- BOJ left key policy rates unchanged in January, as expected

- Updated inflation forecasts provided few clues on the timeline of a potential rate hike

- BOJ Governor Ueda will speak later in the session

Japan’s Nikkei 225 and USD/JPY have been whipsawed following the Bank of Japan’s (BOJ) January interest rate decision with policymakers providing few clues as to whether they’re likely to lift interest rates out of negative territory for the first time in nearly a decade later in the year.

With the key overnight policy rate and 10-year JGB target left unchanged at -0.1% and 1%, as expected by markets, attention quickly turned to what the BOJ would signal in quarterly inflation and GDP forecasts updated at the meeting.

Now hawkish crumbs found in updated forecasts

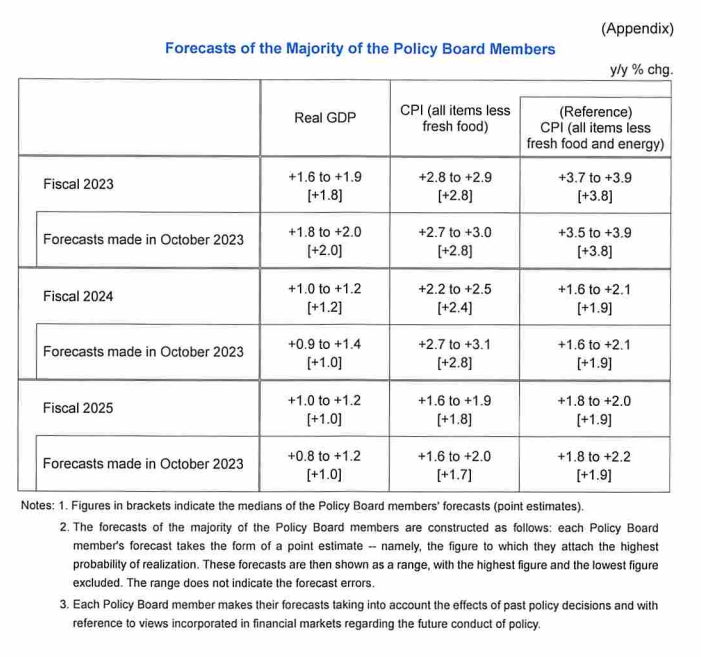

In short, there wasn’t a lot for hawks hoping for a clear signal the BOJ is considering hiking rates imminently with forecasts for core inflation, which the BOJ measures by excluding fresh food prices, downgraded to an annual rate of 2.4% in FY24 while those for FY25 were inched higher to 1.8% from 1.7% three months earlier, still below the 2% BOJ target.

Source: BOJ

Prior to today’s announcement, there had been speculation from some Japanese media outlets that the FY25 forecast could be increased to 2%, guiding the markets towards a 10 basis point hike to overnight policy rates, most likely in April based on current pricing. Forecasts for core-core inflation – which strips out energy and fresh food prices – were left unchanged at 1.9% for FY24 and 1.9% for FY25. GDP for FY24 was upgraded by two-tenths while FY25 remained steady at 1%.

Hike pricing reliant on wages pickup

In the accompanying monetary policy statement, the BOJ stated it needs to closely monitor whether the virtuous cycle between wages and prices will intensify beyond that already seen, largely identical to what the bank has been saying for months beforehand: it needs to see wage pressures sufficiently build in order to be confident inflation will remain around its 2% target over the longer-term, rather than momentarily.

BOJ Governor Ueda will hold a press conference shortly to discuss the decision, providing one last chance to deliver a meaningful surprise for markets. Don’t hold your breath, though. Recent data on inflation and wages has not been kind to the BOJ’s cause.

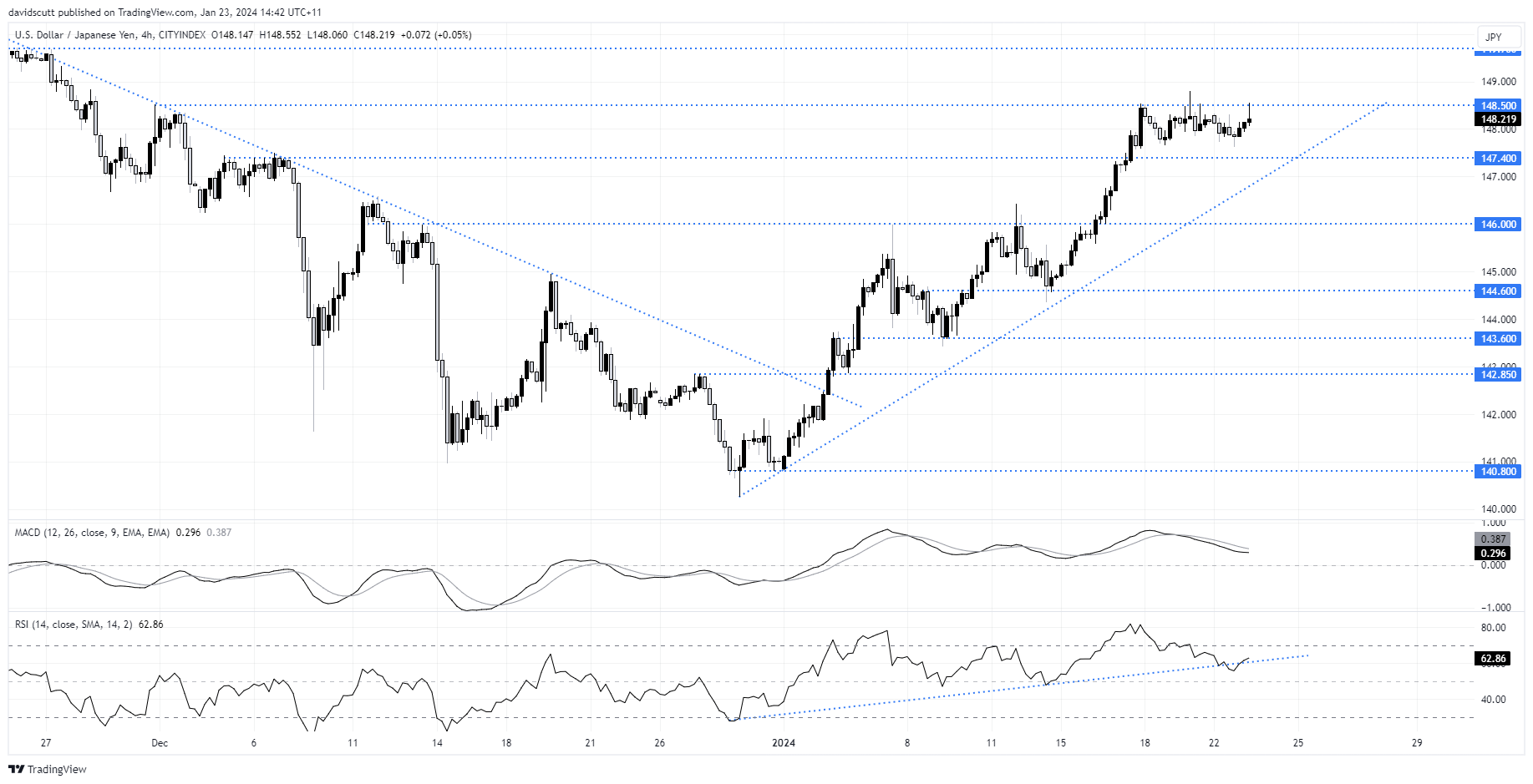

USD/JPY runs into sellers at 148.50

The initial reaction in USD/JPY was to rally following the policy statement. However, the pair ran into resistance at 148.50, seeing it quickly retrace. A break of the beforementioned could lead to a retest of resistance found at 149.70. On the downside, support is located at 147.40 and 146.00, with uptrend support located in between.

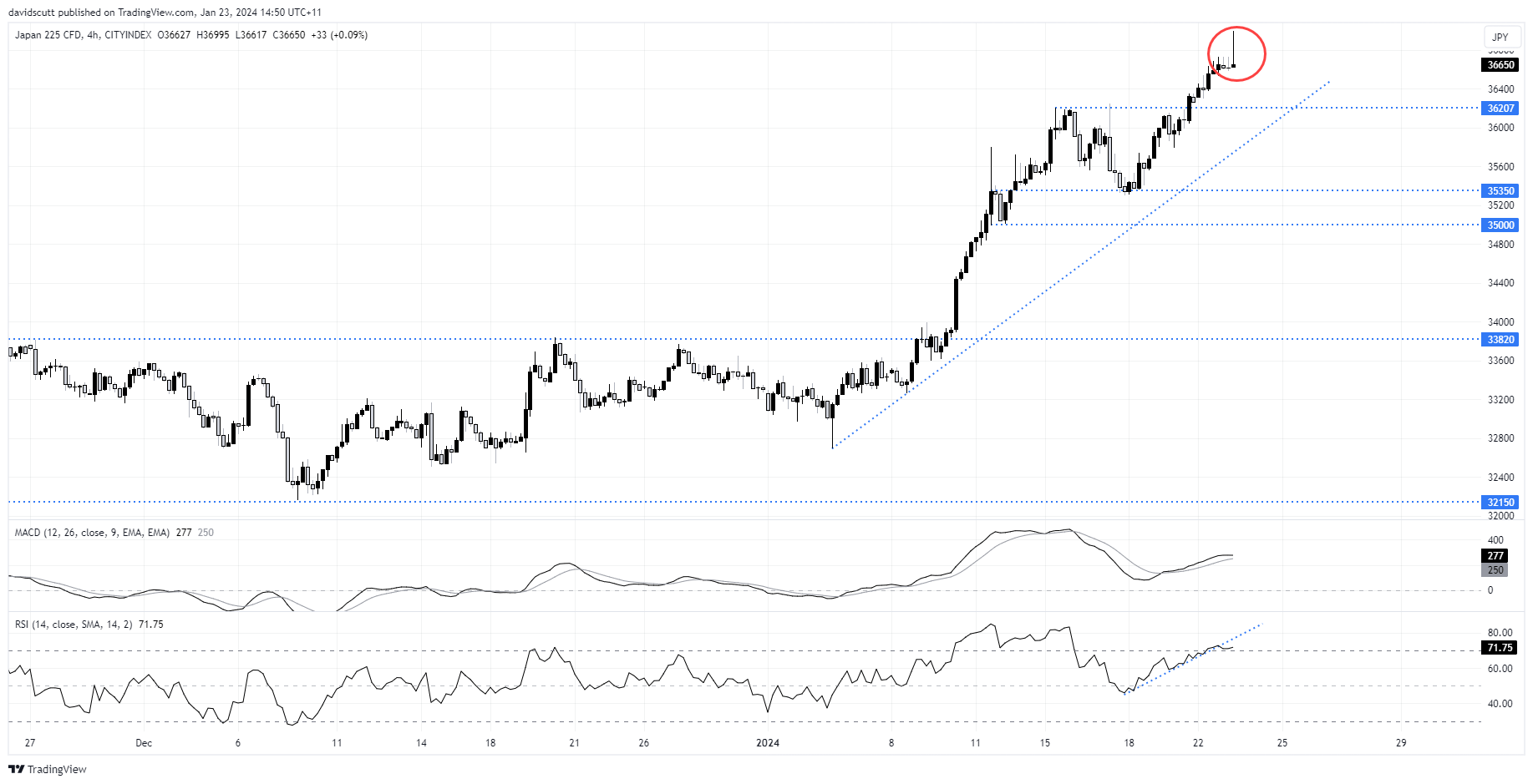

Nikkei 225 reversing gains. China package a factor?

The reaction in the high-flying Nikkei is perhaps more interesting with the index surging to fresh 34-year highs before retracing most of the initial move. It could reflect gyrations in the JPY but it also coincides with media reports that Chinese policymakers are considering further measures to stabilise the nation’s shaky equity markets. It’s hardly a secret that investors have been using the Nikkei as somewhat of a substitution for China exposure given how poor returns from mainland markets have been in recent years.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade