US futures

Dow futures +0.26% at 33080

S&P futures +0.35% at 4245

Nasdaq futures +0.5% at 14649

In Europe

FTSE -0.1% at 7468

Dax +0.56% at 15174

- ADP Payrolls drop to 89k from 177k

- US ISM services PMI data is due to ease to 53.6

- USD slips from 10-month high as treasury yields ease

- Oil falls as the OPEC+ meeting begins

ADP payrolls drop to 89k from 177k

US indices are pointing to a stronger start as treasury yields ease lower from the 16-year high and after a weaker-than-expected ADP payroll report.

ADP private payrolls ease by more than expected to just 89k in September down from 177k In August. This was well below the expected 153k. The data points to some cooling in the labour market. However, it comes after yesterday's stronger-than-expected JOLTS job openings data which paints a mixed picture ahead of Friday's nonfarm payroll report.

The market is in the groove of seeing bad news as good news, which is helping stocks edge higher after slumping by over 1% on Tuesday following the upbeat jobs data. The data sent bond yields surging, weighing on equity valuations amid bets that the Fed will keep interest rates higher for longer.

After yesterday’s drop and despite today’s modest rise, the Dow Jones is now in negative territory for the year although the S&P at the NASDAQ are still up by 10% and 25% respectively, thanks to the AI rally.

Attention now turns to the ISM services PMI, which is expected to ease to 53.6 in September, down from 54.5 in August. The service sector is the dominant sector and accounts for around 75% of the US economy, so an unexpected increase in the services PMI would support a more hawkish Fed and could pull stocks lower.

Corporate news

Intel is rising over 2% premarket After the chip maker announced it will operate its programmable chip unit as a standalone business. The business will have an IPO within the next two to three years.

Apple falls premarket off to keep long cut its rating from overweight to sector weight, saying it expects softer growth in the US.

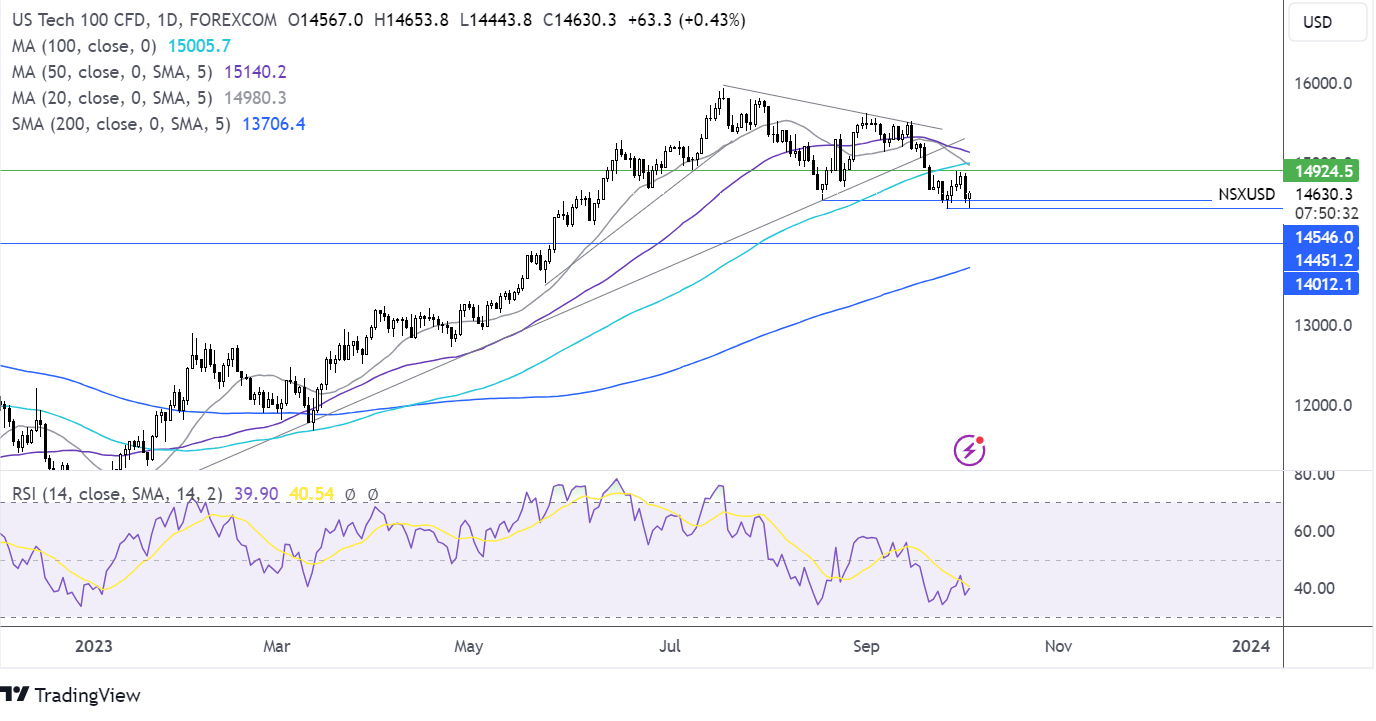

Nasdaq forecast – technical analysis.

The Nasdaq is consolidating between 14440 the September low and 14840, last week’s high. The 20 sma is crossing below the 100 sma in a bearish signal, and the RSI supports further losses while it remains out of oversold territory. Sellers will look for a fall below 14440 to bring 14000 into play. Meanwhile, buyers will look to rise above 14840 to create a higher high and expose the 100 sma at 15000.

FX markets –USD rises, GBP falls

The USD is falling, snapping a 2-day winning run as USD bulls pause for breath, after weaker ADP data and U.S. government bonds yield ease. Yields reached a 16-year high earlier in the day on the expectation that the Federal Reserve will keep interest rates higher for longer. Investors will now look towards the US data for further clues from the health of the US economy.

USD/JPY remains at 149.00 after falling from 150.00 yesterday, as intervention rumors swirl, but Japanese authorities remain quiet.

EUR/USD is rising after a mixed batch of data on the one hand, the eurozone services PMI improved to 48.7, which was ahead of the 48.4 preliminary reading. However, while the headline figure is improving it's worth noting that demand for euro-area goods and services has fallen at its fastest pace since November 2020. Meanwhile, retail sales for the region also fell by much more than expected, dropping -1.2% month on month after falling 0.1% in July.

GBP/USD is rising after data showed that the UK service sector contracted by less than expected in September. The final services PMI reading for September came in at 49.3, slightly down from 49.5 in August but well above the preliminary reading of 47.2 After the preliminary PMI reading on September 22, GBP plummeted to a six-month low on fears of an imminent recession. The PMI indices are closely watched by policymakers for early signs of trends and economic growth. IIt was just before the September flash PMI reading that the BoE unexpectedly voted to keep interest rates unchanged

EUR/USD +0.3% at 1.0505

GBP/USD +0.4% at 1.2120

Oil falls as OPEC meets

Oil prices are Falling sharply as concerns over the demand outlook overshadow pledges by Saudi Arabia and Russia to continue cutting oil production until the end of this year.

Attention has shifted from the tight supply, which had driven oil prices sharply higher across the summer months, to the implications of interest rates staying higher for longer and the resultant subdued growth.

Additionally, the strong U.S. dollar is also weighing on investor sentiment. The USD sits just below a 10-month high, making oil comparatively more expensive for holders of other currencies.

The APEC meeting is taking place online, and the group is expected to hold its current output levels.

WTI crude trades -1.9% at $86.66

Brent trades -1.8% at $88.96

Looking ahead

14:45 US S&P Global Composite PMI

15:00 US ISM Services PMI