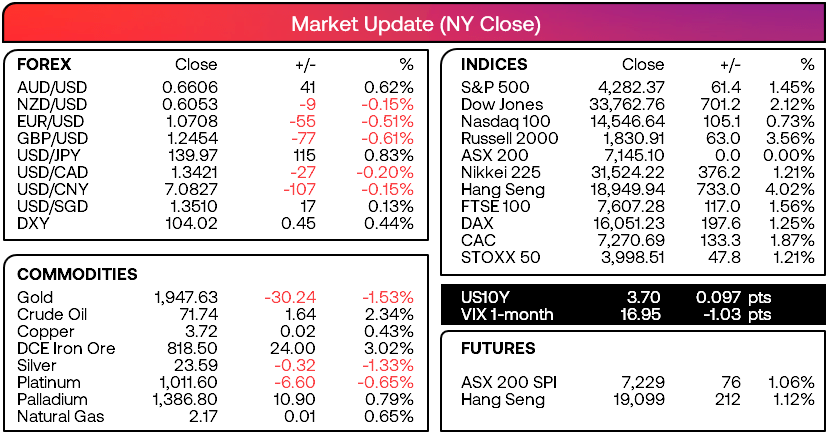

Market summary

- Saudi Arabia are to cut its oil production by around 1 million barrels per day from July – their biggest cut in years – in order to stabilise the market

- Oil prices gapped higher today by ~4% following the weekend announcement, like we saw in April when OPEC’s surprise cut sent oil pries $9 higher at the Monday open

- Appetite for risk improved on Friday as the debt-ceiling deal made its way through the Senate and to Biden’s desk to be signed in to law

- Friday’s NFP report packed another mighty punch with 286k jobs added (160k consensus) and April’s NFP upgraded to 294k from 253k

- The Participation rate also rose 62.6%, above 65.5%, and whilst the unemployment rate rose to 3.7% from 3.5% it remains historically low

- USD was the second strongest major on increased confidence of a Fed hike,

- Yet AUD was the strongest major as Australia’s industrial relations empire increases the minimum wage by 5.75% to place inflationary pressure’s the RBA could do without (which follows on from a strong employment report earlier in the week)

- Wall Street posted strong gains to send the S&P 500 to a 10-month high as bears seemingly capitulate from their excessive net-short exposure, and is just 10 points away from entering a technical bull market (20% higher from its preceding swing low)

Events in focus (AEDT):

- 09:00 – Australian services PMI

- 10:30 – Japan’s services PMI

- 1100 – Westpac/Melbourne Institute monthly inflation gauge

- 11:30 – ANZ Australian job ads

- 11:45 – China’s services and composite PMI (Caixin)

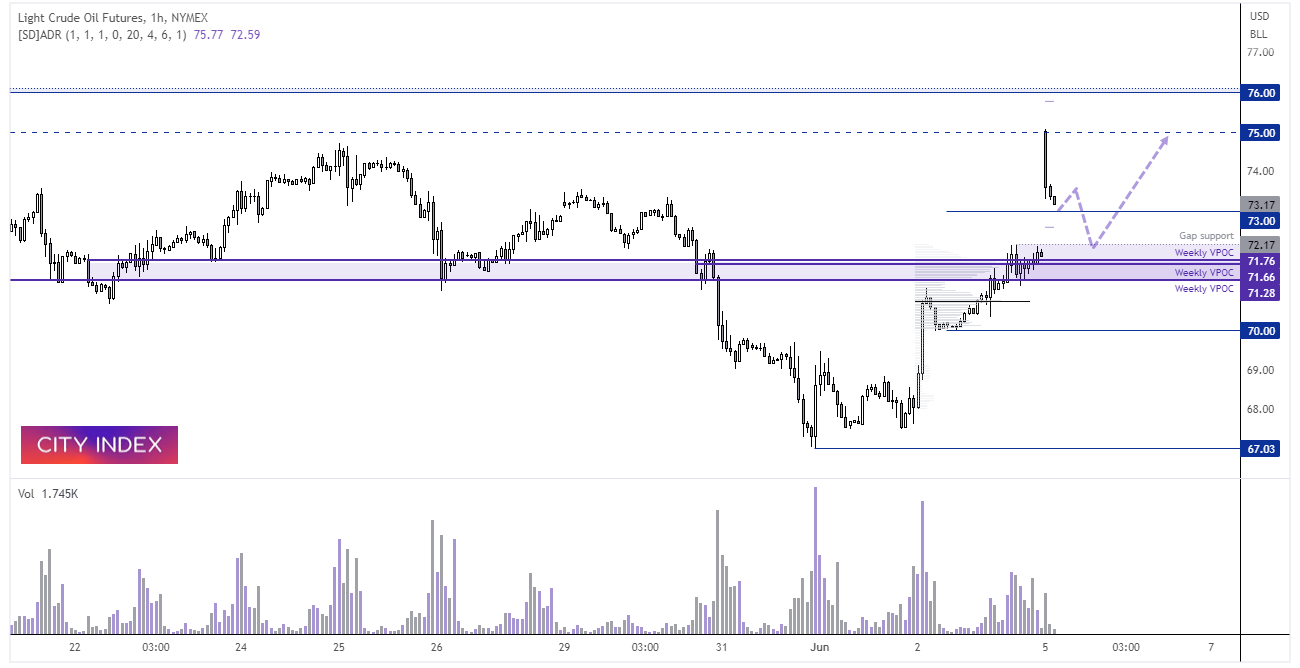

WTI crude oil 1-hour chart

Oil prices gapped up to a 23-day high at the Asian open but immediately hit resistance at the $75 handle. In April we saw oil prices gap over 5% higher before consolidating and edging higher before peaking at 85.53, before prices went on to fall nearly 24% from the April high. What we are highlighting here is that a price cut does not necessarily equate to a sustained rally as other factors are at play. But on the other hand, prices are already much lower than they were in April and we’re yet to find out of other OPEC nations decide to announce cuts, which could further support a rally.

We can see that prices have pulled back on the hourly chart and handed back around half of the gap’s gains, but we also note that there has been strong trading activity around the 71.28 – 71.76 zone over the past three weeks, which makes it a likely zone of support should prices continue to move lower. But we also have $73 and gap support around $72 for bulls to seek evidence of a swing low, and potentially target the $74 and $75 handles over the near-term. A break above which brings the highs around $76 into focus.

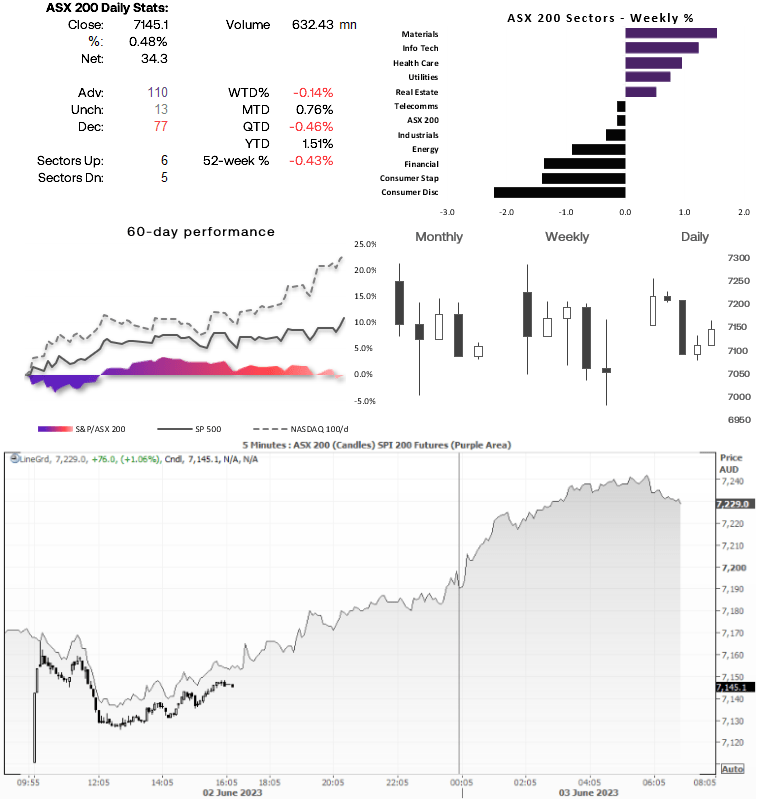

ASX 200 at a glance:

- The ASX 200 rose for a second day from a key support level

- SPI futures rallied over 1% on Friday to suggest a strong open for the ASX cash market today

- A weekly Doji formed around cycle lows to suggest a trough ay have formed

- Oil prices could spike higher with oil prices

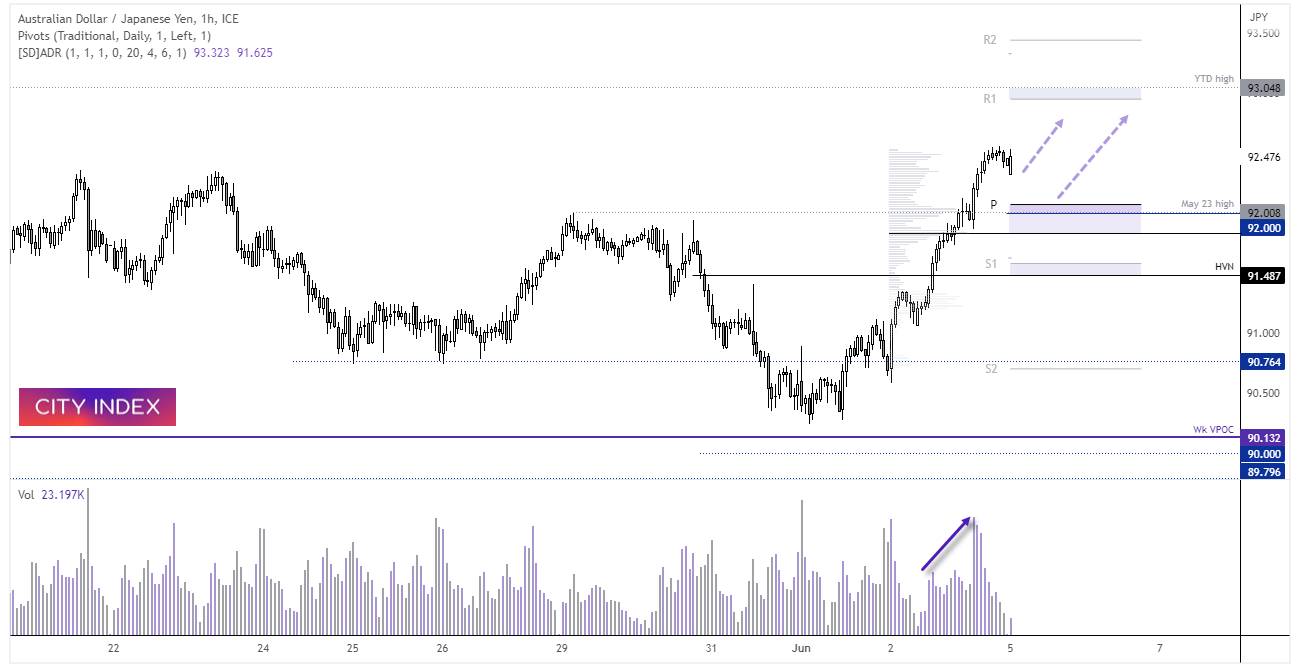

AUD/JPY 1-hour chart:

An increased appetite for risk helped AUD/JPY close at a 3.5-month high and a strong trend develop on the 1-hour chart. Rising volumes appeared in the first half of the trend with lows of activity around the 91.80 level before tailing off. Hopefully we can see prices retrace towards the 91.80 – 92.00 area for a potential swing low and its next leg higher, with 93 being a potential bullish target near the daily R1 pivot point and YTD high.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade