When will Auto Trader release full year results?

Auto Trader Group is scheduled to release full-year results on the morning of Thursday June 10. This will cover the 12 months to the end of March 2021.

Auto Trader earnings consensus: what to expect

The pandemic has brought both problems and opportunity to Auto Trader.

On one hand, it has ignited a surge in demand for cars as more people choose solo forms of transport. In fact, the number of people visiting Auto Trader’s website has been about 20% higher year-on-year since the start of June 2020.

On the other, lockdowns have forced car retailers – some of Auto Trader’s biggest customers – to close and prompted the company to waive advertising fees to help them survive these though times, which has weighed on its financial performance. It has offered free ads and given customers more time to pay their bills on more than one occasion during the year and said this would result in a £5 million to £7 million operating loss for every month it is free to use.

The overall effect has therefore been negative. A Reuters-compiled consensus shows analysts are expecting a steep 32% drop in annual revenue to £249.4 million from £368.9 million the year before, with operating profit expected to plunge 43% to £144.99 million. Basic EPS is forecast to almost halve to 11.93 pence from 22.19p.

|

Auto Trader Group |

FY2019/20 |

FY2020/21E |

|

Revenue |

£368.9 million |

£249.4 million |

|

Operating Profit |

£258.9 million |

£145.0 million |

|

Basic EPS |

22.19p |

11.93p |

The situation should have improved since Auto Trader’s last update in January, with restrictions having been eased and hopefully removing the need for it to provide financial support to its customers. The outlook and current trading will be closely watched to see what could be in store for the new financial year.

The outlook for this year could play a big role in deciding whether to reinstate dividends later this week, or whether it will wait for more certainty. Buybacks and dividends were suspended in 2020 as the pandemic started to bite, but it has said it wants to return to its long-term returns policy, which is to return one-third of annual net income to shareholders in dividends and return remaining surplus cash through buybacks, as soon as it can.

Where next for the Auto Trader share price?

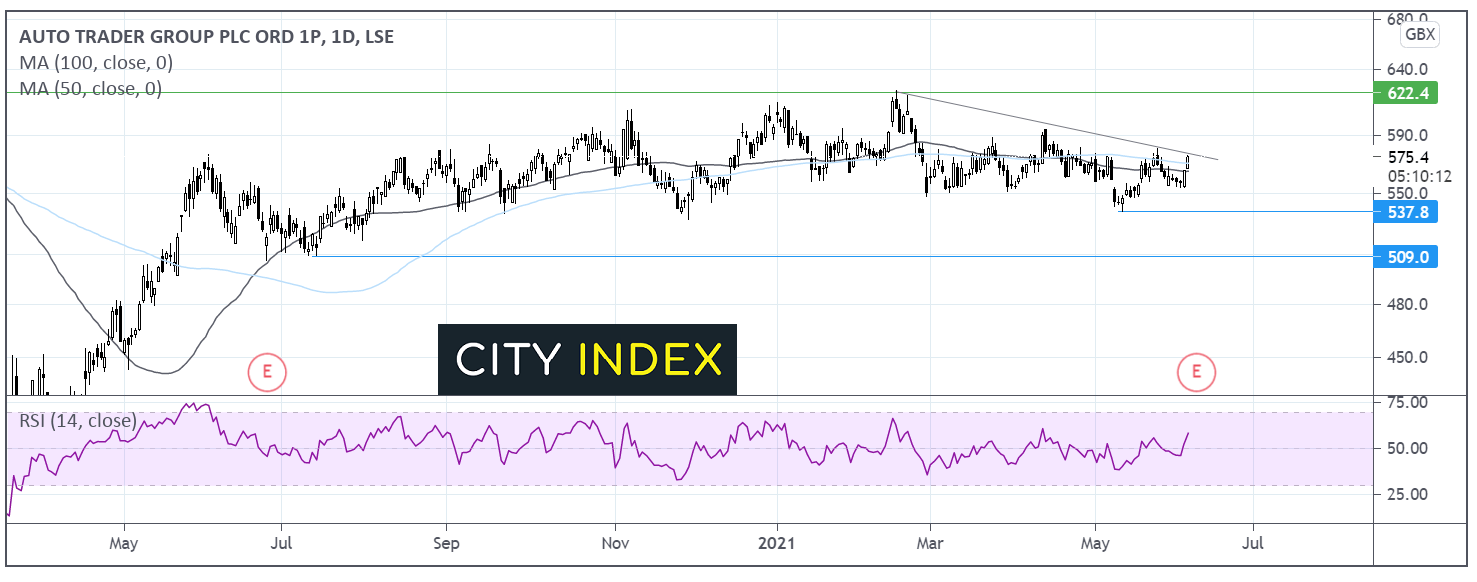

Auto Trader share price has been relatively range bound across the past year, capped on the upside by 623p the all-time high and rarely falling below 540p on the downside.

After hitting 623p mid-February, the price has formed a series of lower highs. It trades below its descending trendline. However, a jump in the share price today has seen it retake the 50 and 100 day ma.

The RSI is supportive of further upside.

A close above the descending trendline could keep the buyers optimistic and open the door to a move over 590p the April high, ahead of 623p the all-time high.

Failure to retake the trend line could see sellers target 535p the yearly low. A move below her could see the seller gain momentum towards 510p the July 2020 low.

How to trade Auto Trader shares

You can trade Auto Trader shares with City Index using spread-bets or CFDs.

Follow these easy steps to start trading Auto Trader shares today.

- Open a City Index account, or log-in if you’re already a customer.

- Search for ‘Auto Trader’ in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade