Blackberry Q2 Earnings Preview | Blackberry Share Price | Blackberry Shares | Blackberry Stock | BB Stock

When will Blackberry release Q2 results?

Blackberry is scheduled to release second quarter earnings on Wednesday September 22.

Blackberry Q2 earnings preview: what to expect from the results

Blackberry, once known for its smartphones, is an entirely different business today. Now, it provides software and services to customers, including all of the G7 governments and almost all of the largest manufacturers and banks from around the world. Security sits at the heart of this, ensuring the growing number of connections and devices entering the market, from computers to self-driving cars, can be managed and protected effectively.

It reorganised its business in the first quarter to focus on what it sees as its two biggest opportunities – the Internet of Things (IoT) and cybersecurity.

The larger of the two is cybersecurity, which focuses on its authentication and security products used across mobile and other devices, its critical event management response designed for governments named AtHoc, and its anti-eavesdropping smartphone software Secusmart. But, despite releasing several new products, Blackberry is still thought to be losing ground in the market, supported by the fact revenue fell to $107 million from $119 million in the first quarter.

The second division, IoT, on the other hand is growing with revenue rising to $43 million in the first quarter from just $29 million the year before. This is primarily driven by its QNX operating system, which is proving particularly popular with the automotive market, but it also homes its intelligent vehicle data platform IVY launched with Amazon, cryptographic protective product Certicom, software composition analysis tool Jarvis and asset tracker Radar.

The challenge here is the global shortage of semiconductors, which is forcing some automakers to scale back production as they struggle to get their hands on the chips they need to control the electricals in vehicles. Blackberry said there was ‘no doubt’ this was impacting production-driven revenue of QNX but said the problem was greater in North America than in Europe or Asia. It said one of its largest customers in North America had said production could be up to 50% lower than usual in the second quarter, but said other customers had ‘less severe’ forecasts. The performance of QNX will be a key focus for investors this week.

In addition to the tough cybersecurity market, the primary driver of the fall in revenue in the first quarter was the sharp reduction in revenue from licensing to $24 million from $58 million the year before. This fall comes as Blackberry looks to sell-off part of its patent portfolio, which is expected to raise key funds to help the firm boost R&D in the cyber security space. Investors should expect a material update on this front after Blackberry said it had ‘started negotiating the definitive agreement’ in the conference call after its last quarterly update in June.

Analysts are expecting third quarter revenue to decline to $163.5 million from $266.0 million the year before due to continued falls in income from licensing and cybersecurity revenue. The firm is forecast to report an adjusted loss per share of $0.07 compared to a $0.11 profit, while its reported net loss per share is forecast to widen to $0.13 from $0.04 last year.

Watch out for any changes to Blackberry’s outlook. Investors will be hoping that its ambition to deliver IoT revenue this year of $180 to $200 million will be reaffirmed amid the chip shortage, while the goal to deliver cybersecurity revenue of $495 million to $515 million is also fragile after Blackberry warned in June that this would be at the lower-end of that range as it hires more staff - and heavily-weighted to the second half. Licensing revenue is set to come in around $100 million this year.

Investors should also keep an eye on the backlog over the coming quarters. Management admitted that its backlog numbers, which are based on figures provided by OEMs like car manufacturers, ‘are on the conservative side’ and exclude its professional services and developer seat backlogs. The board is currently looking at adjusting the methodology to include all the figures and provide a better outlook, so this will lead to increase in the backlog going forward. Blackberry said this may ‘take a couple of quarters’ to complete.

Blackberry shares have been on a bit of a rollercoaster since being caught up in the meme stock rally earlier this year. The rally pushed the stock to its highest level since 2011 in January before finding itself back below $8 in May. Shares currently trade closer to $9.50 but the five brokers covering the stock believe they have further to fall with an average Sell rating and a target price of $9.10, implying the stock is currently overvalued.

Where next for the Blackberry share price?

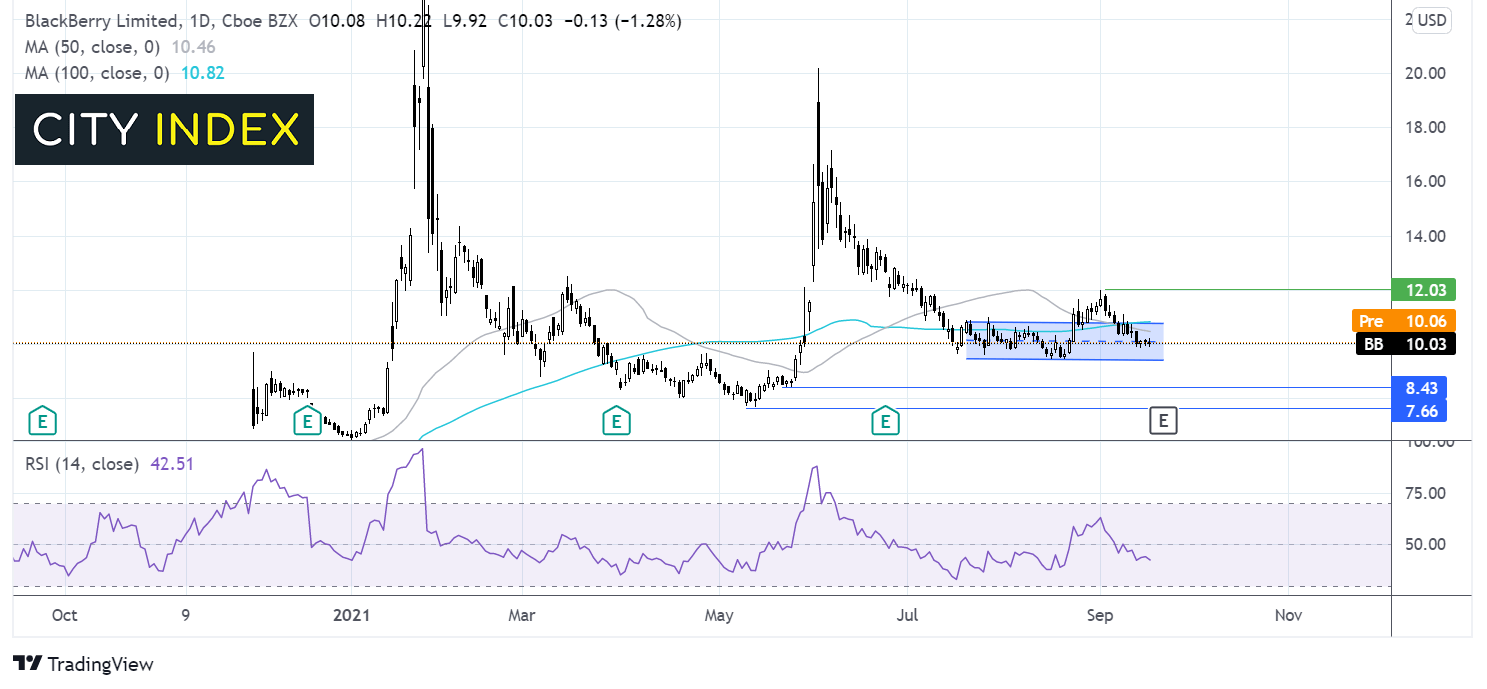

After rising to $20.17 in early June, the Blackberry share price trended lower finding a floor around $9.50. The price has traded in a holding pattern since mid-July, capped in the upside by $10.80 and by $9.50 on the lower band.

Whilst the price briefly broke above the upper band of the channel hitting a high of $12, this was short lived and the Blackberry share price returned to the horizontal pattern.

The price currently trades in the middle of the holding pattern so it could be prudent to wait for a breakout trade. The RSI is in mildly bearish territory and the 50 sma crossed below the 100 sma keeping the bears hopeful. A break below $9.50 could open the door to $8.40 the May 21 low and $7.70 the May low.

On the upside a break above $10.80 the upper band of the holding pattern and the 100 sma could open the door to $12.00 the September high.

How to trade Blackberry shares

You can trade Blackberry shares with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for ‘Blackberry’ in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade