Key takeaways

- Rivian is forecast to report $1 billion in quarterly revenue for the first-time ever

- Losses are narrowing but Rivian is still far from escaping the red

- Reaffirming its goal to double annual output to 50,000 vehicles is key

- Deliveries continue to lag production, leading inventory to build-up

- Has a healthy bank balance, but forecast to keep burning through cash until 2028!

- There are downside risks to Rivian shares ahead of the results following the rally we have seen in recent weeks, setting a high bar. Brokers see limited upside potential.

Rivian Q2 earnings date

Rivian is scheduled to release second quarter earnings after US markets close on Tuesday August 8. A live audio webcast will be held on the same day at 1700 ET.

Rivian earnings consensus

Rivian’s quarterly revenue is forecast to hit $1.00 billion for the first time ever, compared to just $364 million last year.

The adjusted Ebitda loss is seen coming in at $1.1 billion compared to the $1.3 billion loss seen the year before, while its net loss at the bottom-line is expected to narrow to $1.47 billion from $1.71 billion.

Rivian earnings preview

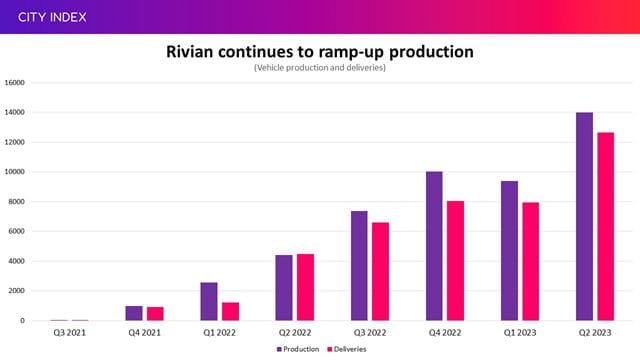

We already know that Rivian produced 13,992 vehicles in the second quarter and delivered 12,640 of them to customers. Production started in the second half of 2021 and the ramp-up has been steady so far apart from the blip we saw in the first quarter of this year, when it suffered some supply chain disruptions that investors hope are far in the rear-view mirror.

Notably, Rivian’s production has been consistently above deliveries for a year now, which could start to raise questions about building inventory levels. There are already concerns over demand across the industry, which is one of the reasons we have seen a price war intensify this year, and the lag in deliveries means it has produced almost 5,500 more vehicles than it has sold over the past year.

Rivian is aiming to ramp-up output this year in order to produce 50,000 vehicles in 2023, over double what we saw last year, and maintaining this guidance is vital to prevent spooking investors. Wall Street is comfortable with the guidance at present and forecasts production will be over 30% higher in the second than the first and that it will make 53,800 vehicles over the course of the full year.

Improving scale is also vital if Rivian is to become profitable and escape the red. Currently, Rivian is losing money on every vehicle it makes but it is aiming to make its first positive gross margin in 2024. With an uplift to production guidance unlikely, Rivian would need to post significantly smaller losses than expected to suggest it is making quicker progress down the road to profitability in order to impress the markets this week.

The company ended March with $12 billion in cash, giving it a healthy cushion to fund its operations. Still, Rivian is expected to burn through around $1.06 billion in free cashflow in the second quarter alone and over $4 billion over the full year, and it has to stretch that balance as far as possible considering Wall Street thinks it won’t generate any money until 2028! Rivian has said it could book annual Ebitda losses of $4.3 billion in 2023.

Where next for RIVN stock?

Rivian shares started to rally in late June and have risen over 87% in less than seven weeks, although it has found it more difficult finding higher ground this month.

The sharp drop we saw on Friday shows sellers dominated the day, with the stock only falling and ending at its low point throughout the entire session. We have also seen a notable decrease in trading volumes over the past month, suggesting interest is waning. Short interest stands at over 15% of its free float ahead of the results, according to Fintel, showing there are a sizeable level of bets against the company. There was some evidence that $24 was low enough to attract buyers back into the market earlier this month but a drop below here could open the door to $21.

On the upside, the initial goal is to return to the high of $28 set late last month in order to set new 2023-highs. The 23 brokers that cover Rivian currently have an average target price of $25.95.

How to trade Rivian stock

You can trade Rivian with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for ‘Rivian’ in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade

Or you can practice trading risk-free by signing up for our Demo Trading Account.