Tesla shares drop despite record results

Tesla revealed that it generated record sales and profit in the third quarter. Revenue rose 56% from last year to $21.5 billion and operating income soared 90% to come in at $4.96 billion. Free cashflow more than doubled from last year and rose five-fold from the previous quarter to hit $3.3 billion.

But markets have not welcomed the results considering Tesla shares are down over 6% in extended hours today.

That is partly because revenue came in short of the $22.2 billion forecast by Wall Street, while its gross margin also fell and surprised analysts, but there are other concerns weighing on sentiment. Let’s have a look at what is going on.

Tesla: Is the 50% delivery growth target at risk?

Although Tesla is once again growing production and deliveries at a rapid rate after recovering from the supply chain problems and Covid-19 disruption in China that plagued production in the first half, it is still ultimately not ramping-up as fast as markets had hoped for.

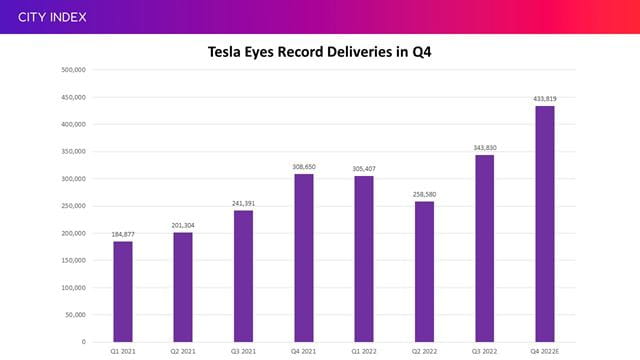

Tesla delivered a record 343,830 vehicles in the third quarter but that fell far short of the 359,162 forecast by Wall Street, and that had already been lowered from more optimistic estimates earlier this year.

Tesla is set to report another set of record delivery numbers in the fourth quarter, with CEO Elon Musk forecasting an ‘epic end of year’. However, we have already seen Wall Street estimates fall to 433,819 from over 436,000 before the results were released, according to consensus numbers from Bloomberg.

Tesla is on course to deliver 1.34 million cars over the full year if it meets expectations in the fourth quarter. That would be up 45% from 2021, but short of Tesla’s ambition to grow annual deliveries by around 50%.

It could struggle to deliver that goal next year too. For now, Wall Street believes Tesla can deliver 1.99 million cars in 2023 – which would be just shy of that 50% goal (assuming it meets expectations in 2022) – but we have already seen some brokers cut their expectations following the recent miss. Morgan Stanley adjusted its 2023 estimates before the results and said it expected this to come in closer to 1.8 million vehicles. At that rate, production would only grow by 33% next year.

Tesla: Is there a problem with supply or demand?

Tesla has blamed the recent delivery miss on logistical issues and stressed it is not an internal problem ramping-up production or, more importantly, any sign that demand is faltering. Getting cars to customers is proving more difficult and expensive, especially as Tesla usually finds itself rushing to hit delivery targets at the end of each quarter. Trying to ship so many vehicles toward the end of each period is pushing up transportation costs and testing capacity.

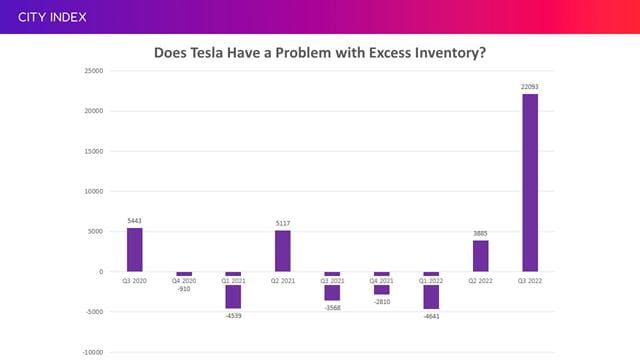

As a result of the problems getting its cars to customers, Tesla produced over 22,000 more cars than it delivered in the third quarter. It is understandable why some are concerned by this when you compare that figure to previous quarters:

Musk said he firm is working on smoothing out deliveries each quarter as it localises production and lowers expedite costs to avoid the usual end-of-quarter rush. The company has ‘began transitioning to a smoother delivery pace’ and said this should also lower the cost per vehicle.

‘We remain focused on increasing vehicle production as quickly as possible, by increasing our weekly build rate in Fremont and Shanghai and progressing steadily through the production ramps in Berlin and Texas,’ Tesla said.

Its factories in Fremont and Shanghai are producing a record number of vehicles at present, with the latter having benefited from a recent upgrade that doubled the plant’s annual capacity. The company is also ramping-up output since it opened a new factory in Berlin, Germany, back in March to mark its first site in Europe and that was swiftly followed by the launch of another plant being opened in Austin, Texas in April.

Musk said there is ‘excellent demand’ for the fourth quarter and that Tesla expects to ‘sell every car that we make for as far into the future as we can see’. This is an important message as concerns over demand start to emerge, especially as markets brace for a possible recession next year. Musk said Tesla isn’t ‘recession proof’ but said it’s ‘certainly recession resilient’. Notably, Tesla revealed customer deposits fell sequentially for the first time in six quarters yesterday.

Wells Fargo said before the latest earnings that the delivery miss in the third quarter highlights rising concern about underlying demand, particularly in China. We saw sales of electric vehicles in China rise at their slowest pace in five months in September, with the China Passenger Car Association warning the ‘recovery trend is far lower than our expectation’ and that the ‘market is overall relatively weak’. Musk said China is in a ‘recession of sorts’ thanks to the turmoil in the property market.

Competition is also intensifying at home against startups and traditional automakers, which are set to test Tesla’s market leading position over the coming years. Tesla is still the dominant player and held around two-thirds of the US electric vehicle market in the second quarter of 2022, but that has seen this lead shrink in recent years considering this sat at around 86% at its peak back in 2018. Still, Tesla does boast a significant advantage over its rivals considering it boasts an operating margin close to 18%. Other electric vehicle startups are loss-making while traditional automakers like Ford and General Motors have much lower margins in the region of just 4% to 6%. There may be some good news for Tesla and other US automakers from the Inflation Reduction Act, which is set to make it more difficult for foreign competitors, such as those in China, from entering the US market.

What about the Semi Truck and Cybertruck?

Tesla has two new models in the pipeline, the first of which is the Semi truck that will hit the roads before the end of the year once it delivers its first ones to beverage giant PepsiCo in December. Tesla is hoping to have 50,000 of them on the road in North America by 2024.

Meanwhile, the long-awaited Cybertruck that has been delayed on several occasions is still on course to enter production in the middle of 2023.

Tesla buyback: Will it repurchase shares?

Tesla shares are down over 44% since the start of the year and, amid the selloff, many retail investors submitted questions ahead of the conference call about whether the company will take advantage and repurchase shares in the current climate. Many of the biggest firms, such as Apple and Microsoft, wield their significant horde of cash to repurchase shares and this is more advantageous when prices are depressed as it helps provide support to the share price and artificially enhances earnings per share figures.

Tesla confirmed it plans to buyback between $5 billion to $10 billion worth of shares, although this will need to be approved by both the board and investors first. Tesla had over $21 billion in cash at the end of September following solid cashflow generation in the latest quarter.

What does this all mean for Tesla stock?

Tesla has delivered record revenue and profits and a significant improvement in cashflow. But ultimately, markets are concerned that Tesla is going to struggle to grow as fast as it has promised and that the 50% growth target is at risk.

Plus, while Tesla still boasts superior profitability, margins are coming under pressure from the strong dollar, inflation and other headwinds which is also prompting some to believe it will also be less profitable over the near-term than previously expected. Its automotive gross margin dropped to 25.1% in the third quarter from 26.6% the year before, and this was a disappointment considering Wall Street was hoping this would stay flat thanks to higher prices.

Supply snarls are the main problem right now as this is what is holding Tesla’s deliveries back, but recession fears in the US, China and further afield are all causing concerns as attention starts to turn to 2023.

Growth is now expected to be slower than previously expected and margins tighter than anticipated, both of which detracts from Tesla’s prospects and therefore its value. Tesla has a big job to do to deliver as many vehicles as possible in the current quarter by smoothing out its supply chain problems, and must set a positive tone for next year.

Where next for TSLA stock?

Tesla shares are down over 6% in premarket trade today at $208.53 after releasing results late last night.

Investors will be hoping that $208 can emerge as a level of support like it did back in June and July 2021 and again in May 2022. Otherwise, the stock will be at risk of falling back toward the 16-month low of $204 that we saw last week. Tesla could slide toward $198 if it drops below here.

On the upside, $224 is the first upside target for Tesla before $234, a level of support on several occasions during the six months to July this year, comes back into view before it can consider a recovery back above the $250 mark.

Turning to the weekly chart, we can see Tesla shares have formed a series of lower-highs and lower-lows over the past year. The 16-month low of $204 needs to hold to avoid setting a new lower-low and break the downtrend.

How to trade Tesla stock

You can trade Tesla shares with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for ‘Tesla’ in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade

Or you can try out your trading strategy risk-free by signing up for our Demo Trading Account.