Nasdaq 100 trading guide

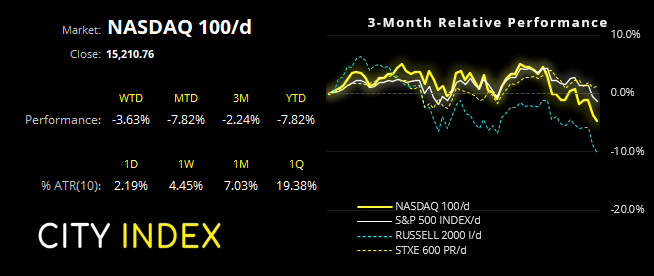

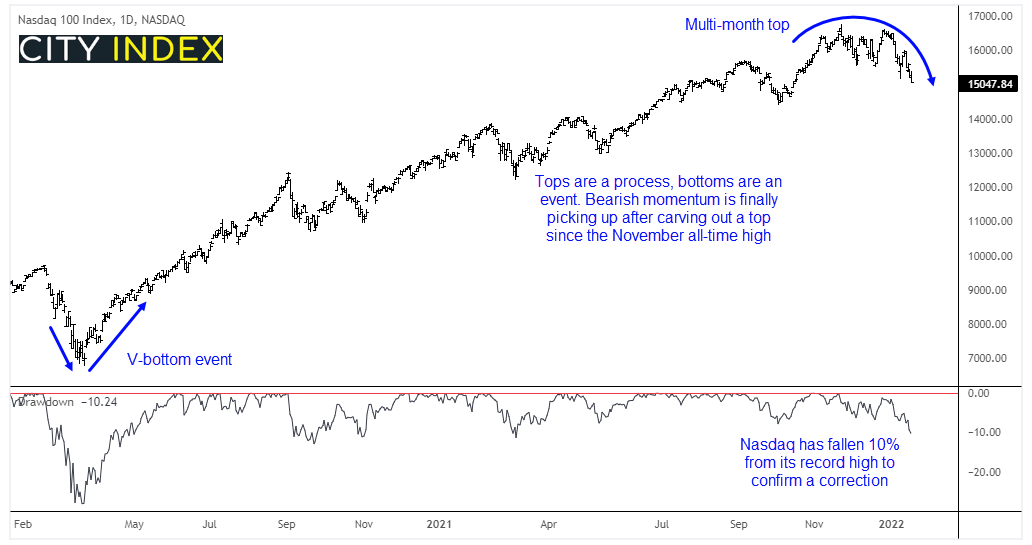

There’s a saying in the stock markets that “tops are a process, bottoms are an event”. And this relates to the tendency that market tops can be a slow and grinding experience whilst bottoms can happen quickly. It’s not always the case, but we appear to be seeing that on US markets at the moment. Compare the March 2020 ‘V-bottom’ low to price action since the record high on the Nasdaq 100 and you’ll see what we mean.

Price action has been choppy for the past couple of months, although bearish momentum is increasing as yields rise ahead of anticipated hikes form the Federal Reserve. So can prices accelerate lower from here? Quite possibly. But markets rarely move in a straight line and bear markets / deep corrections are notorious for countertrend whipsaws.

On that note, the Nasdaq 100 has fallen over 10% from its record high which confirms it as a correction over a pullback. Looking across headlines it is a well-publicised event, and that alone leaves the index at risk of a corrective bounce. But we also have the 200-day eMA and 15,000 handle just below yesterday’s close which increases the odds that it might not drop immediately lower, alongside the fact yields in the US stopped rising yesterday (which was a key driver of lower tech stocks) and the Nasdaq’s version of the VIX (NDX) ticked lower yesterday, despite the lower index.

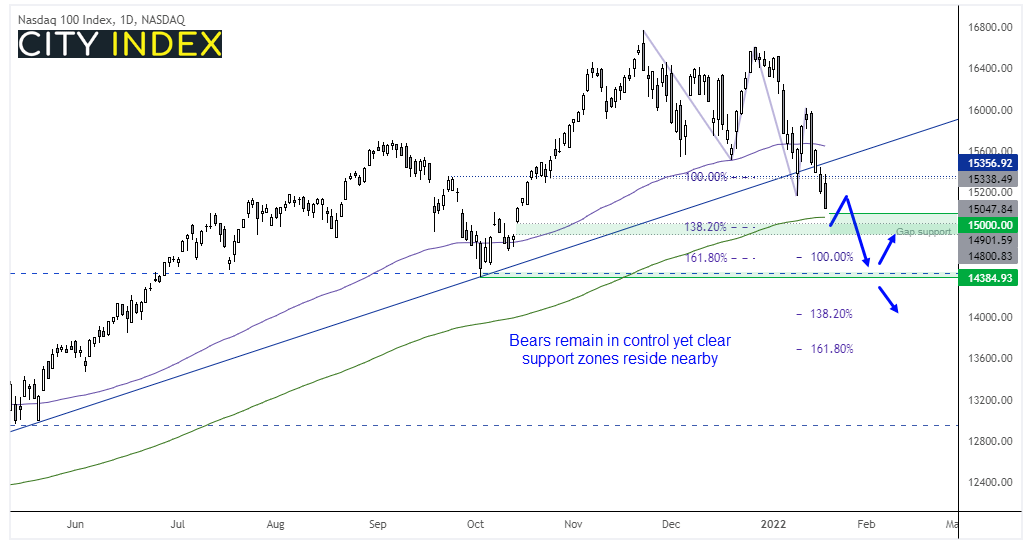

If we look at the daily chart, bearish momentum is now accelerating lower on the Nasdaq 100. However, three clear support zones stand out.

- 15,000 as it is a round number, and right near the 200-day eMA

- 14,800 – 14,900: Unclosed gap, 138.2% Fibonacci projection

- 14,834 – 14,566: October low, 100 / 161.8% Fibonacci projection, long-term 23.8% Fibonacci ratio

We therefore suspect downside could be limited over the near-term and prices could bounce from the 14,800 – 14,900 support zone if prices breach 15,000. But unless we see a decent pullback with bond yields then the core view remains bearish down to the lower support zone, around the October lows. However, a direct move back above 15,500 invalidates our bearish bias.

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade