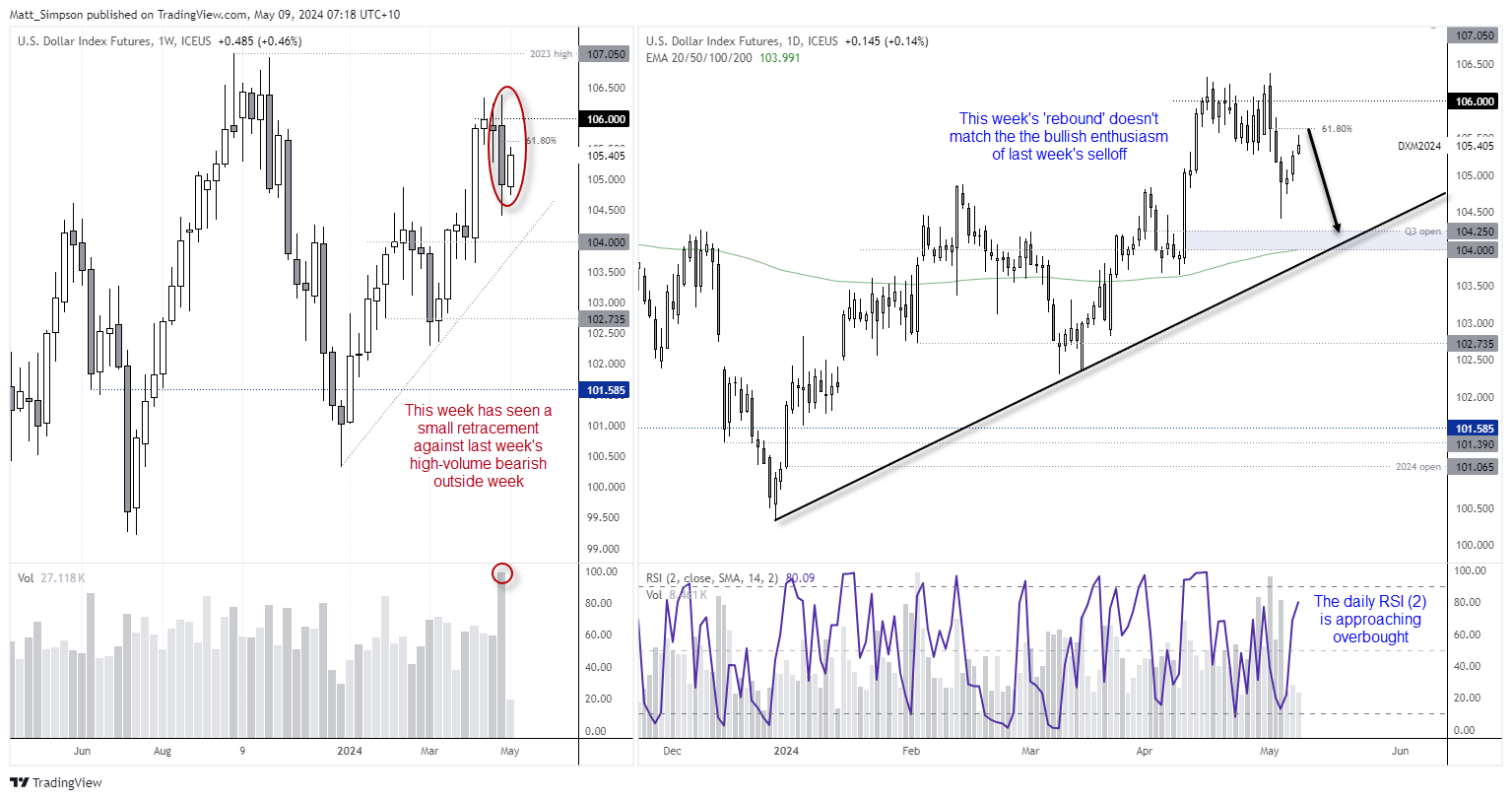

The US dollar extended its rise for a third day, although its corrective nature suggests this could be the build up to its next drop. The index was certainly hesitant to break and hold above 106 this year and the high-volume bearish outside week likely marks the beginning of at least a minor correction – even if the dollar is trying to form a small bullish inside week.

Perhaps a move towards 104 or the bullish trendline could be on the cards. Whether it could provide a deeper drop likely requires US economic data to roll over. As much as traders want to hear about Fed cuts, they’re not yet confirmed and the Fed still retain the highest interest rate among developed central banks. And that risks limited downside unless US economic data rolls over.

But looking at the daily chart suggests the dollar’s next leg lower could be near; Wednesday’s high-to-low range was its smallest in nearly two months, at just 0.25; the past three days has seen just a 0.75% rise from Monday’s low to Wednesday’s high compared to the -1.85% drop of the prior three days.

Ultimately, I suspect another leg lower could soon be approaching, and that should throw a level of support under its respective FX major peers.

- Wall Street indices were mixed with the S&P 500 flat, Nasdaq -0.04% lower but the Dow Jones rose 0.44%

- Gold prices failed retraced slightly lower for a second day, and whilst it didn’t spring higher in line with yesterday’s bias it still shows the potential to do so whilst it hold above $2300

- Silver’s structure appears to be the stronger of the two with its small bullish doji holding above $27

- The Japanese yen retraced lower for a third day, although it essentially moved sideways during US trade to show a hesitancy to continue its trend

- USD/JPY still shows the potential to push for 156, but if analysis on the US dollar index is correct then perhaps the upside is limited (particularly if the BOJ become more vocal about the weaker yen and markets take notice to push USD/JPY lower)

- AUD/USD retraced for a second day and closed beneath 66c, yet again due to the suspicions of limited US dollar upside and a lower tail on AUD/USD, perhaps it is close to forming a base (if not, a rebound)

- WTI crude oil prices saw a false break of $78 before closing the day with a bullish outside day with lower tail – is the swing low finally in?

Economic events (times in AEST)

- 09:30 – BOJ summary of opinions

- 11:30 – Australian building approvals

- 13:00 – China trade balance

- 15:00 – Japan leading index

- 21:00 – BOE interest rate decision, MPC votes, minutes

- 22:15 – ECB De Guindos speaks

- 22:30 – US jobless claims

- 23:15 – BOE Bailey speaks

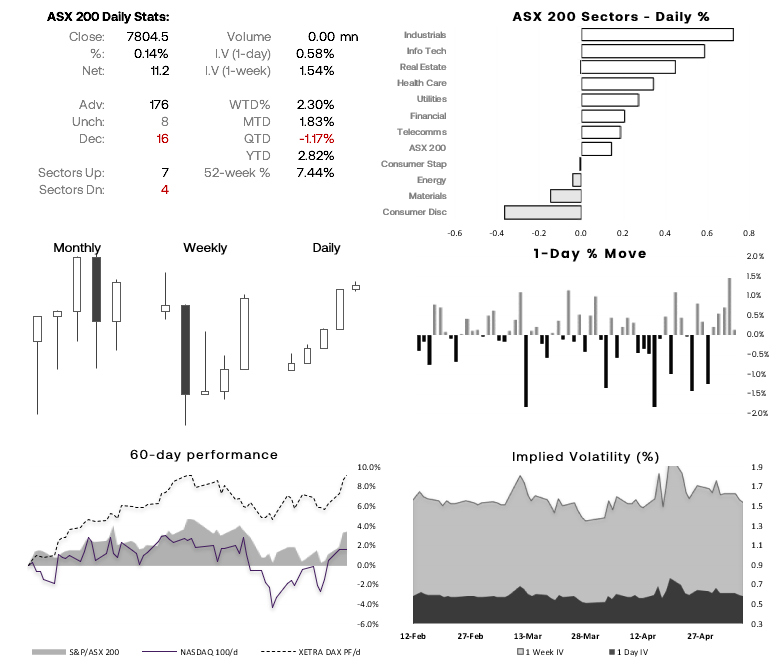

ASX 200 at a glance:

- A fifth consecutive bullish day was achieved on the ASX 200, its first such sequence since late January

- Although the very narrow range surely suggests a hesitation to push much higher without a risk-on catalyst – so I remain on guard for a pullback

- Futures prices were lower overnight which points to a minor gap lower for the cash index at today’s open

- With no top tier news scheduled until the BOE interest rate decision, we could be in for another narrow-ranged day without a fresh catalyst

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade