Top UK Stocks | Grafton Shares | Pershing Square Holdings Shares | Costain Shares | Rank Shares

Top News: Grafton Group delivers record profits and cashflow

Grafton Group said it generated record profits and cashflow in the first half of the year and that it remains on track to deliver significant profit growth in 2021.

The building materials and DIY company said revenue was up over 46% in the first half at £1.02 billion as activity levels continued to gain momentum after picking up in March. The company flagged notable contributions from Woodie’s DIY stores and its home and garden business in Ireland. It also said its new acquisition of StairBox had also performed ahead of expectations.

‘Trading in January and February was subdued due to national restrictions at a time when rollout of vaccines was still in the early stages. Strong revenue growth trends developed in the group's continuing operations in March and April and were maintained through May and June,’ said Grafton.

Adjusted operating profit soared to £157.8 million and hit a new all-time record compared to just £46.9 million the year before. The record margin and profits follows on from Grafton’s decision to sell its lower-margin traditional merchanting business, which will allow it to focus on growing its international presence going forward.

Reported pretax profit at the bottom-line followed higher to £142.9 million from £29.5 million the year before.

It also generated record levels of cash of £255.3 million, allowing it to end June with net cash of £302.5 million. Grafton declared an interim dividend of 8.5 pence per share this morning which will cost around £20.4 million in total.

‘2021 marks a key phase of a very considered strategic transformation we have executed at Grafton over recent years, which today comprises a portfolio of high returning, differentiated businesses with the capacity to grow and outperform in our chosen markets,’ said chief executive Gavin Slark.

Grafton Group said the vaccine rollout and reopening of economies was helping deliver the improved performance and warned of the risk posed by new variants or the need for further lockdowns. The supply chain is also under pressure and is expected to suffer some disruption over the ‘coming months’.

Average daily like-for-like revenue was up 4.4% in the period from July 1 to August 15 as positive growth from its distribution and manufacturing businesses offset the anticipated decline in retailing.

Grafton said it is aiming to deliver annual adjusted operating profit of around £240 million this year, which would be a new record and compare to the £193.3 million profit delivered in 2020 and the £204.8 million profit delivered in 2019 before the pandemic hit.

Where next for the Grafton share price?

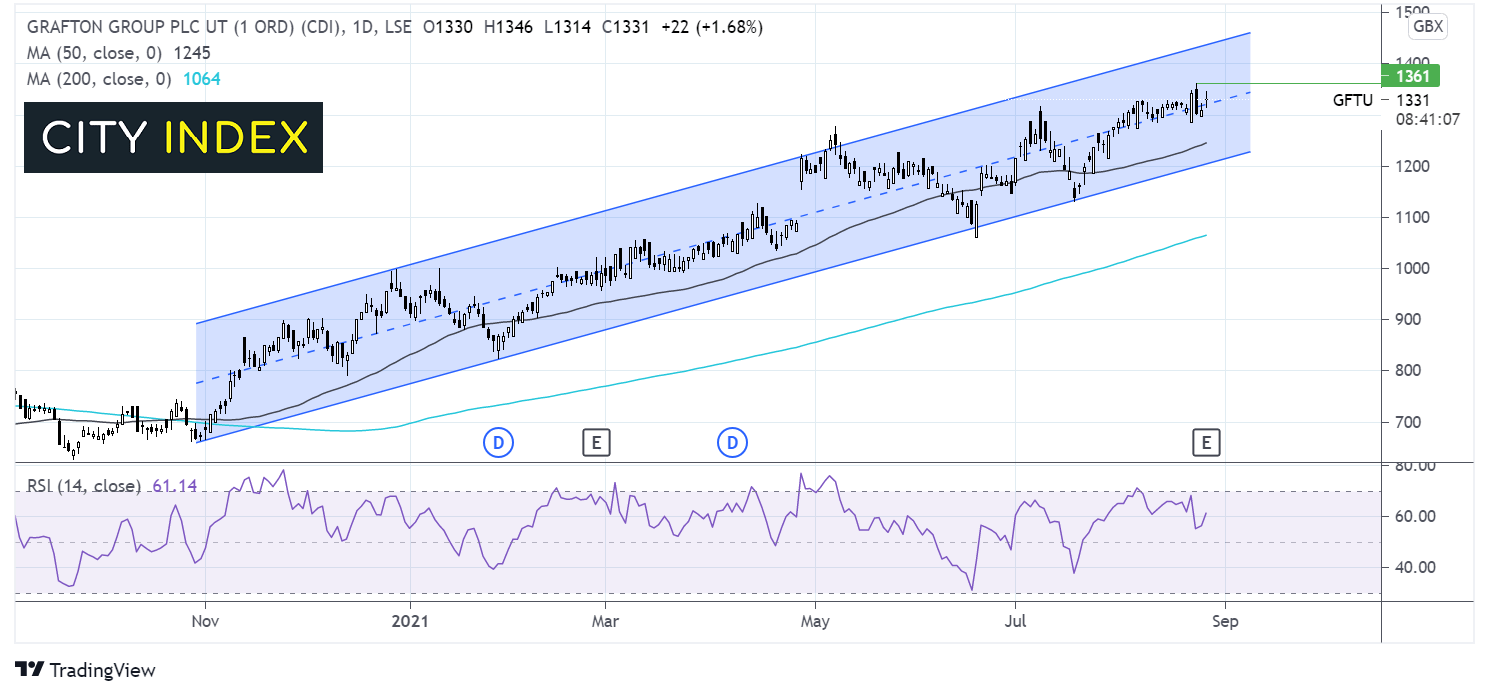

The Grafton share price trades within an ascending channel dating back to November last year as the price formed a series of higher highs and higher lows. The price hit an all-time high of 1361p on Monday before easing lower on Tuesday of this week. The price is on the rise again today.

The RSI is in bullish territory, supportive of further upside whist it remains below 70 the overbought level. Buyers will need to break above 1361 to reach fresh all-time highs.

Support can be seen at 1288 the weekly low, ahead of 1240p the 50 sma. It would take a move below 1205p the lower band of the ascending channel for sellers to gain traction.

Pershing Square Holdings remains confident it can find a deal for PSTH

Pershing Square Holdings said it is confident it can find a merger for Pershing Square Tontine Holdings (PSTH), the largest-ever SPAC that it launched last year, as it revealed it significantly underperformed its benchmark.

The company’s net asset value per share has increased 5.8% between the start of 2021 and August 17, while its share price gained just 2% in the same period. That underperformed its benchmark, the S&P 500, which increased 19.5% over the same timeframe.

Pershing Square Holdings said it is focused on long-term capital gains and that the underwhelming performance this year follows on from three years of strong growth. For example, it delivered a net return of 70.2% in 2020 and 58.1% in 2019.

The company said it shifted around its portfolio in the first half of 2021, exiting its position in coffee chain Starbucks to take up a new position in Domino’s Pizza. It also sold-off its shares in Agilent Technologies during the period.

The best performing assets within the portfolio between the start of 2020 and August 17 were Chipotle Mexican Grill, Agilent Technologies, Domino’s Pizza and Lowe’s. All of its portfolio companies delivered positive contributions during the first half apart from its investments in Fannie Mae and Freddie Mac.

PSTH – its new SPAC model that bought a minor stake in Universal Music Group – also detracted from the company’s performance in the first half. PSTH, which raised $4 billion when launched, is the biggest SPAC to have ever been listed.

Universal will become a public company later this year when majority owner Vivendi distributes shares to investors. Universal Music Group will be the biggest single investment in the portfolio once it has listed.

It also said that its efforts to launch a Special Purpose Acquisition Rights Company (SPARC) out of PSTH to hunt for a new deal are still up in the air as it ‘cannot be certain that SPARC will be approved by the SEC’. It said its plans to return cash to shareholders once the SPARC is approved ‘does not in any way mean that we are walking away from Pershing Square Tontine Holdings and giving up on completing a deal’.

Pershing Square Holdings shares were trading broadly flat this morning at 3425.0p.

Costain escapes the red and remains confident about 2021

Costain reported strong topline growth and revealed it escaped the red during the first half to keep it on course to meet expectations this year.

The tech-led engineering and construction firm said revenue rose to £556.8 million in the first half of 2021 from £459.9 million the year before. Adjusted operating profit improved to £11.5 million from £5.7 million while its reported pretax profit at the bottom-line of £9.1 million turned from a £92.3 million loss the year before.

‘We are pleased to report an improved level of profitability and a strong cash position, demonstrating the focus on trading performance and cash generation across the business,’ said chief executive Alex Vaughan.

‘We are busy bidding for new work across all of our markets, combining Costain's core strengths and our broader service offering in line with our strategy. Importantly, we are being selective in our approach to tendering, focussing on bidding discipline and risk management,’ said Vaughan.

Costain ended June with an order book worth £4.0 billion, broadly level with what it had at the end of December. It won £334.3 million worth of new work in the first half, mainly from existing long-term contracts.

Costain said it was still focused on bidding for high-quality work that offers higher margins and lower risk and that more of its partners were starting to combine its construction offerings with its higher-margin consultancy work. It said examples include water firm United Utilities, rail operator Network Rail and Gatwick Airport.

‘We have good visibility on the completion of contracts for the remainder of this year which gives us confidence in delivering full year results in line with our expectations,’ he added.

Costain shares were down 1.9% in early trade this morning at 63.2p. Although the stock has bounced over 80% higher since hitting pandemic-induced lows in March 2020, shares remain over two-thirds below their pre-pandemic levels.

Rank Group set for £80 million VAT windfall

Rank Group said HMRC has decided not to appeal against the decision to refund the company the VAT paid on income made from slot machines, paving the way for Rank Group to secure a windfall.

The casino and bingo hall operator celebrated a win in June when the First-Tier Tax Tribunal ruled that HMRC should refund the VAT paid by Rank Group from slot machine income between 2006 and 2013.

HMRC was given 56 days to appeal, but Rank Group said this morning that it has ‘decided not to appeal the decision’. The tribunal has now approved a 60-day extension for Rank and HMRC to discuss the ‘exact quantum of the claim’ – which Rank believes will see it receive a refund worth around £80 million.

Rank Group shares were up 2.1% in early trade this morning at 176.4p.

How to trade top UK stocks

You can trade a wide variety of UK stocks with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade