US futures

Dow futures +0.13% at 38009

S&P futures -0.05% at 4892

Nasdaq futures -0.4% at 17450

In Europe

FTSE +1.5% at 7645

Dax +0.17% at 16943

- US core PCE eases to 2.9%, but personal spending jumps

- Intel falls as Q1 forecasts underwhelm

- USD falls after the mixed data

- Oil eases but is set to book strong gains across the week

US personal spending jumps

U.S. stocks are heading for a mixed open after UK personal spending figures supported speculation that the Federal Reserve will keep interest rates high for longer, but core PCE cooled.

Core PCE, the Federal Reserve's preferred gauge for inflation, is eased 2.9%, down from 3.2%, coming in below forecasts of 3%. However, optimism of cooling inflation was matched with a 0.7% jump in personal spending on a monthly basis, which was well ahead of forecasts of a 0.4% increase and up from 0.2% in November.

The data comes after US GDP figures yesterday were also ahead of expectations at 3.3% and add to evidence that the US economy is heading for a soft landing.

The data also comes ahead of next week's FOMC rate decision, where the Federal Reserve is widely expected to leave interest rates on hold; instead, investors will be watching for clues about when the Fed might start to cut rates. According to the CME Fed watch tool there is a 50/50 probability of the central bank cutting interest rates in March.

Meanwhile, the stock futures also continued to digest the latest round of earnings, with disappointing Intel numbers hitting sentiment.

Corporate news

Intel is expected to open around 8% lower after posting disappointing Q1 guidance. The chip maker expects adjusted EPS of $0.13 per share in Q1 2024, below the $0.33 forecast on an uncertain outlook for PCs. Intel has lagged behind in the AI race, which is showing through in the weak numbers.

Levis Strauss is set to climb 1% after saying that it will cut 10% of its corporate workforce due to restructuring efforts. The jeans maker posted Q4 earnings ahead of estimates but fell short of revenue expectations.

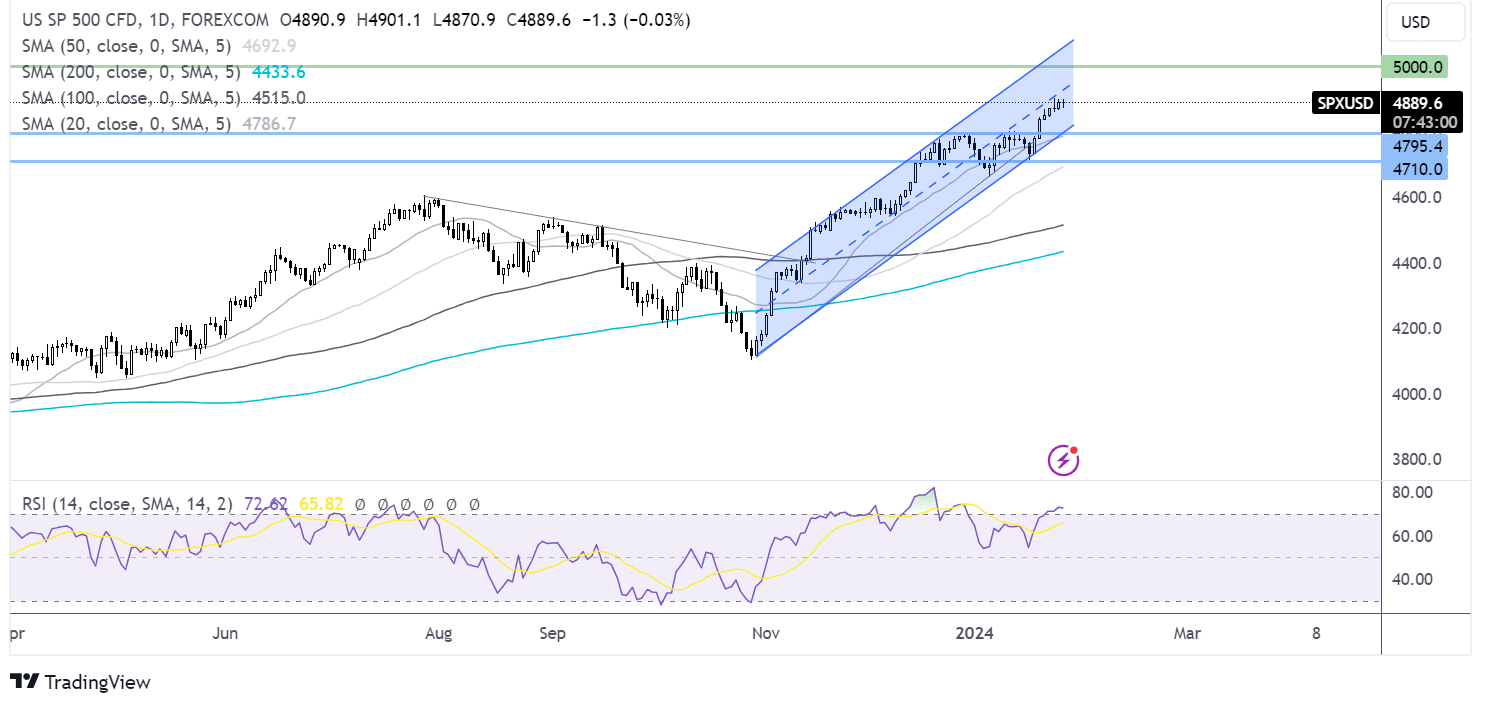

S&P 500 forecast – technical analysis

The S&P500 continues to trade in a rising channel and is attempting to retake the 4903 record high and onwards towards 5000. The RSI is in overbought territory so buyers should be cautious. On the downside, support can be seen at 4840 the weekly low ahead of 4800 round number the December high.

FX markets – USD falls GBP/USD rises

The USD is falling but has recovered from the session lows after the mixed data. All eyes are on the Fed next week for further clues on a possible rate cut timeframe.

EUR/USD is rising as investors continue to digest yesterday's ECB interest rate decision and the lack of clarity surrounding the start of interest rate cuts by the central bank. German consumer confidence plunged in February, raising concerns of a prolonged economic downturn in the region.

GBP/USD is rising after UK consumer confidence rose to a two year high in January as inflation eases. This marked the third straight month that consumer confidence improved and came following the upbeat January PMI data, which showed economic activity rose at the fastest pace in seven months. The BoE interest rate decision is due next week, and policy policymakers are expected to leave rates on hold.

Oil eases but is set to book strong gains across the week

Oil prices are slipping slightly lower away from a two-month high and are on track to book the largest weekly gain since October.

The price has been lifted this week by a larger-than-expected draw in US crude stockpiles and an improving demand picture.

Stronger-than-expected U.S. Q4 economic growth and top oil importer China announcing plans to ramp up stimulus to support the fragile economy recovery boosted the demand outlook, helping WTI over $75 per barrel.

Today, prices have come off slightly amid signs that geopolitical tensions in the Red Sea could ease as China pressures Iran to curb attacks on ships. While oil supply hadn't been directly affected by the events in the Middle East, the geopolitical risk premium had boosted the price, which is now unwinding slightly today.

.