Top UK Stocks | Clarkson Share Price | PageGroup Share Price | AstraZeneca Share Price | Vectura Share Price | McColls Share Price

Top News: Clarkson confident as shipping industry benefits from higher prices

Shipping giant Clarkson reported strong growth in revenue and earnings in the first half and said the market is finally starting to recover after a decade of poor conditions.

Revenue rose to £190.1 million in the first six months of 2021 from £180.4 million the year before. Clarkson has been capitalising on improving market conditions for the shipping industry, with average earnings of main vessels coming in 27% higher than the year before, which has been more than enough to offset the headwind of GBP/USD strengthening – with Clarkson earning most of its money in dollars.

Underlying pretax profit climbed to £27.5 million from £21.1 million while reported profit followed higher to £27.3 million from £20.9 million.

‘The company generated significantly increased profits in the first half of the year, aided by a robust performance in our Broking division and a strong recovery from our Financial division. I am also excited by the progress and momentum that our Sea/ platform is building,’ said chief executive Andi Case.

‘The outlook for Clarksons as a group is strong and the board believes we are in the early stages of a recovery in the shipping markets after a decade of unfavourable demand/supply dynamics,’ said chairman Bill Thomas.

Clarkson said it has made a ‘strong start’ the second half and said momentum is still increasing.

Clarkson raised its interim dividend to 27p from 25p, keeping it on course to deliver its 19th consecutive year of dividend growth in 2021.

Where next for the Clarkson share price?

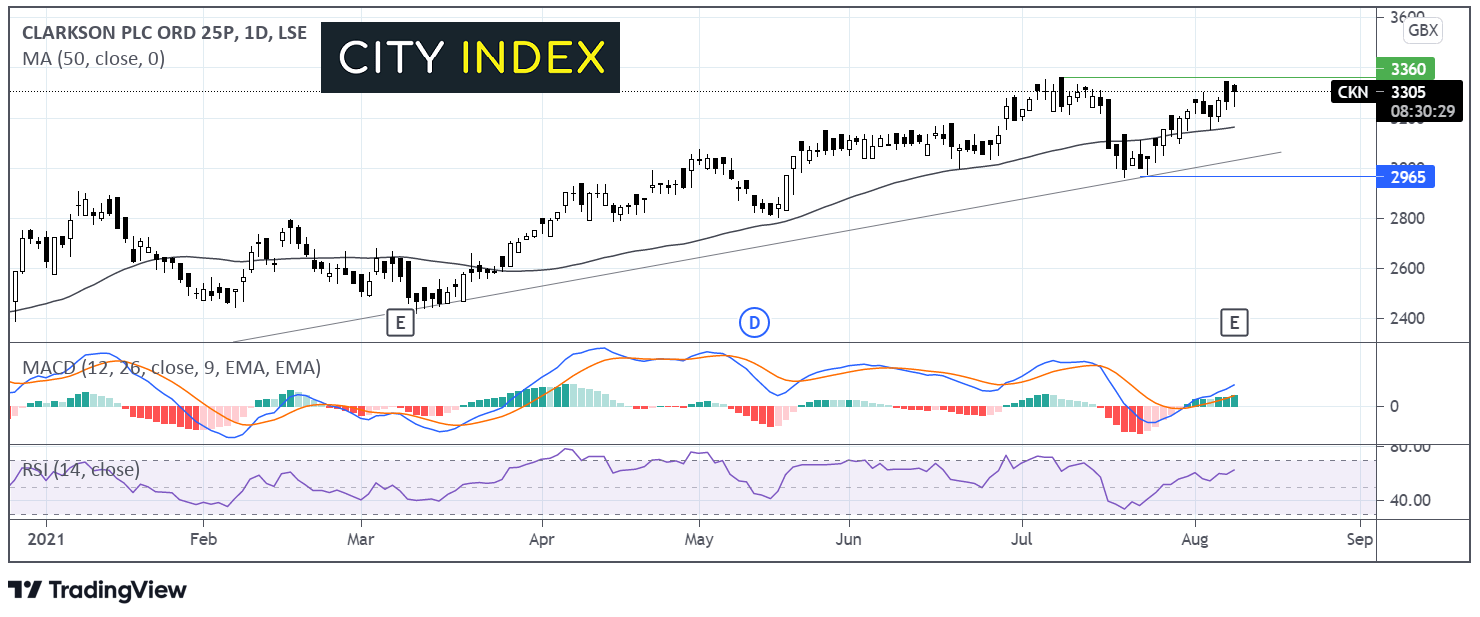

The Clarkson share price has been trending steadily higher since November last year. It trades above its multi month ascending trendline and its 50 dma.

The RSI is in bullish territory and pointing higher, supportive of further gains whilst it remains below 70 the overbought level. The bullish MACD is also supportive of further upside.

Immediate resistance can be seen at 3360p the all time high, a break above this level could open the door to fresh all-time highs.

On the flip side support can be seen at 3165p the 50 dma, a breakthrough here could open the door to 3045 the ascending trendline support. It would take a move below 2965p to negate the uptrend and see sellers gain traction.

PageGroup reintroduces dividend as it recovers from the pandemic

Recruitment firm PageGroup reinstated its dividend and announced it will also make a special one-off payout to investors as it continues to bounce back from the pandemic.

Revenue in the first half of 2021 came in at £766.4 million, rising from the £655.0 million booked last year when the pandemic severely disrupted the business. However, that remained below the £820.5 million in revenue delivered before the pandemic hit in the first half of 2019, showing it still has a way to go until it has fully recovered.

PageGroup booked a pretax profit of £63.7 million in the half and turned from the £800,000 loss booked last year, but again profits remained below the £74.6 million delivered before the pandemic.

The company said it ended June with 7,075 employees, up 5.7% from the year before but still 8% lower than pre-pandemic levels.

The improving conditions prompted PageGroup to reintroduce its interim dividend with a 4.7p payout, which will be complimented by a one-off special distribution of 26.71p. Together, the two dividends will cost PageGroup around £100 million.

‘Looking ahead, there continues to be a high degree of global macro-economic uncertainty as COVID-19 remains a significant issue and restrictions continue in a number of the group's markets. Additionally, at this stage of the recovery, it is not clear whether the improved performance is still the result of pent-up supply and demand, or a sustainable trend,’ said chief executive Steve Ingham.

PageGroup raised its full-year guidance back in July and reiterated this morning that it is aiming to deliver annual operating profit of £125 million to £135 million in 2021. That would compare to just £17 million in 2020 but will remain below the £146.7 million delivered before the pandemic in 2019, which was also a record year for the business.

PageGroup shares were down 2.1% in early trade this morning at 608.8p.

AstraZeneca provides upbeat update on Enhertu and Forxiga

AstraZeneca said it is preparing to submit filings to get Enhertu approved around the world as it revealed that Forxiga has been given the green light in the European Union.

Forxiga has been approved in the EU to treat chronic kidney disease after officials analysed the latest Phase III trial results, with AstraZeneca calling it ‘the most significant advancement in chronic kidney disease in more than 20 years’.

Chronic kidney disease affects 840 million people worldwide and can increase the chances of someone having heart disease or a stroke. About 47 million people suffer from the condition in the EU. However, the number could be significantly higher considering diagnosis rates remain low. AstraZeneca says up to 90% of all people with the disease are unaware they have it.

Separately, AstraZeneca said its Enhertu drug significantly improved progression-free survival in a head-to-head trial with trastuzumab emtansine in patients with HER2-positive metastatic breast cancer.

The company said Enhertu ‘demonstrated superiority’ over the other drug and met its primary endpoint. It also showed a ‘strong trend toward improved overall survival’ compared to trastuzumab emtansine.

‘There is a continued need for new options and better outcomes for patients with HER2-positive metastatic breast cancer who often experience disease progression after initial treatment with available standards of care. These transformative progression-free survival results demonstrate the superiority of Enhertu compared to T-DM1, and the encouraging safety data may open future opportunities to bring this benefit to patients in earlier treatment settings,’ said Susan Galbraith, executive vice president of AstraZeneca’s Oncology R&D.

AstraZeneca shares were trading broadly flat this morning at 8156.0p.

Philip Morris raises takeover bid for Vectura

The battle for London-listed Vectura Group is heating up after Philip Morris International raised its bid for the company, which it wants to ‘form the backbone’ of its inhaled therapeutics business as it shifts away from traditional tobacco products.

The latest offer from Philip Morris is for 165 pence per Vectura share, valuing the company at £1.02 billion in total. That has been raised from its previous bid of 150p after US outfit Carlyle Group tabled an improved offer of 155p offer over the weekend.

Vectura shares were trading 2.1% higher this morning at 167.7p, signalling investors expect more bids to be tabled.

Philip Morris said it wants Vectura to play a big role in its transition away from traditional tobacco products as part of its ‘Beyond Nicotine’ plan, which will see the company generating over $1 billion in annual revenue from its next-gen products in 2025. It said it plans to operate Vectura as an autonomous business and said its size and scale will allow it to boost the firm’s research and development.

That comes after Carlyle noted the ‘reported uncertainties relating to the impact on Vectura's wider stakeholders arising as a result of the possibility of the company being owned by PMI’.

McColl’s Retail Group considers raising cash to fund store conversions

McColl’s Retail Group said this morning that it is ‘currently exploring options relating to a potential capital raise’ as it responded to media speculation that circled over the weekend.

Sky News reported that McColl’s is planning to raise £30 million and has spoken to institutional investors about raising the cash. However, that is a hefty sum considering McColl’s boasted a market cap of just over £40 million before the bell today.

McColl’s shares were down over 19% in early trade this morning at 28.3p, plunging its market cap down to just £33 million.

‘No final decisions have been made on whether to proceed with a capital raise or with regards to the timing or size of any such capital raise,’ McColl’s said in a statement this morning.

McColl’s confirmed that any funds would be used to accelerate the conversion of its stores into Morrisons Daily outlets and to strengthen its balance sheet. McColl’s is currently converting hundreds of its stores under the Morrisons brand thanks to a deal that sees the supermarket provide wholesale services to McColl’s. Notably, that was extended to 2027 earlier this year.

Sky News suggested chief executive Jonathan Miller could be preparing to commit a ‘seven-figure sum’ in McColl’s shares as part of any fundraise in order to inject confidence among other investors.

It comes at a time when a takeover battle for Morrisons is intensifying. Bidder Clayton, Dublier & Rice has been given more time, until August 20, to make a firm offer or walk away after being outbid by rival Fortress. McColl’s has previously said the potential takeover does not affect its deal with the supermarket.

How to trade top UK stocks

You can trade a wide variety of UK stocks with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade