Key takeaways

- US banks are forecast to report lower earnings in the third quarter, apart from outperformer JPMorgan

- Higher for longer rates and recession risks weigh on the outlook, which could result in more cautious commentary from US banks

- Markets have priced-in weaker prospects, with bank stocks underperforming this year and now trading at valuation multiples below their historic averages

- Green shoots emerging in investment banking

US banks Q3 earnings calendar

Major US banks, as usual, will be the first industry to report results and kick-off the third-quarter earnings season. JPMorgan, Wells Fargo and Citigroup are scheduled to be the first to report, followed by the other major banks the week after:

|

US Bank |

Q3 Earnings Date |

|

JPMorgan |

Friday October 13 |

|

Wells Fargo |

Friday October 13* |

|

Citigroup |

Friday October 13 |

|

Bank of America |

Monday October 16* |

|

Goldman Sachs |

Tuesday October 17 |

|

Morgan Stanley |

Wednesday October 18 |

(*To be confirmed)

US banks Q3 earnings consensus

We can see that most banks are forecast to report lower earnings in the third quarter, partly because they are starting to come up against tougher comparatives following the rise in earnings we have seen over the past year. Costs are also rising at a faster pace than revenue at most banks, and loan loss provisions are building across the industry.

|

US Bank |

Q3 Adjusted EPS Forecast |

YoY Change |

|

JPMorgan |

$3.83 |

22.9% |

|

Wells Fargo |

$1.25 |

-4.2% |

|

Citigroup |

$1.21 |

-19.2% |

|

Bank of America |

$0.82 |

1.5% |

|

Goldman Sachs |

$6.82 |

-17.4% |

|

Morgan Stanley |

$1.41 |

-7.7% |

(Source: Bloomberg earnings consensus)

US banks Q3 earnings preview

This could be a weak earnings season for US banks, although it appears markets have already priced-in bleaker prospects.

Rising interest rates may have boosted profitability for banks following a decade of low rates and tepid growth. However, net interest income growth is slowing and margins are stabilizing considering the Federal Reserve has now been hiking rates for 18 months, making comparatives increasingly tougher. Plus, the Fed’s higher-for-longer rate message, which is finally starting to get through to the markets, is posing threats to the US economy and raising the risk of a recession. The health of the US consumer and the economic outlook will therefore be key themes this earnings season.

Higher rates, persistent inflation, dwindling savings and the restart of student loan repayments are just some of the headwinds facing consumers, and markets will want to know how spending and savings are shaping-up as a result. Credit card delinquencies are on the rise, bankruptcies have hit their highest level since the great financial crash and deposits are falling as stimulus-ladened savings vanish. It isn’t all bad news, with the jobs market thus far unshaken and keeping Americans employed.

That suggests households will see their budgets tested going forward. Consumer spending has slowed significantly in recent months and the brakes are expected to come down further in the fourth quarter. US consumer spending accounts for around two-thirds of US GDP, which is also forecast to see much slower growth over the next three quarters. We expect the big banks to issue more cautious commentary about the health of the US consumer and the broader economy as a result, but this appears to already be baked into share prices for most.

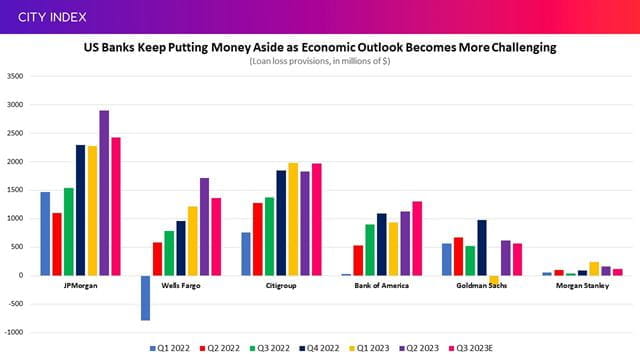

To reflect these challenges, banks have been putting aside more money to ensure they have enough to cover any losses that stem from customers defaulting on their loans, which shows that the industry is bracing for tougher times. Collectively, the big six banks are forecast to book loan loss provisions of over $7.7 billion in the third quarter. We can see signs that provisions may have peaked at some banks, but not at others:

(Source: Bloomberg consensus)

There could be some green shoots in investment banking. M&A activity picked-up in the third quarter but, year-to-date, US volumes have fallen about 26% compared to the same timeframe in 2022, according to data from Bloomberg. Goldman Sachs has been the top advisor this year with a 41% market share, followed by Morgan Stanley (29.2%), JPMorgan (27.1%) and Bank of America (20%).

We should see an improvement in equity underwriting in the third quarter, given the start of what markets hope will be a revival in the IPO market after the likes of Arm, Instacart and Klaviyo went public in recent weeks, with others like Birkenstock waiting in the wings and set to be next to test the waters. However, the performance of the newest additions has been mixed and none have set the markets alight, which shows the jury is still out over whether there is appetite for new listings that are still setting valuations high.

Conditions remain tough for trading fixed-income and equities trading arms. Most will continue to struggle in the current environment, but some are seen outperforming. Bank of America is expected to deliver the best improvement in fixed-income trading and Citigroup could also put in an outperformance in the third quarter.

US banks Q3 earnings: Key themes to watch

We think early signs that investment banking has bottomed-out will be the key themes at Morgan Stanley and Goldman Sachs, with the latter also likely to draw attention as its tries to offload its consumer business. Citigroup’s massive restructuring, which is yet to win the confidence of the markets, will also remain under the spotlight although a proper update isn’t expected until later this year. Wells Fargo, which is focused on more traditional banking activities and still hamstrung by limits on how large it can grow, is also divesting assets to improve efficiency and redirect resources to core activities.

JPM stock: Will JPMorgan keep outperforming?

JPMorgan is the only one of the six that is in positive territory this year even after the recent slide in share prices across the industry.

The largest bank in the US got even bigger this year after leading the industry’s efforts to stabilize the market following the banking crisis back in March and eventually went on to buy assets, including loans and deposits, from First Republic after it run into trouble. That has ultimately led to an influx in deposits and grown its loan book, which has given it more firepower and allowed it to capitalize more on higher interest rates. We can see from the consensus figures that this will help JPMorgan continue to outperform and shine versus its smaller rivals this earnings season.

Is the tougher outlook for US banks already priced-in?

A shaky economic outlook, a muted investment banking market and tougher financial market conditions all point toward weaker prospects for banks, but has this already been priced-in? Banking stocks, tracked by the SPDR S&P Bank ETF, are down over 40% since hitting their cyclical peak back in January 2022 (just three months before the Fed started its hiking cycle) and have shed over 20% since the start of 2023 alone after tumbling in the wake of the banking crisis that erupted in March.

Banks have sank to new lows as a result. Wells Fargo is bouncing back from 5-month lows while investment banking specialists Morgan Stanley and Goldman Sachs have recently hit 1-year lows. Citigroup and Bank of America are licking their wounds after slumping to their lowest level in three years!

The pressure on share prices has caused bank valuation multiples to slump and all but one are now trading below their five-year historic average.

|

Bank |

BF PE Ratio |

5-Year Average |

|

JPMorgan |

9.6x |

11.0x |

|

Wells Fargo |

8.1x |

8.0x |

|

Citigroup |

6.8x |

7.6x |

|

Bank of America |

8.0x |

9.7x |

|

Morgan Stanley |

11.6x |

12.9x |

|

Goldman Sachs |

9.2x |

11.6x |

(Source: Bloomberg, blended-forward price-to-earnings ratio based on estimates over the next 12 months versus the historical average over the past five years).

Markets currently see scope for around two rates cuts in 2024, with the pivot seen happening in the second half. However, markets were expecting up to four rate cuts next year not too long ago and these expectations remain at risk depending on how inflation and economic data rolls in. It is still early to be discussing cuts when markets are still debating whether we will see another hike before the end of 2023, while some have warned we could be nowhere near peak rates after JPMorgan boss Jamie Dimon warned he said the world should ensure it is prepared for rates to climb as high as 7%! Plus, several Fed members have suggested markets are still underappreciating how long interest rates could remain elevated even after they peak, which casts doubts on those hopes for cuts.

Regardless, it appears the current challenging climate will continue to cloud the landscape for banks and test the strength of the economy for many more quarters to come considering it can take anywhere between six to 18 months for interest rates to really feed through.

We believe US banks won’t issue any shocks when it comes to the outlook for the fourth and final quarter of 2023 as it will take time before these multitude of headwinds start to really weaken the economy, but estimates for 2024 should be treated as fragile given how uncertain the economic picture is.

S&P 500 analysis: Where next?

The big six banks only make up around 3% of the S&P 500 but they have a big influence on the broader market considering their vital role at the heart of the economy. That means they can still heavily influence how the index performs.

The S&P 500 has been trending lower since the start of August and has now fallen for five consecutive weeks. We have seen 4,230 emerge as a potential floor in recent sessions and the 200-day moving average at 4,208 remains there to provide a potential safety net, although there is a risk it could slip below 4,200 and toward the ceiling we saw in the first five months of the year.

The immediate job is to climb back above 4,270 before eyeing the August-trough at 4,335.

How to trade US bank ETFs

You can trade individual bank stocks this earnings season, or you could opt to trade the sector as a whole given the uncertain environment.

For example, you could opt for the SPDR S&P Bank Index (KBE) if you want to trade the industry as one basket. This is comprised of around 66% regional banks with the rest made up of the larger banks and other financial firms.

If you want direct exposure to the more volatile regional banking sector, then go for the SPDR S&P Regional Banking ETF (KRE) that tracks the performance of a basket made up solely of small and mid-sized banks.

How to trade bank stocks

You can trade bank stocks, banking ETFs and indices with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the stock, ETF or index you want in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade

Or you can practice trading risk-free by signing up for our Demo Trading Account.

Take advantage of extended hours trading

The major US banks will release earnings before US markets open and most traders must wait until they open before being able to trade. But you can get ahead of the game by taking a position in premarket hours by taking advantage of our service that allows you to trade JPMorgan, Bank of America and Wells Fargo using our extended hours offering.

While trading before and after hours creates opportunities for traders, it also creates risk, particularly due to the lower liquidity levels. Find out more about Extended Hours Trading.