Top UK Stocks and Shares | Pennon Shares | B&M Shares | Chemring Shares | Workspace Shares | Nord Gold IPO

Top News: Pennon buys Bristol Water and plans to return billions to shareholders

Pennon Group revealed it has agreed to purchase Bristol Water and decided to return up to £1.9 billion to shareholders after it sold-off Viridor last year.

The water utility firm booked £3.7 billion from selling Viridor, making a £1.7 billion profit, and had told shareholders to expect news about what it would do with the money when it released annual results this morning.

Pennon is spending £425 million in cash for Bristol Water to add 1.2 million customers to its books. It said it expects the deal to boost earnings and increase its regulatory capital value by 16% in the recently-ended financial year.

‘The acquisition of Bristol Water brings great people and a great business to Pennon and I am hugely excited about building a future together. We see attractive opportunities to continue to invest in the Bristol Water business to deliver enhanced resilience and water security to benefit customers in Bristol and beyond. This latest acquisition, building on a strong heritage and history, firmly cements Pennon as one of the leading UK water and waste water companies,’ said chief executive Susan Davy.

Pennon will use £1.5 billion to pay a special dividend of 355p per share to shareholders and return up to a further £400 million through share buybacks if it cannot find any other M&A opportunities. Importantly, Pennon intends to conduct a share consolidation in tandem with the special payout to issue 2 new shares in the company for every 3 shares currently held.

The balance of the proceeds have been reinvested in the business, used to pay down debt and to plug pension contributions.

‘Additionally, we have demonstrated our credentials as a responsible business, reducing debt levels, increasing pension contributions, and further supporting the Green Recovery for the much-needed regeneration of our region,’ Davy said.

‘Pennon is also proposing an on-market share buy-back programme of up to £0.4 billion expected to be conducted through to September 2022, noting that this may be reconsidered if other attractive growth opportunities are identified. We are also pleased to be recognising shareholder support through the return of £1.5 billion to shareholders in the form of a special dividend,’ Davy added.

The good news came as Pennon revealed it would raise its dividend level by 9% in the new financial year, equal to a 2.0 pence rise per share, giving it a sector-leading payout policy. This is to reflect the addition of Bristol Water. The dividend for the recently-ended financial year will be 21.74p, up 3% from its rebased policy the year before.

Pennon said revenue grew 1.2% in the year to the end of March to £644.6 million, but revealed profits came in lower. Ebitda was down 8.4% to £334.7 million and pretax profit plunged 14.2% to £157.0 million.

Where next for the Pennon share price?

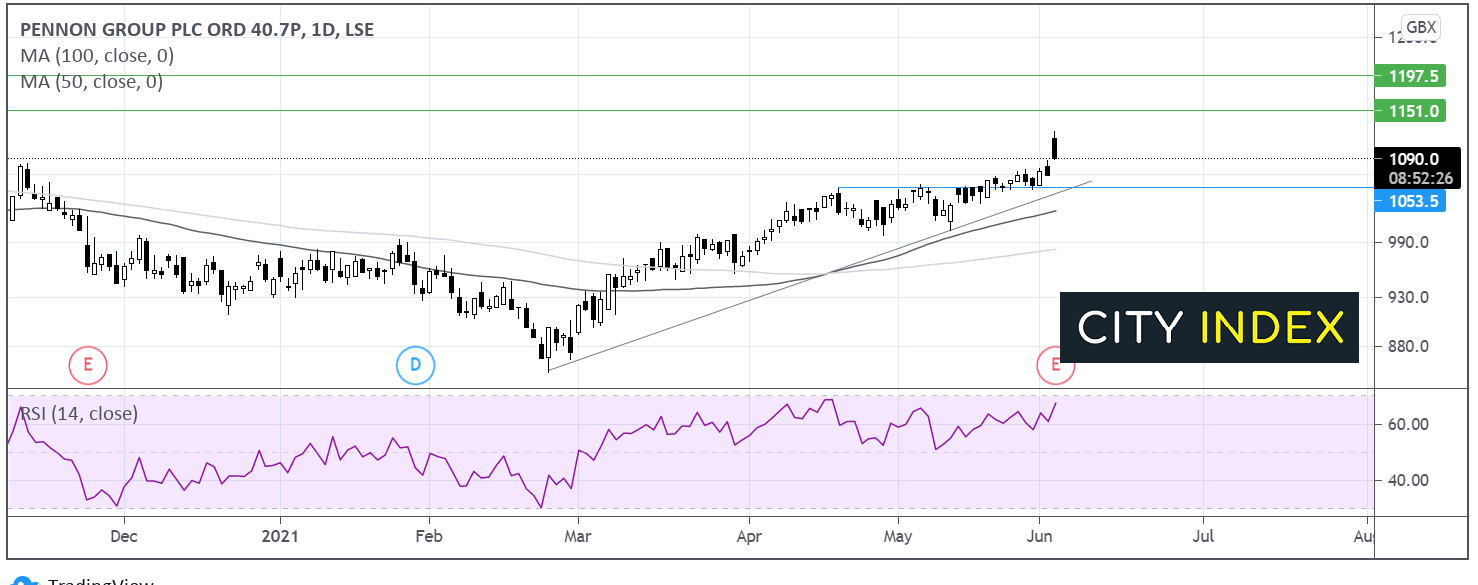

Pennon Group share price trades above its ascending trendline dating back to November. It trades above its 50 & 100 sma on the daily chart in an established bull trend and trades at its highest level since July last year.

The RSI is also supportive of further gains, whilst it remains below the 70-level indicating overbought territory.

Bulls will be looking for an extension of today’s jump towards 1150p the high from May last year. This could open the door to a move towards 1200p the June 2020 high.

It would take a move below 1050p, the ascending trendline support and April’s high to negate the near-term uptrend. A break-through here could open the door to 1025p the 50 sma ahead of 1000p round number.

B&M raises dividend after reaping rewards of being an essential retailer

B&M European Value Retail said it experienced an ‘exceptional year’ as it posted strong growth in revenue and profits and hiked its dividend after being among the small group of bricks-and-mortar retailers able to benefit during lockdown.

The discount retailer was able to keep the majority of its stores open during the year to March 27, allowing it to swallow up business from rivals that were forced to close during lockdown. Overall revenue was up 25.9% in the year to £4.80 billion. That was also bolstered by the fact it opened 43 new stores in the UK during the year, mostly during the second half, while only closing 18 stores.

Adjusted Ebitda jumped 83% to £626.4 million from £342.3 million as its margin expanded to 13% from 9%. Its pretax profit at the bottom-line more than doubled to £525.4 million from £252.0 million.

‘The last year has been an exceptional one. Our results reflect the speed at which we responded to the challenges presented by Covid-19, and the strength of our execution. The core B&M UK business, as an essential retailer, traded throughout the year and welcomed a number of new shoppers, with colleagues working tirelessly to maintain on-shelf availability and provide a safe shopping environment. We also made strong progress in France, despite many stores being closed for up to ten weeks throughout the year. I express my sincere thanks to colleagues across the Group for all of their efforts and determination,’ said chief executive Simon Arora.

Cash generation improved to £944.0 million from £539.5 million. B&M said it has decided to hike its final dividend to 13.0 pence from just 5.4p the year before. That means shareholders will receive a 17.3p payout for the year as a whole compared to only 8.1p the year before – and this excludes the £450 million returned through special payouts during the year.

Net debt of £519.8 million sits at just 0.8x adjusted earnings, comfortably below the 2.25x ceiling that B&M has set itself.

‘Looking ahead, there are many uncertainties as society slowly emerges from lockdown and trading patterns are likely to be unpredictable for much of the year. Within our UK business, we will be up against the strong comparatives from last year but we remain confident that the B&M customer proposition, with its modern network of predominantly Out of Town stores and value-led variety offer, will prove highly relevant to the needs of shoppers. As such, we are well positioned to support the communities in which we trade, retain the loyalty of new customers, and to continue our store roll-out strategy,’ said Arora.

B&M said sales in the last month of its financial year were ‘very strong’, setting the stage for another year of growth. However, it warned that trading ‘continues to be volatile’ and said uncertainty will continue.

B&M shares were trading 2.7% lower in early trade this morning at 546.7p.

Chemring reports strong growth as it unveils new acquisition

Chemring said its expectations for the full-year remain unchanged after posting strong growth during the first half as it revealed it has adopted a new dividend policy and acquired a new business to help bolster its UK-based Roke unit.

The company, which makes products such as sensors for the likes of the defence and aerospace industries, said revenue grew 4% in the six months to the end of April to £198.5 million and was up 8% at constant currency.

Underlying operating profit jumped 12% to £28.1 million and reported operating profit grew at an even faster pace of 24% to £25.2 million. Its profit before tax grew to £24.3 million from £19.0 million the year before.

‘Chemring's positive first half performance again demonstrates the progress that we continue to make in building a higher quality technology-based group. With strong order cover for the full year the group remains on track to deliver year on year growth, and the board's expectations for the full year remain unchanged,’ said chief executive Michael Ord.

Chemring lifted its interim payout by 23% to 1.6 pence from 1.3p the year before, and said it is introducing a new policy that targets a medium-term dividend cover of 2.5x underlying earnings per share.

‘Whilst our modernisation and operational excellence programmes will continue, our focus is now shifting towards the growth of our Sensors & Information segment, where our market leading positions and investment in high technology niches positions us well in this area of growing customer requirement. We are investing in our organic capabilities, both in the development of our technology and people. In addition we now have the financial flexibility to pursue both organic and inorganic growth opportunities,’ Ord added.

Chemring has already pursued inorganic opportunities after revealing it has bought Q6 Holdings, better known as Cubica Group. It did not reveal the price tag but said it will be paid in cash from existing facilities and by a deferred issuance of shares in the business. Cubica was founded in 2013 and is based in Woking. It specialises in artificial intelligence, machine learning, data fusion and autonomy and mainly serves the defence and security sectors.

It is also the majority owner of another company named Vigil AI, which has technology used to detect imagery relating to child sexual exploitation.

‘The acquisition creates further opportunities for Chemring to enhance and further accelerate growth in its Roke business. Roke's customers require an exponential increase in capability to achieve digital advantage against complex threats. Cubica's leading edge capability in Machine Augmented Intelligence and Autonomy complements Roke's existing capabilities in cyber security, intelligence and electronic warfare, offering customers a force multiplier for their missions,’ Chemring said.

Chemring shares were trading 1.3% higher in early trade today at 309.5p.

Workspace ‘optimistic’ about recovery prospects after entering red

Workspace Group entered the red in its recently-ended financial year after rental income collapsed during the pandemic as people worked from home, but said it is seeing signs of a recovery and has ‘a lot to be optimistic about’.

The company, which provides office space, meeting rooms and workshops across London, posted a 33% fall in net rental income during the year to the end of March to £81.5 million from £122.0 million the year before. The drop was also driven by almost £20 million of rent discounts it gave to its customers.

That caused its trading profit after interest – a key measure for the business – to more than halve to £38.7 million from £81.0 million. It entered the red at the bottom-line, turning to a hefty £235.7 million loss before tax from a £72.5 million profit the year before.

The current climate has also led to a reduction in the value of its properties. Its portfolio was valued at £2.32 billion at the end of the year, down 10% from the year before to take into account lower rental values.

‘This has been an incredibly challenging year for the entire country, and we have seen first-hand the impact of Covid-19 on many of our customers. Despite the unprecedented circumstances, we have delivered a resilient performance which underlines the strength of our model, prudence of our financial strategy and enduring appeal of our flexible offer,’ said chief executive Graham Clemett.

Workspace said it is paying a total dividend of 17.75 pence for the year, down from the 36.16p payout in the previous year. Workspace had delayed its decision on dividends earlier in the year when the UK was in lockdown, but said it had decided to make the payout as it could be fully covered by its earnings.

Workspace said occupancy levels were down 11.7% in the year, but said this had stabilised in the fourth quarter while it collected 95% of all rents due for the period by the end of the year. Plus, the number of enquiries, viewings and actual lettings have all steadily increased month-on-month between January and March 2021, painting a rosier picture for the new financial year.

‘We are seeing encouraging signs of recovery in customer demand and we have a lot to be optimistic about in the next year and beyond. We see significant opportunities for organic and inorganic growth as the economy comes back to life, whilst delivering on our commitment to becoming a net zero carbon business by 2030, and continuing to drive employment-led regeneration across the capital. After an incredibly challenging year, we are confident that our customer-focused strategy will enable us to take a leadership position and seize the significant market opportunity in front of us,’ Clemett said.

Workspace shares were trading 1.9% lower in early trade this morning at 893.3p.

Gold miner Nord Gold eyes London IPO

Nord Gold has unveiled plans to list in London after experiencing a record year in 2020 and to help it achieve its ambitions in Russia.

The company produces over 1 million ounces of gold each year and delivers over $1.0 billion of adjusted Ebitda. It has nine mines in operation - four of which are in Russia, one is in Kazakhstan, one is in Guinea, and three are in Burkino Faso. This means just over half of its output comes from Russia and Kazakhstan with the rest coming from West Africa.

Gold output has increased at a compound annual growth rate of 15% from 193,000 ounces in 2018 to 1.04 million in 2020. It has ‘ambitious growth plans’ and wants output to rise by 20% over the next five years while reducing operating costs. This will be primarily achieved by developing assets in Russia. It intends to compliment its main listing in London with a secondary listing in Moscow.

‘Nordgold is an international gold miner of scale, with a diversified, high quality global asset portfolio and a proven track record of new mine development, having successfully launched three new large scale mines since 2013, each with a payback period of less than three years. We also benefit from an experienced well-established Board, a deeply ingrained commitment to the highest ESG standards, and a core management team that has led the growth of the Group since its inception,’ said chief executive Nikolai Zelenski.

‘Following a record year in 2020, and with a low cost, low risk development pipeline centred on the highly prospective Gross Region in Russia, now is the right time for Nordgold to seek a premium London listing. We believe the combination of scale, a strong development pipeline, ambitious growth plans and excellent track record, together with consistent free cash flow generation, disciplined capital allocation, low leverage and a commitment to shareholder returns, makes for a compelling investment case,’ Zelenski added.

Nord Gold will be a dividend payer, having dished out funds to investors in each of the last eight years. It intends to pay out a minimum of $400 million in its first year as a public company and then adopt a policy to payout at least 50% of free cashflow before capital expenditure in the 2022 financial year.

How to trade top UK stocks

You can trade a wide variety of UK stocks with City Index. Follow these easy steps to start trading the opportunities with UK stocks.

- Open a City Index account, or log-in if you’re already a customer.

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade