Both US tech stocks and Chinese tech stocks benefited immensely from the pandemic lockdown and work from home dynamic. The pandemic accelerated a digitization process that had already started.

Big tech stocks such as Apple, Amazon, Alphabet, Microsoft & Facebook surged to record highs, as did Chinese tech stocks such as Baidu and Alibaba.

The fortunes of US and Chinese tech stocks have since diverged significantly. Whilst big US tech share prices have had a wobbly journey, they are underpinned and are once again trending higher.

Meanwhile Chinese big tech is on a very different path, wiping out pandemic gains.

Let’s take a closer look:

US tech stock revival

High growth tech stocks, which sold off sharply across several points so far this year is experiencing a revival in demand.

The tech heavy Nasdaq Index is a weighted index, its top five heavyweight components are Apple, Microsoft, Amazon, Google and Facebook. The Nasdaq surged to record highs this week.

However, it hasn’t been plane sailing this year by a long shot.

The big tech stocks which dominate the Nasdaq had an impressive earnings season, they beat estimates and revised estimates on both revenue and earnings. The numbers showed that these companies are fundamentally booming as a result of the acceleration in digitalization that the pandemic brought.

Even so these tech giants have seen two sharp corrections recently, one in March at the end of Q1 and one last month in May just after the blow out earnings.

Rotation into value

The movements out of tech has been driven by a mix of rising inflation fears, concerns of the Fed tightening policy and repositioning for the covid recovery trade.

Tech outperformed across the pandemic. However, when signs of rising inflation sent treasury yields surging investors rotated into value - an area of the market which under-performed last year and is more closely linked to the economic health of the economy. Value stocks and cyclicals were better positioned to outperform as economies reopened. Think energy stocks, industrials and financials for example.

Strategy rethink?

More recently this trade appears to be unwinding. Many of the stocks associated with the reopening trade actually hit all time highs in April or May and have been under pressure since.

Cyclical stocks such as Caterpillar is 8% off 52 week high. Homebuilders are also out of favour, for example Pulte is down 16% from its 52 week high and now banks are also coming under pressure with Bank of America down 4% just last week.

Meanwhile, the rotation into old school tech stocks has been on the rise. Cisco, IBM and Alphabet scaled to new highs.

Speculative tech such as Zoom and Shopify are up 15% and 11% respectively from mid-May which suggests that the value trade could already be starting to unwind.

Interestingly yields had also fallen steeply to 3 month lows, as the markets concerns over inflation eased.

Fed rate hike coming, tech shows resilience

The Fed in its June meeting signaled that it aims to raise interest rates in 2023, earlier than the 2024 initially planned. Whilst all three main stock indices closed lower, the Nasdaq fared better than the Dow. It could be worth keeping an eye on the relationship between yields, the Dow and the Nasdaq over the coming days for further signs that the rotation into value is unwinding.

G7 tax agreement

Another key risk for the US tech giants is tax. The G7 group agreed a deal aimed at making big multinational businesses pay more tax. Big tech companies dominate the tax avoidance list so could be the hardest hit if and when the deal comes into practice.

So far big tech stocks have brushed this off. This could be because:

1) The actual hit will only equate to around a 2% increase in tax, according to Goldman Sachs.

2) Relief that this would mean avoiding the more punitive digital sales tax.

3) Any deal would still need to be approved by Congress, and its dubious whether Republicans could agree.

4) As this movement gains momentum through the G20, then tech stocks might start to show more of a response to the tax risk but for now any global agreement is still some time off.

Regulation risk

The other key point for big tech – which is arguably even more of an issue for Chinese tech stocks which we will come to shortly, is regulation.

The seemingly boundless growth of these tech mega cap is unsurprisingly catching the eyes of lawmakers and regulators who raise questions over their business practices and look to rein in their market influence.

Stricter regulatory regimes & tighter antitrust enforcements are expected going forward. Excluding Microsoft, the likes of Apple, Facebook and Amazon have a long list of legal battles running and investigations into their power & competitiveness.

Where deemed necessary regulators are likely to impose further limits on these firms’ main business operations. So far, the market has taken these risks very much in its stride.

Upbeat outlook

Despite the risks and challenges facing these tech megacaps, as seen in the latest results, they are fundamentally booming. Furthermore, they also expected to lead the way in the digital transformation in cloud computing, 5G wireless tech and the increasingly key area of cloud technology.

Learn more about trading shares

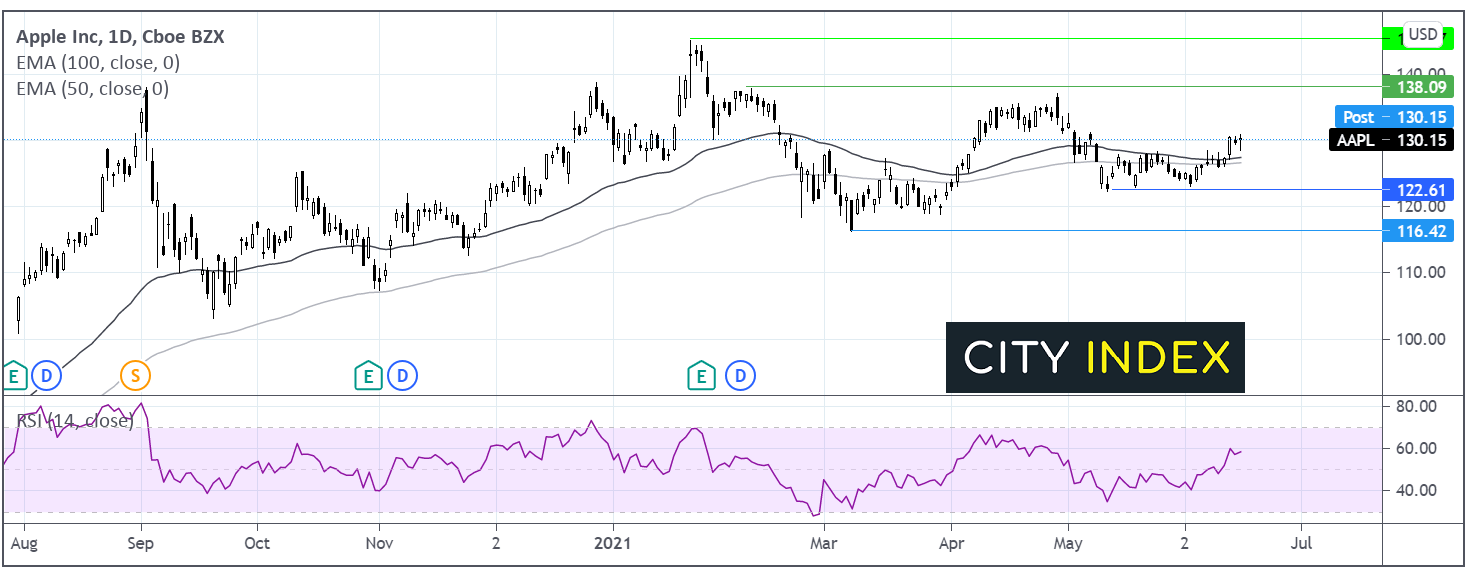

Where next for Apple share price?

After a solid run up across the second half of 2020, the Apple share price has traded rangebound since the beginning of the year. Apple has traded in a holding pattern capped on the upper side by $137 and on the lower band by $117. The share price currently trades just above the mid point having retaken the 50 & the 100 EMA. The RSI is in bullish territory supportive of further upside. Resistance can be seen at $137 to bring $145 the all time high back into focus. Meanwhile a move below $122 could see sellers gain traction towards $117.

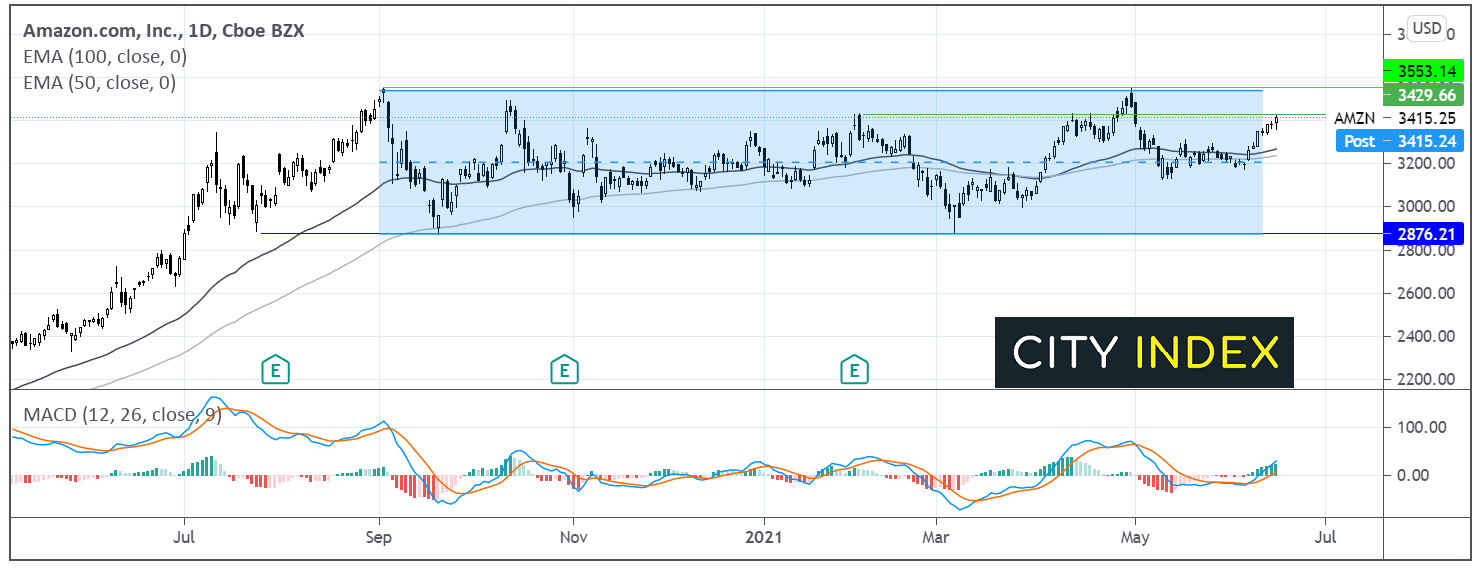

Where next for Amazon?

Amazon share price, like Apple, saw a steep run up across party of 2020. However, it entered its holding pattern earlier than Apple, around early September. The price has traded between the range of $2875 - $3550 over the past 6 months in consolidation. A bullish crossover on the MACD could keep buyer optimistic. Any recovery would need to cross resistance at $3430, the February high. A breakthrough this level could open the door to 3550 and a new all-time high. Sellers would be looking for a break below the horizontal channel midline around $3180 ahead of a move lower towards $2875.

Chinese tech stocks wipe out pandemic gains

Regulation is a key theme for Chinese tech stocks. China’s internet tech sector is stumbling. From what started out as a crackdown on anti-competitive practices, with regulators imposing record $2.8 billion antitrust fine on Alibaba in April, has since ramped up. The campaign against Chinese tech stocks now includes a broad range of areas such as data usage and employment practices. Furthermore, there is now end in sight. The situation could well deteriorate further.

The regulatory clampdown and focus on the sector could well result in both slower growth and revenue prompting investors to sell out.

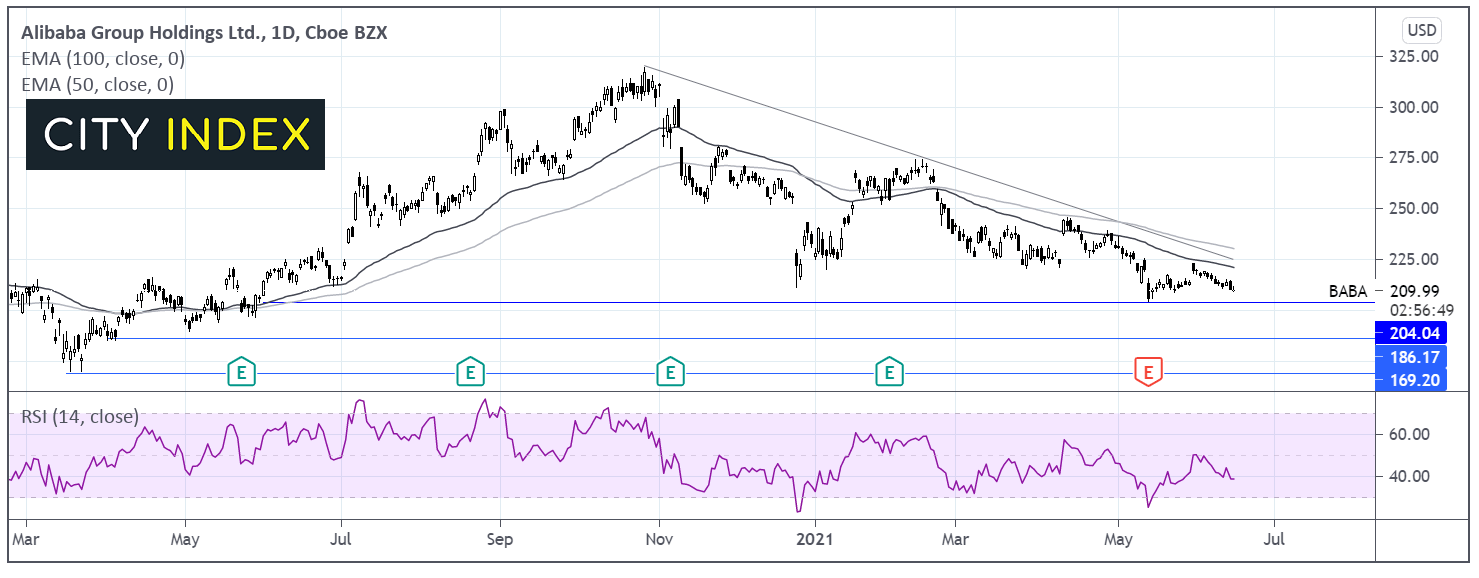

Where next for Alibaba Group share price?

After hitting an all time high in late October, Alibaba share price has been trending lower. It trades below its descending trendline from that date and below its 50 & 100 EMA on the daily chart in an established bearish trend. The RSI is supportive of further losses. A break through immediate support at 204 the May 13 low could see the share price tumble towards $185 a level last seen in early April 2020. On the upside, any recovery would need to retake the 50 EMA at $220, followed by the descending trendline resistance at $225 and the 100 EMA at $330. A break through this area of considerable resistance could mark a significant shift in the technical picture.

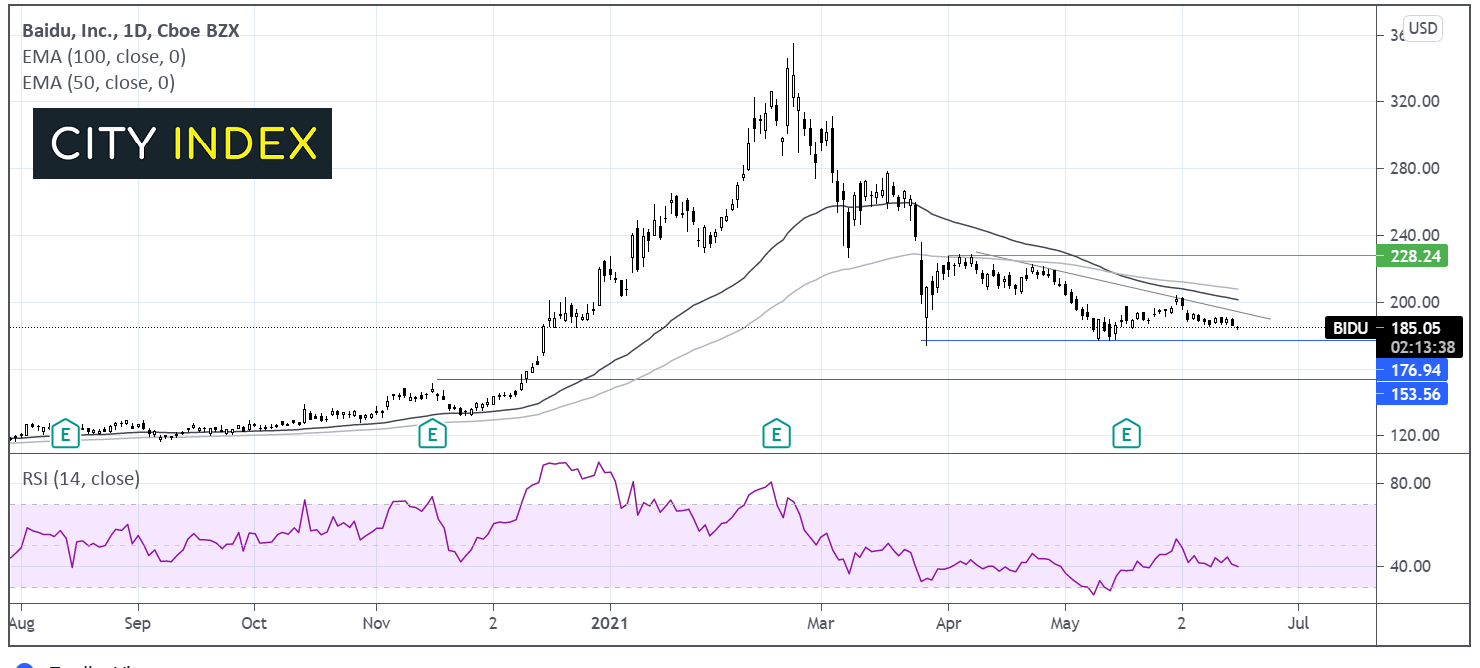

Where next for Baidu share price?

Baidu share price hit an all time high of $354 in February and has been falling since. Baidu trades below its 50 & 100 EMA on the daily chart and below its descending trendling dating back to early April. The 50 EMA also crossed below the 100 EMA in a bearish signal. The RSI is supportive of further downside. Immediate support cane be seen at $175. A break below here could open the door to $150 a level last seen in mid November. On the flip side an area of strong resistance can be seen at 195 the ascending trendline, 200 the 50 EMA and $210 the 100 EMA. A break above this area could signify an important shift in the technical structure.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.