Top UK Stocks | Dunelm Shares | Morrisons Shares | Smiths Group Shares | Biffa Shares | Avon Protection Shares

Top News: Dunelm remains confident profits can keep on growing

Dunelm revealed it is returning over £178 million to shareholders through dividends after delivering stunning levels of growth during a tough year plagued by the pandemic, and said it expects profits to continue growing going forward.

Annual sales rose over 26% in the 52 weeks to June 26 to £1.33 billion from £1.05 billion the year before. That, twinned with an improvement in gross margin to 51.6% from 50.3%, allowed pretax profit to jump over 44% to £157.8 million from £109.1 million.

The performance is impressive considering stores were closed for more than one-third of the year, but the popularity of Dunelm’s omnichannel offering, driven by its online and click-and-collect operations, helped more than offset the blow. Dunelm made 46% of all its sales online during the year compared to just 27% the year before.

Dunelm saw free cashflow fall to £108.5 million from £174.7 million but still ended the year with a higher net cash balance of £128.8 million compared to just £45.4 million a year earlier.

The company said it is to pay a final dividend of 23.0p, taking the total payout for the year to 35.0p. Plus, having made no payouts last year during the pandemic, Dunelm said it was rewarding shareholders with an additional one-off special payout worth 65.0p per share.

‘Sales growth in the first ten weeks of the new financial year has been encouraging, including a positive response from customers to our

Markets currently expect Dunelm to book a pretax profit of £153 to £175 million in the financial year to the end of June 2022.

Dunelm flagged some challenges going forward, namely a rise everything from the cost of the raw materials needed to make products to the freight services needed to distribute them. The shortage of drivers is adding to those problems. However, Dunelm said it is ‘well-placed relatively to manage these challenges’ and is focusing on what it can control, such as increasing stock levels.

Where next for the Dunelm share price?

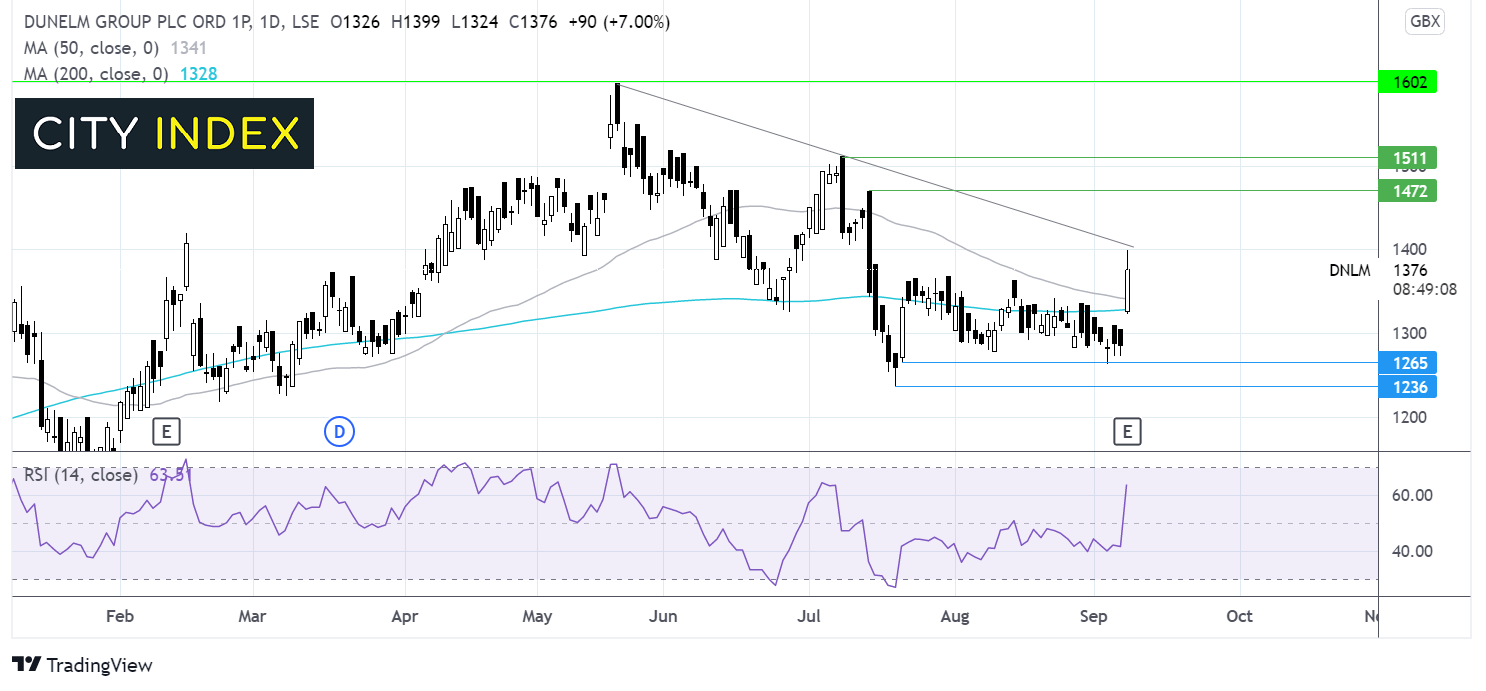

Dunelm has surged higher this morning, breaking above the 200 & 50 sma before meeting resistance at 1400 the multi-month descending trendline. The RSI is in bullish territory and pointing higher, indicative of further upside.

The price needs to clear 1400p, the falling trendline, in order to attack 1470p the mid-July high before 1510p moves into target.

Support can be seen at 1340p the 50 sma and 1325p the 200 sma. It would take a move below this level for sellers to once again gain traction and head towards 1265p the September low.

Morrisons to bring an end to bidding war with auction process

Morrisons said the takeover battle for the UK’s fourth largest supermarket chain will go to auction in the hope of bringing a fruitful end to a drawn-out process.

There are currently two bidders vying to buy Morrisons. In early August, Morrisons accepted an offer from a consortium led by the owner of Majestic Wine, Fortress, that is worth 272p per Morrisons share, comprised of 270p in cash and a 2p dividend. However, it then went on to accept a separate bid from Clayton, Dublier & Rice worth 285p per share in cash.

This morning, Morrisons said neither bidder has declared their most recent offers as final. This means a ‘competitive situation continues to exist’ and that either of them could still increase their offer.

As a result, Morrisons is now taking action in order to bring the bidding war to an end. Morrisons is looking to launch an auction procedure whereby both interested parties would need to bid for Morrisons until a winner emerges.

Depending on which bidder wins that auction process, Morrisons shareholders will then hold a meeting for shareholders to vote on the winning deal on or around October 18. However, Morrisons reiterated that its recommendation will not be solely driven by money but how any new owner plans to manage and advance Morrisons going forward.

Fortress released a statement this morning that said it was considering its options.

Smiths Group accepts higher bid for Smiths Medical

Smiths Group said it has received and accepted a superior offer for Smiths Medical, prompting it to withdraw its recommendation to sell to another bidder.

The company struck a deal in early August to sell its medical division to TA Associates for $2.3 billion, with the ability to earn a further $200 million depending on the performance of the business. It was also set to take a 30% stake in the company set to buy the medical business that would have been worth another $200 million and allowed the firm to retain some exposure.

At the time, Smiths Group said the offer was ‘superior to all other proposals received during the separation process’.

However, on Wednesday, Smiths Group said it has now received an offer from ICU Medical that offers superior value. ICU Medical has offered $2.7 billion in cash with the ability for Smiths Group to earn a $100 million earnout. Plus, Smiths Group would receive 2.5 million new shares in ICU Medical, equal to around a 10% stake that is worth around $500 million, to allow Smiths Group to retain exposure to its medical arm.

This means Smiths Group is set to receive more cash and a more valuable equity component under the ICU Medical deal, prompting it to withdraw its recommendation for the deal struck with TA Associates.

Smiths Medical had already said that it intended to return around 55% of the net proceeds of the deal to shareholders through a buyback. The new offer from ICU Medical would see around £737 million dished out to investors, with the remainder being used to strengthen and grow the business.

Smiths Group hopes the deal with ICU Medical can be completed in the first six months of 2022. After the sale, Smiths Group will be left focused on its industrial technology business.

Biffa sees acquisitions drive topline growth

Biffa said it has continued to perform in line with expectations as new acquisitions continue to drive revenue growth, and said it was working hard to manage the shortage in HGV drivers and other challenges within the supply chain.

The waste disposal company said net revenue in the five months to the end of August grew 12% year-on-year. That was solely driven by new acquisitions, with revenue falling 3% when they were excluded.

In July, Biffa said it expected to deliver annual adjusted Ebit around 10% above the market expectations at the time of £87.6 million, implying it is looking to deliver annual earnings of around £96.3 million. Biffa said its outlook for the full year remains unchanged. That would compare to the £90.5 million delivered in 2020 and the £81.7 million booked in 2019.

Biffa also said it is making ‘good progress’ with the integration of Viridor after completing its acquisition at the start of September, and advancing its work on collecting energy from its waste facilities and improving its plastics recycling operations.

‘As with many other businesses across the UK, we are working hard to mitigate the impact of the national shortage of HGV drivers, along with other supply chain challenges, on our services,’ said Biffa.

Avon Protection wins US Army contract for new helmets

Avon Protection said it has won a $87.6 million contract to develop and supply the US Army with the next generation of ballistic helmets over a two-year period.

The London-listed company had struck a deal for the helmets last year, but the order was withdrawn after a competitor complained. Avon will now supply the next generation Integrated Head Protection System in tranches. The US Army has placed an initial order worth $1.3 million that will see test samples sent over during the first half of the 2022 financial year.

‘Production under the contract will follow on from the existing low-rate initial production contract for the first generation IHPS which, following the extension announced on 1 April 2021, is due to end in 2022,’ Avon Protection said.

The news will be welcomed by shareholders after Avon Protection warned last month that revenue and earnings would be lower than expected this year because of a number of delays and problems in the supply chain. This saw Avon Protection warn that revenue in the year to the end of September 2021 will be $245 to $260 million lower than originally thought. This will also cause tighter margins and lower cash conversion. It also saw the company slash $320 to $340 million from its revenue expectations for the year to the end of September 2022.

How to trade top UK stocks

You can trade a wide variety of UK stocks with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade