Market Summary:

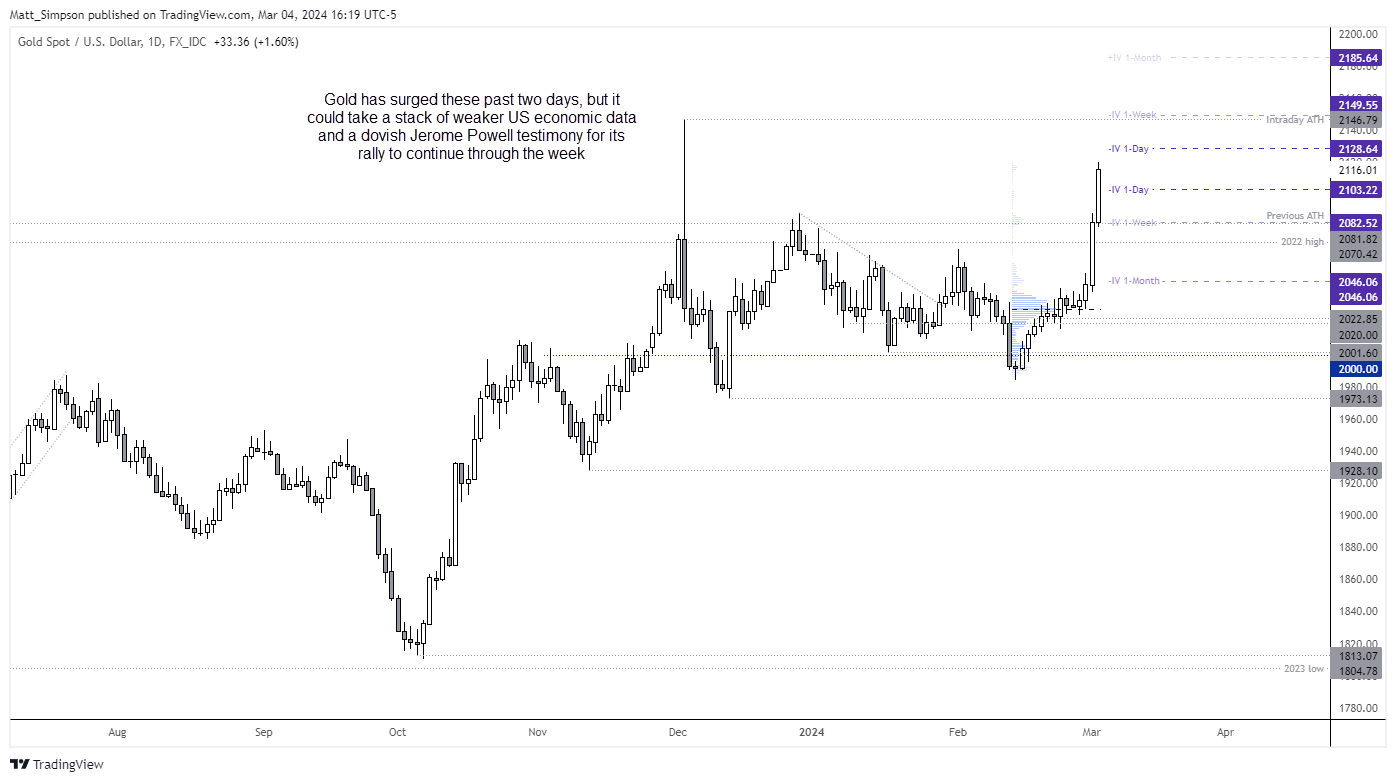

- Gold prices extended their record high on Monday and traded above $2100 for the first time ever, on bets that inflation will continue to cool and force central banks to cut interest rates sooner

- Gold rose another 1.6%, taking its two-day total to over 3.5% since weak ISM manufacturing data on Friday spurred bets of Fed easing, despite higher US yields

- XAU/AUD (gold against the Australian dollar) now trades at the record high of 3251

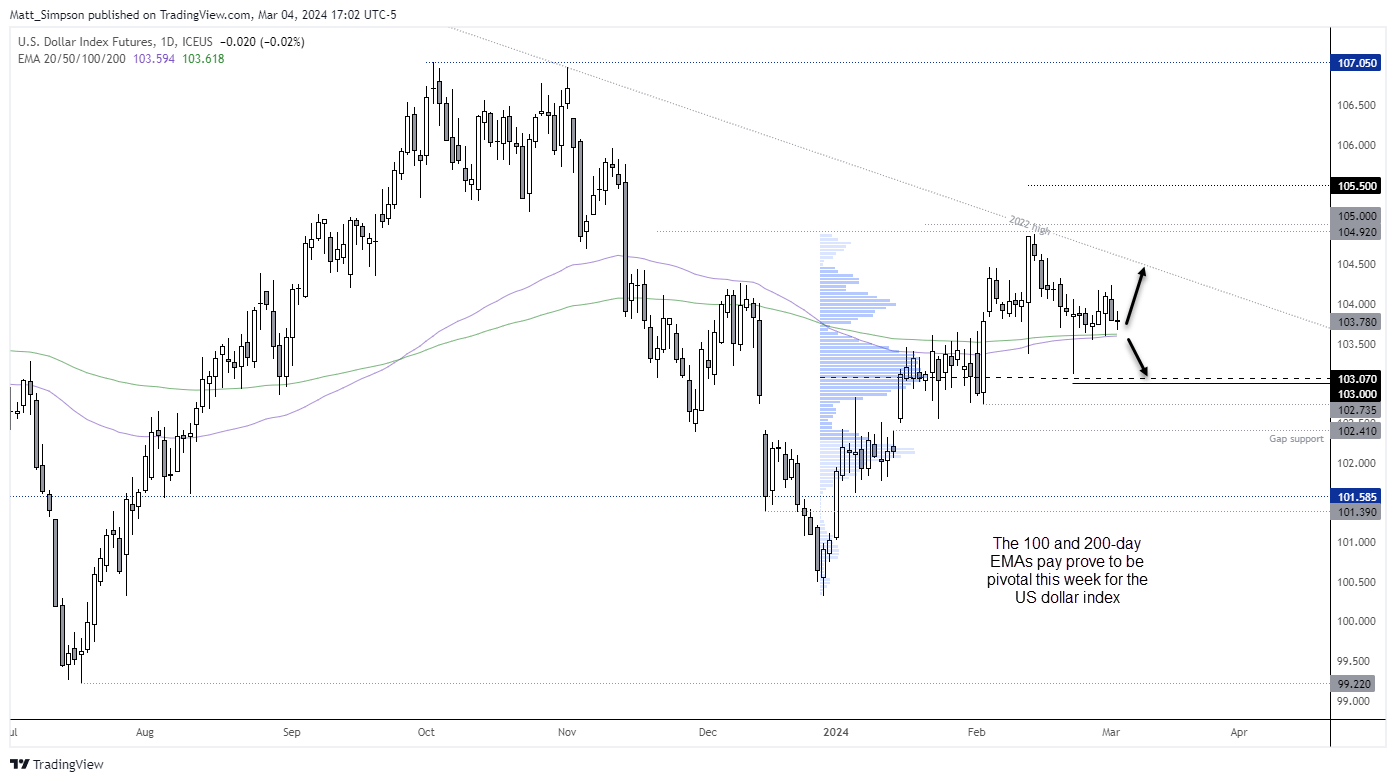

- The US dollar index retreated for a second day although it has found support at its 200-day EMA, which limited gains on EUR/USD to 1.0860

- Still, if US data continues to soften this week then a USD index break beneath the 20-day EMA seems inevitable – but then o does a rally from this key technical level if economic data perks up

- Wall Street touched intraday record highs on Monday before pulling back into the top quarter of Friday’s range

- WTI crude oil continues to provide trick trading conditions, by handing back most of Friday’s gains and falling back below $80 – reminding us that it is a day-trader’s market for the foreseeable future

- Australian building approvals fell -1% in January, and December’s was revised from -9.5% to -10% to appease the minority calling for RBA cuts

- AUD/USD handed back ~50% of Friday’s gains, and if the US dollar regains some ground above the 200-day EMA then a retest and potential break of last week’s low is on the radar

- Given the RBA retained their hawkish bias in their February statement, cuts remain in the distant futures as they’ll need to drop this bias before even considering providing markets with the ‘dovish pivot’ they crave

Events in focus (AEDT):

There’s a host of economic data for traders to chew on today, but the three standout events are Tokyo CPI, BOJ governor Ueda speaking and US services PMI. Tokyo inflation provides a three-week lead on Japan’s national CPI, as the two move very much in tandem. And anyone who hopes the BOJ will tighten may want to see Tokyo’s CPI to come in hotter than expected today. And it is worth paying attention to comments from Ueda to see if he supports hawkish comments made by Tanaka last week. As any such developments could help send USD/JPY lower in line with my bias – on the assumption that it doesn’t tag 151 first.

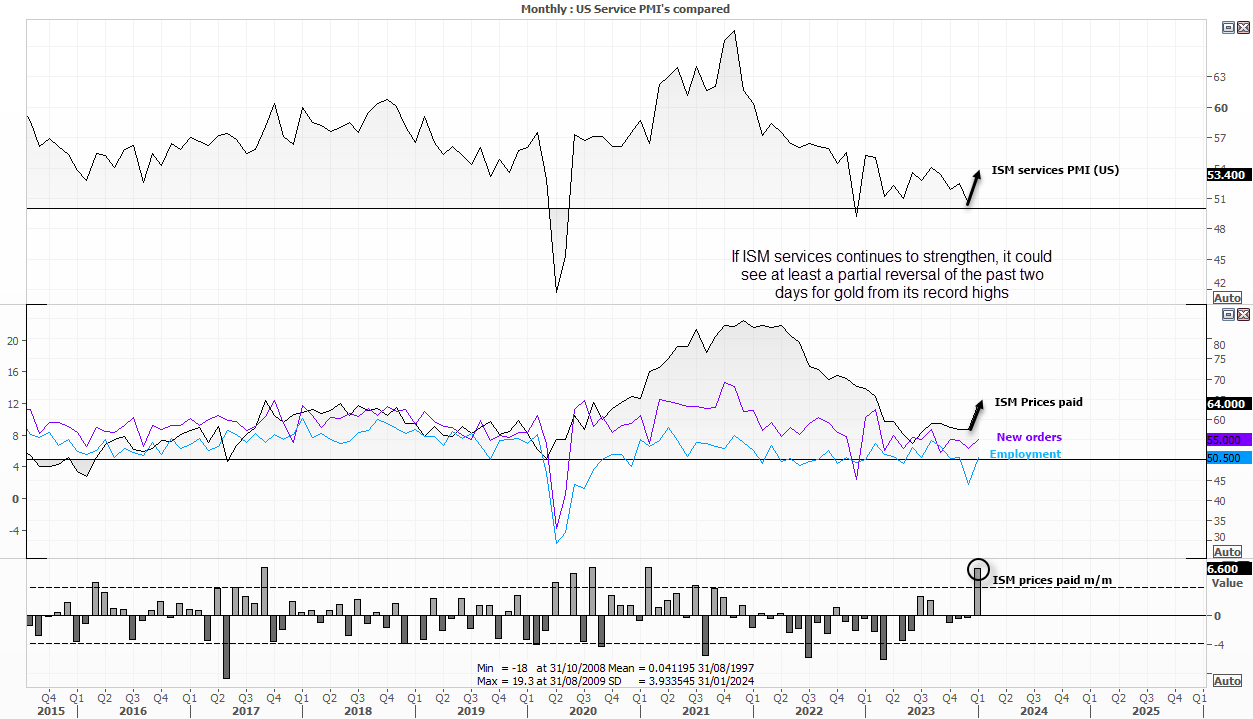

ISM services PMI is a data point which could burn bearish bets on the US dollar. The prices paid index rose sharply higher in January, new orders and employment expanded. And if these patterns persist, it overpowers the case for multiple Fed rate cuts and could knock gold from its highs, support the US dollar and yields and generally unwind some of the dovish-Fed bets seen over the past two days of trading.

- 09:00 – Australian services PMI

- 10:30 – Tokyo CPI

- 11:30 – Australian current account, net-export contribution

- 11:30 – Japan’s services PMI

- 12:45 – China services PMI (Caixin)

- 15:00 – BOJ Ueda speaks

- 21:00 – Eurozone PPI

- 01:45 – US final PMIs (S&P Global)

- 02:00 – US services PMI

- 04:00 – Fed Vice Chair for Supervision Barr Speaks

US dollar index technical analysis:

The USD index formed a bearish outside day on Friday which could also be part of a lower high. Yet Monday’s bearish follow-through was sorely lacking, as it closed with a spinning top doji around Friday’s low. Prices are also holding above the 100 and 200-day EMAs, so it remains unclear which direction the dollar’s next big move will be. But we have more than enough evnts lined up to see volatility return.

Ultimately, should prices continue to show evidence of support above the 100 and 200-day EMAs, then a rally to trend resistance could be on the cards. And a hawkish Powell testimony and strong US data could send it above the technical resistance level. But if the incoming events are skewed to the dovish side for Fed policy, a break beneath the 100 and 200-day EMAs seems inevitable, which brings the 103 handle into view near the high-volume node of the current rally.

Gold technical analysis:

I’ll admit to being caught by surprise with the rally on gold. Yes, gold prices surged on weak ISM manufacturing data – but to extend that rally and print another record high or similar magnitude raises questions as to whether something else is at play. I’ll let others answer that question after the fact.

For now what I see is a strong rally into record highs ahead of a busy week of economic events. As mentioned above, ISM manufacturing could knock some wind out of gold’s rally should it come in strong again, as could any hawkish comments from Jerome Powell’s testimony to the House Committee on Wednesday and Thursday, or strong data from Friday’s NFP report.

Ultimately the sceptic in me doubts gold can maintain its current trajectory for the week, which is why I simply including implied volatility bands to show expectations of volatility from options traders over the daily, weekly and 1-month timeframe.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade