The inclusion in the index of three of the country’s largest firms previously excluded, including Nintendo, has also bolstered sentiment today.

Nintendo is amongst the world’s most well-known brands and needs no introduction. Keyence makes industrial automation systems and is the second-largest firm in the country by market value. Murata is a key supplier to smartphone makers, including Apple.

The addition of the three firms is seen as modernizing the index and will result in passive funds whose performance tracks the index, needing to buy the three new stocks and sell the stocks of the three firms now excluded.

Further supporting risk sentiment, Chinese trade data has beaten consensus expectations. Customs data showed exports jumped 25.6% y/y in August, well above the consensus forecast for a 17% rise despite the impact of the recent covid outbreak that clogged and closed ports.

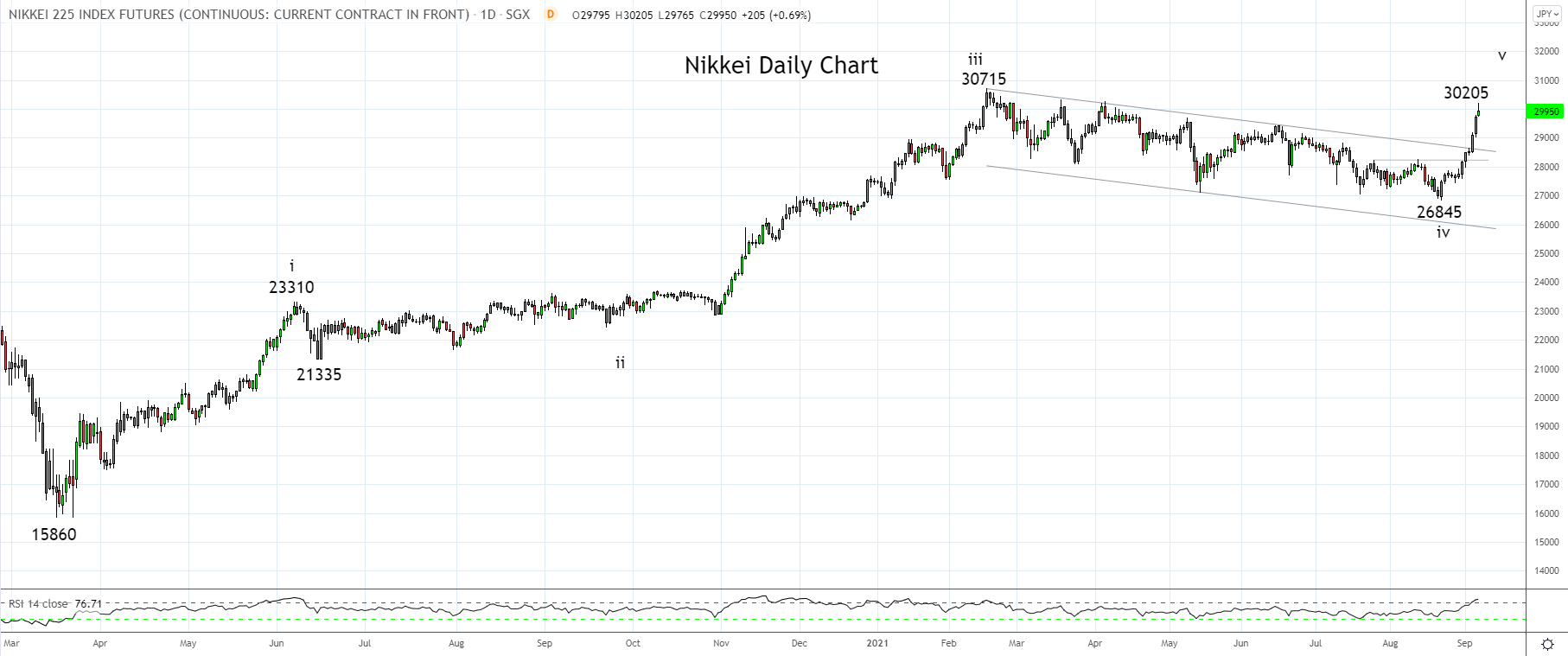

While the Nikkei futures have since eased back below 30,000, the rally has further to go. As viewed on the chart below, the Nikkei remains on track for a test and break the February 30,715 high as outlined in an article last week here.

Above 30715, there is scope for the rally to extend toward 32,000, before a meaningful correction unfolds.

Source Tradingview. The figures stated areas of September 7, 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation