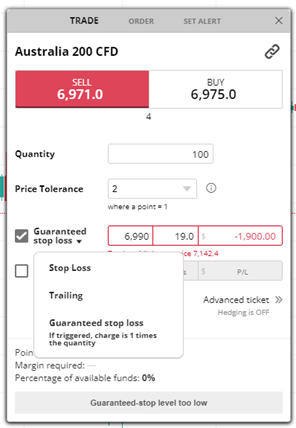

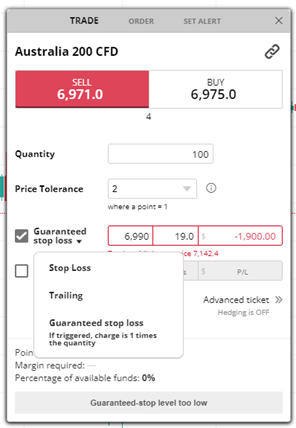

Using guaranteed stop-loss orders (GSLOs) with CFDs

A GSLO protects your CFD trades from risk by always executing at the level you’ve set, regardless of market volatility. This means you’ll never face slippage risk, as City Index takes it on for you.

GSLOs are free to place, with a small premium payable only if your stop is triggered.

Learn about CFD fees

To place a GSLO on a CFD trade, you just need to select ‘guaranteed stop loss’ from the drop-down menu on our deal ticket and choose your level.

Using a trailing stop with CFDs

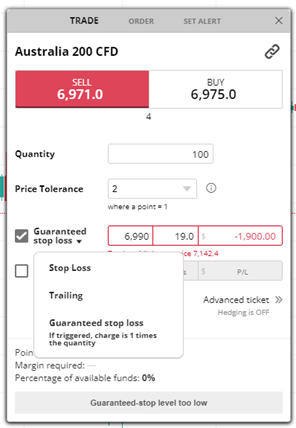

There’s a third type of stop-loss order available to you with City Index, called a trailing stop. This is a conditional order whereby you set an amount that your stop will ‘trail’ the market price by.

his means your stop will remain a defined percentage or point amount behind the asset’s price, ensuring that your position can remain open and profitable as long as possible. But it will still automatically close if the market turns against you.

Just like a GSLO, you can select ‘Trailing’ from the drop-down menu in our platform. Unlike a GSLO, trailing stops are completely free to use.

Limit orders with CFDs

Just like stops, there are two types of limit orders available to CFD traders. These are entry and exit.

Limit-entry orders

A limit entry order is an instruction to your broker to open a position on an asset at a specific price that is more favourable than the current market price. For a long position, this would be lower than the current level, and for a short position, this would be higher than the current level.

It’s the same idea that’s behind ‘buying the dip’ – you want to look for places where the market retreats slightly before continuing a trend to enter a trade.

Limit-exit orders

A limit exit order would do the opposite, it would instruct your broker to close your position when a certain price – that’s better than the current price – is reached. This enables you to lock in profits and close your position once your target has been hit. It helps take the emotional side out of trading, and avoid letting a winning trade turn into a losing one.

Hedging with CFDs

Hedging is a strategy used by CFD traders and investors alike to reduce portfolio risk as much as possible. A hedging strategy may not eliminate risk entirely, but it can help minimise uncertainty.

CFDs are a common hedging tool because they enable traders to go short as well as long. This means that a trader who has a long position already can easily cover it with a short trade, and vice versa.

Get started CFD trading

Practise CFD trading in a risk-free demo

A demo account gives you the space to build a CFD trading plan, and practise your strategies in a risk-free environment. You’ll get all the same markets, indicators, platform features and prices, but you won’t be trading with real money.

Instead, the market simulator comes with $20,000 in virtual funds for you to use over 90 days. You’ll get to experiment with our risk management tools and start developing your skills without commitment.

Open a City Index demo account