Top UK Stocks | Rolls Royce Share Price | Serco Share Price | Glencore Share Price | WPP Share Price | Frasers Share Price

Top News: Rolls Royce warns of slower recovery in international travel

Rolls Royce returned to profit in the first half after making a ‘good start’ to the year as it recovers from being hit hard by the pandemic and said it is hoping to start generating cash again before the end of 2021, but warned the recovery in international travel will be slower than first thought.

Revenue fell to £5.15 billion from £5.67 billion the year before. Its underlying pretax profit of £133 million turned from a £3.20 billion loss last year, while reported profit of £144.0 million swung from a mighty £5.21 billion loss. Analysts had expected Rolls Royce to largely remain in the red during the period.

That signals the start of a turnaround after Rolls Royce was hard hit by the pandemic, which caused severe problems for its largest division that supplies engines to the civil aviation industry as global travel was grounded. The situation got so worrisome late last year that Rolls Royce launched a £2 billion rights issue.

Today, Rolls Royce continues to burn through cash. It burnt through £1.17 billion worth of free cashflow from operations in the first half, but that was still considerably better than the £2.86 billion outflow booked the year before. Rolls Royce said it plans to start generating free cashflow again by the end of 2021 but that it expects the annual outflow to be around £2.0 billion for the full year compared to the £4.2 billion outflow booked in 2020.

The anticipated improvement in cashflow will be complimented by £1 billion worth of cost savings and £2 billion worth of asset sales this year as a result of its ongoing restructuring. It revealed yesterday that it is in exclusive talks to sell ITP Aero but said there was no guarantee a deal would be reached.

Rolls Royce said the leaner cost base and the fact it has no debt maturing before 2024 means it is well positioned to bounce back from the pandemic.

Having said that, Rolls Royce warned that it now expects the pace of recovery in international travel to take longer than previously thought, stating it was likely to ‘occur beyond the initial expected timeframe of 2022’.

Where next for the Rolls Royce share price?

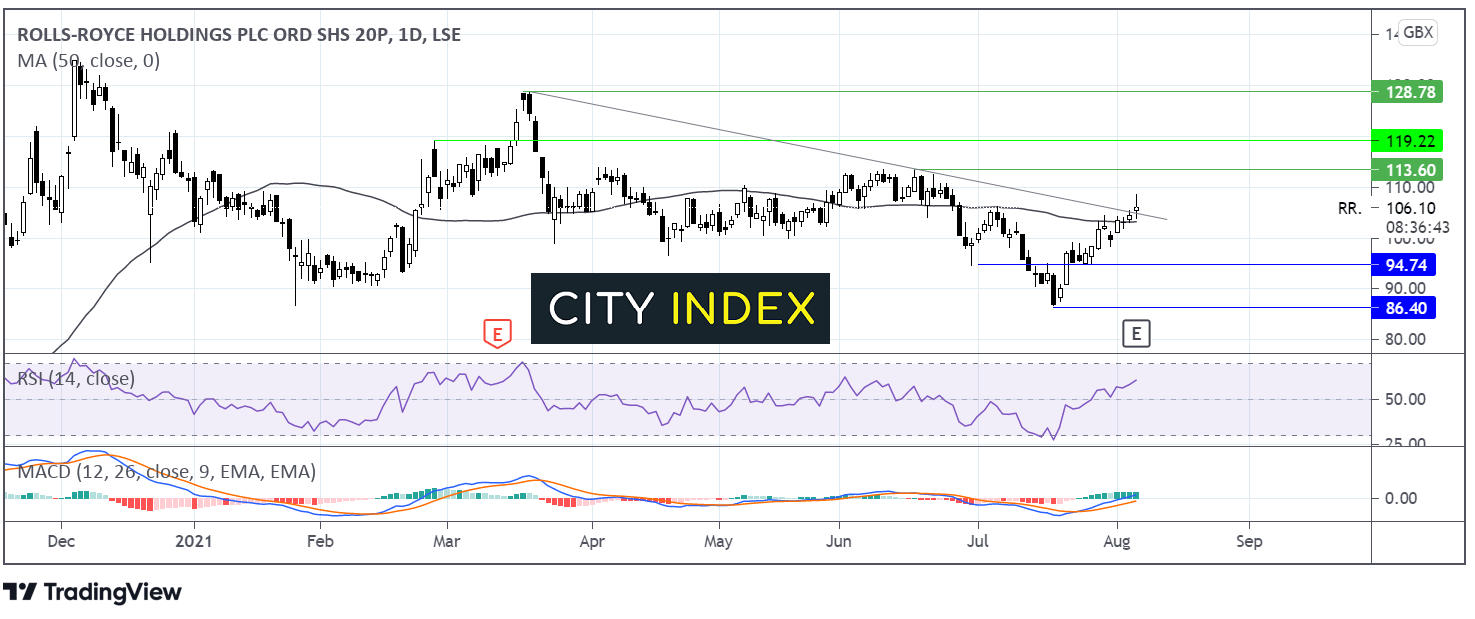

Rolls Royce has been trending lower since mid-March. The share price hit a low of 86p July 20 and has grinded higher since.

Rolls Royce share price is extending gains above the 50 dma and has broken above the descending trendline. The RSI above 50 and pointing higher and MACD are supportive of further upside.

Resistance can be seen at 119p the February high ahead of 128 the year to date high reached in March.

A zone of support can be seen at 103-105p the 50 dma and descending trendline, followed by 95p the June low and 86p the July low.

Glencore ups shareholder distributions despite missing expectations

Glencore said the improvement in commodity prices delivered record levels of Ebitda in the first half of the year, prompting it to raise shareholder distributions, but ultimately missed expectations at the bottom-line.

Revenue jumped 32% year-on-year in the first half to $93.80 billion thanks to higher prices of metals including copper and zinc. Adjusted Ebitda grew at a quicker rate of 79% to $8.65 billion from $4.83 billion, marking a new record for business.

The surge in Ebitda came from its mining operations that, coupled with better prices, also benefited from better mining margins of 38% versus just 22% the year before. Meanwhile, its Marketing arm that trades commodities around the world reported a $220 million fall in adjusted Ebitda to $1.8 billion as it came up against record results last year.

Glencore reiterated its belief the Marketing arm can deliver annual adjusted Ebitda toward the top end of its $2.2 to $3.2 billion target range – which should be in-line with the record $3.3 billion performance delivered in 2020.

Net income of $1.27 billion turned from a $2.60 billion loss the year before, coming in less than half the $3.14 billion expected by analysts. That was after it took a $625 million accounting hit at its Mopani mine following the disposal of Koniambo. EPS of $0.10 improved from the $0.20 loss booked last year, but was also less than half the $0.23 expected.

Despite missing expectations, Glencore ended the period with net debt of $10.6 billion, toward the bottom-end of its $10 to $16 billion target range. As a result, Glencore said it is distributing $530 million through a payout worth $0.04 per share and launching a new $650 million share buyback which, combined with other declarations this year, brings total shareholder returns to $2.8 billion in 2021 so far. That comes after operating cashflow surged 66% in the first half to $7.18 billion.

Glencore shares were up 0.6% in early trade this morning at 330.25p.

Serco to pay first interim dividend since 2014

Serco said it has decided to pay its first interim dividend in seven years after reporting significantly higher revenue and profits in the first half, partly driven by the array of work it has won helping governments respond to the coronavirus pandemic.

Revenue rose 19% year-on-year in the first half of 2021 to £2.16 billion from just £1.82 billion the year before. That was partly boosted by Serco’s work related to the pandemic by supporting hospitals, operating vital transport services, operating testing centres, or its contracts helping Public Health England with its Test and Trace programme.

It said around 17% of its total revenue came from work related to the coronavirus pandemic during the first half, which Serco expects to fall away as the pandemic eases.

‘We believe that as a result of Covid-19 related contracts our skills and capabilities will be greater and our reputation with governments will be enhanced. We take the £4 billion of order intake we have won in the first half as encouraging early evidence of this, and it will certainly help to cushion the impact of the inevitable wind-down of Covid-19 related work.

Serco’s order intake came in at £4.1 billion and 60% of that came from new work compared to the 40% coming from rebidding for contracts. It said its order book ended the period at £14.1 billion compared to £13.5 billion a year earlier.

‘We have had extremely strong order intake, and the book-to-bill ratio was 190%, which bodes well for the future. Our three largest divisions - Asia Pacific, North America and UK & Europe - all delivered good growth, and this reflects both the trust our government customers have shown in us during the pandemic, and Serco's ability to respond to their requirements with speed and at scale,’ said chief executive Rupert Soames.

Underlying trading profit surged 58% to £123.0 million and still managed to rise 31% to £116.0 million when one-off exceptional charges were taken into account. Underlying EPS was up 75% to 6.75p and reported EPS leapt to 18.77p from just 5.66p the year before.

Serco said it is expecting underlying trading profit to grow by nearly 30%, or around £200 million, over the full year but said this will be weighed to the first half. It also said it expects to generate slightly more cashflow this year than previously expected, which will allow it to trim debt by more than originally planned.

Serco delivered a 61% improvement in free cashflow to £130 million, helping give the business the confidence to pay an interim payout of 0.8 pence per share – marking the first interim dividend Serco has paid since 2014.

Serco shares were down 0.6% in early trade this morning at 139.85p, having initially found higher ground when markets opened.

Frasers Group profits plunge during lockdown

Frasers Group saw profits plunge after losing out on sales during lockdown in the last financial year and warned the outlook remains highly uncertain due to the threat of further restrictions being introduced later this year.

Revenue fell 8.4% in the year to April 25 to £3.62 billion. Premium Lifestyle brands managed to eek out 1.9% growth but that was not enough to offset double-digit declines in its wider sports retail operations in the UK and overseas as well as a milder decline from its wholesale and licensing division.

The fall in sales was primarily caused by the fact most of its stores had to close for much of the year during lockdown, which it was only partly able to offset through its online operations and the pent-up demand it has seen since non-essential retail reopened earlier this year.

Underlying Ebitda improved 29.4% to £390.8 million but reported Ebitda took a 2.6% knock to £536.5 million. Reported pretax profit at the bottom-line plunged to £8.5 million from £143.5 million the year before.

‘Our stores in the UK have reopened above expectations and our online channel continues to significantly outperform pre-Covid-19 periods. None the less, management remains of the view that there is a high risk of future Covid-19 pandemic restrictions, likely to be over this Winter and maybe beyond,’ said chief executive Mike Ashley.

‘The board of Frasers Group has continued to consider the probable return of restrictions during FY22, including within its accounting judgements and estimates for FY21. As the effects of the Covid-19 pandemic continue to cause future uncertainty, including the Delta variant surge we are currently seeing, the board of Frasers Group considers it cannot currently confirm with enough material accuracy what the outcome for FY22 will look like,’ he added.

Frasers Group also announced that Ashley will hand over the CEO role to Michael Murray during the current financial year for a handover to happen at the start of May 2022.

Frasers Group shares were down 0.5% in early trade this morning at 610.0p.

WPP launches buyback as sales return to pre-pandemic levels

WPP reported a significant improvement in results during the first half of the year after activity returned to pre-pandemic levels, prompting it to return cash to shareholders through share buybacks.

WPP shares were trading 2.9% higher in early trade this morning at 969.7p.

The advertising and communications giant reported a 5% rise in revenue less pass-through costs to £4.89 billion from £4.66 billion the year before. Notably, like-for-like revenue growth was up 19.3% in the second quarter, a record performance that shows WPP is building momentum and, more importantly, that was 1.3% higher than pre-pandemic levels booked in 2019.

‘We have returned to 2019 levels in 2021, a year ahead of our plan, with good momentum into 2022,’ said chief executive Mark Read.

Adjusted pretax profit rose to £502.0 million from just £15.4 million the year before, while reported profit at the bottom-line of £394.0 million turned from the hefty loss of over £3.17 billion. EPS of 20.6p compared to a 262.0p loss.

‘We expect our strategy to translate into benefits for all of our stakeholders: a powerful, modern offer to support our clients' growth; a great place for our people to work; a positive contribution to communities and the environment; and good financial returns for shareholders, with the interim dividend raised 25% and £600 million of share buybacks planned in 2021,’ Read said.

WPP upped its interim dividend to 12.5p from the 10.0p payout made last year. That was sweetened by a £248 million share buyback in the first half and WPP said it intends to return another £350 million through share repurchases in the second half.

WPP said it is expecting like-for-like annual growth in revenue less pass-through costs of 9% to 10% this year with an operating margin toward the top end of its 13.5% to 14.0% target range, having come in at 12.1% in the first half.

How to trade top UK stocks

You can trade a wide variety of UK stocks with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade