Top UK Stocks and Shares | Indivior Share Price | Dixons Carphone Share Price | Stagecoach Share Price | Serco Share Price | Rio Tinto Share Price

Top News: Indivior raises guidance on strong SUBLOCADE sales

Indivior said it has raised its expectations for 2021 thanks to stronger than expected sales of its SUBLOCADE injection and resilience of SUBOXONE Film in the US.

The company, which specialises in medicines to help people with addictions, said adjusted pretax profit is ‘now expected to be significantly above the group’s original guidance’, but did not provide a precise figure.

It said it was now expecting net revenue in 2021 to be between $705 million and $740 million, a considerable improvement from its previous target to deliver at least $625 million. That would be an improvement from the $647 million in revenue delivered in 2020, but still below the $785 million delivered in 2019.

Its revenue target for SUBLOCADE, which is used by people trying to kick their addiction to opioids, has been raised to $210 million to $230 million from its previous goal of $185 million to $210 million. That looks set to soar from just $130 million in 2020.

It said it is aiming to deliver a gross margin in the low 80%s range, also higher than previously expected. However, it did warn that adjusted operating costs will rise to $470 million to $480 million this year from its original budget of $420 million to $440 million.

Indivior plans to release interim results covering the first half of 2021 on July 29.

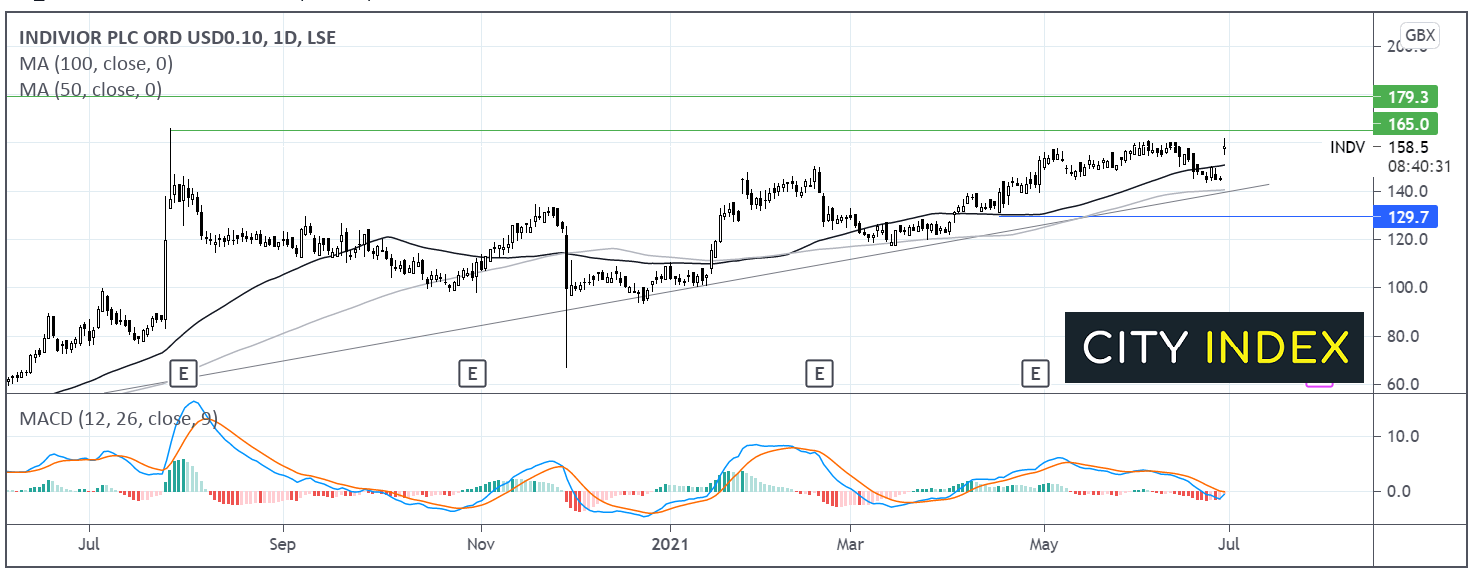

Where next for the Indivior share price?

Indivior has been steadily trending higher since its mid-March 2020 low. It trades above its 100 sma and has now also jumped above its 50 sma on the daily chart.

The RSI looks to be forming a bearish crossover keeping the buyers hopeful.

Immediate resistance can be seen at 165p the July 27 high. A break above here could see the share price head towards 180p a level last seen in 2018.

Support can be seen at 150p the 50 sma, a break below this level could open the door to 142p the confluence of the ascending trend line and the 100 sma. A break below this level could see the sellers target 130p.

Dixons Carphone restores dividend after navigating pandemic

Dixons Carphone said it has decided to reinstate its dividend after reporting higher revenue and profits during its recently-ended financial year, and said trading has remained strong in the new one.

The company has been able to capitalise on the increased demand for tech at home during the pandemic thanks to its strong online offering, with digital sales having grown by triple-digit figures. That helped cushion the sales lost from its stores having to be closed during lockdown and a severe drop in revenue and earnings from its mobile division.

Revenue rose 2% in the year to the end of April to £10.34 billion. Adjusted pretax profit rose to £156 million from £116 million the year before and it turned to a reported profit at the bottom-line of £33 million from a £140 million loss.

Adjusted profit came in much higher than the £145.6 million expected by analysts but the reported profit was well below the £109.1 million forecast.

Dixons Carphone said it ended the year with net cash of £169 million compared to net debt of £204 million a year earlier. Having repaid all the furlough money received from the government, Dixons Carphone said it has decided to reinstate its dividend after suspending payouts to preserve cash. The company will be making a full-year payout of 3.0 pence per share.

‘The start to the financial year has seen continued strong trading. We continue to see evidence that our markets will be structurally larger post-pandemic, and that not all last year's growth was pulled forward. In UK&I Electricals, our sales are up on last year, with around half of the sales through our stores, as expected. In International, our sales are trending positively against strong growth in the previous year,’ said Dixons Carphone.

Dixons Carphone said its priority for the new financial year is to maintain a net cash position. It said exceptional costs related to store closures are now expected to be around £100 million, down from the previous estimate of £130 million.

Dixons Carphone shares were trading 1.2% lower in early trade this morning at 122.15p.

Stagecoach starts to see recovery in regional bus services

Stagecoach reported better annual results than expected this morning and said demand for regional bus services had started to recover as lockdown eased.

Travel was limited during the year as people stayed at home during lockdowns, although Stagecoach services continued to operate to ensure people could make essential trips and demand in London held up.

That resulted in revenue falling to £928.2 million in the year to the start of May from £1.41 billion the year before and adjusted pretax profit dropping to £17.0 million from £90.9 million. On a reported basis, profit dropped to £24.7 million from £40.6 million.

That was better than expected, with analysts having anticipated revenue of £912.3 million and an adjusted loss of £1.3 million.

However, demand for regional bus services has recovered strongly since Stagecoach’s last update that said sales were running at just 46% of pre-pandemic levels in March. Stagecoach said sales were now running at around 68% pre-pandemic levels. Stagecoach is preparing for the rebound in regional bus services to be gradual as people continue to prefer travelling by car to avoid other people, but believes the long-term outlook remains strong, especially after the UK government released its new national bus strategy.

‘It remains difficult to reliably predict the speed and extent of the recovery in the short-term, including the level of profit for the new financial year ending 30 April 2022. Nevertheless, we remain positive on the long-term outlook. The actions we have taken and the continuing support of government should ensure we continue to generate positive EBITDA and operating profit for the time being. We will look to re-build profitability closer to pre-COVID levels as the COVID-19 restrictions are eased.,’ said chief executive Martin Griffiths.

Stagecoach shares were up 1% in early trade this morning at 82.8p.

Serco reaps the rewards of Covid-19 work

Serco said it will report significantly higher revenue and profits when it releases interim results and raised its sales growth and cashflow targets for the remainder of the year.

The company said revenue was up 19% year-on-year in the first half to around £2.2 billion, and up 15% on an organic basis. That has been partly boosted by more work helping the government manage the coronavirus crisis, with Covid-19 revenue of £380 million compared to only £80 million the year before.

It said underlying trading profits will be between £120 million and £125 million, some 50% higher than the year before. Serco said all four of its regions were trading ahead of the year before and that its order intake currently stands at a near record high of around £3.8 billion.

‘Serco's performance in the first half underlines the trust governments around the world place in us, and our ability to respond at scale and pace to rapidly-changing requirements. We expect to deliver revenue growth in the first half of nearly 20%, and Underlying Trading Profit growth of more than 50%; just as pleasing, our order intake will be at record levels at almost £4bn, including large new contracts with the UK Ministry of Defence, the Department of Work & Pensions and the Royal Canadian Airforce,’ said Serco.

Serco is aiming to deliver underlying trading profit of around £200 million in 2021 as a whole, up around 30% at constant currency. IT noted that profits will be first-half weighted as it expects Covid-19 work to reduce in the second half and for investment to increase.

It said it now expects to deliver organic sales growth of 6% this year rather than its original 4% target, and is aiming for free cashflow of £100 million rather than £85 million.

Serco shares were trading 0.3% lower in early trade this morning at 137.1p.

Rio Tinto declares force majeure at South African mine

Mining giant Rio Tinto said it has ceased all work at Richards Bay Minerals in South Africa due to security concerns.

‘Rio Tinto has declared force majeure on customer contracts at Richards Bay Minerals in South Africa due to an escalation in the security situation at the operations. This has led to the decision to cease operations until the safety and security position improves,’ the company said in a statement.

All mining and smelting operations will now remain suspended until further notice. Richards Bay Minerals is involved in extracting heavy mineral sands and is the largest mineral sands producer in the country, producing the likes of zircon, rutile and iron. The project employs over 1,800 people and over 3,000 further contractors.

Rio Tinto owns 74% of Richards Bay Minerals, with local communities owning the other 26%.

Notably, the Zulti South project has remained suspended since the initial security concerns came to light in 2019, when it had hoped to move into the next stage of development

A report from the Mining Journal last month suggested violent incidents were taking place as protests escalate because the Zulti South project remains closed, leaving many out of work.

Rio Tinto shares were trading broadly flat this morning at 6024.0p.

How to trade top UK stocks

You can trade a wide variety of UK stocks with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade