Inflation remains key sticking point preventing interest rate cuts from the Reserve Bank of New Zealand, ensuring Wednesday’s first quarter consumer price inflation report will be closely watched by financial markets, especially should it print on the softer side of expectations.

What is the data expected to show?

Inflation is expected to increase 0.6% in the March quarter, a slight acceleration from the 0.5% pace recorded in the three months to December. The year-on-year rate is expected to slow to 4% as stronger inflation prints from a year earlier exit the data series.

A 0.6% quarterly increase would double the 0.3% pace forecast by the RBNZ, a discrepancy largely explained by the softer New Zealand dollar and higher energy prices over the past two months. As such, it’s year-on-year forecast of 3.8% is likely to be exceeded, leaving inflation above the 2% midpoint of its 1-3% target band.

Like other developed central banks, the RBNZ puts greater weight on underlying inflation readings that remove large, one-off price movements. The average of core readings have eased over the past year, sliding to 4.1% in Q4 2023, well off the 6.7% pace hit in 2022.

The RBNZ’s preferred underlying inflation indicator, its sectoral factor model, will be released at 2pm in Wellington, later than Statistics New Zealand’s survey at 8.45am. The former can and does move New Zealand financial markets.

New Zealand in double-dip recession

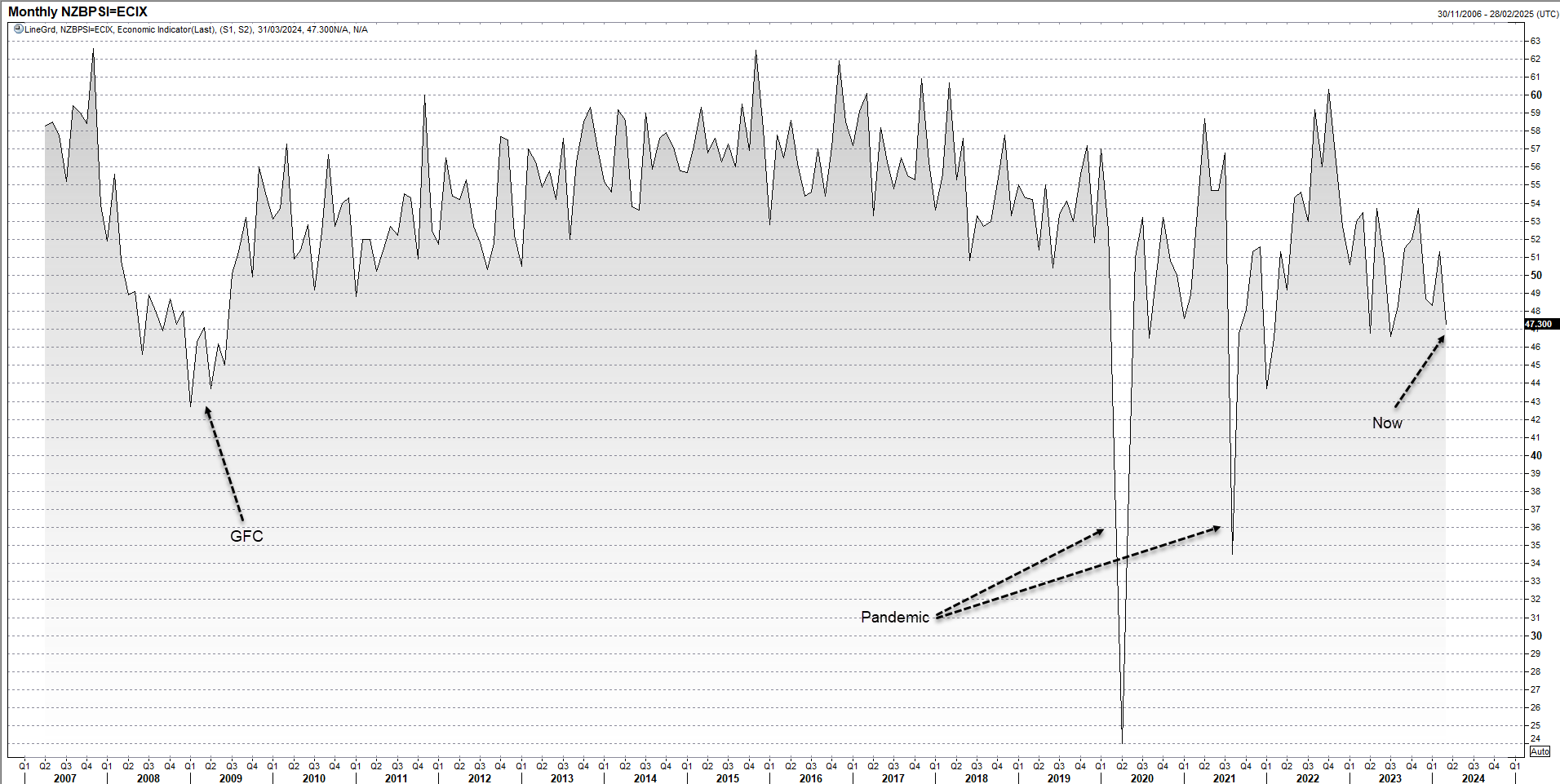

While price pressures may not have eased sufficiently to warrant rate cuts, remaining New Zealand economic data has been undeniably weak. The economy entered a double-dip recession in the second half of 2023 with soft data such as the NZIER Business survey and Business NZ Performance of Services Index (PSI) pointing to even weaker outcomes at the end of the March quarter.

The PSI fell so dramatically that it left the index at levels not seen outside of periods of financial and economic turmoil.

Source: Refinitiv

Given the weakness in the economy, it suggests risks for domestic price pressures may be skewed to the downside in the March quarter inflation report.

Markets, economists expect rate cuts soon

Markets and economists believe the RBNZ will begin cutting rates in either the September or December quarter, earlier than the mid-2025 view offered by the RBNZ in February. While markets have pared rate cut bets following similar moves in the US, the RBNZ is a central bank with a track record of going its own way on rates, meaning it will move if deemed necessary even if the Fed doesn’t.

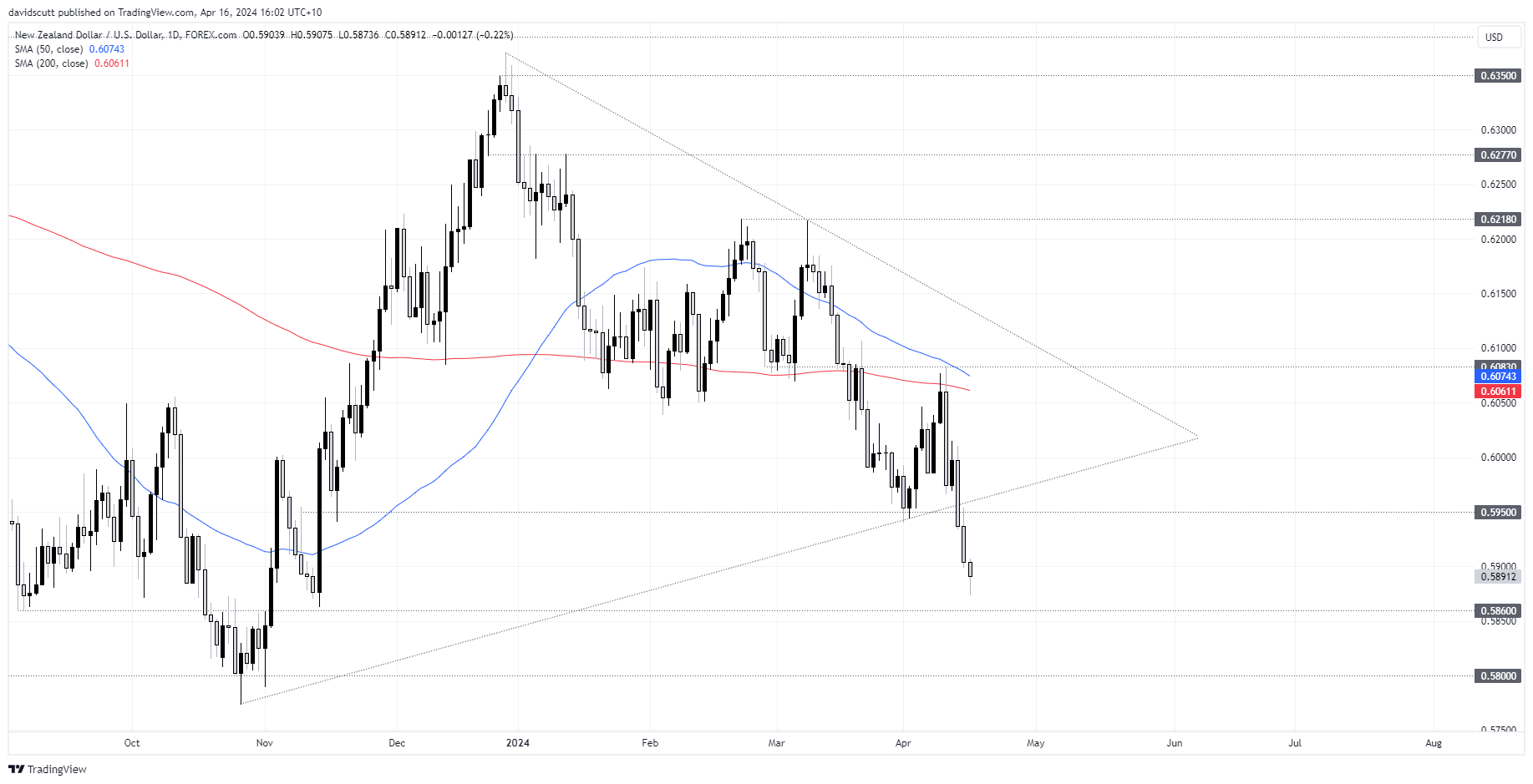

NZD/USD hammered on US rate recalibration, geopolitics

NZD/USD has seen better days, tumbling to the lowest level since November on the back of widening interest rate differentials with the United States, geopolitical tensions and volatility in riskier asset classes. Given the prevailing sentiment, it suggests an inflation undershoot may deliver the greatest impact on the Kiwi as it would be going with the trend rather than against it.

On the downside, support is located at .5860 and again at .5800, with little else to speak of until you get back into the mid 50 cent region. On the topside, the intersection of horizontal resistance at .5950 and former uptrend support above may prove tough to crack near-term. Beyond, .6083 is the next upside target, although that appears unlikely to be revisited any time soon without a dramatic shift in prevailing sentiment.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade