Top UK Stocks and Shares | NatWest Share Price | AstraZeneca Share Price | Dunelm Share Price | Barratt Share Price

Top News: NatWest gets upgraded by Moody’s

Credit ratings agency Moody’s Investors Services has upgraded a number of debt ratings of NatWest, sending shares higher.

Moody’s has upgraded the senior unsecured debt rating of NatWest to Baa1 from Baa2 to reflect a stronger intrinsic strength of the bank. The outlook is positive. A full table of the ratings changes can be found below.

The positive news comes after the Bank of England removed restrictions on banks paying dividends or conducting share buybacks. Having restricted the industry’s ability to return cash to shareholders after the pandemic erupted, the BoE said ‘extraordinary guardrails on shareholder distributions are no longer necessary’.

The move was prompted by the results of the latest stress tests, which measures the strength of the banking industry under several scenarios, as well as lower-than-expected losses on loans.

|

Previous Rating |

New Rating |

Outlook |

|

|

Natwest Group |

Baa2 |

Baa1 |

Positive |

|

Inside the Ring-Fence |

|||

|

National Westminster Bank |

A2 |

A1 |

Stable |

|

The Royal Bank of Scotland |

A2 |

A1 |

Stable |

|

Outside the Ring-Fence |

|||

|

NatWest Markets PLC |

A3 |

A2 |

Positive |

|

NatWest Markets NV |

A3 |

A2 |

Positive |

Where next for the NatWest share price?

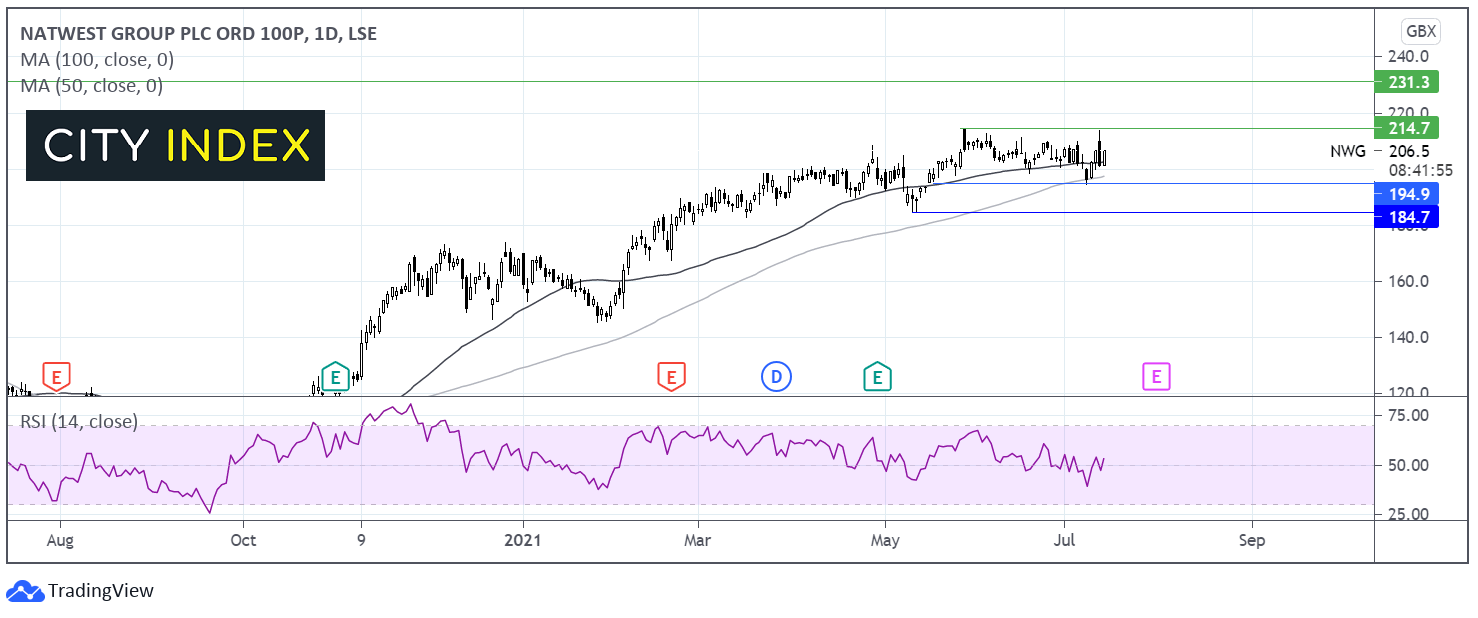

After a strong run up across the start of the year, NatWest has been trading in a holding pattern since the end of May. The parallel channel has been capped on the upper band by 214p and on the lower band by 194p. The price trades on the flat 50 sma and the RSI is neutral but points higher. The upward sloping 100 sma offers support.

Buyers may look for a breakout above 214p in order to target the pre-pandemic level of 230p.

Meanwhile sellers could look for a break below 196p to head towards 184p the May low.

Dunelm sales and profits continue to surge past pre-pandemic levels

Homewares retailer Dunelm said sales and profits continued to grow and exceeded pre-pandemic levels, prompting it to raise investment to capitalise further.

The company said total sales in the fourth quarter of its financial year covering the 13 weeks to June 26 came in at £380.1 million. That was more than double the sales reported the year before, when stores were closed due to lockdown.

That meant full-year sales totalled £1.33 billion, up 26.3% from the previous year.

Notably, although sales were partly flattered due to store closures, they remained well above pre-pandemic levels. Fourth-quarter sales were almost 44% higher than the same period two years ago, while annual sales were still over 21% higher than before the pandemic hit.

Dunelm’s strong online offering has been one of the main reasons it has been able to navigate the pandemic. Digital sales accounted for 46% of all sales during the full-year. However, growth in digital sales did slow in the fourth quarter as stores reopened.

‘The homewares market showed further growth throughout the quarter. Encouragingly, since the re-opening of our stores in April, we have delivered sales growth materially ahead of the market and have gained meaningful share over the full year. This is despite significant periods of store closures during which some of our competitors were allowed to remain open,’ said Dunelm.

The improvement in sales, twinned with better margins, prompted Dunelm to state it expects to report annual pretax profit of around £158 million for the full-year. That is just ahead of the £149 million to £153 million expected by the markets, and an improvement from the £109.1 million profit booked the year before - and above pre-pandemic levels.

The stronger-than-expected sales performance since stores reopened also means that cashflow has improved, resulting in Dunelm ending the year with net cash of £129 million compared to just £45 million the year before.

‘We expect to see continued appetite for consumers to improve and refresh their homes and, whilst the macro economic outlook remains unclear, and we have strong comparatives in the first quarter, we are well placed to further expand our market share through ongoing improvements to our customer offer,’ said Dunelm.

Dunelm said it will raise investment in the new financial year, including in two new distribution facilities to improve its supply chain. The first is a new facility at the Daventry International Freight Terminal development in the East Midlands and a second standalone site in Stoke, close to some of its existing sites. Both sites will become operational in the new financial year and cost around £12 million to set up and £8 million a year in incremental operating costs.

Dunelm shares were trading 2.5% lower in early trade this morning at 1399.0p.

AstraZeneca to merge with Alexion next week

AstraZeneca will formally complete its $39 billion merger with Alexion Pharmaceuticals next week after being given the green light by the UK’s Competition & Markets Authority.

The pair agreed to merge late last year in a deal that will see AstraZeneca pay $60 in cash and issue 2.1243 American Depositary Shares for each Alexion share. This will see Alexion shareholders own around 15% of the combined group.

The merger is set to combine Alexion’s strong position in immunology with AstraZeneca’s strengths in oncology, cardiovascular, renal and metabolism, and respiratory diseases. It will also see AstraZeneca push Alexion’s portfolio in new countries and territories. The pair are also launching a new rare disease unit called Alexion AstraZeneca Rare Disease, which will be based in Boston in the US.

The combined group is expecting to deliver double-digit revenue growth through to 2025 and the deal should enhance earnings in the first year.

With the UK regulator being the last to approve the deal, it should now be completed next week on Wednesday July 21.

‘We are very pleased to have secured this critical final clearance from the UK Competition and Markets Authority for the acquisition of Alexion. We look forward to the imminent closing of the transaction so that we may pursue our shared ambition to bring more innovative medicines to patients worldwide and begin AstraZeneca's next chapter of growth,’ said chief financial officer Marc Dunoyer.

‘AstraZeneca anticipates providing updated 2021 financial guidance for the new, combined entity in due course. Consolidation of Alexion will start from the closing of the transaction and the first quarter of consolidated financial reporting is expected to be the third quarter of 2021 due for announcement on Wednesday 10 November 2021,’ AstraZeneca added.

AstraZeneca shares were trading 1% lower in early trade this morning at 8673.0p.

Barratt to beat expectations as completions recover

Barratt Developments said a strong recovery in the number of houses being built and an increase in demand means it will report profits toward the top end of expectations when it releases annual results next month.

The housebuilder completed 17,243 homes in the year to the end of June. That was ahead of its guidance and an improvement from the 12,604 homes built the year before, and in-line with the 17,856 homes constructed in the 2019 financial year.

That helped Barratt capitalise on higher demand, with net private reservations per active outlet per week rising to 0.78 from 0.60 the year before. Average selling prices increased to £289,000 from £280,300 the year before.

‘The reservation rate increase of 30.0% on last year reflects the impact in the comparative period caused by the unprecedented closure of our sales outlets and sites by 27 March 2020 due to COVID-19,’ said Barratt.

Barratt said adjusted pretax profit would be ‘marginally above’ the top end of expectations. Analysts currently expect the housebuilder to book an annual profit of between £860 million to £899 million. Reported pretax profit is also expected to be above the £761 million and £812 million forecast by analysts.

The news sent Barratt shares 1.2% higher in early trade this morning at 703.6p.

Barratt is confident going into the new financial year, with total forward sales of 14,334 homes worth £3.47 billion on its books at the end of June compared to 14,326 homes worth £3.24 billion the year before. Notably, average selling prices for forward-sold homes has increased to £339,800.

‘Reflecting our strong reservation rate, we are substantially more forward sold for FY22 than we were at the same point in 2019 for planned FY20 home completions. We are therefore well positioned for FY22, with the high level of forward sales providing us with increased visibility for our build programmes and a strong platform for the year ahead,’ said Barratt.

Coats Group to beat forecasts after strong sales performance

Coats Group said it expects to beat expectations in 2021 as sales exceeded pre-pandemic levels in the first-half.

The industrial thread manufacturer said sales in the first six months of 2021 rose to $732 million from $536 million the year before, when business was disrupted by the eruption of the pandemic. Still, sales have grown past pre-pandemic levels from the $702 million of sales made in the first half of 2019.

Organic sales were up 34% year-on-year and 1% higher than pre-pandemic levels. Organic sales of thread used in apparel and footwear was broadly level with 2019 while performance materials reported 4% growth.

Coats Group expects to report an interim operating profit of around $95 million, a huge improvement from the $34 million booked the year before but still below the $102 million in profit booked in the first half of 2019 before the pandemic hit.

The company said its performance for the full-year is now expected to be ‘moderately ahead of our previous expectations’.

Coats Group shares jumped 2.2% in early trade this morning to 69.2p, hitting their highest level since January.

Coats Group plans to release its interim results on August 3.

Boohoo strikes deal to push Debenhams in the Middle East

Boohoo has formed a new partnership with Alshaya Group to help grow the Debenhams brand across the Middle East.

Alshaya already runs Debenhams stores in shopping malls in the region and the new deal will give it the exclusive right to operate them and allow it to launch local online stores in Kuwait, Saudi Arabia, the United Arab Emirates, Bahrain, Egypt, Oman and Qatar.

The deal will see other brands owned by Boohoo launched in Debenhams stores across the region in the final three months of 2021. The new local online platforms should be active from ‘early 2022’.

Boohoo shares were up 0.2% in early trade this morning at 291.8p.

‘I am delighted to be working with Alshaya to operate Debenhams in the Middle East. The Debenhams brand has been popular in the region for a number of years so this is a great opportunity to build on the existing brand awareness, while expanding the product ranges and brands available to customers. It also offers a new route to market for brands within the boohoo group, raising their profile in a growing new market. This is a great step as we progress the integration of Debenhams and look at wholesale partnership opportunities to continue to scale the group,’ said chief executive John Lyttle.

Alshaya Group runs franchises in the Middle East, Russia, Turkey and Europe featuring a swathe of global brands spanning H&M and Mothercare to American Eagle Outfitters and The Cheesecake Factory.

How to trade top UK stocks

You can trade a wide variety of UK stocks with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade